Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

Abstract: Axi, a broker with a significant global footprint and a history stretching back to 2007, is frequently a subject of this critical evaluation. So, is Axi legit? This in-depth analysis will move beyond surface-level marketing claims to provide a data-driven answer. By leveraging the comprehensive metrics, regulatory details, and user-generated feedback compiled by the global broker inquiry platform WikiFX, we will dissect Axi’s operational credibility.

For experienced traders, the process of selecting a new broker transcends a simple comparison of spreads and leverage. The foundational question—the one that underpins the potential for a long-term, stable trading relationship—is one of legitimacy. In a market saturated with options, discerning a reputable partner from a potential liability is paramount. Axi, a broker with a significant global footprint and a history stretching back to 2007, is frequently a subject of this critical evaluation. So, is Axi legit?

This in-depth analysis will move beyond surface-level marketing claims to provide a data-driven answer. By leveraging the comprehensive metrics, regulatory details, and user-generated feedback compiled by the global broker inquiry platform WikiFX, we will dissect Axis operational credibility. We will examine its regulatory framework, performance benchmarks, and the stark contrast between positive and negative client experiences to build a holistic picture for traders considering Axi as their next brokerage.

Regulatory Framework and Corporate Structure: The Core of Axi's Legitimacy

A broker's legitimacy begins and ends with its regulatory status. For any seasoned trader, this is a non-negotiable checkpoint. On this front, Axi presents a strong case, holding licenses from two of the world's most respected financial authorities.

According to data from WikiFX, Axi is regulated by:

• The Australian Securities and Investments Commission (ASIC): As an Australian-registered company (AxiTrader LLC), regulation by ASIC provides a robust layer of security. ASIC is known for its stringent requirements regarding capital adequacy, client fund segregation, and transparent business practices.

• The Financial Conduct Authority (FCA) in the United Kingdom: FCA regulation is often considered the gold standard in the forex industry. It imposes strict rules on brokers, including participation in the Financial Services Compensation Scheme (FSCS), which can protect client funds up to £85,000 in the event of a firm's insolvency.

The presence of these two top-tier licenses is a powerful testament to Axi's legitimacy and regulatory credibility. It demonstrates a commitment to operating within established legal frameworks that prioritize client protection. Brokers willing to subject themselves to the scrutiny of bodies like the FCA and ASIC are typically well-capitalized, professionally managed, and serious about long-term business integrity.

However, the analysis cannot stop there. WikiFX data also points to a more complex corporate structure that experienced traders must understand. While the company is registered in Australia, the contact address listed is in St. Vincent and the Grenadines (SVG). This indicates the existence of an offshore entity, AxiTrader LLC, which serves its global client base.

This dual structure is common among major brokers. The offshore entity allows Axi to offer more flexible trading conditions, such as the 1:1000 leverage mentioned in one user complaint, which are not permissible under FCA or ASIC rules. The critical takeaway for traders is that the level of protection you receive is entirely dependent on the specific Axi entity your account is registered with. Clients onboarded through the UK or Australian entities benefit from the full force of FCA and ASIC protections. Conversely, clients trading under the SVG entity operate in a far lighter regulatory environment, with significantly fewer safeguards and recourse options if disputes arise. This distinction is fundamental to assessing the practical legitimacy of the broker for your specific circumstances.

Operational History and Business Integrity

Beyond licenses, a broker's history provides a narrative of its reliability. Fly-by-night operations and scams rarely survive for over a decade in the competitive retail trading industry. WikiFX data confirms that Axi has been in operation for 15-20 years, a substantial track record that suggests a sustainable and resilient business model. This longevity implies that the broker has successfully navigated numerous market cycles, regulatory shifts, and technological changes, which is a strong indicator of operational competence and legitimacy.

Further bolstering this point are the on-site surveys conducted by WikiFX. The platforms teams have performed physical inspections of Axi's offices in both Australia and Hong Kong, with both visits yielding a “Good” rating. While not a full financial audit, this physical verification confirms that Axi maintains a tangible corporate presence in key financial hubs, separating it from anonymous, web-only operations that lack transparency and accountability.

WikiFX also identifies Axi as operating on a Market Maker (MM) model. For experienced traders, this is a crucial piece of information. As a market maker, Axi acts as the counterparty to its clients' trades, creating a potential conflict of interest. However, it is essential to note that market making is a standard and legitimate business model in the industry. The key is how a broker manages this conflict. Reputable market makers rely on volume and managing their overall book of risk, rather than trading against individual clients. The strong performance metrics and long history suggest Axi manages this model professionally, but traders who exclusively prefer a pure ECN/STP environment should take note.

A Quantitative Look at Trading Conditions and Performance

Legitimacy isn't just about safety; it's also about delivering a professional-grade trading experience. A broker that fails to provide reliable execution and a stable platform cannot be considered a legitimate long-term partner for a serious trader. WikiFX conducts extensive technical evaluations of broker environments, and its findings for Axi are highly revealing.

Axi earns an impressive overall Environment score of AA. This top-tier rating is derived from several key performance indicators:

• Transaction Speed (AAA): With an average transaction speed of just 256.3 ms, Axi's execution infrastructure is rated as excellent. For traders employing strategies sensitive to latency, such as scalping or news trading, this speed is a significant advantage and a hallmark of a technologically proficient broker.

• Platform Stability (Disconnected: AA): The high score for platform connectivity indicates a low probability of experiencing disruptive disconnections or platform freezes, particularly during volatile market conditions. This reliability is critical for maintaining control over open positions.

• Trading Costs (A): The “A” rating for costs suggests a pricing structure that is competitive but perhaps not the absolute cheapest in the market. This aligns with public information about Axi offering both a commission-free Standard account with wider spreads and a Pro account with raw spreads plus a commission. This structure provides choice, but traders must analyze which model best suits their trading frequency and style.

• Slippage (A): An “A” rating for slippage indicates that while some slippage is present (as is expected in live market conditions), it is generally well-managed. This suggests that orders are typically filled at or very near the expected price, a sign of good liquidity and fair execution.

Furthermore, WikiFX confirms that Axi holds a Full License for the MT4 platform. This is a significant investment and distinguishes it from brokers using less stable White Label solutions. A full license gives the broker more control over its server infrastructure, contributing to the stability and speed reflected in the performance scores.

The Critical Counterpoint: Analyzing User Complaints and Risk Alerts

No broker review is complete without a frank examination of client grievances. This is often where the theoretical legitimacy of regulation and history meets the practical reality of the user experience. WikiFX is transparent in this regard, issuing a clear alert: “The WikiFX Score of this broker is reduced because of too many complaints!” The platform notes a total of 16 user complaints, which, while not an enormous number for a broker of Axi's size and age, points to recurring friction points.

A qualitative analysis of the complaints provided reveals several critical themes:

1. Fund Handling and Withdrawal Issues: A user from Brazil alleges that a deposit was not credited to their MT4 account after they had successfully made a profitable withdrawal. They claim this is a tactic to penalize profitable traders, a serious accusation of bad faith. This complaint, which mentions 1:1000 leverage, almost certainly originates from a client of the offshore SVG entity. Another report from a different public source echoes this theme, where a user was forced to withdraw via bank wire despite exclusively using Skrill for deposits, causing significant friction.

2. Security and Fund Safety: A trader from the Philippines reports that their account funds were “stolen” on two occasions. After a three-month investigation, Axi allegedly refused to refund the amount. This raises serious questions about account security protocols and the broker's dispute resolution process.

3. Disputes Over Terms and Conditions: A Japanese trader describes a complex issue involving a deposit bonus, a negative balance, and an auto-rebate. The core of the complaint is that the rebate was used to offset the negative balance, effectively nullifying its value. This highlights a potential lack of clarity or fairness in the application of promotional T&Cs, an area where offshore entities often have more aggressive and less client-friendly clauses.

These specific issues highlight the importance of thorough due diligence. Prospective clients can review the full history of user-submitted complaints and the broker's regulatory status in detail on the WikiFX platform to form their own judgment on these recurring problems. The pattern suggests that while the core regulated operations may be sound, clients trading with the offshore entity face higher risks related to fund handling and dispute resolution.

Balancing the Narrative: Positive User Experiences

To provide a balanced perspective, it's equally important to consider the positive feedback. The WikiFX platform also features numerous positive reviews from Axi clients, painting a very different picture and suggesting that negative experiences are not universal.

Key themes from satisfied traders include:

• Execution and Platform Performance: Multiple users praise Axi's “lightning-fast execution” and platform stability. One trader notes that even during major news events, execution remains “clean” with no freezes, a critical factor for intraday strategies. Another highlights the benefits of MT5 for algorithmic trading, indicating the availability of MetaQuotes' newer platform.

• Transparency and Fees: A trader explicitly states that they switched to Axi because of its transparent fee structure, with no “hidden fees” in their statements. This contrasts with the often-opaque costs found at less reputable brokers.

• Efficient Withdrawals: In direct contradiction to the complaints, several users praise Axi for “fast withdrawals, no unnecessary questions.” This dichotomy is common in the industry and suggests that while some clients face issues, the process can be smooth for others, possibly depending on the client's region, funding method, and regulatory entity.

These positive accounts underscore that for many traders, Axi delivers a reliable and professional service that meets or exceeds their expectations.

Conclusion: Is Axi a Legitimate Broker?

So, is Axi legit? Based on a comprehensive, data-driven analysis, the answer is a qualified yes. Axi is not a scam operation; it is an established, long-standing brokerage with a strong foundation of top-tier regulation from the FCA and ASIC. Its 15-20 year history, verified physical presence, and excellent quantitative performance scores for execution speed and platform stability all point to a legitimate and serious business.

However, the question of its suitability for a long-term trading partnership is more nuanced. The primary risk factor stems from its dual corporate structure.

• For traders who can open an account under the FCA (UK) or ASIC (Australia) entities, Axi presents a highly legitimate and secure option. These traders benefit from stringent regulatory oversight, client fund protection schemes, and clear avenues for dispute resolution.

• For traders onboarded through the offshore SVG entity, the picture is more complex. While they gain access to higher leverage, they forfeit the critical protections afforded by top-tier regulation. The user complaints regarding fund handling, security, and opaque terms appear to be concentrated among this group.

Therefore, the defining question for a prospective client is not simply “Is Axi legit?” but rather, “Which Axi entity will I be trading with, and am I comfortable with the associated level of risk and protection?”

Axi appears best suited for performance-focused traders who value execution speed and platform reliability. Those who prioritize the highest level of regulatory security must ensure they are onboarded with the FCA or ASIC-regulated branches. Traders tempted by the high leverage of the offshore offering must proceed with caution, fully aware of the diminished protections and the potential risks highlighted in user complaints.

Ultimately, choosing a long-term brokerage partner is a significant decision. Before committing capital, traders are strongly advised to consult independent resources like WikiFX to get the latest, structured data on scores, user feedback, and any new regulatory alerts concerning Axi.

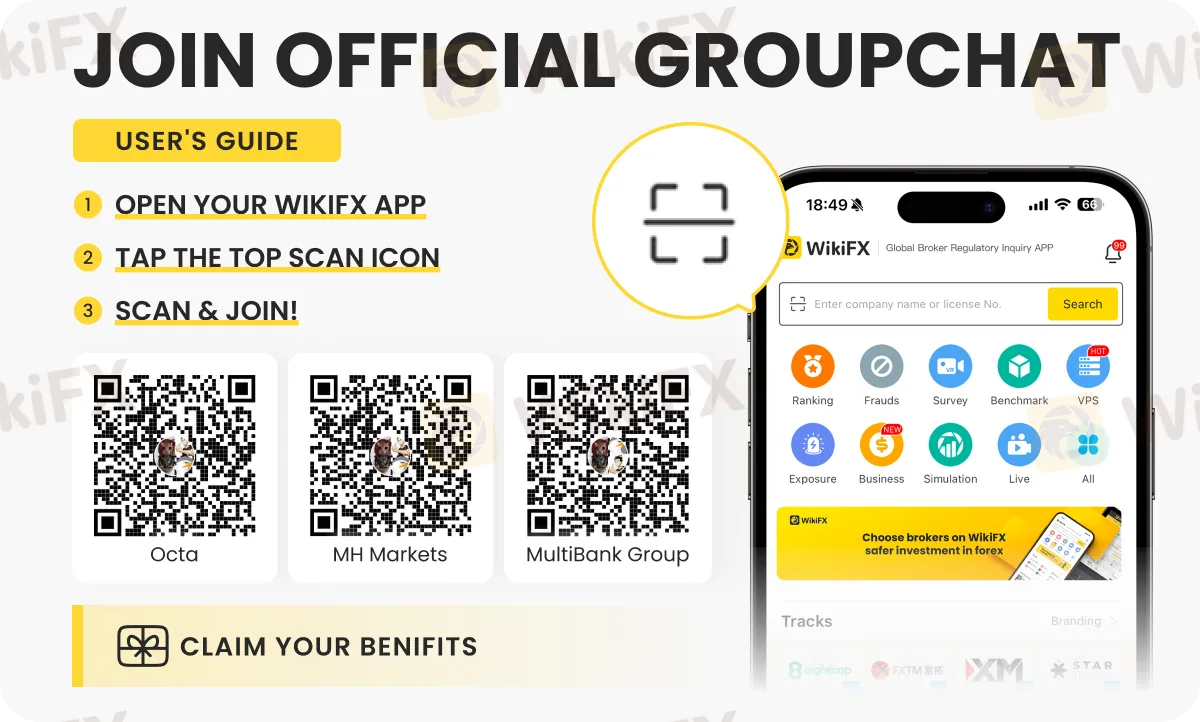

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc