CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Abstract:CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

London-listed brokerage CMC Markets (LSE: CMCX) has reported a record-breaking performance in its Australian stockbroking division. However, this period of financial success coincides with a heightened security risk, as cyber security firms issue warnings about a targeted phishing campaign aiming at the platform's high-net-worth clients.

Australian Business Records Stellar Growth

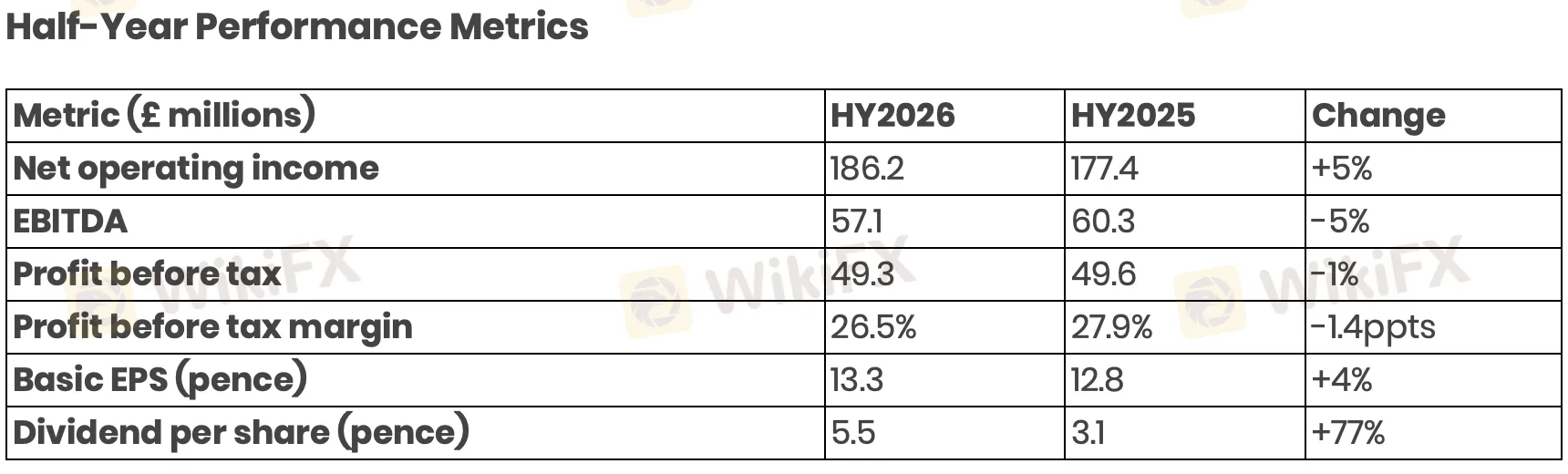

According to CMC Markets latest financial data for the first half of the FY2026, the company recorded a net operating income of £186.2 million, marking a 5% year-on-year increase. The Australian market was the primary catalyst for this result.

The Australian stockbroking unit delivered a record half-year performance, with net operating income climbing 34% to A$65.9 million. Assets under Administration in the region also increased by 14% to approximately A$91 billion. This robust growth has positioned CMC as Australias second-largest stockbroker by revenue.

Furthermore, CMC Markets‘ extended white-label partnership with Westpac Banking Corporation, Australia’s second-largest bank, is expected to fuel future growth, with projections suggesting a 40% increase in the Australian customer base and a roughly 45% uplift in domestic trading volumes following the integration period.

Phishing Campaign Targets High-Value Credentials

Despite the strong financial results, a significant security concern has emerged. Cyber security firm MailGuard AU detected a sophisticated phishing campaign impersonating both CMC Markets and TD Direct Investing. The operation specifically targets wealthy investors.

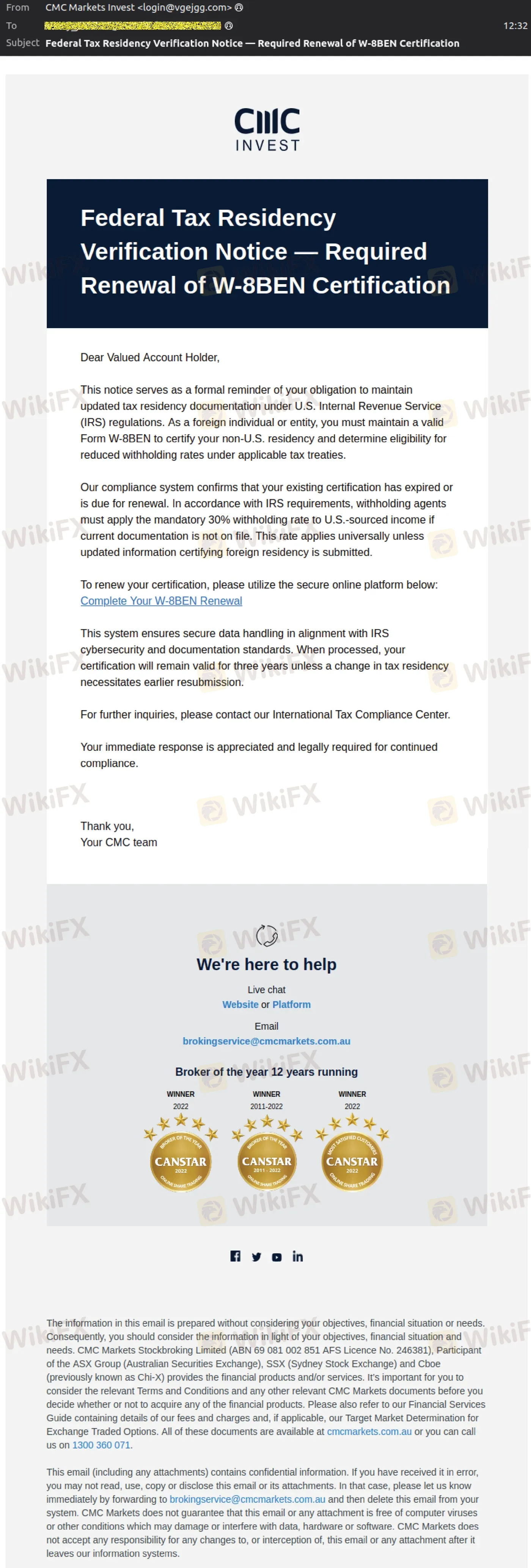

These highly convincing emails are designed to steal user login credentials. They often carry the subject line: “Federal Tax Residency Verification Notice — Required Renewal of W-8BEN PMC Certification.”

The fraudulent messages utilize branding consistent with CMC Invest, referencing real financial processes, and include detailed legal disclaimers to appear credible. Users who click the embedded links are directed to fake login portals designed to harvest sensitive account information.

ASIC Intensifies Crackdown on AI-Driven Scams

The specific threat to CMCs clients reflects a wider pattern of online financial fraud noted by the Australian Securities and Investments Commission (ASIC). The regulator has voiced concerns over the proliferation of sophisticated scams, often utilizing AI-driven tools to create more convincing fake websites.

ASIC is actively combating this surge, reporting that it is taking down approximately 130 fraudulent investment websites each week, with more than 10,000 removed to date. The regulator stresses that scammers frequently clone legitimate sites, including ASICs own consumer resource, Moneysmart, to solicit personal data.

Despite these increased enforcement efforts, financial losses remain substantial, with investment scams reaching $945 million in 2024. Investors are urged to exercise extreme caution and verify any requests for tax information or personal data directly through official communication channels.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc