Zenswealth Broker Review and Regulation Warning

Abstract:Zenswealth Broker flagged as unregulated. FCA warns investors in latest review.

Zenswealth Review: An Investigative Overview

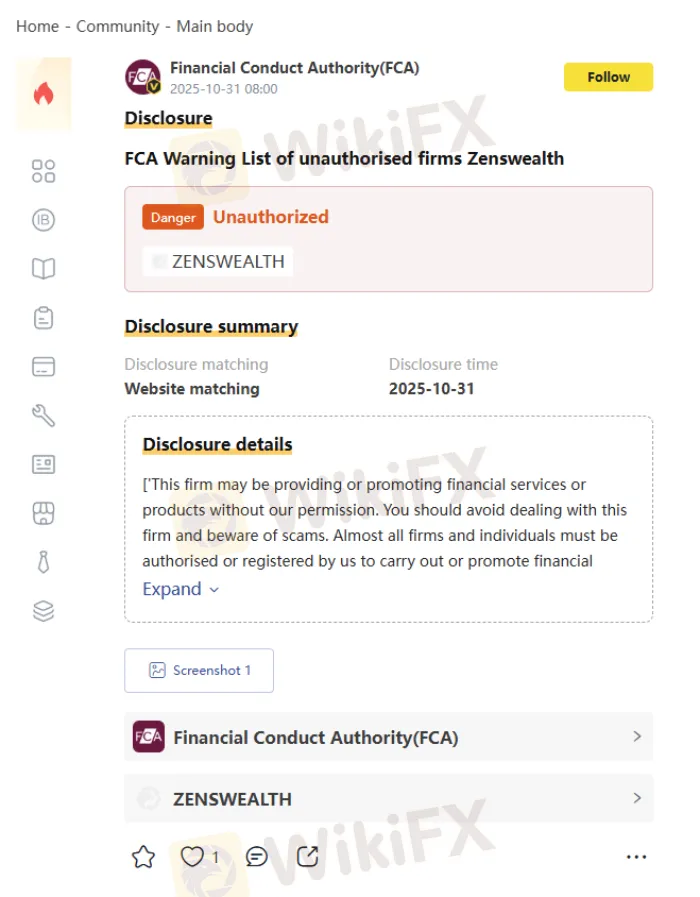

Zenswealth has recently drawn attention from regulators and traders alike. According to the Financial Conduct Authority (FCA), the broker is operating without authorization, placing it on the official warning list of unauthorised firms. This Zenswealth Review examines the brokers regulatory standing, investment plans, trading instruments, and overall credibility.

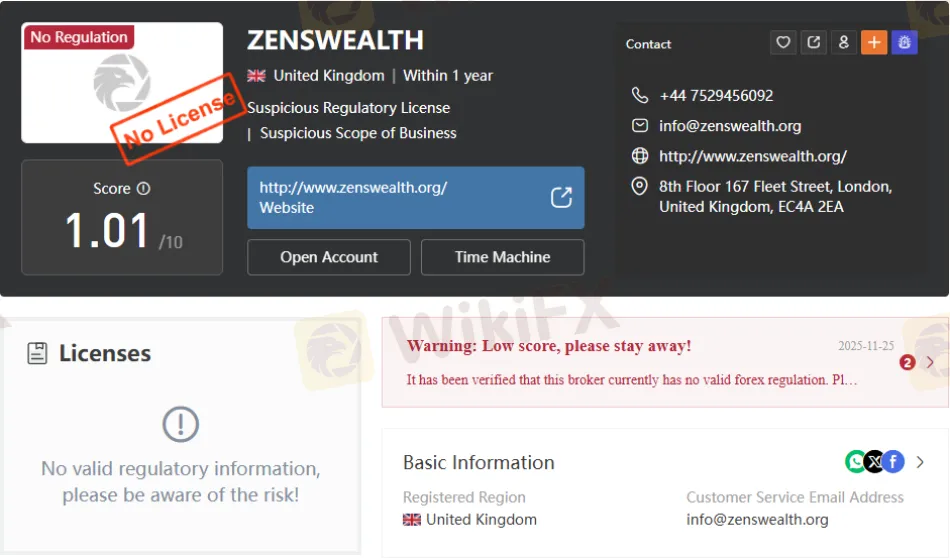

Zenswealth Broker Regulatory Status

The most pressing issue surrounding Zenswealth is its regulatory absence. The FCA explicitly warns that the firm may be providing or promoting financial services without permission. Almost all brokers must be registered or licensed to operate legally in the UK.

- Regulatory Authority: Financial Conduct Authority (FCA)

- Status: Unregulated, no valid license

- Disclosure Date: October 31, 2025

- Website: zenswealth.org

- Registered Address: 8th Floor, 167 Fleet Street, London, EC4A 2EA

This lack of oversight raises serious concerns about Zenswealth Regulation and investor safety.

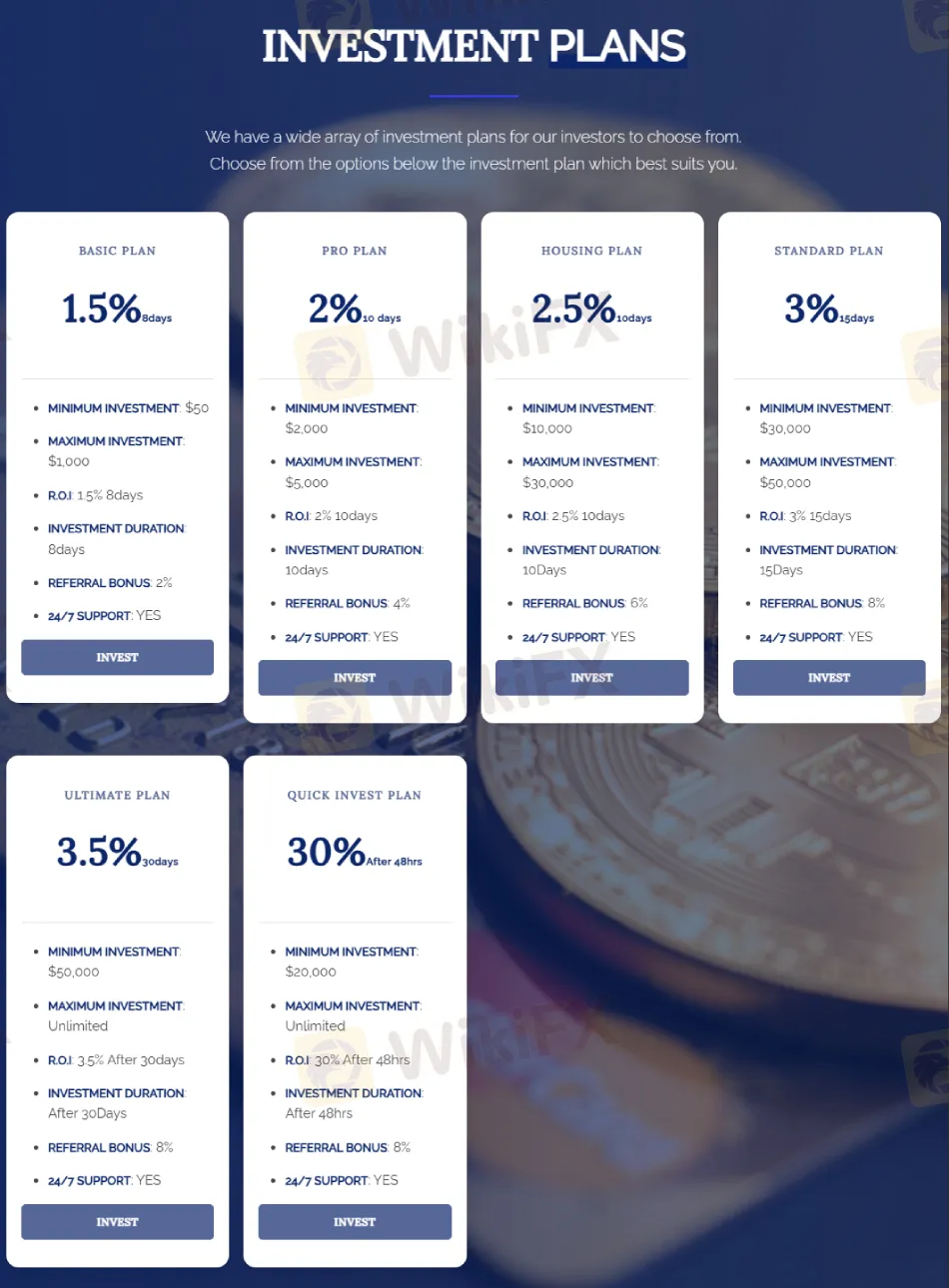

Zenswealth Broker Investment Plans

Zenswealth promotes a wide array of investment schemes with unusually high returns. These include short-term plans promising daily percentages and quick-invest options with extreme ROI claims.

| Plan Name | Minimum Investment | Maximum Investment | ROI & Duration | Referral Bonus |

| Basic Plan | $50 | $1,000 | 1.5% daily, 8 days | 2% |

| Standard Plan | $2,000 | $5,000 | 2% after 10 days | 4% |

| Housing Plan | $10,000 | $30,000 | 2.5% after 10 days | 6% |

| Pro Plan | $30,000 | $50,000 | 3% after 15 days | 8% |

| Ultimate Plan | $50,000 | Unlimited | 3.5% after 30 days | 8% |

| Quick Invest Plan | $20,000 | Unlimited | 30% after 48 hours | 8% |

Such aggressive ROI promises are red flags in the brokerage industry, often associated with high-risk or fraudulent schemes.

Zenswealth Trading Instruments

Zenswealth advertises access to multiple asset classes:

- Cryptocurrency

- Forex Trading

- Real Estate

- Stock Market

- Bonds

While this range appears diverse, the absence of regulatory oversight makes it impossible to verify execution quality, spreads, leverage, or platform reliability.

Zenswealth Broker Website and Security

The brokers website, zenswealth.org, is flagged as not secure. This compromises user data protection and raises questions about the legitimacy of its operations.

- Domain: zenswealth.org

- Security Status: Not secure (SSL absent)

- Customer Service Email: info@zenswealth.org

- Phone Contact: +44 7529456092

Pros and Cons of Zenswealth Broker

✅ Pros

- Multiple investment plans advertised

- Wide range of trading instruments listed

- 24/7 customer support claims

❌ Cons

- Unregulated broker flagged by FCA

- Website lacks security protocols

- Unrealistic ROI promises (up to 30% in 48 hours)

- No transparency on spreads, leverage, or fees

- High minimum deposits for advanced plans

Zenswealth Regulation vs Competitors

Compared to regulated brokers in the UK, Zenswealth falls short in every critical category:

- Competitor brokers typically disclose FCA license numbers, audited financials, and transparent fee structures.

- Zenswealth Broker provides none of these assurances, relying instead on aggressive marketing of high-yield investment plans.

This stark contrast underscores the importance of verifying broker regulation before committing funds.

Bottom Line: Zenswealth Review

The Zenswealth Review reveals a broker flagged by the FCA as unauthorised and unregulated. Despite offering multiple investment plans and trading instruments, the absence of valid regulation, insecure website infrastructure, and unrealistic ROI claims make Zenswealth a high-risk choice for investors.

Final Verdict: Traders should exercise extreme caution. The lack of Zenswealth Regulation and the FCAs explicit warning strongly suggest avoiding this broker.

Read more

In-Depth Review of Stonefort Securities Withdrawals and Funding Methods – What Traders Should Really

For any experienced forex and CFD trader, the mechanics of moving capital are as critical as the trading strategy itself. The efficiency, security, and transparency of a broker's funding procedures form the bedrock of a trustworthy, long-term trading relationship. A broker can offer the tightest spreads and the most advanced platform, but if depositing funds is cumbersome or withdrawing profits is a battle, all other advantages become moot. This review provides a data-driven examination of Stonefort Securities withdrawals and funding methods. We will dissect the available information on payment options, processing times, associated costs, and the real-world user experience. Our analysis is anchored primarily in data from the global broker regulatory inquiry platform, WikiFX, supplemented by a critical look at publicly available information to provide a comprehensive and unbiased perspective for traders evaluating this broker.

MH Markets Deposits and Withdrawals Overview: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles. MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging pr

GAIN Capital Review: Exploring Complaints on Withdrawal Denials, Fake Return Promises & More

Is your forex trading experience with GAIN Capital full of financial scams? Does the broker disallow you from withdrawing your funds, including profits? Have you been scammed under the guise of higher return promises by an official? Does the GAIN Capital forex broker not have an effective customer support service for your trading queries? Concerned by this, many traders have shared negative GAIN Capital reviews online. In this article, we have discussed some of them. Read on!

Can These Five Brokers boost your wealth?

Choosing a reliable broker can directly impact your long-term profitability. WikiFX evaluates a broker’s safety, regulatory compliance, and service quality. According to WikiFX’s latest ratings, the following five brokers consistently achieve higher scores than many competitors. Whether you're a beginner or a seasoned investor, these well-regulated, reputable platforms may help you trade with greater confidence and potentially boost your wealth.

WikiFX Broker

Latest News

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

The 350 Per Cent Promise That Cost Her RM604,000

INZO Commission Fees and Spreads Breakdown: A 2025 Data-Driven Analysis for Traders

Rate Calc