User Reviews

More

User comment

10

CommentsWrite a review

2025-07-28 14:23

2025-07-28 14:23

2025-07-27 06:43

2025-07-27 06:43

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

MT4 Full License

Capital Ratio

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index9.79

Software Index9.69

License Index7.85

Single Core

1G

40G

More

Company Name

Goldenway Japan Co., Ltd.

Company Abbreviation

FXTF

Platform registered country and region

Japan

Number of employees

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

FXTF Information | |

| Founded | 2006 |

| Registered Country/Region | Japan |

| Regulation | FSA |

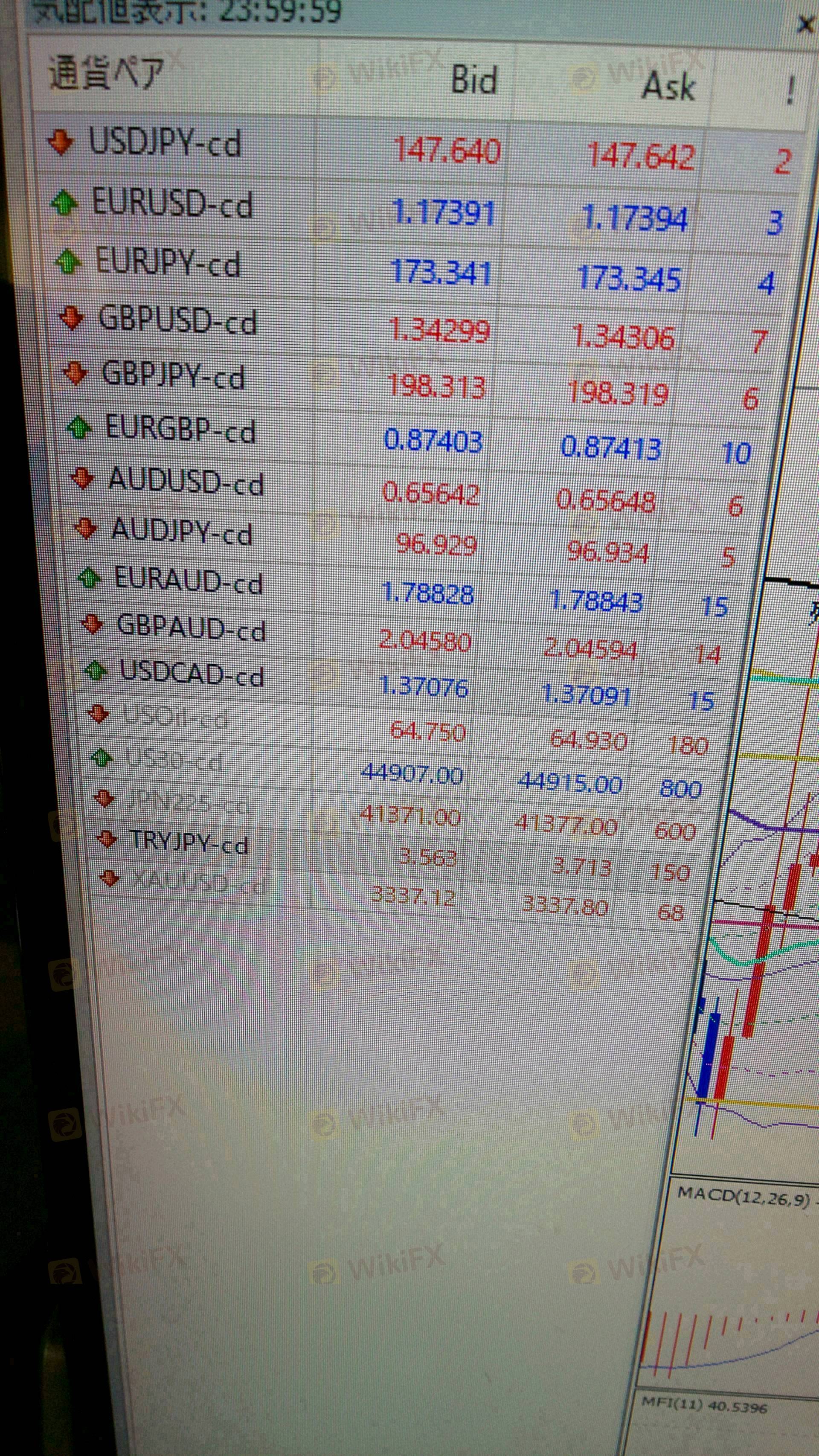

| Market Instruments | Cryptocurrency CFDs, Commodity CFDs, option, Forex |

| Account Type | Individual Account, Corporate Account |

| Trading Platform | MT4 trading system, GX trading system |

| Customer Support | Phone: 0120-445-435 |

| Email: support@fxtrade.co.jp | |

FXTF, founded in 2006, is a brokerage registered in Japan. The trading instruments it provides cover cryptocurrency CFDs, commodity CFDs, option, forex. It is regulated by Japan.

