XTB Review 2025: Pros, Cons and Legit Broker?

Abstract:XTB limited has 6,898 instruments, low spreads from 0.5 pips, no min deposit and it is FCA & CySEC regulated. Pros: commission-free CFDs. Cons: withdrawal fees under 50 USD. Read full review.

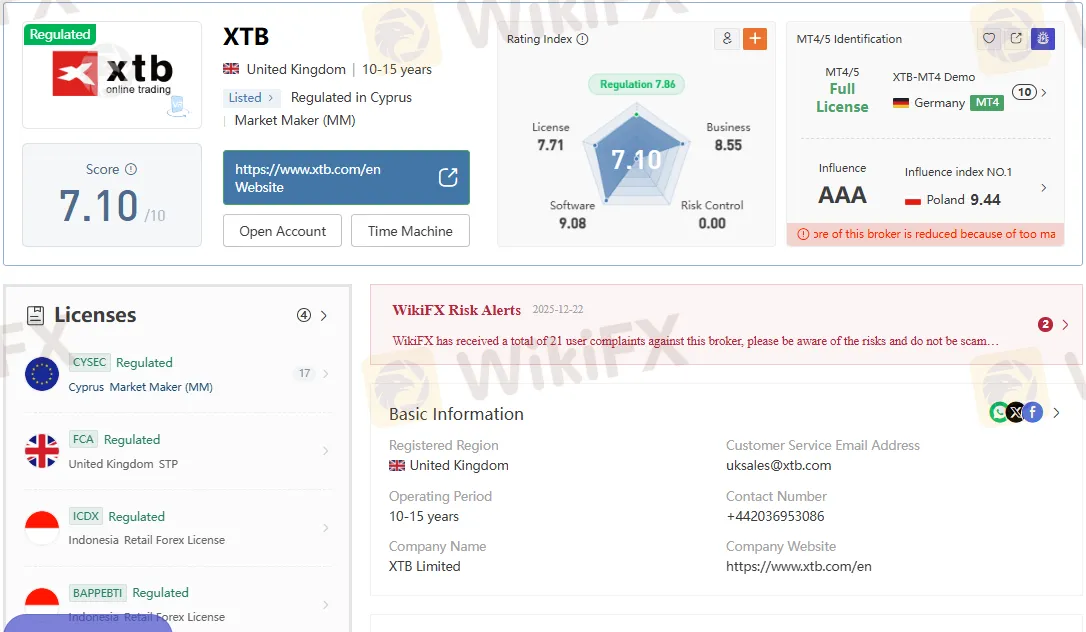

XTB Broker Overview

XTB Limited, operating under the brand XTB Broker, is a UK-registered entity founded in 1995. The firm has grown into one of Europes most recognized online trading providers, offering access to 6,898 financial instruments across forex, stocks, ETFs, indices, and commodities. According to the attached regulatory documents, XTB holds multiple licenses:

- CySEC (Cyprus Securities and Exchange Commission) – License No. 169/12, Market Maker (MM), effective since 2012.

- FCA (Financial Conduct Authority, UK) – License No. 522157, Straight Through Processing (STP), effective since 2011.

- Indonesia Commodity and Derivatives Exchange (ICDX) – License No. 196/SPKB/ICDX/DIR/III/2020.

- BAPPEBTI (Indonesia) – License No. 003/BAPPEBTI/SI/08/2020.

This multi-jurisdictional regulation underscores XTBs legitimacy, positioning it as a broker with strong compliance credentials compared to less-regulated competitors.

Trading Instruments and Market Access

XTB Broker provides one of the broadest product ranges among retail brokers:

- Forex: Major, minor, and exotic pairs with leverage up to 1:500.

- CFDs: Commission-free trading on indices, commodities, and currencies.

- Stocks & ETFs: Over 6,000 listed instruments, with commissions applied beyond €100,000 monthly turnover.

- Cryptocurrencies, Bonds, Options: Available through CFDs, expanding diversification opportunities.

Competitor comparison: While brokers like IG and Saxo Bank also offer multi-asset coverage, XTBs zero minimum deposit and commission-free CFD structure provide a more accessible entry point for retail traders.

Platforms and Technology

The brokers proprietary xStation5 platform is available on mobile, desktop, and tablet. It integrates advanced charting, sentiment analysis, and risk management tools. Unlike many rivals, XTB does not rely solely on MetaTrader 4/5, though demo servers for MT4 are being acquired by the XTB.

Execution speed averages 160 ms, which is competitive but not industry-leading compared to brokers like Pepperstone, known for sub-100 ms latency.

Account Types and Fees

XTB offers a single standard account type:

- Minimum Deposit: £0.

