INZO Commission Fees and Spreads Breakdown: A 2025 Data-Driven Analysis for Traders

Abstract:INZO in-depth review provides a granular INZO commission fees and spreads breakdown. We will dissect the broker's advertised cost structure, cross-referencing it with independent data and user-reported experiences to build a complete picture. By examining the INZO spreads commissions and swap policy in the context of its regulatory standing and client feedback, we aim to help experienced traders determine the real, all-in cost of trading with this broker.

For the discerning forex and CFD trader, the true cost of market access is a critical metric in broker selection. It extends far beyond the headline spread advertised on a broker's homepage. A comprehensive cost analysis involves a meticulous breakdown of spreads, commissions, overnight financing (swaps), and any potential non-trading fees. However, for experienced professionals evaluating a broker for a long-term partnership, the analysis must go deeper still, factoring in the implicit costs of unreliability, poor execution, and operational risk.

This in-depth review provides a granular INZO commission fees and spreads breakdown. We will dissect the broker's advertised cost structure, cross-referencing it with independent data and user-reported experiences to build a complete picture. By examining the INZO spreads commissions and swap policy in the context of its regulatory standing and client feedback, we aim to help experienced traders determine the real, all-in cost of trading with this broker.

INZO: Corporate Profile and Regulatory Standing

Before delving into fees, it is essential to establish the operational and regulatory foundation of the broker. A low-cost environment is rendered meaningless if client funds and trade integrity are not adequately protected.

According to data from the global broker inquiry platform WikiFX, INZO operates under the company name INZO L.L.C., registered in Saint Vincent and the Grenadines (SVG). The firm has an operating history of 2-5 years. It's crucial for traders to understand that SVG is a popular jurisdiction for broker incorporation, but its Financial Services Authority (FSA) does not regulate forex and CFD brokerage activities. The registration is a business incorporation, not a financial license.

The actual regulatory license held by INZO is from the Seychelles Financial Services Authority (FSA), under the licensed entity INZO GROUP LTD with license number SD163. The Seychelles FSA is an offshore regulator. While this provides a formal regulatory framework, it does not offer the same stringent oversight or investor protection mechanisms—such as segregated fund compensation schemes—that are mandated by top-tier regulators like the UK's FCA or Australia's ASIC. This offshore status is a key reason WikiFX assigns tags like “Offshore Regulated” and “High potential risk” to the broker.

Compounding these concerns is the broker's low WikiFX score, which the platform explicitly notes is “reduced because of too many complaints.” This suggests a significant disconnect between the broker's marketed services and the actual experiences of its clientele.

Deconstructing INZO's Advertised Trading Costs and Account Tiers

INZO presents a tiered account structure designed to cater to a spectrum of traders, from novices to high-volume professionals. The cost model varies significantly across these accounts, primarily pivoting between a spread-only model and a raw spread plus commission model.

Based on publicly available information, here is a breakdown of the primary account types offered:

| Account Type | Minimum Deposit | Maximum Leverage | Swap-Free Option | Advertised Pricing Model |

| Standard | $100 | 1:500 | Yes | Spreads from 0.8 pips, no commission |

| Zero Standard | $50 | 1:500 | Yes | Not explicitly detailed, likely a hybrid |

| Zero | $5,000 | 1:200 | Yes | Raw spreads from 0.0 pips + commission |

| INZO VIP | $50,000 | 1:50 | No | Raw spreads from 0.0 pips + lower commission |

| Stocks | $500 | 1:20 | No | Spread-based, specific to equities |

| Crypto | $50 | 1:100 | Yes | Raw spreads + commission |

This structure provides apparent flexibility. Traders who prefer simplicity and predictable, all-in costs might gravitate towards the Standard account. In contrast, scalpers and algorithmic traders who require the tightest possible spreads would likely consider the Zero or INZO VIP accounts, accepting a fixed commission as a trade-off.

A Granular Look at INZO's Spreads, Commissions, and Swap Policy

The core of any broker's cost structure lies in its spreads, commissions, and overnight financing charges. Here, we analyze INZO's claims and the available data for each component.

Spreads Analysis

INZO claims its pricing is powered by “Raw Pricing technology” sourcing liquidity from over 25 providers, enabling ultra-low spreads.

• Standard Accounts: These accounts feature spreads starting from 0.8 pips. This is a commission-free model, where the broker's remuneration is built entirely into the spread. A spread of 0.8 pips on a major pair like EUR/USD is competitive but not market-leading.

• Raw/Zero Accounts: These accounts are advertised with spreads starting from 0.0 pips. This “raw spread” model gives traders direct access to interbank pricing. However, it's critical to remember that 0.0 pip spreads are typically only available on the most liquid pairs during peak market hours and are not constant. The average spread will be higher.

The broker's marketing suggests an average spread on EUR/USD starting from 0.1 pips, which likely refers to its Raw Spread accounts. While attractive, this figure must be viewed as a best-case scenario.

Commission Structure: A Point of Confusion

For its commission-based accounts (Zero, INZO VIP, Crypto), the pricing becomes more complex and, based on available information, somewhat inconsistent.

• Zero Account: The account description in one review source states a commission of $8 per lot round turn.

• INZO VIP Account: This premium account, requiring a $50,000 deposit, reportedly offers a reduced commission of $4 per lot round turn.

• Crypto Account: Commissions are said to start from $0.08, though the unit (per coin, per lot) is not clearly specified.

However, other fee schedules published by the broker present conflicting information. One table shows a flat fee of $10 per 1.00 lot for a long list of forex pairs, including all majors. Another trading cost example provided by the broker calculates commission at $3.50 per lot per side, which equates to $7 per lot round turn.

This discrepancy—with stated commissions of $4, $7, $8, and $10 per lot depending on the source and account—is a significant red flag. Experienced traders rely on precise and predictable cost calculations. The lack of a single, clear, and consistent commission schedule makes it difficult to accurately forecast trading costs and raises questions about transparency.

INZO Swap Policy and Swap-Free Options

Overnight financing, or swaps, are a key consideration for swing and position traders. INZO's swap policy includes several standard industry practices:

• Calculation: Swaps are based on the interest rate differential between the two currencies in a pair.

• Triple Swaps: For positions held over the weekend, a triple swap is typically charged on a Wednesday for most forex and metals instruments.

• Negative Swaps: It's possible for some instruments to have negative swap rates for both long and short positions, meaning a charge is incurred regardless of trade direction.

• Real-Time Rates: Traders are advised to check the exact swap rates for any instrument directly within the MetaTrader 5 or cTrader platform's symbol specifications.

A notable feature is the availability of swap-free accounts. According to the account table, the Standard, Zero Standard, Zero, and Crypto accounts all offer an Islamic (swap-free) option. This is a valuable feature for traders who cannot pay or receive interest for religious reasons, or for position traders who wish to avoid swap costs on certain pairs. The premium INZO VIP and Stocks accounts, however, do not appear to offer this feature.

The Hidden Costs: Non-Trading Fees and Operational Risks

The most sophisticated traders know that the most damaging costs are often not the ones listed on the fee schedule. These include withdrawal fees, platform manipulation, and the ultimate cost—the inability to access one's funds.

Deposits, Withdrawals, and Transparency

INZO supports a range of funding methods, including major credit cards (VISA, MasterCard), e-wallets (Payeer), and a variety of cryptocurrencies. However, a critical piece of information is conspicuously absent from most public materials: a clear fee schedule for deposits and withdrawals. The lack of transparency regarding processing times and potential fees for moving funds is a significant concern.

This opacity is amplified by an alarming volume of user complaints centered on withdrawals. The “Exposure” section on WikiFX is filled with detailed accounts from traders alleging severe withdrawal obstruction. These are not simple delays; they are claims of systematic roadblocks, including:

• Repeatedly demanding video selfies and then rejecting them without clear reason.

• Forcing clients into “video conferences” for interrogation-style questioning.

• Changing account verification requirements after a withdrawal request is made.

If a trader cannot reliably and efficiently withdraw their capital and profits, then spreads and commissions become irrelevant. The potential cost of a blocked withdrawal is infinite.

The True Cost of Trading Condition Manipulation

A second, equally disturbing theme from user complaints involves the alleged manipulation of trading conditions post-deposit. Multiple traders have filed detailed reports claiming that INZO engages in bait-and-switch tactics.

• Leverage Reduction: A common complaint is that after depositing funds based on an advertised leverage of 1:500, the leverage is suddenly and drastically cut to as low as 1:20 without warning. This can instantly trigger margin calls and liquidate a trader's entire portfolio.

• Spread and Pair Manipulation: Traders report that spreads have been artificially widened or that entire currency pairs have been removed from the platform while they had open positions, making it impossible to manage or close their trades.

• Unauthorized Trade Closure: The most severe allegations include claims that the broker has closed open trades without client authorization, citing new, unannounced internal policies.

These alleged actions introduce a catastrophic and unquantifiable cost. A trading strategy built on a 0.8 pip spread is useless if the spread widens to 10 pips during a critical moment, or if the leverage is cut by 95% without notice. The volume and severity of these allegations, which traders can verify on platforms like WikiFX, suggest a pattern of behavior that introduces a substantial risk factor into the cost equation.

Final Verdict: Balancing Advertised Costs Against Documented Risks

On paper, the INZO commission fees and spreads breakdown reveals a broker with a flexible and potentially competitive cost structure. The choice between spread-only and raw spread + commission accounts, combined with the availability of swap-free options, appears to cater to diverse trading styles. A VIP client could theoretically trade with raw spreads and a $4 per lot commission, which is highly competitive.

However, a professional analysis cannot stop there. The on-paper costs are fundamentally undermined by three critical factors:

1. Offshore Regulation: The Seychelles FSA license provides a minimal level of regulatory oversight, leaving traders with limited recourse and no safety net from a compensation fund.

2. Lack of Transparency: The inconsistent information regarding commission rates and the absence of a clear fee schedule for withdrawals are major transparency failures.

3. Overwhelming Negative Feedback: The sheer volume and severity of user complaints regarding withdrawal obstruction and trading condition manipulation represent an unacceptable level of operational risk.

For an experienced trader, consistency, reliability, and fund safety are paramount. The potential savings from a 0.1 pip spread are dwarfed by the potential cost of a single blocked withdrawal or a manipulated trade. The documented user experiences suggest that the real cost of trading with INZO may not be the commission or the spread, but the risk to one's entire capital.

Therefore, while the advertised fees may seem appealing, experienced traders must weigh them against the considerable risks highlighted by user exposures. Before committing any capital, it is imperative for traders to conduct their own thorough due diligence, and consulting the detailed broker profile and user reviews on WikiFX is a prudent final step in that process. The data suggests that the attractive cost structure may be a facade for a high-risk trading environment where the true costs are hidden, unpredictable, and potentially devastating.

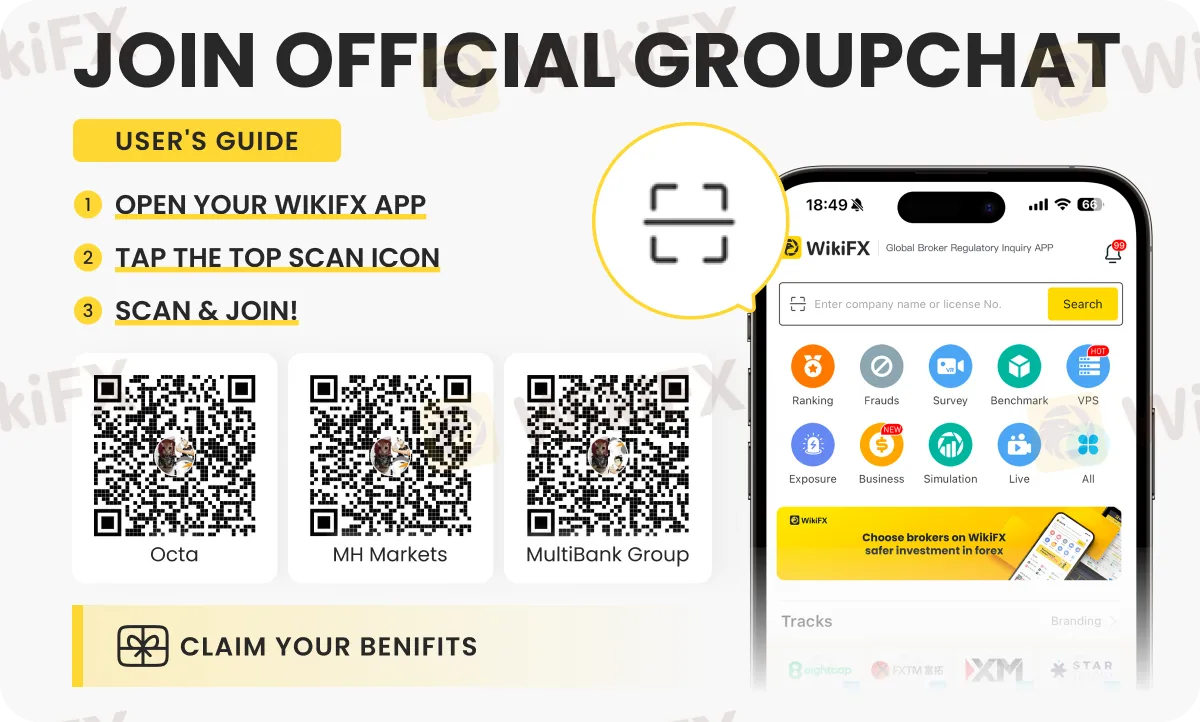

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

The 350 Per Cent Promise That Cost Her RM604,000

INZO Commission Fees and Spreads Breakdown: A 2025 Data-Driven Analysis for Traders

Rate Calc