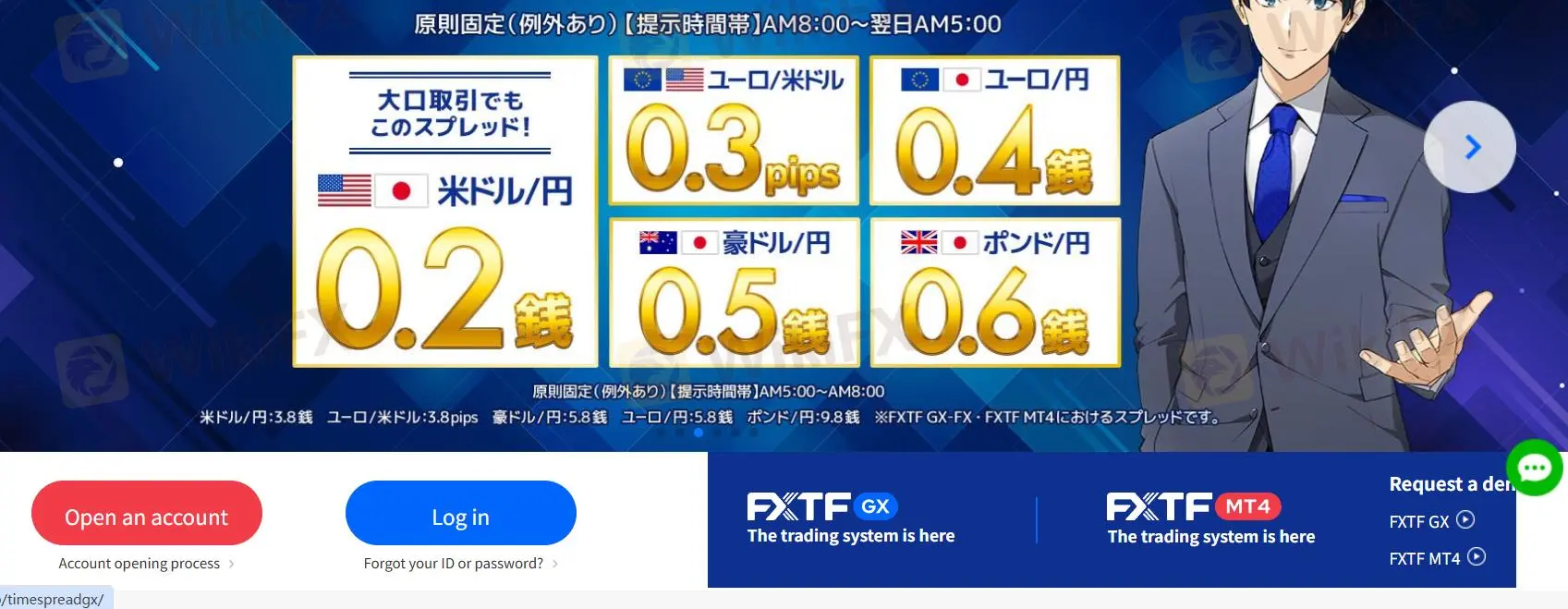

| Pros | Cons |

| Regulated | No commission information |

| Wide range of trading instruments | No clear information about accounts |

| 2 types of trading systems | Limited account types offered |

| Low spreads | No Islamic account |

FXTF is regulated by FSA in Japan. Its current status is regulated.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Japan | FSA | ゴールデンウェイ・ジャパン株式会社 | Retail Forex License | 関東財務局長(金商)第258号 | Regulated |

FXTF offers traders cryptocurrency CFDs, commodity CFDs, option, forex to trade.

| Tradable Instruments | Supported |

| Cryptocurrency CFDs | ✔ |

| Commodity CFDs | ✔ |

| Option | ✔ |

| Forex | ✔ |

| Stocks | ❌ |

| Metals | ❌ |

| Indices | ❌ |

| Futures | ❌ |

FXTF offers 2 different types of accounts to traders - Individual Account, Corporate Account. But there is no more information about accounts.

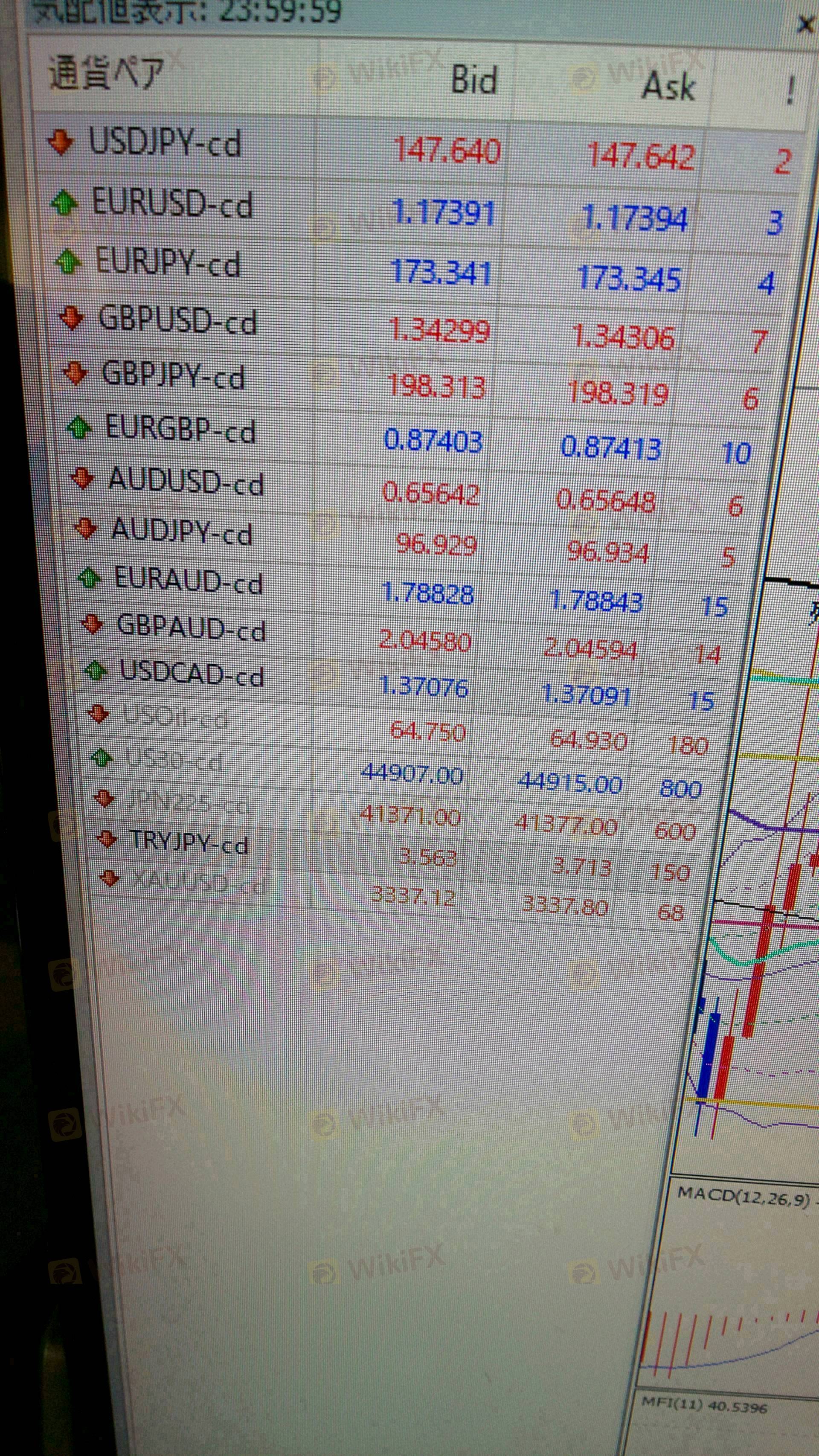

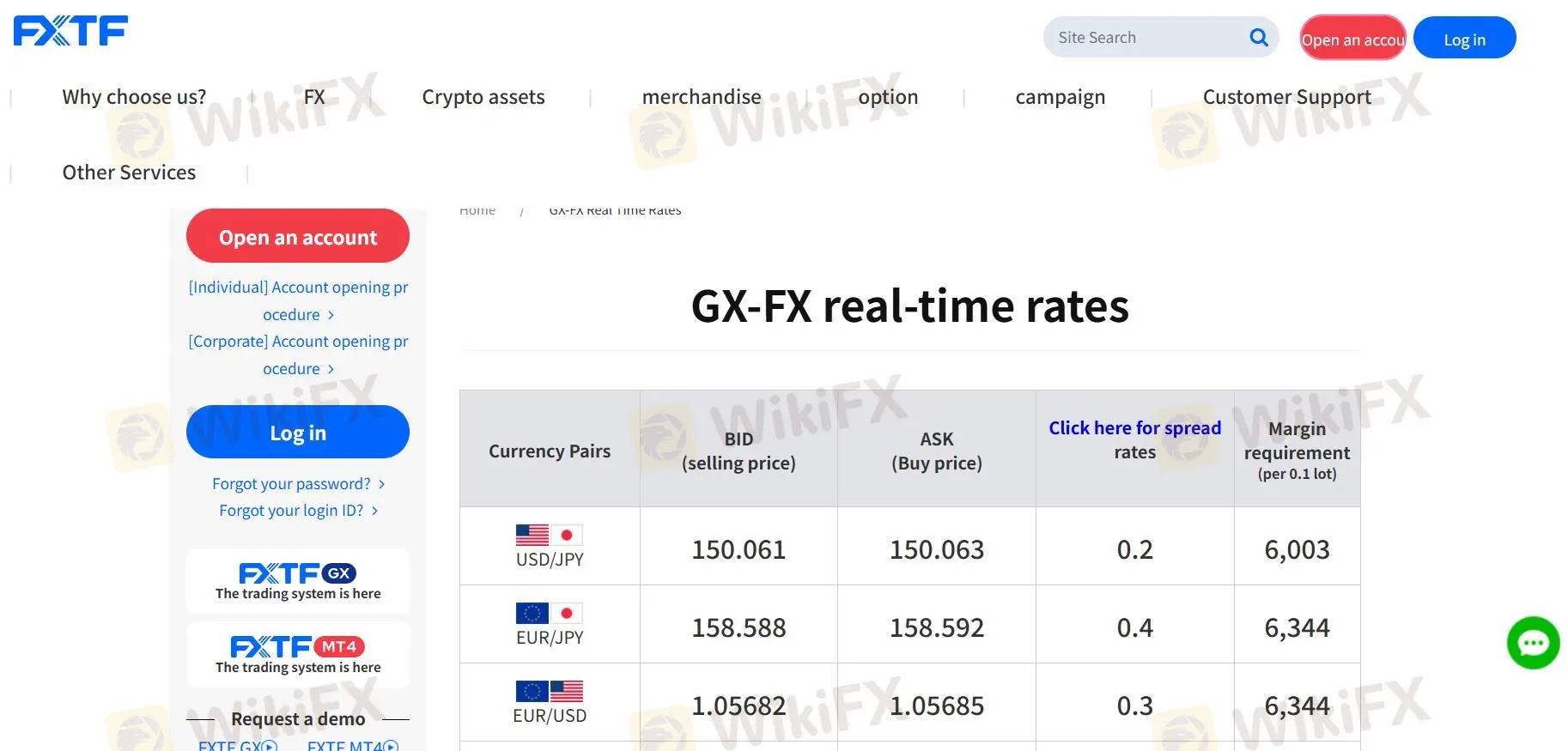

FXTF's trading platforms are MT4 trading system, GX trading system, which support traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT4 Margin WebTrader | ✔ | Web, Mobile |

| GX trading system | ✔ | Web, Mobile |

| MT5 | ❌ |

In the complex world of online trading, verified licenses and confirmed operational presence offer important reference points for evaluating a broker. FXTF is one such firm that has undergone regulatory registration and address verification

WikiFX

WikiFX

After the yen fell to 151.94 per dollar on October 21, a 32-year low, the government decided to intervene. Japan spent a record 5.62 trillion yen ($42.5 billion) that day. Then, on October 24, a second intervention was initiated, with 730 billion yen invested to stop the currency's further drop.

WikiFX

WikiFX

More

User comment

10

CommentsWrite a review

2025-07-28 14:23

2025-07-28 14:23

2025-07-27 06:43

2025-07-27 06:43