- Spreads: Floating, starting from 0.5 pips; EUR/USD averages around 1.0 pips.

- Commissions:

- CFDs: Commission-free.

- Stocks/ETFs: 0.2% after €100,000 turnover, minimum £10.

- Withdrawal Fees: Free above 50 USD/EUR/GBP; £5 fee below this threshold.

- Inactivity Fee: £10 monthly after 365 days of inactivity.

Compared to competitors, XTBs fee structure is transparent but less forgiving for small withdrawals. Brokers like eToro waive withdrawal fees entirely, giving them an edge for micro-investors.

Regulatory Standing and Transparency

The XTB confirmed FCA and CySEC regulation, alongside Indonesian oversight. This multi-layered compliance framework is a significant advantage over offshore brokers.

However, investigative notes highlight discrepancies:

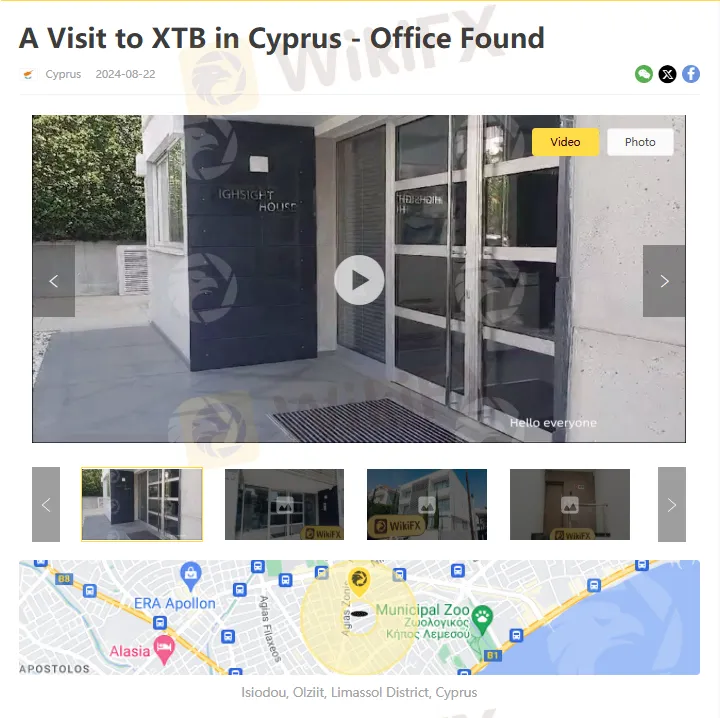

- Cyprus Office: Verified presence in Limassol.

- UK Office: A 2021 inspection reported “no office found” at Canary Wharf, raising questions about operational transparency in the UK.

Domain registration: The official site xtb.com/en is consistent with licensed entities, but traders should remain cautious about clone sites.

Reported Cases and User Complaints

The reported cases includes 43 user reviews, with mixed sentiment:

- Positive: Many users praised the platforms clean interface, fast deposits, and educational resources.

- Neutral: Some noted the brokers heavy reliance on CFDs, limiting long-term investment appeal.

- Exposure Cases: Multiple reports of withdrawal issues, including funds withheld, delays exceeding one month, and unresponsive customer support.

Examples:

- A trader in Ecuador reported receiving only $140 from a $200 withdrawal.

- An Indian client claimed withdrawals were blocked for over a month.

- A Colombian user feared funds were lost after no bank transfer was recorded.

These cases highlight operational risks that prospective clients should weigh against regulatory assurances.

Pros and Cons of XTB Broker

Pros:

- FCA & CySEC regulated.

- Commission-free CFD trading.

- No minimum deposit requirement.

- Broad product range (6,898 instruments).

- Rich educational resources.

Cons:

- Withdrawal fees under 50 USD/EUR/GBP.

- An inactivity fee after 12 months.

- Limited account types (only standard).

- Reports of delayed or failed withdrawals.

- Proprietary platform only; limited MT4/MT5 support.

Bottom Line: Is XTB Legit?

Yes, XTB Broker is legitimate, backed by FCA and CySEC regulation, alongside Indonesian oversight. Its broad instrument coverage, commission-free CFDs, and zero minimum deposit make it attractive for retail traders.

However, investigative found serious withdrawal complaints and inconsistencies in office verification. While XTB remains a regulated broker, traders should approach it with caution, particularly regarding fund withdrawals and long-term reliability.

For those seeking a regulated, commission-free CFD provider, XTB offers value. Yet, competitors like IG or Pepperstone may provide stronger execution speeds and fewer withdrawal concerns.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Rate Calc