QuoMarkets Review 2025: Safety, Features, and Reliability

Abstract:QuoMarkets is a UAE-based brokerage established in 2022, offering completely digital account opening and access to the MetaTrader 5 (MT5) platform. While the broker provides support for multiple account types and cryptocurrency funding, it currently holds a low WikiFX Score of 3.09. This score reflects significant concerns regarding its regulatory status, with licenses marked as "Exceeded" or "Unverified" and explicit warnings from financial authorities.

QuoMarkets is a UAE-based brokerage established in 2022, offering completely digital account opening and access to the MetaTrader 5 (MT5) platform. While the broker provides support for multiple account types and cryptocurrency funding, it currently holds a low WikiFX Score of 3.09. This score reflects significant concerns regarding its regulatory status, with licenses marked as “Exceeded” or “Unverified” and explicit warnings from financial authorities.

Pros and Cons of QuoMarkets

Based on the available data, here is a summary of the broker's strengths and weaknesses:

- ✅ Trading Platform: Offers the industry-standard MT5 software (White Label).

- ✅ Account Variety: Four distinct account types (Infinite, Zero, Standard, Raw) to suit different trading styles.

- ✅ High Leverage: Offers leverage up to 1:2000 on specific account types.

- ✅ Funding Options: Supports a wide range of payment methods including USDT, BTC, ETH, and local bank transfers.

- ❌ Regulatory Status: UAE license is “Exceeded,” while South African and Seychelles licenses are “Unverified.”

- ❌ Official Warnings: Flagged by CySEC (Cyprus) and FSA (Seychelles) as an unauthorized entity.

- ❌ Low Safety Score: A WikiFX score of 3.09 indicates a high-risk environment.

- ❌ User Complaints: Reports of withdrawal blocks, intimidation, and severe slippage.

Is QuoMarkets Safe? Regulatory Analysis

When evaluating the safety of QuoMarkets, the regulatory data presents several critical red flags. The broker claims affiliation with several jurisdictions, but the verification results are concerning.

License Status

- UAE (SCA): The license held by “TRADEQUOMARKETS FINANCIAL SERVICES L.L.C” is marked as “Exceeded,” meaning the business operations may go beyond the scope of what the license permits.

- South Africa (FSCA): The license for “TRADEQUO (PTY) LTD” is currently Unverified.

- Seychelles (FSA): The license for “Trade Quo Global Ltd” is currently Unverified.

Risk Warning: Regulatory Disclosures

QuoMarkets has been the subject of specific warnings from regulatory bodies:

- CySEC (Cyprus): Issued a warning stating that quomarkets.com is not authorized to provide investment services.

- Seychelles (FSA): Issued a warning alerting the public that the website quomarkets.com is not associated with any entity licensed or regulated by the FSA, classifying it as an unauthorized use of a website.

Given these factors, QuoMarkets does not currently hold a valid, verified Tier-1 license, placing client funds at higher risk compared to fully regulated brokers.

Real User Feedback and Complaints

The broker has received serious complaints regarding fund safety and trading ethics. Below is a summary of real user experiences.

Withdrawal Issues and Intimidation

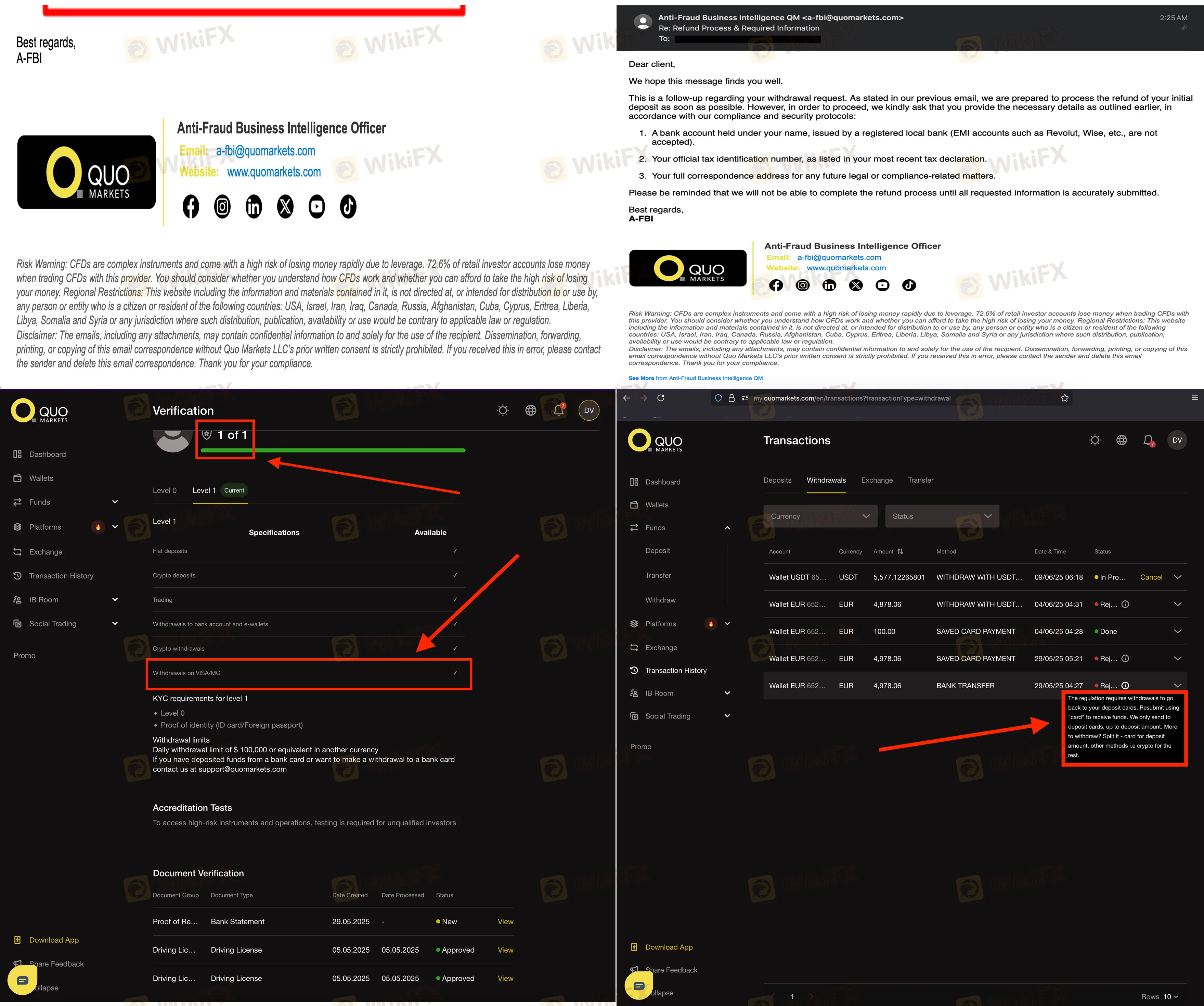

A user from the United States reported severe difficulties withdrawing €4,878.06. After completing KYC, the broker allegedly refused to return funds to a Visa card and demanded a conversion to USDT. Even after compliance, the withdrawal was blocked, and the broker demanded unrelated documents not listed in the client agreement. Most concerningly, the user reported receiving emails from an address mimicking law enforcement (“a-fbi@quomarkets.com”), demanding the deletion of public posts and the signing of a waiver to access funds.

Trading Manipulations

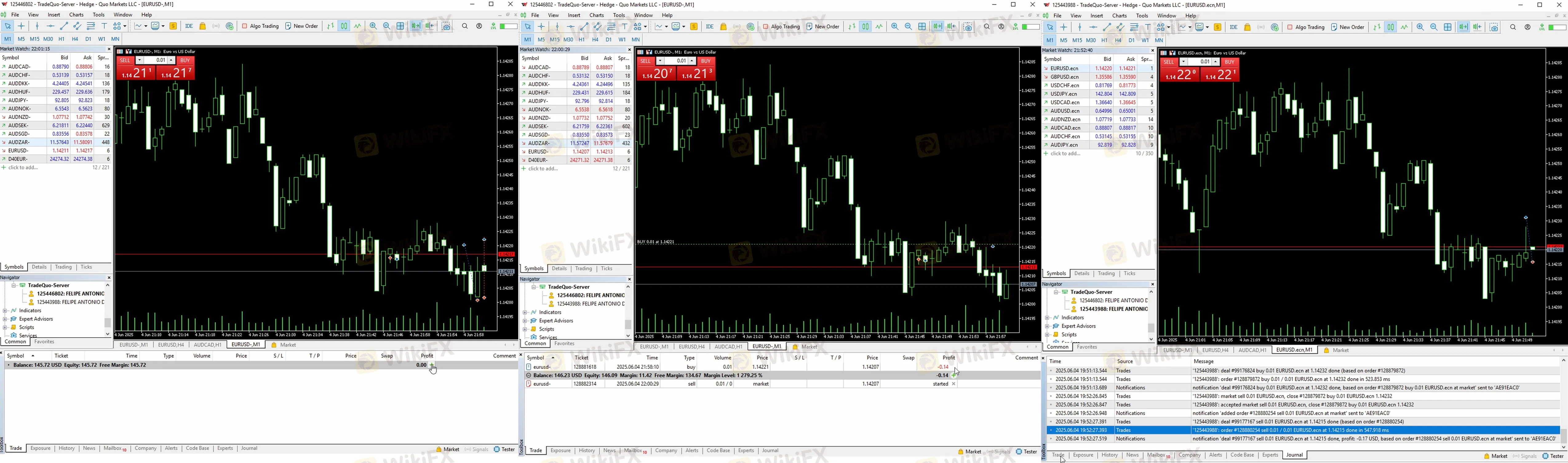

A client from Brazil described the broker as a “complete disaster.” While deposits were executed quickly, the user experienced execution delays of up to 1 second and severe slippage—sometimes up to 30 points on EUR/USD in a flat market. The user also alleged spread manipulation on the “Zero” account type.

General Trust Warnings

A user from Germany labeled the broker a “scam,” advising potential traders to look into the broker's headquarters and negative reviews elsewhere.

Trading Conditions and Fees

QuoMarkets offers competitive conditions on paper, though these features come with the risks associated with an unregulated environment.

Leverage

The broker offers extremely high leverage, which significantly increases risk:

- Zero Account: Max leverage of 1:2000.

- Standard & Raw Accounts: Max leverage of 1:1000.

Spreads

Spreads vary by account type and appear competitive:

- Raw Account: Spreads as low as 0.1 pips.

- Standard Account: Spreads from 0.4 pips.

- Infinite Account: Spreads from 0.6 pips.

Platforms

QuoMarkets utilizes the MetaTrader 5 (MT5) platform. The platform supports Expert Advisors (EAs), allows scalping and hedging, and is available in multiple languages. However, the software qualification is listed as a “White Label,” and the broker does not support proprietary mobile apps for iOS or Android, relying on the standard generic MT5 software.

Final Verdict

QuoMarkets presents a visually modern offer with high leverage and popular trading software (MT5). However, the WikiFX Score of 3.09 and the “Exceeded” or “Unverified” status of its licenses suggest it is a high-risk broker. The existence of official warnings from CySEC and the Seychelles FSA, combined with user reports of withdrawal denials and intimidation tactics, indicates significant safety concerns.

Traders should exercise extreme caution.

To stay safe and view the latest regulatory certificates, check QuoMarkets on the WikiFX App.

Read more

KUBERA MARKETS Payout & Withdrawal Issues — What Traders Are Saying

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

BelleoFX Review: Allegations of Controversial Profit Cancellations & Account Closure

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

Is Dbinvesting Real or Fake: A Simple Check to See if This Trading Company Can be Trusted

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check

Dbinvesting Complete Review (2026): A Detailed Look at Safety, Costs, and Customer Experiences

An Honest First Look When checking out a forex broker, the main question is always about trust: "Is Dbinvesting a safe place for my investments?" This review answers that question directly. Dbinvesting says it's an experienced broker that offers the popular MT5 platform, different account options, and access to worldwide markets. But as we look closer, we find a very different story. Our research found serious warning signs, especially its weak overseas regulation and a very low trust score from independent reviewers. This review gives you a short summary of what we found, comparing what the broker promises with the serious problems shown by real data and lots of user feedback. We want to give you a clear, fact-based answer to help you understand the major risks before investing. The difference between what it promises and what users actually report is the main focus of our investigation.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Rate Calc