Gold Outlook: Record Highs Test Momentum Into Year-End

Abstract:Gold reached its latest record high during quiet trade on Monday. The question for traders now is whether it can sustain momentum into the year end with depleting volumes.

Gold prices have moved back into the spotlight after breaking above the previous October high, a move that has caught the attention of many market watchers as the year draws to a close. Spot gold was the first to push past the record level on Monday, with futures following shortly after. There was no single headline or major event driving the breakout, but in this case, one may not have been necessary. Gold has been on a steady uptrend since its October low, and seasonal patterns, combined with thinner trading volumes heading into Christmas and year-end, have helped keep the bullish momentum intact.

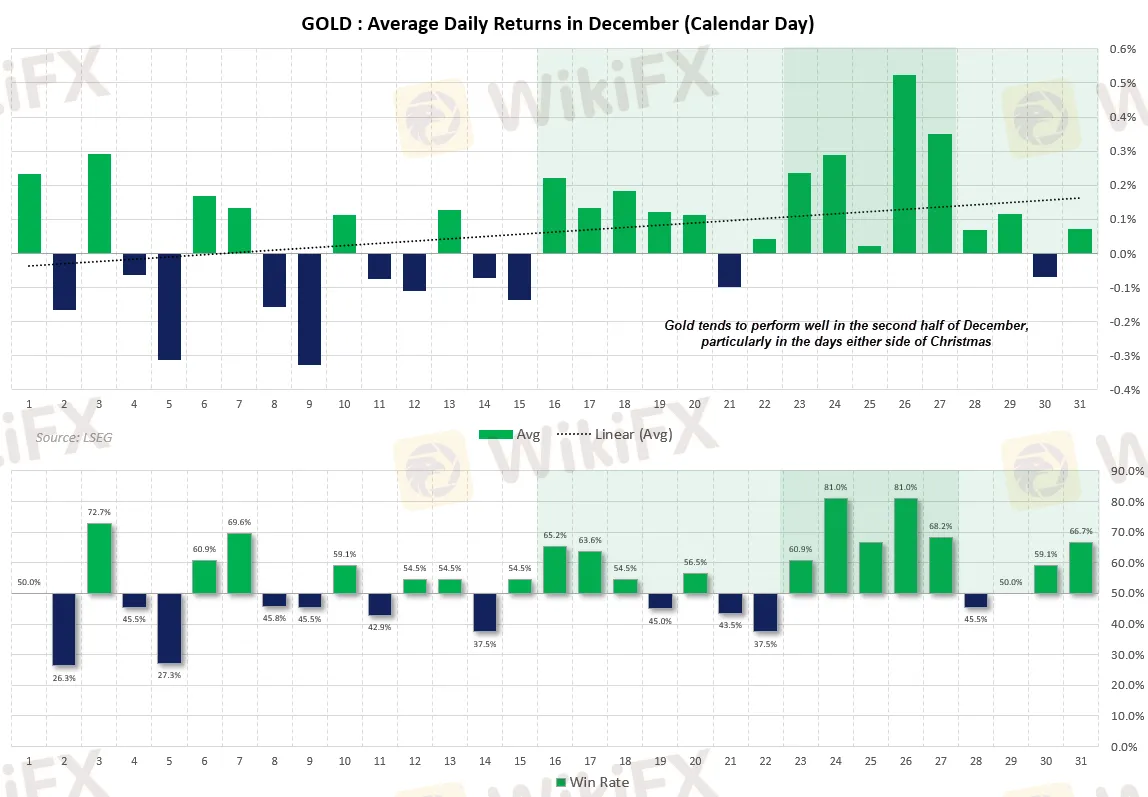

December has historically been a supportive month for gold, although the results are not always straightforward. Looking back over the past 50 years, gold has posted average and median gains of about 1.1% during the month, suggesting a generally positive bias. That said, the win rate sits at around 52%, which means gains are far from guaranteed every year. Still, when December is a winning month, the upside can be meaningful, with average returns close to 4.8%. In contrast, losing Decembers tend to see smaller declines, averaging around 2.9%. This uneven pattern reflects why traders often remain optimistic but cautious during this period.

With only about a week of real trading left before the year ends, some caution is still warranted. Gold has already climbed roughly 4.3% so far this December, and lower liquidity during the holiday period can sometimes lead to consolidation or short-term profit-taking. That said, there are no clear technical signs pointing to an immediate top. The 14-day RSI has only just moved into overbought territory, which is typical during a healthy uptrend rather than a warning signal on its own.

Seasonal trends also continue to favour the bulls. Historically, gold tends to perform well in the sessions around Christmas, with average daily returns leaning positive and win rates relatively high. This keeps the door open for another push higher before any end-of-year profit-taking comes into play. Looking beyond the holidays, the broader outlook for gold remains constructive, with any pullbacks likely to attract buyers looking to add on dips rather than exit the market altogether.

Read more

ASIC Review Leads to Millions in Refunds After Widespread CFD Rule Breaches

After detecting major compliance failures, ASIC secures refunds for thousands of CFD traders and forces changes across the brokerage industry.

Australian Dollar Strengthens on Robust Jobs Data, US Dollar Holds Steady

The Australian Dollar (AUD) advanced against the US Dollar on Thursday after stronger-than-expected employment data reinforced expectations that the Reserve Bank of Australia (RBA) may maintain a tighter monetary policy stance for longer. Meanwhile, the US Dollar remained steady as easing trade tensions offset reduced expectations for near-term Federal Reserve rate cuts.

Angel Broking Review 2026: Is Angel Broking a Safe Broker or a High-Risk Platform?

When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the broker’s background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

BDFX Exposure: Alleged Misleading Market Advice & Poor Withdrawal Management

Do BDFX officials mislead you with poor market advice that leads to capital losses? Do you feel they themselves cannot trade the risk management analysis perfectly? Did the Comoros-based forex broker close your forex trading account and steal your funds? Did your numerous fund withdrawal requests go in vain? These are potential forex investment scams. Many traders have highlighted these trading issues on broker review platforms. Check out some of their complaints in this BDFX review article.

WikiFX Broker

Latest News

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

AI in Medicine: Diagnostics, Privacy, and Ethical Challenges

TSMC Earnings Confirm AI "Supercycle," But Capacity Wall Looms

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Rate Calc