SPREADEX Review: Reliable Broker Check

Abstract:SPREADEX, FCA-regulated since 1999, provides 15k+ assets, low spreads & secure trading. No scam flags; reliable broker. Read full review.

SPREADEX broker has been part of the UK financial landscape since 1999, offering spread betting and CFD trading to a wide range of clients. Under the Financial Conduct Authority (FCA), SPREADEX regulation ensures transparency and compliance with strict financial standards. This review explores SPREADEX's services, platforms, fees, and overall reliability, offering a balanced perspective for traders considering SPREADEX's login and trading options.

Company Background

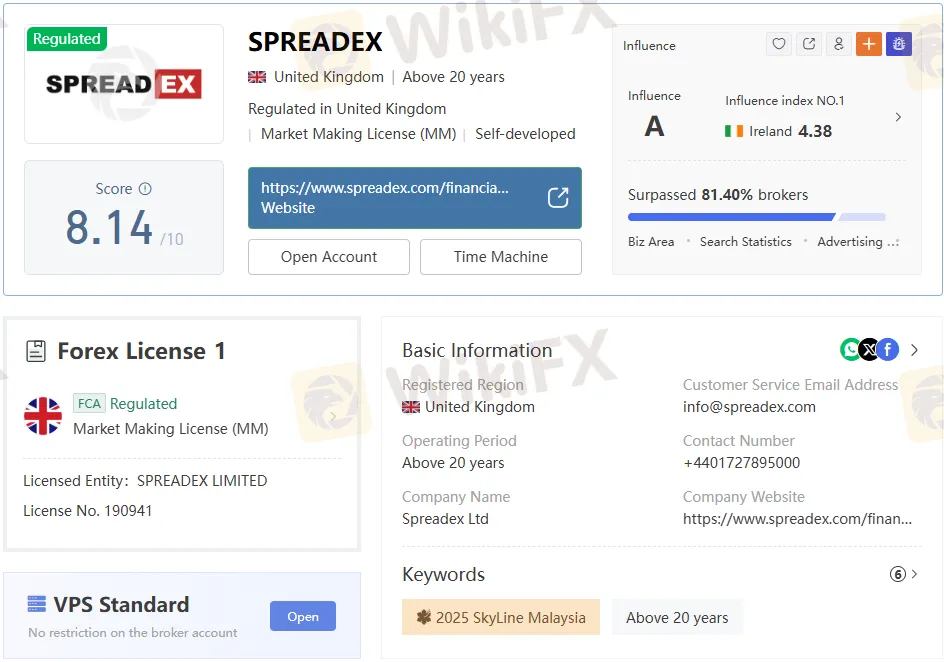

Founded in London, SPREADEX has grown steadily over the past two decades. It operates under license number 190941, holding a Market Making License that authorizes activities such as Forex trading, futures, derivatives, and options. The broker caters to both institutional and retail clients and offers a broad portfolio of more than 15,000 tradable assets.

SPREADEX review highlights its unique dual role as both a spread betting provider and a CFD broker, offering traders flexibility in how they approach the markets. Unlike many competitors, Broker SPREADEX has maintained independence, building its own proprietary platform rather than relying on third-party solutions.

Regulatory Status and Trustworthiness

- Regulation SPREADEX: FCA oversight since 1999.

- Jurisdiction: United Kingdom.

- Client Safety: Segregated accounts protect client funds.

- Transparency: No scam flags reported on the WikiFX App.

This regulatory framework is a strong indicator of trust. FCA regulation is widely recognized as one of the strictest in the industry, ensuring that SPREADEX broker adheres to capital requirements, reporting standards, and fair dealing practices.

Trading Instruments

SPREADEX Forex and CFD offerings are extensive:

- Forex SPREADEX: Major, minor, and exotic currency pairs. Spreads on EUR/USD start at 0.6 pips.

- Indices: Global indices including FTSE 100, S&P 500, and Nikkei.

- Shares: Thousands of equities across the UK, US, and European markets.

- Commodities: Energy, metals, and agricultural products.

- Cryptocurrencies: Bitcoin, Ethereum, and other leading digital assets.

- Options & IPOs: Limited online options trading, plus IPO participation.

This breadth of instruments allows traders to diversify portfolios and hedge positions across multiple asset classes.

Account Types and Accessibility

SPREADEX broker offers a single account type with straightforward conditions:

- Minimum Deposit: $1, making it accessible to beginners.

- Leverage: Retail capped at 1:30, professional accounts eligible for higher ratios.

- Spread Betting vs. CFDs: Traders can choose between tax-efficient spread betting (UK residents) or CFDs for broader global access.

The simplicity of the account structure reduces confusion, though advanced traders may prefer more specialized account tiers.

Fees and Spreads

- Forex: Tight spreads, EUR/USD at 0.6 pips.

- Shares: Financing charges between 1.25%–1.5%.

- Commodities & Indices: Competitive spreads, though liquidity varies.

- Commissions: No hidden charges reported.

SPREADEX's review shows that while spreads are competitive, financing costs on shares may be higher than those of some rivals.

Platforms and Technology

SPREADEX login options include:

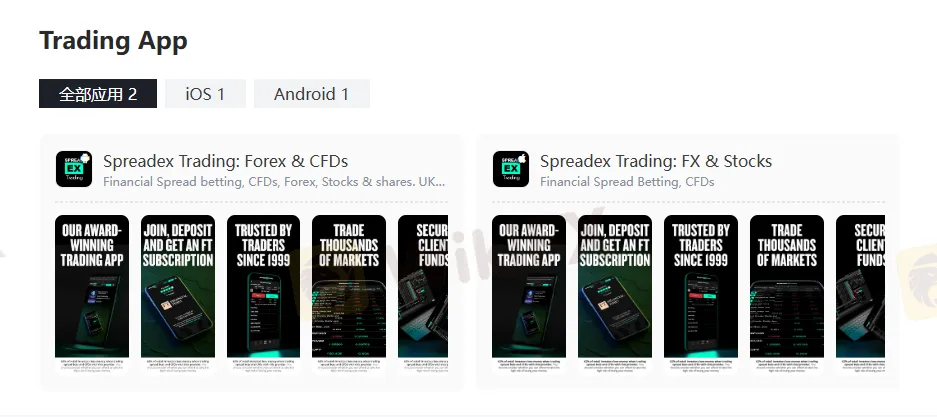

- Web Platform: Proprietary, intuitive interface.

- Mobile App: Available for iOS and Android.

- TradingView Integration: Advanced charting and community features.

The absence of MT4/MT5 may deter traders accustomed to those platforms, but the proprietary system is designed for simplicity and efficiency.

Deposits and Withdrawals

- Methods: Bank transfer, credit card, cheque, direct debit.

- Processing: Card withdrawals within 2 hours; bank transfers within 2 days.

- Minimum Withdrawal: £50 unless withdrawing the full balance.

- Limitations: No e-wallets such as PayPal or Skrill.

While secure, the limited payment methods may restrict flexibility for international traders.

Customer Support and Education

SPREADEX broker provides multiple support channels:

- Live Chat & Phone: Quick responses during UK business hours.

- Email Support: For detailed queries.

- Social Media: Active presence on Facebook, X, YouTube, and LinkedIn.

- Education: Glossary, FAQs, and video training center.

Educational resources are practical but not as extensive as those offered by larger brokers.

Strengths and Weaknesses

| Strengths | Weaknesses |

| FCA-regulated since 1999 | No MT4/MT5 support |

| 15,000+ tradable assets | Limited payment methods |

| Competitive spreads | Options trading limited |

| User-friendly proprietary platform | Regional restrictions |

Comparison with Other Brokers

Compared to peers, SPREADEX regulation provides stronger trust signals than offshore brokers. Its asset range surpasses many mid-tier competitors, though platform limitations may be a drawback for algorithmic traders. For UK residents, the ability to choose spread betting offers a tax advantage not available with most brokers.

WikiFX App Insights

The WikiFX App is a valuable resource for verifying broker legitimacy. Traders can use it to check SPREADEX broker ratings, regulatory details, and user feedback. Mentioning the WikiFX App ensures transparency and helps traders avoid unreliable brokers.

Conclusion

Review SPREADEX: With FCA regulation, a wide range of instruments, and competitive spreads, SPREADEX broker stands as a reliable choice for traders seeking security and variety. Its proprietary platform and low entry requirements make it accessible, while professional traders benefit from higher leverage options.

However, limitations in payment methods and the absence of MT4/MT5 may be drawbacks. For those evaluating brokers, the WikiFX App provides additional insights into SPREADEX's regulatory status, spreads, and user experiences.

Overall, SPREADEX review findings suggest a trustworthy broker with strong regulatory backing, suitable for both beginners and experienced traders.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

MultiBank Group Analysis Report

Pepperstone Analysis Report

TradingPro: Regulation, Licences and WikiScore Analysis

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

Weltrade Review: Safety, Regulation & Forex Trading Details

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Rate Calc