"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

Abstract:Multiple investors are reporting a disturbing pattern of blocked funds and shifting requirements at Grand Capital. While the broker claims validity, regulatory bodies across three jurisdictions have issued warnings or blacklisted the entity entirely. The data suggests significant risk for anyone currently holding funds on this platform.

Anonymity Disclaimer: All cases mentioned in this report are based on real records submitted to WikiFX; specific user identities have been hidden for protection.

The “Moving Goalpost” Strategy

The most alarming signal regarding a broker is not usually a technical glitch, but a conditional withdrawal. A technical glitch is fixed; a condition is often a trap designed to burn through client funds.

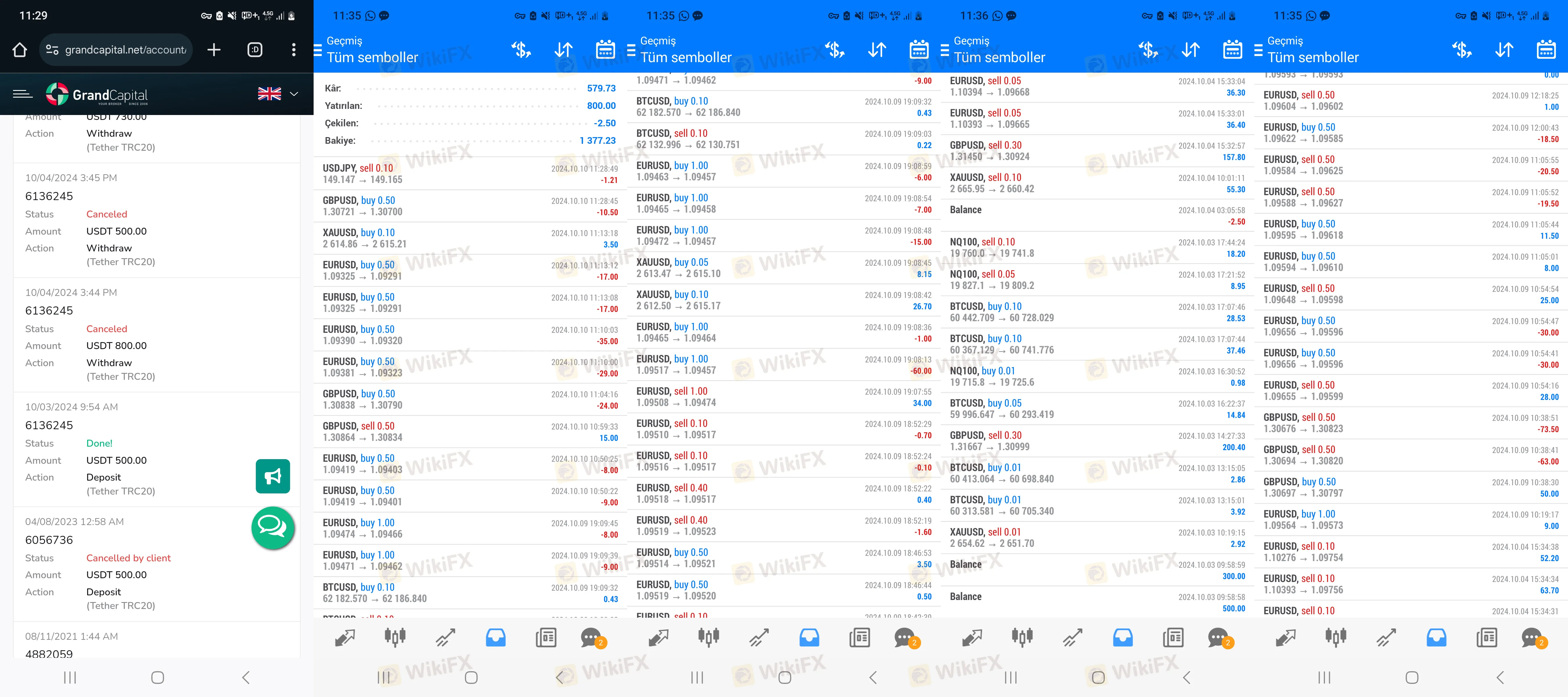

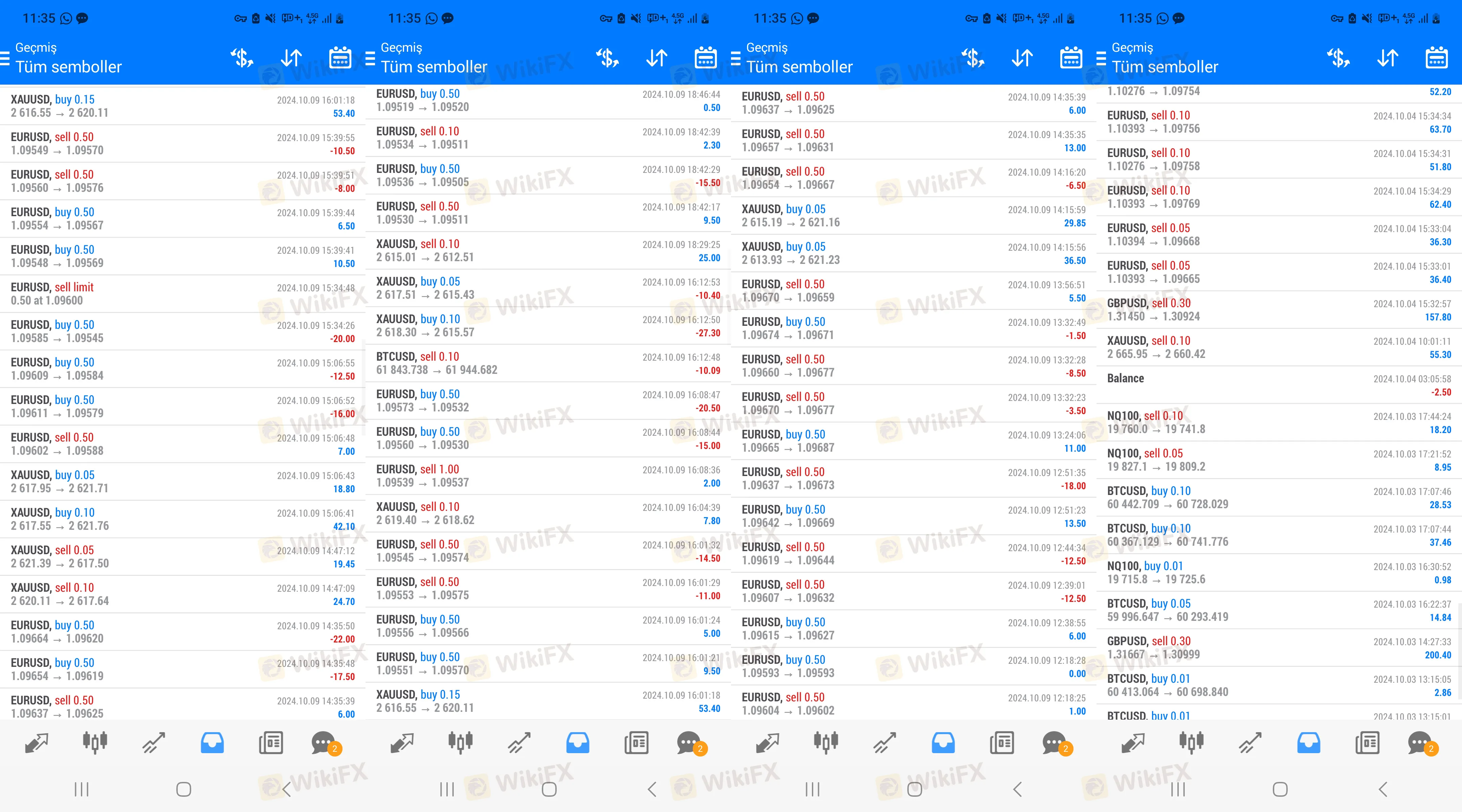

We recently received a detailed complaint that exposes exactly how this mechanism works at Grand Capital. A user deposited funds and successfully traded, generating a profit. When they attempted to withdraw their capital, the request wasn't simply denied—it was held for ransom.

Support agents informed the trader that they needed to trade a volume of “5% lots” to unlock the funds. The trader complied, executing the required trades. Instead of releasing the money, the broker moved the goalpost: they demanded the user trade 9 more lots. Desperate to retrieve their money, the user complied again. Grand Capital then demanded 15 more lots.

This is a classic “churning” technique. By forcing a client to over-trade, the broker hopes the client will eventually lose the principal balance to market volatility, resolving the broker's “liability” without ever sending a dime back.

From “Under Review” to Silence

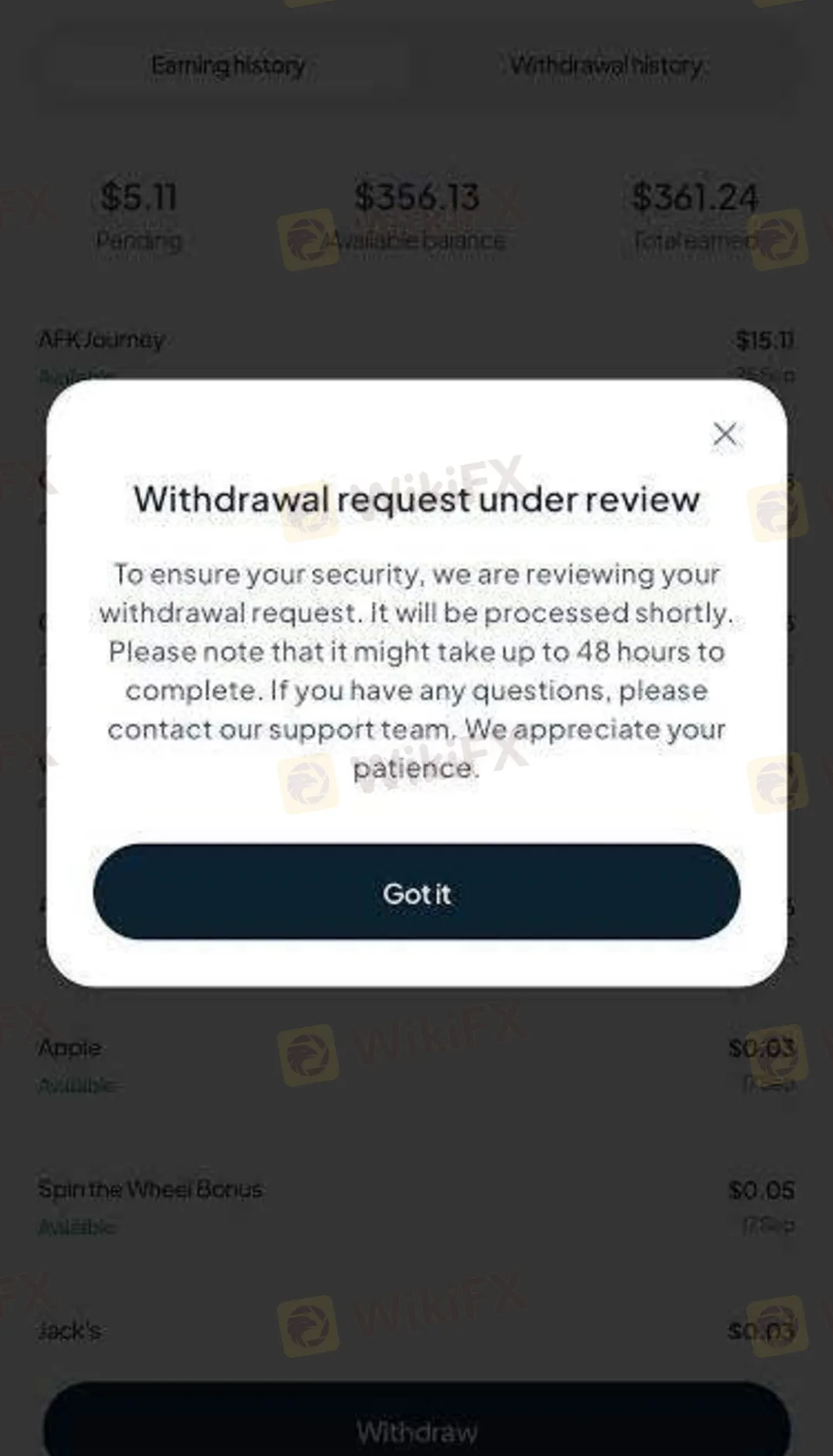

While some users are trapped in a loop of excessive trading requirements, others are facing a wall of silence. Our Support Center has been flooded with recent reports from investors who find their withdrawal status permanently stuck on “In Review.”

One user reported that after weeks of waiting, they attempted to escalate the issue as an “emergency” via customer service channels. The result? Zero feedback. The application interface reportedly freezes or takes excessive time to load when withdrawal options are selected, leading some users to suspect the technical friction is intentional.

Another complaint highlights a discrepancy in deposits: a user noted that upon depositing funds, an immediate deduction was made without explanation, meaning the full capital never even hit the trading account.

The Root Cause: A Regulatory Mirage

Why can Grand Capital operate this way without immediate consequences? The answer lies in their regulatory status. While the broker claims to be a legitimate international entity, the regulatory data tells a drastically different story.

The discrepancy between the broker's claims and the official records is the “smoking gun” in this investigation.

The Regulatory Disconnect

Below is the complete breakdown of the regulatory environment for Grand Capital. Investors should note that none of these records indicate a valid license to hold client funds.

| Regulator | Country | Status | What This Means for You |

|---|---|---|---|

| FSA (Seychelles Financial Services Authority) | Seychelles | Unauthorized / Scam Alert | The regulator explicitly warned the public that Grand Capital is not licensed. The FSA stated the firm acts without authorization. |

| AMF (Autorité des Marchés Financiers) | France | Blacklisted | The broker appears on the AMF's official blacklist of unauthorized companies and websites. |

| CMVM (Comissão do Mercado de Valores Mobiliários) | Portugal | Warning Issued | The Portuguese regulator issued a warning that this entity is not authorized to carry out financial intermediation in Portugal. |

The Seychelles FSA Warning Explained:

The most critical warning comes from the Seychelles FSA (Reg Id: 202408230810293589). In July 2024, the authority issued a specific alert regarding grandcapital.net and Grand Capital ltd. They clarified that this company has never been licensed by the FSA.

This is not a case of an expired license; it is a case of a regulator explicitly stepping forward to disavow the broker.

The Trap of False Profits

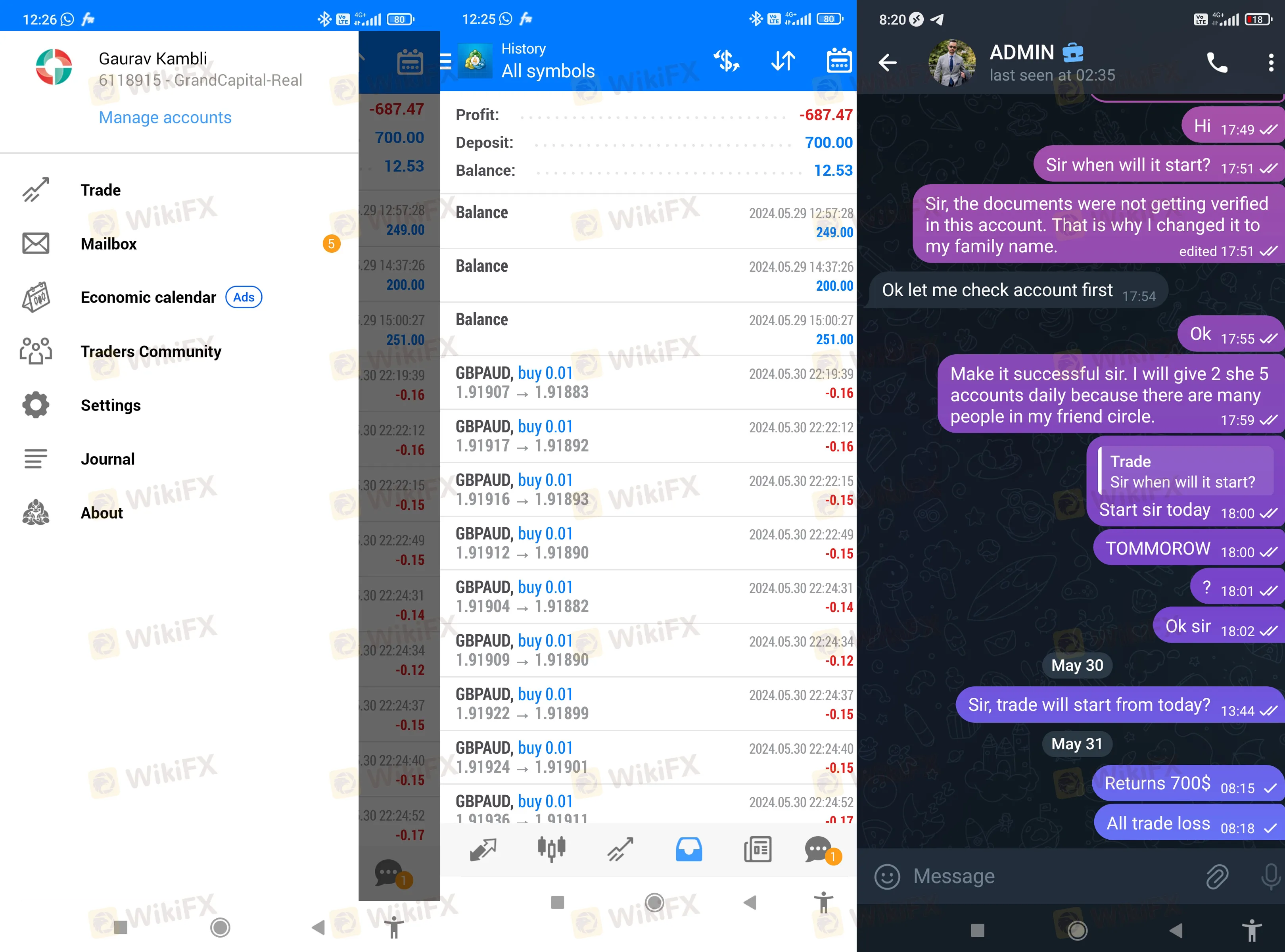

A secondary pattern emerging in the complaints involves “Account Managers” or third-party signals. One user reported being shown a live account demonstrating massive profits to induce a deposit. After depositing roughly $700, the funds were allegedly removed from the user's account.

This tactic—showing high returns on a controlled “live” account to bait new investors—is frequently paired with the withdrawal issues mentioned earlier. By the time the new investor realizes the legitimate-looking trades cannot be converted into withdrawn cash, the initial deposit is already gone.

Verdict: High Risk Anomalies

The combination of a specific fraud warning from the Seychelles FSA and user reports of conditional withdrawals suggests Grand Capital poses a severe risk to capital. The “tax” or “trading volume” excuses used to delay payments are major red flags.

WikiFX Risk Warning:

Forex and CFD trading involve significant risks and are not suitable for all investors. The leverage used in trading can work against you. Before deciding to trade, please carefully consider your investment objectives, experience level, and risk tolerance. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

Read more

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police bust fake investment scam run by Chinese nationals

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

Mazi Finance Exposure: Do Traders Find it Hard to Place Trades and Access Withdrawals?

Did Mazi Finance deny withdrawals once you made profits? Did the Saint Lucia-based forex broker deny based on terms and conditions that did not exist while opening a trading account? Do you frequently encounter issues concerning the Mazi Finance App download? Do you fail to place trades due to the server issues on the trading app? These are some problems traders have highlighted while sharing the Mazi Finance review. Read on as we share some complaints against the forex broker.

WikiFX Broker

Latest News

Geopolitical Risk Ignites Commodities: Gold Eyes $5,600, Oil Rallies on Iran Fears

China Reportedly Scraps Three Red Lines Reporting, Signaling Property Sector Pivot

Emerging Currencies and Gold Rally as US Dollar Stumbles

Grand Capital Review: The Anatomy of a Regulatory Fugitive

Fortrade Review 2026: Is this Forex Broker Legit or a Scam?

SARB Defies Easing Expectations with Hawkish Hold on Rates

Fed Signals 'Dovish Pause' as Political Pressure Mounts on Powell

Melaka police bust fake investment scam run by Chinese nationals

ZarVista Analysis Report

BOJ Dilemma: Tokyo Inflation Cools as MOF Adopts 'Tactical Silence' on Yen

Rate Calc