Future Currency Trading

摘要:Future Currency Trading, an online trading platform, provides its clients with the MT5 trading platform. Future Currency Trading offers different account types with varying minimum deposit requirements. The maximum leverage offered by Future Currency Trading is 1:200.

Note: Regrettably, the official website of MOKFX Global, namely https://www.futurecurrencytrading.cc/, is currently experiencing functionality issues. Consequently, it is proving to be quite a challenge to obtain specific and precise details about the broker from their own website. As a result, we have had to rely on existing online sources to offer a general overview of MOKFX Global and its activities.

| Future Currency Trading Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | Dominic |

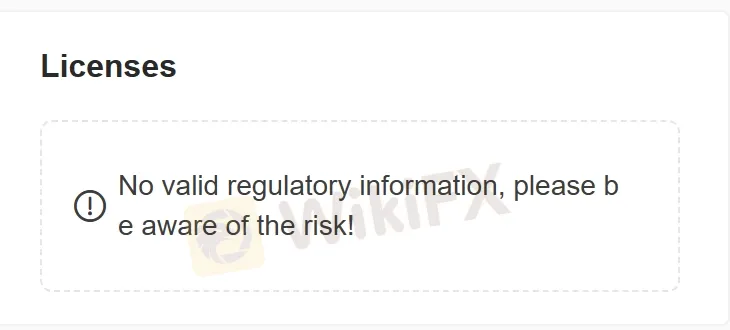

| Regulation | Unregulated |

| Market Instruments | N/A |

| Demo Account | N/A |

| Leverage | 1:200 |

| Spreads | 2 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | $250 |

| Customer Support | Phone and email |

What is Future Currency Trading?

Future Currency Trading, an unregulated online trading platform, provides its clients with the MT5 trading platform. Future Currency Trading offers different account types with varying minimum deposit requirements. The maximum leverage offered by Future Currency Trading is 1:200.

If you are interested, we encourage you to read our forthcoming article where we will conduct a detailed evaluation of the broker from multiple perspectives. We will present you with concise and well-organized information, covering various aspects. By the end of the article, we will provide a succinct summary that will give you a comprehensive understanding of the broker's main features.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

- They offer a variety of account types, which provides flexibility for traders with different preferences and experience levels.

- Future Currency Trading supports MT5 trading platform, which is a popular and widely used platform among traders.

Cons:

- Future Currency Trading is not regulated, which means that there is no oversight or protection for investors.

- The website is currently unavailable, which raises concerns about the reliability and stability of the platform.

- The high minimum deposit required by the broker can be challenging for some traders to meet.

Is Future Currency Trading Safe or Scam?

Investing in Future Currency Trading, an unregulated platform with an inaccessible website, poses significant risks.

This lack of regulation makes it difficult to ensure the reliability and security of their trading platform. Therefore, caution is advised when considering investing with MOKFX Global. It is highly recommended to thoroughly research and evaluate the potential risks and rewards before making any investment decisions. It is generally safer to choose brokers that are properly regulated to protect your funds.

Account Types

| Account Type | Minimum Deposit Requirement | Key Features |

| Black Account | $1,000,000 | Premium features, personalized services, dedicated account managers, VIP treatment, exclusive trading conditions |

| Diamond Account | $500,001 | High-end trading services, priority customer support, advanced trading tools, potentially lower spreads |

| Platinum Account | $150,001 | Enhanced benefits, faster execution speeds, free educational resources, advanced market analysis, possibly lower commissions |

| Gold Account | $50,001 | Increased trading privileges, access to certain trading platforms or tools, potential for personalized trading strategies or recommendations |

| Silver Account | $15,001 | Additional features like higher leverage options, market research reports, potentially reduced fees on certain transactions |

| Bronze Account | $5,001 | Basic trading features, access to standard trading platforms, possibly limited range of educational resources |

| Basic Account | $250 | Essential trading capabilities, access to standard trading instruments, basic level of customer support |

Leverage

Future Currency Trading offers a maximum leverage of 1:200 to its traders. Leverage allows traders to control larger positions in the market with a smaller amount of capital. This means that traders only need to put down a small percentage of the total position size, while the broker provides the rest of the required capital. For example, with leverage of 1:200, a trader can control a position of $200,000 with a margin requirement of just $1,000.

While leverage can greatly increase profits, it also increases risk. Higher leverage means higher risk, as it amplifies both profits and losses. Traders who use high leverage must be careful to manage their risk appropriately, as even small fluctuations in the market can result in significant losses.

Spreads & Commissions

Future Currency Trading offers the spread from 2 pips. The spread refers to the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy a currency pair). The spread can be fixed or variable, depending on the broker. A fixed spread remains constant regardless of market conditions, while a variable spread may fluctuate depending on factors such as market volatility.

Besides, it is impossible to learn about the commission of Future Currency Trading due to the inaccessible website.

Trading Platform

Future Currency Trading offers its clients the MetaTrader 5 (MT5) trading platform. MT5 is a comprehensive trading platform that offers advanced trading tools, technical analysis indicators, and algorithmic trading capabilities. Its user-friendly interface makes it easy for traders to execute trades and monitor their positions in real-time.

MT5 offers several order types, including market orders, limit orders, stop orders, and trailing stop orders. Traders can also use the one-click trading feature to quickly execute trades without having to confirm each trade manually.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +44 1618181333

Email: support@fctrading.pro

Conclusion

In conclusion, Future Currency Trading is an online trading platform that offers clients access to the MT5.

However, it is important to note that Future Currency Trading currently lacks regulation. Additionally, Future Currency Trading's website accessibility issues contribute to the concerns about its legitimacy and transparency. The inability to access their official website can make it difficult to obtain essential information about the company and its services.

Considering the potential risks associated with unregulated trading platforms, investors may be better off seeking out platforms that are regulated by reputable authorities. Regulatory oversight provides an added layer of security and accountability, reassuring traders of fair practices and investor protection.

Frequently Asked Questions (FAQs)

| Q 1: | Is Future Currency Trading regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at Future Currency Trading? |

| A 2: | You can contact via phone, +44 1618181333 and email: support@fctrading.pro. |

| Q 3: | Does Future Currency Trading offer the industry leading MT4 & MT5? |

| A 3: | Yes. It offers MT5. |

| Q 4: | What is the minimum deposit for Future Currency Trading? |

| A 4: | The minimum initial deposit to open an account is $250. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

天眼交易商

熱點資訊

選擇ECN還是標準帳戶?外匯交易新手必須了解的真相

FTMO 向 CVC 收購 OANDA,並計劃將其獨立運營

市場解析:OANDA安達曾以傳承自豪,如今成為 FTMO 收購戰利品

外匯牌價怎麼看?

曝光跨國詐騙集團Wintersnow:用戶血淚控訴PUA吸金全過程

1/20-2/2外匯詐騙高風險平台曝光

Emar Markets安全疑慮大!遭馬來西亞SC示警,多位投資人爆料無法出金

Magic Compass寶匯是否值得信賴?全面解讀平台監管資訊、交易環境、用戶評價、營運概況

匯率計算