What WikiFX Found When It Looked Into XS

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about XS and its licenses.

XS positions itself as a globally licensed broker, holding authorisations from multiple well-known regulatory bodies. At first glance, the list of licences suggests a commitment to compliance, with recognised authorities such as the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), the Labuan Financial Services Authority, and the Cyprus Securities and Exchange Commission (CySEC) appearing on its records. However, a closer look reveals a mix of fully verified approvals, exceeded licence scopes, and unverified authorisations, raising questions about the brokers overall regulatory strength.

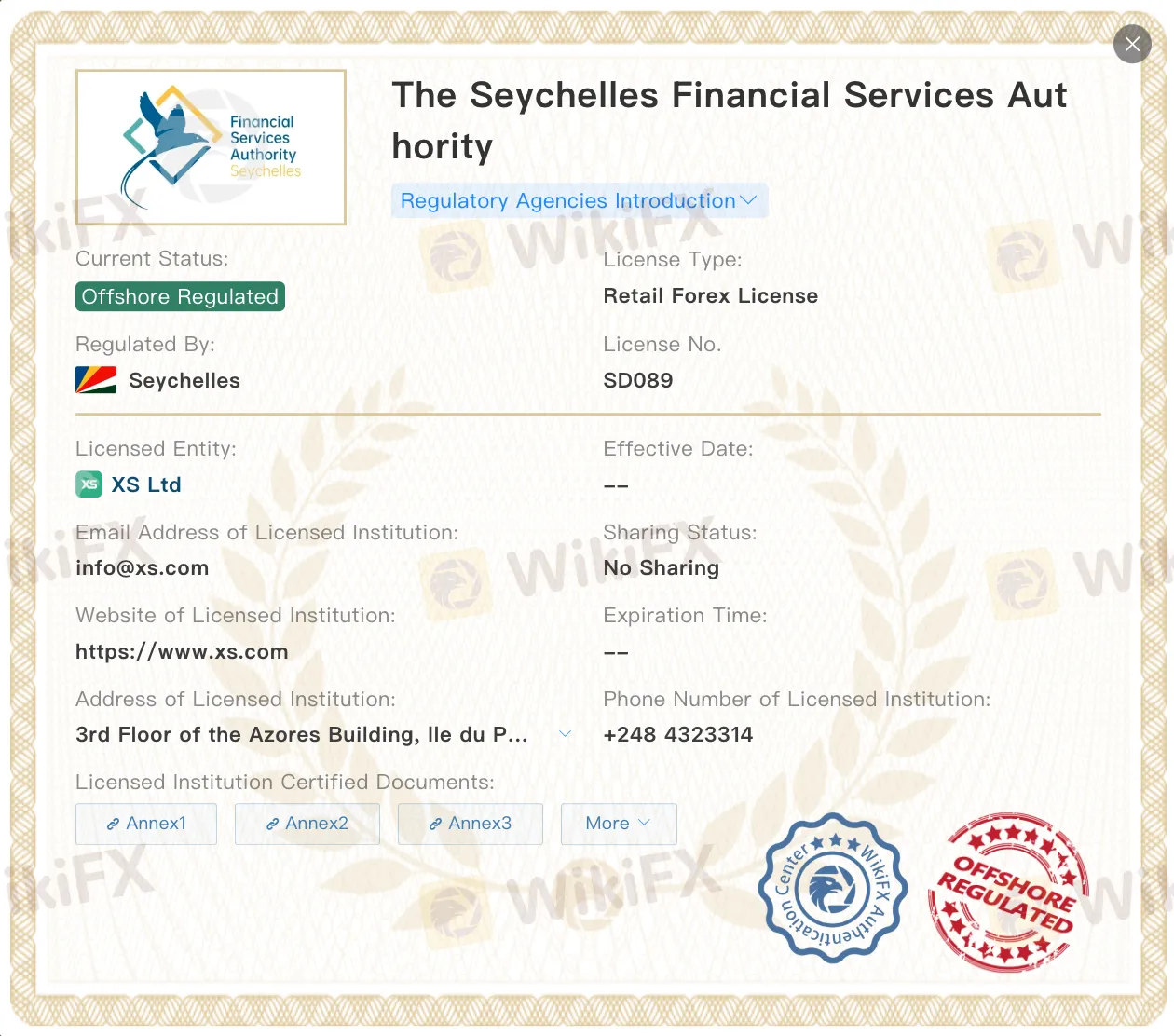

In Australia, XS holds an Institution Forex Licence (STP) under licence number 000374409, issued by ASIC. This is one of the most reputable regulators globally, known for its strict oversight of financial services providers. Similarly, its Retail Forex Licence from the Seychelles FSA under licence number SD089 allows it to operate in offshore markets, and while the FSA does impose certain standards, it is generally considered a lighter-touch regulator compared to ASIC.

XS is also licensed by the Labuan FSA under licence number MB/21/0081, granting it permission to operate under a Straight Through Processing (STP) model in Malaysias Labuan International Business and Financial Centre, which is a mid-tier jurisdiction with defined compliance requirements.

Concerns emerge when looking at the brokers South Africa FSCA licence (number 53199). While the FSCA is a legitimate market conduct regulator, official records indicate that XS exceeds the authorised business scope of its licence. This means the company may be offering services beyond what the FSCA has permitted, which could be an operational risk that traders should not ignore.

Another point of caution is the brokers CySEC licence (number 412/22). While CySEC is a respected European regulator under ESMA guidelines, this licence is marked as unverified, leaving uncertainty about whether it is active, suspended, or still pending full approval.

According to WikiFX, XS has a WikiScore of 6.56/10, a middling score that reflects both the strength of its top-tier licences and the weaknesses from its exceeded and unverified authorisations. For traders, this means that while parts of XSs operations are well-regulated, others operate in a grey area that could affect client protection.

For those considering opening an account, understanding which branch of XS you are dealing with, and under which licence, is essential. Different jurisdictions have different rules for client fund protection, dispute resolution, and operational conduct, meaning your level of safety can vary significantly depending on where your account is registered.

Read more

Gold Outlook: Record Highs Test Momentum Into Year-End

Gold reached its latest record high during quiet trade on Monday. The question for traders now is whether it can sustain momentum into the year end with depleting volumes.

Quotex Review 2025: Safety, Features, and Reliability

Quotex is an online brokerage established in 2020. While the platform has built a presence in markets such as Canada, Ecuador, and the United States, significant concerns regarding its safety and legitimacy have been raised. The broker currently holds a WikiFX Score of 1.52, which is considered very low and indicates a high-risk trading environment. Furthermore, Quotex is classified as unregulated, with its headquarters located in St. Vincent and the Grenadines.

COINEXX Review 2025: Is This Broker Safe or a Scam?

Choosing the right online broker is critical for the safety of your funds. COINEXX, established in 2018, presents itself as an ECN broker offering high leverage and low spreads. However, despite its claims of specialized trading services, the broker holds a concerningly low score on WikiFX, raising questions about its legitimacy.

Exness Review: Is the Low Score of 1.51 a Warning Sign?

When evaluating a forex broker, the safety of funds and regulatory standing are paramount. Exness (specifically the entity operating via premiumexness.com) presents a complex profile for traders to consider. Established fairly recently in 2020 and headquartered in Seychelles, this broker has attracted attention, but not necessarily for the right reasons.

WikiFX Broker

Latest News

QuoMarkets Review 2025: Safety, Features, and Reliability

Strifor Review 2025: A Risk Analysis of This Unregulated Broker

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

Titan Capital Markets Review 2025: Safety Warning and Scam Analysis

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

Why You’re a Millionaire on Demo but Broke in Real Life

Cabana Capital Review 2025: Safety, Features, and Reliability

XTB Review 2025: Pros, Cons and Legit Broker?

Fake Government Aid Scams Are Wiping Out Elderly Savings

Rate Calc