FXZANK

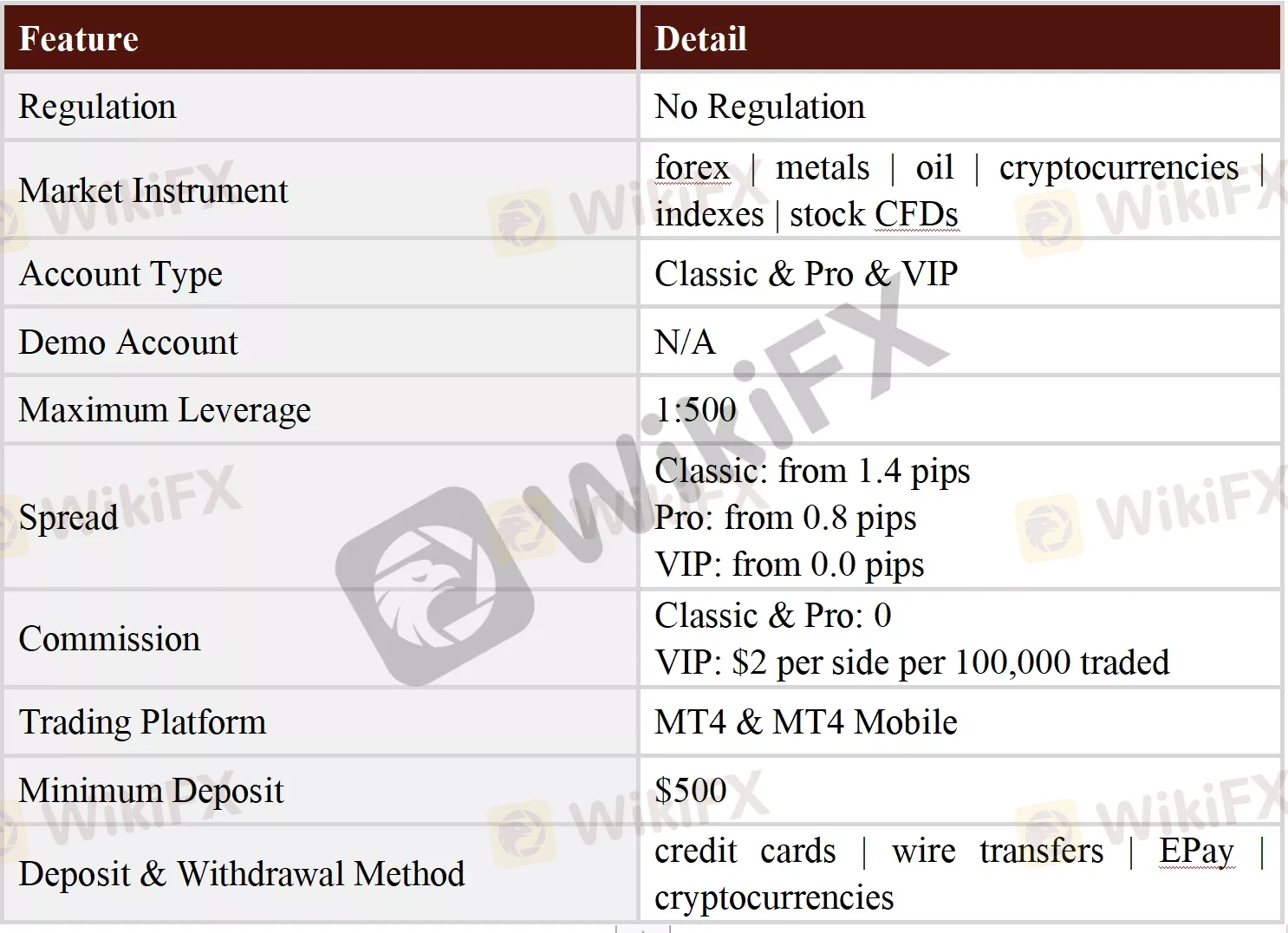

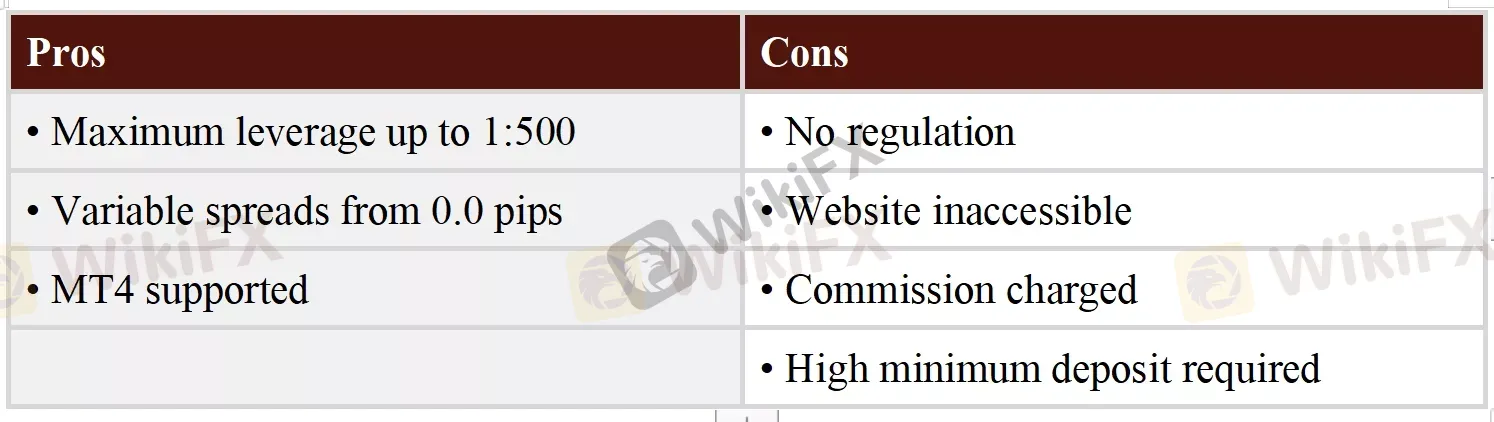

Abstract:FXZANK, a trading name of ZANK INTERNATIONAL LTD., is allegedly a forex and CFD provider registered in the United Kingdom that claims to provide its clients with various tradable financial instruments with leverage up to 1:500 and floating spreads from 0.0 pips on the MT4 and MT4 Mobile trading platforms via three different live account types.

Note: FXZANK is to operate via the website - https://www.zankcapital.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

General Information & Regulation

FXZANK, a trading name of ZANK INTERNATIONAL LTD., is allegedly a forex and CFD provider registered in the United Kingdom that claims to provide its clients with various tradable financial instruments with leverage up to 1:500 and floating spreads from 0.0 pips on the MT4 and MT4 Mobile trading platforms via three different live account types.

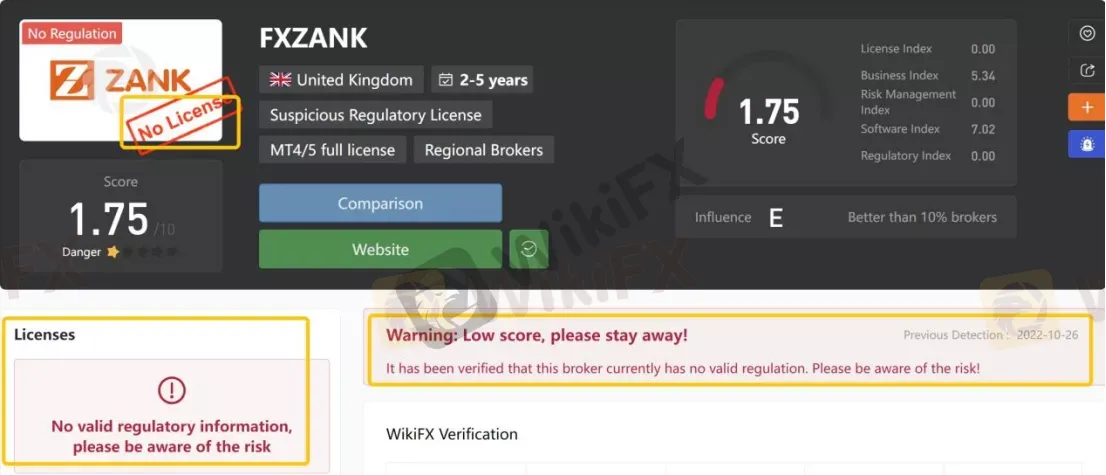

As for regulation, it has been verified that FXZANK does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.75/10. Please be aware of the risk.

Market Instruments

FXZANK advertises that it offers access to a wide range of trading instruments in financial markets, including forex, metals, oil, cryptocurrencies, indexes and stock CFDs.

Account Types

FXZANK claims to offer three types of trading accounts, namely Classic, Pro and VIP, with the minimum initial deposit requirements of $500, $10,000 and $50,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The leverage provided by FXZANK is capped at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

All spreads with FXZANK are a floating type and scaled with the accounts offered. Specifically, clients on the Classic account can experience spreads from 1.4 pips, while the Pro and VIP account members can enjoy tighter spreads from 0.8 pips and 0.0 pips respectively. As for commissions, there is no commission on the Classic and Pro accounts, while the VIP account will be charged a commission of $2 per side per 100,000 traded.

Trading Platform Available

The platform available for trading at FXZANK is one of the most notable and preferred trading platforms the market offers - MetaTrader4 and MT4 Mobile. This trading terminal is highly praised by traders and brokers alike due to its ease of use and great functionality. The MT4 offers top-notch charting and flexible customization options. It is especially popular for its automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

FXZANK says to accept deposits via credit cards, wire transfers, EPay and cryptocurrencies. The minimum initial deposit requirement is said to be as high as $500.

Customer Support

The only way you can approach FXZANK is via email: SUPPORT@ZANKGLOBAL.COM. However, this broker doesnt disclose other more direct contact information like telephone numbers or the company address that most transparent brokers offer.

Pros & Cons

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

How to Become a Profitable Forex Trader in Pakistan in 2025

If you want to enter the forex market in Pakistan and achieve success, earning consistent profits and excelling in trading, then you should check out this “How to Become a Profitable Forex Trader in Pakistan in 2025” article. You will wonder why you need to do this? The answer is simple: this article covers all the essential topics such as Forex Trading in Pakistan, and ways to learn Forex Trading in Pakistan, even if you are a native speaker and want to learn forex trading in Urdu. This article talks about that too. So, if you want to succeed in the forex market in 2025, read this article sincerely.

BitDelta Pro Review: Unregulated or Legit Broker?

BitDelta Pro Review: No valid regulation, risky spreads, and hidden broker issues. Traders should proceed with caution.

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

Is trading with Alpha FX fraught with too many errors and scams? Have you seen your forex trading account blocked after requesting fund withdrawals with the broker? Invested a heavy amount, but finding it hard to withdraw the sum? Have you seen domain changes while attempting an Alpha FX login? These issues have become typical for Alpha FX traders, with many of them sharing their frustration online. In this Alpha FX review guide, we have shared some trading complaints against the UK-based forex broker. Read on!

In-Depth Review of MH Markets Trading Conditions and Leverage – An Analysis for Experienced Traders

For experienced traders, selecting a broker is a meticulous process that extends far beyond marketing claims and bonus offers. It involves a granular analysis of the core trading environment: the quality of execution, the flexibility of leverage, the integrity of the regulatory framework, and the suitability of the conditions for one's specific strategy. MH Markets, a broker with a 5-10 year operational history, presents a complex and multifaceted profile that warrants such a detailed examination. This in-depth review dissects the MH Markets trading conditions and leverage, using primary data from the global broker inquiry app, WikiFX, to provide a clear, data-driven perspective. We will analyze the broker's execution environment, account structures, and regulatory standing to determine which types of traders might find its offering compelling and what critical risks they must consider.

WikiFX Broker

Latest News

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

The 350 Per Cent Promise That Cost Her RM604,000

INZO Commission Fees and Spreads Breakdown: A 2025 Data-Driven Analysis for Traders

Rate Calc