NinjaTrader Review: Platforms & Risks (2026)

Abstract:NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

NinjaTrader offers strong futures and forex platforms but was fined $250K by the NFA for anti‑money laundering lapses, while its regulated status remains in place. This updated NinjaTrader review examines its platforms, risks, and regulatory licenses so WikiFX App users can better understand the brokers position in 2026.

Overview of NinjaTrader Broker

NinjaTrader broker operates under the NinjaTrader Group, which provides brokerage, clearing, and trading technology services to active and professional traders. Through its own brand and related entities such as Tradovate, the company offers access to multiple asset classes, including futures, forex, CFDs, and stocks.

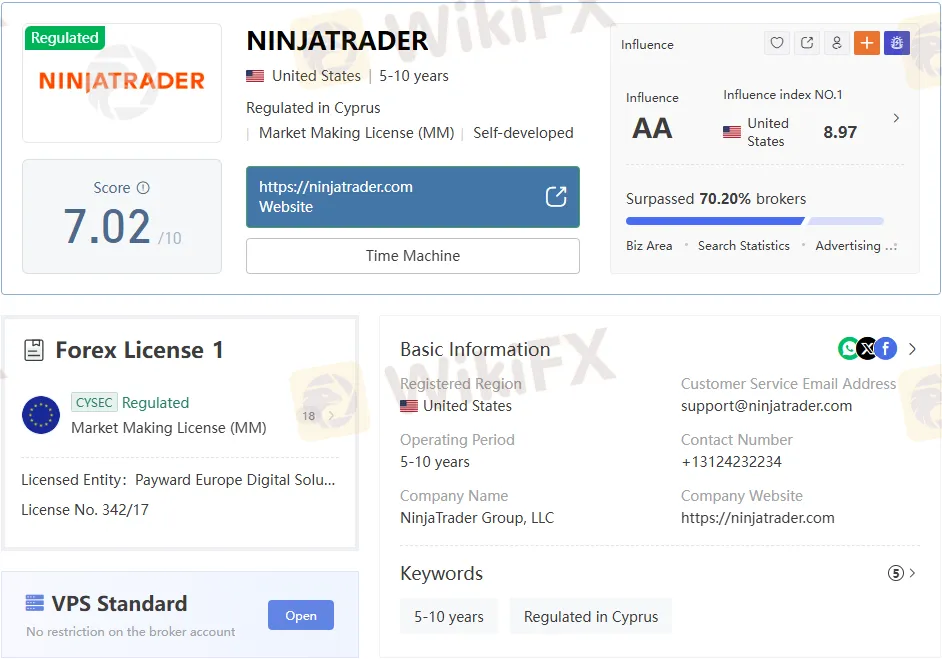

The WikiFX App lists NinjaTrader as a regulated broker and presents key information on ownership structure, business scope, and client focus. By consulting the NinjaTrader review section in the WikiFX App, users can see how the broker combines technology‑driven platforms with traditional brokerage services.

Trading Platforms and Products

The core NinjaTrader platform is built for active traders who want advanced charting, multiple order types, and support for automated strategies. According to the NinjaTrader broker page, clients can trade CFDs, foreign exchange contracts, futures, and stocks through a unified interface designed for fast execution and detailed analysis.

NinjaTrader Forex is positioned alongside futures trading, so users can manage currency and derivatives exposure from a single account. The broker NinjaTrader and its Tradovate brand were among the first to offer Nano Bitcoin futures (BIT) from Coinbase Derivatives Exchange, providing commission‑free access to that contract with no market‑data fees.

For traders interested in cryptocurrency‑linked derivatives, this Nano Bitcoin futures listing shows how the NinjaTrader broker expands its product line while remaining within established derivatives frameworks. Users considering Forex NinjaTrader or digital asset strategies can review contract specifications, margin requirements, and fee structures through the WikiFX App before funding an account.

Regulatory Status, CySEC License, and NFA Fine

NinjaTrader's regulatory status is a central factor in assessing its overall risk profile. The WikiFX page reports that the broker was fined $250,000 by the National Futures Association (NFA) for anti‑money laundering failures, including missed suspicious trades and high‑risk accounts.

Despite this enforcement action, NinjaTrader remains classified as regulated and continues to hold licenses in multiple jurisdictions. One key authorization is a Market Making License (MM) issued by the Cyprus Securities and Exchange Commission (CySEC) under license number 342/17, effective from 13 November 2017, with the licensed entity being Payward Europe Digital Solutions (CY) Limited, and NINJATRADER is listed as a brand.

The CySEC license covers foreign exchange trading and agency services, financial derivatives trading and agency, securities trading and agency, bond trading and agency, and other financial product activities, with cross‑border services available in numerous EU member states. This CySEC authorization supports the regulated status shown for NinjaTrader on WikiFX App, even as the NFA fine highlights shortcomings in its historical AML controls.

Traders using a NinjaTrader login should recognize that such an AML fine signals operational weaknesses at the time of the investigation, not the loss of licensing. Checking the NinjaTrader regulation section in the WikiFX App, including details of the CySEC license and NFA action, helps users judge whether the brokers overall compliance framework aligns with their risk tolerance.

Key Risks Highlighted in This NinjaTrader Review

The primary risk identified in this review and NinjaTrader analysis is that past AML lapses may indicate broader issues in transaction monitoring, customer due diligence, or escalation procedures. Even after improvements following the NFA sanction, a $250K penalty suggests that earlier systems did not adequately detect or report suspicious activity.

While platform capabilities and product range appear strong, the regulatory findings add a non‑trivial layer of operational and compliance risk. Traders evaluating NinjaTrader Forex and futures offerings should weigh these issues alongside spreads, commissions, execution quality, and available risk‑management tools.

Users who rely on high‑frequency trading or algorithmic strategies might pay particular attention to how the broker monitors complex trading patterns under its AML framework. Using the WikiFX App to cross‑reference NinjaTrader broker disclosures, regulatory news, and user feedback can provide a more rounded picture than platform marketing alone.

Practical Steps Before Using NinjaTrader Login

Before creating or funding a NinjaTrader login, prospective clients should read the full NinjaTrader review and regulatory notes on the WikiFX broker page. This includes understanding which corporate entity holds the CySEC license, how NFA supervision applies, and what products fall under each jurisdiction.

Traders may wish to compare NinjaTrader broker conditions with those of other regulated providers listed in the WikiFX App, focusing on cost structure, platform reliability, licensing strength, and any past sanctions. Reviewing alternatives helps determine whether the combination of advanced tools, CySEC authorization, and NinjaTrader's historical AML issues fits their personal risk profile.

Finally, users should establish their own risk‑management rules—such as maximum position sizes, leverage limits, and stop‑loss practices—rather than relying solely on platform features or regulatory labels. Combining disciplined trading plans with the detailed regulatory and licensing information available in the WikiFX App can support a more informed and cautious use of NinjaTraders platforms in 2026.

Read more

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX Review: High-Risk Forex Broker Warning

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc