BitDelta Pro Review: Unregulated or Legit Broker?

Abstract:BitDelta Pro Review: No valid regulation, risky spreads, and hidden broker issues. Traders should proceed with caution.

Is BitDelta Pro Broker Legit or a Scam?

BitDelta Pro positions itself as a multi-asset broker offering access to over 5,000 CFDs across forex, commodities, indices, shares, ETFs, and crypto. On paper, this looks impressive. However, a closer investigation reveals that BitDelta Pro Broker operates without valid regulation.

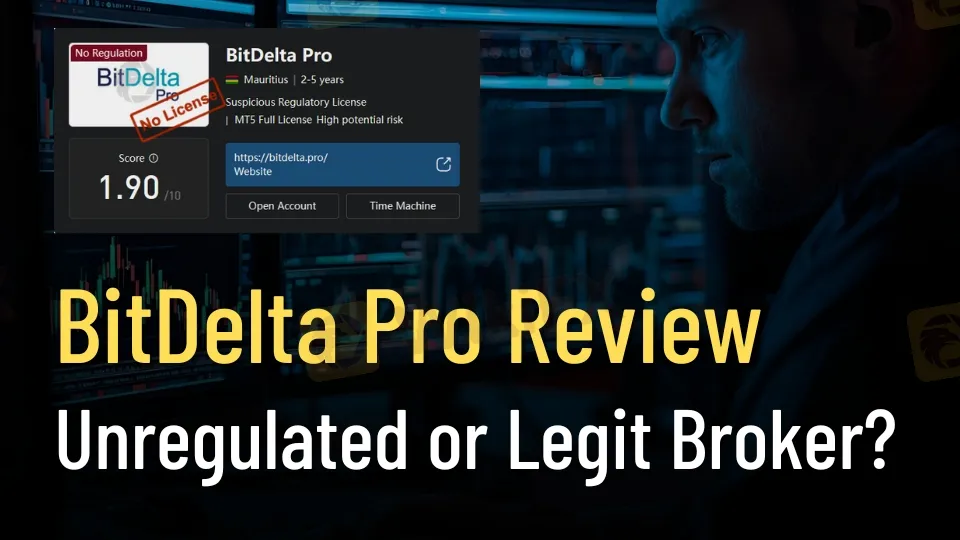

The company claims to hold a license from the Financial Services Commission (FSC) in Mauritius, but official records show no such authorization. WikiFX rates the broker at 1.90/10, explicitly warning traders to stay away due to suspicious licensing and lack of transparency.

This raises the critical question: Is BitDelta Pro a scam or legit? Evidence strongly suggests that BitDelta Pro is unregulated, exposing traders to significant risks.

BitDelta Pro Regulation and Licensing Explained

- Claimed License: FSC Mauritius, License no: GB24202926

- Verified Status: No record found in FSCs database

- WikiFX Assessment: “No valid regulation, high potential risk”

Without proper oversight, BitDelta Pro Regulation is essentially non-existent. Traders should note that unregulated brokers can change terms, manipulate spreads, or even restrict withdrawals without accountability.

For comparison, trusted online broker reviews of regulated firms (e.g., IG, Pepperstone, or Saxo Bank) highlight transparent licensing, audited financials, and investor protection schemes. BitDelta Pro offers none of these safeguards.

BitDelta Pro Review: Account Types & Fees

BitDelta Pro provides three main account tiers: Standard, VIP, and Institutional.

| Account Type | Spreads (EURUSD/XAUUSD/WTI) | Leverage | Commission | Minimum Deposit | Bonus |

| Standard | 0.00008 / 0.27 / 0.028 | 1:200 | $0 | $10 | None |

| VIP | 0.00007 / 0.24 / 0.028 | 1:200 | $0 | $50 | 20% |

| Institutional | 0.00003 / 0.15 / 0.025 | 1:200 | $5 Commodities / $3 Forex | $5,000 | None |

Key takeaways:

- Low entry barrier: $10 minimum deposit for Standard accounts.

- Hidden costs: Institutional accounts charge commissions despite marketing “low fees.”

- Bonus inconsistency: VIP accounts offer a 20% bonus, but others do not.

Compared to regulated brokers, these spreads and commissions are inconsistent and often higher than industry averages.

BitDelta Pro Spreads and Leverage Explained

BitDelta Pro advertises dynamic leverage up to 1:500, but most accounts cap at 1:200. While high leverage can amplify profits, it also magnifies losses.

Spreads are problematic:

- Commodities spreads reach 35 points on Standard accounts.

- Forex spreads average 20 points, far above industry norms.

This means traders face slippage and inflated costs, eroding profitability. In contrast, leading brokers typically offer EURUSD spreads below 1 pip with transparent commission structures.

BitDelta Pro Trading Platform Features

BitDelta Pro supports MetaTrader 5 (MT5) alongside its proprietary platform and CQG.

- Execution Speed: Average 174 ms

- Supported Devices: Web, mobile, desktop

- Tools: Charting, automated trading, technical indicators

While MT5 is a respected platform, the broker‘s infrastructure raises concerns. Reports of severe slippage and inconsistent execution suggest that BitDelta Pro’s servers may not meet professional standards.

For traders comparing options, regulated brokers like Pepperstone or IC Markets deliver faster execution and audited performance metrics.

BitDelta Pro Deposit and Withdrawal Methods

The broker advertises flexible deposits starting at $10. However, transparency around withdrawal methods is limited.

- Deposit Minimums: $10 (Standard), $50 (VIP), $5,000 (Institutional)

- Withdrawal Transparency: Unclear, with no detailed policies published

- Customer Service: 24/7 chat, email (support@bitdelta.pro), phone, and social media

The lack of clear withdrawal terms is a red flag. In trusted online broker reviews, withdrawal speed and reliability are critical benchmarks. BitDelta Pro fails to provide sufficient assurance.

Pros and Cons of BitDelta Pro Broker

Pros

- Wide range of trading instruments (5,000+ CFDs).

- Multiple account types with low entry deposits.

- MT5 platform support.

- 24/7 customer service.

Cons

- Unregulated – no valid license.

- High spreads and slippage.

- Lack of transparency on withdrawals.

- Relatively new (founded 2023).

- Institutional accounts require $5,000 minimum deposit.

Comparing BitDelta Pro Broker vs Competitors

When placed against regulated competitors, BitDelta Pro falls short:

| Feature | BitDelta Pro | Regulated Broker (e.g. IG, Pepperstone) |

| Regulation | None | FCA, ASIC, CySEC, BaFin |

| Minimum Deposit | $10 | $100–$250 |

| Spreads (EURUSD) | 20 points | <1 pip |

| Leverage | Up to 1:500 | Typically capped at 1:30 (EU/UK) |

| Transparency | Low | High – audited, investor protection |

This comparison underscores why the best forex broker comparison consistently favors regulated firms over unregulated entities like BitDelta Pro.

The Bottom Line on BitDelta Pro Broker

BitDelta Pro markets itself as a modern broker with diverse instruments and MT5 support. Yet, beneath the surface, the lack of regulation, suspicious licensing claims, and high spreads make it a high-risk choice.

Traders seeking security should prioritize brokers with verifiable licenses, transparent fee structures, and proven track records. BitDelta Pro does not meet these standards.

Final Verdict: BitDelta Pro is not a trusted broker. Its unregulated status, hidden costs, and questionable transparency place traders at risk. Those looking for reliable trading should consult trusted online broker reviews and choose regulated alternatives.

Read more

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

Is trading with Alpha FX fraught with too many errors and scams? Have you seen your forex trading account blocked after requesting fund withdrawals with the broker? Invested a heavy amount, but finding it hard to withdraw the sum? Have you seen domain changes while attempting an Alpha FX login? These issues have become typical for Alpha FX traders, with many of them sharing their frustration online. In this Alpha FX review guide, we have shared some trading complaints against the UK-based forex broker. Read on!

In-Depth Review of MH Markets Trading Conditions and Leverage – An Analysis for Experienced Traders

For experienced traders, selecting a broker is a meticulous process that extends far beyond marketing claims and bonus offers. It involves a granular analysis of the core trading environment: the quality of execution, the flexibility of leverage, the integrity of the regulatory framework, and the suitability of the conditions for one's specific strategy. MH Markets, a broker with a 5-10 year operational history, presents a complex and multifaceted profile that warrants such a detailed examination. This in-depth review dissects the MH Markets trading conditions and leverage, using primary data from the global broker inquiry app, WikiFX, to provide a clear, data-driven perspective. We will analyze the broker's execution environment, account structures, and regulatory standing to determine which types of traders might find its offering compelling and what critical risks they must consider.

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

For any experienced trader, the long-term viability of a brokerage partner hinges on a delicate balance of trust, execution quality, and, critically, cost. Trading fees, both direct and indirect, can significantly erode profitability over time. This makes a granular understanding of a broker's cost structure not just beneficial, but essential. This in-depth analysis focuses on MH Markets, breaking down its commission fees, spreads, and other associated costs to provide a clear, data-driven perspective for traders evaluating this broker for their long-term strategies. Drawing primarily on verified data from the global broker inquiry platform WikiFX, alongside other public information, we will dissect the MH Markets spreads commissions cost structure. We aim to move beyond marketing claims and uncover the practical, real-world costs of trading with this broker, helping you determine if its pricing model aligns with your trading style and financial goals.

Is Tio Markets Legit? Detailed Review with Real User Complaints

So, we will begin this Tio Markets review with the key topic—its regulation and the authorities it is licensed under. After that, we will walk you through the real user complaints we found during our research.

WikiFX Broker

Latest News

The 350 Per Cent Promise That Cost Her RM604,000

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

Rate Calc