What WikiFX Found When It Looked Into FXTF

Abstract:In the complex world of online trading, verified licenses and confirmed operational presence offer important reference points for evaluating a broker. FXTF is one such firm that has undergone regulatory registration and address verification

FXTF, a Japan-based forex broker, has received a strong WikiScore of 8.49 out of 10 from WikiFX, a global platform that evaluates brokers across multiple criteria. The rating reflects the brokers standing in areas such as regulatory compliance, licensing, trading environment, risk management, and overall business operations.

A key factor contributing to FXTF‘s score is its regulation by Japan’s Financial Services Agency (FSA). As the countrys main financial regulator, the FSA oversees a wide range of financial institutions, including forex brokers. Its responsibilities include supervising service providers, ensuring market stability, and protecting investors, depositors, and policyholders.

FXTF operates under Licence No. 258, which permits the company to offer retail forex trading services. The licence is fully regulated and reflects the brokers adherence to the strict standards set by the FSA. This level of oversight provides clients with assurance that the firm operates within a well-regulated framework.

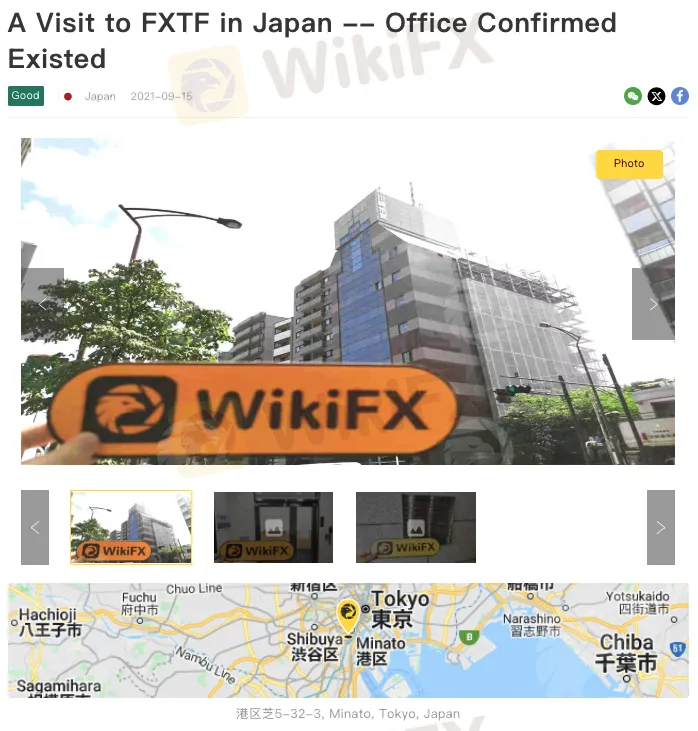

To further verify the broker‘s operational status, WikiFX conducted a field investigation at FXTF’s registered address: the 4th floor of the Mita Kawasaki Building in Minato-ku, Tokyo. The inspection confirmed that FXTF maintains an active presence at the location.

Such physical verifications are an important part of assessing broker reliability. In some jurisdictions, companies may hold valid licences but operate without a physical office, often relying on virtual or placeholder addresses. This can create uncertainty for clients, particularly when dealing with online platforms.

WikiFXs field surveys aim to close this gap by checking whether brokers are genuinely operating from the locations they list. These verifications offer an added layer of transparency, especially for traders choosing between firms that may appear similar on paper but differ significantly in practice.

For investors, knowing that a broker is not only licensed but also physically active at its registered address can provide added confidence. FXTFs confirmed location and strong regulatory standing make it a noteworthy choice for traders seeking a trusted and transparent trading partner.

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc