CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Abstract:CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

London-listed brokerage CMC Markets (LSE: CMCX) has reported a record-breaking performance in its Australian stockbroking division. However, this period of financial success coincides with a heightened security risk, as cyber security firms issue warnings about a targeted phishing campaign aiming at the platform's high-net-worth clients.

Australian Business Records Stellar Growth

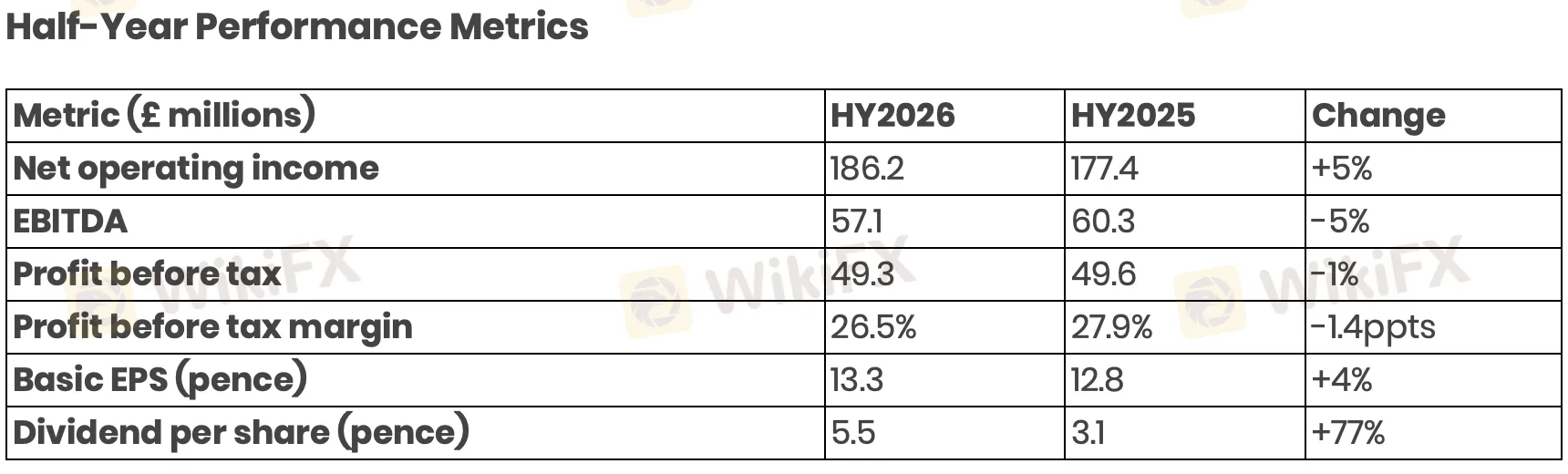

According to CMC Markets latest financial data for the first half of the FY2026, the company recorded a net operating income of £186.2 million, marking a 5% year-on-year increase. The Australian market was the primary catalyst for this result.

The Australian stockbroking unit delivered a record half-year performance, with net operating income climbing 34% to A$65.9 million. Assets under Administration in the region also increased by 14% to approximately A$91 billion. This robust growth has positioned CMC as Australias second-largest stockbroker by revenue.

Furthermore, CMC Markets‘ extended white-label partnership with Westpac Banking Corporation, Australia’s second-largest bank, is expected to fuel future growth, with projections suggesting a 40% increase in the Australian customer base and a roughly 45% uplift in domestic trading volumes following the integration period.

Phishing Campaign Targets High-Value Credentials

Despite the strong financial results, a significant security concern has emerged. Cyber security firm MailGuard AU detected a sophisticated phishing campaign impersonating both CMC Markets and TD Direct Investing. The operation specifically targets wealthy investors.

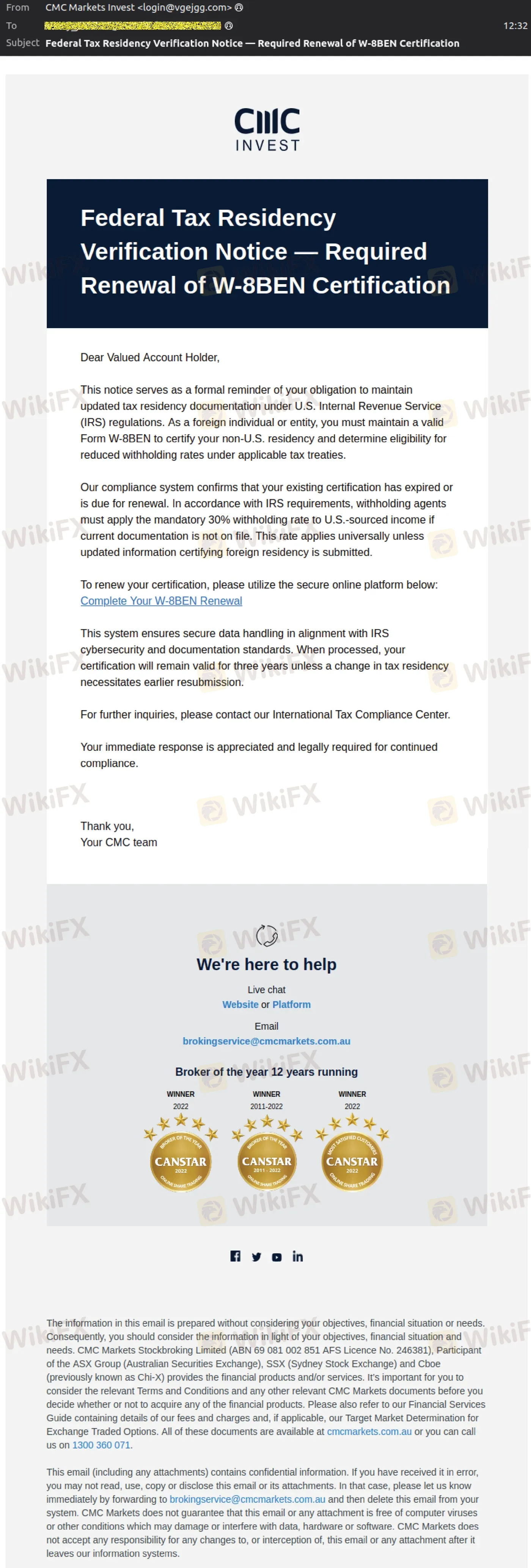

These highly convincing emails are designed to steal user login credentials. They often carry the subject line: “Federal Tax Residency Verification Notice — Required Renewal of W-8BEN PMC Certification.”

The fraudulent messages utilize branding consistent with CMC Invest, referencing real financial processes, and include detailed legal disclaimers to appear credible. Users who click the embedded links are directed to fake login portals designed to harvest sensitive account information.

ASIC Intensifies Crackdown on AI-Driven Scams

The specific threat to CMCs clients reflects a wider pattern of online financial fraud noted by the Australian Securities and Investments Commission (ASIC). The regulator has voiced concerns over the proliferation of sophisticated scams, often utilizing AI-driven tools to create more convincing fake websites.

ASIC is actively combating this surge, reporting that it is taking down approximately 130 fraudulent investment websites each week, with more than 10,000 removed to date. The regulator stresses that scammers frequently clone legitimate sites, including ASICs own consumer resource, Moneysmart, to solicit personal data.

Despite these increased enforcement efforts, financial losses remain substantial, with investment scams reaching $945 million in 2024. Investors are urged to exercise extreme caution and verify any requests for tax information or personal data directly through official communication channels.

Read more

E TRADE Review: Traders Report Tax on Withdrawals, Poor Customer Service & Fund Scams

Has your E Trade forex trading account been charged a withholding tax fee? Did your account get blocked because of multiple deposits? Did you have to constantly call the officials to unblock your account? Failed to open a premium savings account despite submitting multiple documents? Is fund transfer too much of a hassle at E Trade? Did you find the E Trade customer support service not helpful? In this E Trade review article, we have shared certain complaints. Take a look!

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Can’t perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety. This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions prici

In-Depth Review of Stonefort Securities Regulation and Oversight – A Trader's Guide to the Risks

For experienced traders, the process of selecting a new broker transcends a simple comparison of spreads and leverage. It is a meticulous due diligence exercise where the integrity of the broker's regulatory framework is paramount. Stonefort Securities, a relatively new entrant in the crowded brokerage space, presents a complex and often contradictory profile. On one hand, it boasts a modern MT5 platform and a stream of positive user testimonials. On the other hand, it is shadowed by severe regulatory warnings that question the very foundation of its operations. This in-depth review focuses on the core issue for any long-term trader: Stonefort Securities regulation and oversight. We will dissect the broker's corporate structure, scrutinize its licensing claims, and analyze what the data implies for trader protection and fund security. For traders evaluating whether Stonefort Securities is a trustworthy partner, understanding these details is not just important—it is essential.

WikiFX Broker

Latest News

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

Young Singaporean Trader Grew USD 52 into a USD 107,700 Portfolio

Is GGCC Legit? A Data-Driven Analysis for Experienced Traders

Rate Calc