NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

Abstract:When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

An Initial Look at Payments

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker.

One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from “How can I withdraw?” to “Is it safe to invest here?” This background information is essential for protecting your capital.

Key Takeaways First

· Advertised Methods: NEWTON GLOBAL says it supports deposits and withdrawals through channels like Korapay, B2B in PAY, Bank Transfer, and STICPAY.

· The Critical Warning: The broker operates without valid regulation. Independent analysis from verification platforms, such as WikiFX, confirms a “Suspicious Regulatory License” and assigns a very low trust score.

· The Implication: This lack of oversight means there is no governing body to enforce fair practices, no investor protection fund, and no formal dispute resolution process. This places your deposited funds and any potential profits at significant risk during the NEWTON GLOBAL withdrawal process.

Advertised Payment Methods

To give you a direct answer to your question, we have listed the payment methods that NEWTON GLOBAL advertises. It is important to see this information as what the broker *claims* to offer, not as a guaranteed promise of service. The broker shows a mix of e-wallets and bank transfers, which looks modern and convenient on the surface.

However, a closer look shows some unclear points. For example, while it mentions processing times, there is not enough specific information about transaction fees. Good brokers usually provide a clear fee schedule for all deposit and withdrawal methods. The lack of this clarity can be concerning, as unexpected charges could come up. Below is a breakdown of the official channels and funding requirements as presented by the company.

Official Deposit & Withdrawal Channels

We have organized the broker's stated payment options into a clear table. This data is based on the information publicly provided by NEWTON GLOBAL.

| Payment Method | Type | Advertised Processing Time | Stated Fees |

| Korapay | E-wallet/Payment Gateway | Within 24 hours | Not Specified |

| B2B in PAY | E-wallet/Payment Service | Within 1 hour | Not Specified |

| Bank Transfer | Bank Wire | Within 24 hours | Not Specified |

| STICPAY | E-wallet | Within 24 hours | Not Specified |

Minimum Deposit Requirements

To give you more information about funding an account, NEWTON GLOBAL has set up different account levels with different minimum deposit requirements. This setup is common in the industry, but the entry points are important for traders to consider.

· Silver Account: $500 minimum deposit

· Gold Account: $2,000 minimum deposit

· Platinum Account: $10,000 minimum deposit

This system suggests it is trying to serve different types of traders, from beginners to those with more capital to invest. However, the safety of these deposits, no matter the amount, depends on whether the broker is properly regulated and operates honestly.

The Alarming Disconnect

Our analysis shows a serious gap between what NEWTON GLOBAL advertises and what users and regulatory databases report. The broker's marketing promotes fast, efficient transactions, which is important for any trader. Yet, this promise falls apart when we look at evidence pointing to a high-risk, unregulated environment. This section goes beyond what the broker claims to provide a critical view based on facts we can verify and real user experiences.

The main issue is that the broker has no accountability. Without a regulatory body to answer to, promises of “24-hour withdrawals” become empty marketing slogans. When a trader has a problem, they have no official way to get help. This gap between marketing and reality is not just a small problem; it is a serious threat to the security of your funds. We will now break down the most important warning signs that every potential user must consider.

Red Flag #1: No Regulation

The term “unregulated” is not just a technical detail; it has serious, practical consequences for every trader. When a broker is unregulated, it means:

· No Investor Protection: Your funds are not kept in protected accounts and are not covered by any investor compensation program. If the broker goes out of business, your capital is likely lost.

· No Dispute Resolution: If you have a problem with a NEWTON GLOBAL withdrawal process, there is no independent, third-party authority you can appeal to. You are completely dependent on the broker's internal support, which may not be helpful.

· No Accountability: A regulator has the power to fine, suspend, or shut down a broker for bad practices. Without this oversight, there is nothing to prevent a broker from doing unethical things.

Our research, supported by data from the global broker inquiry platform, WikiFX, confirms that NEWTON GLOBAL has “No valid forex regulation.” The platform also flags its license status as “Suspicious.” This is the most important risk factor and should be enough for any careful investor to stay away.

Red Flag #2: User Experiences

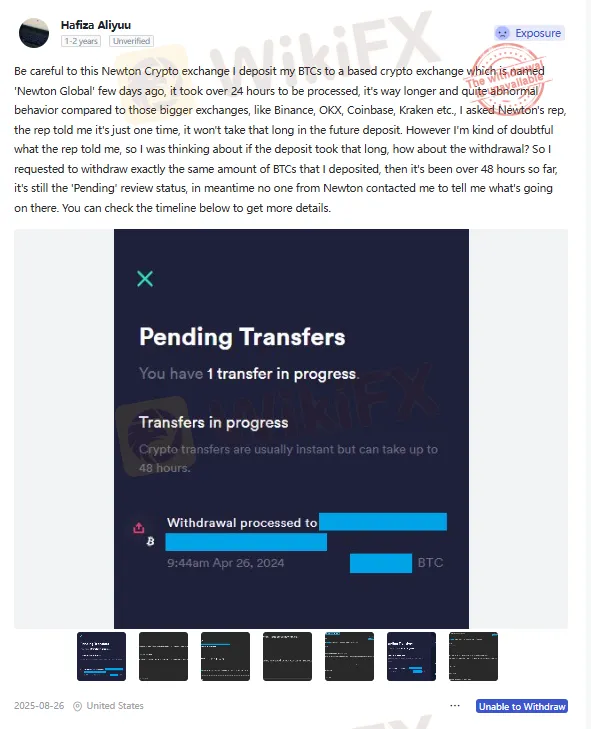

The most telling evidence of how a broker really operates comes from its users. The experiences reported by traders trying to withdraw funds from NEWTON GLOBAL show a disturbing picture that directly contradicts what the broker advertises about processing times.

> Multiple users have reported significant issues with the NEWTON GLOBAL withdrawal process. One trader noted that after a lengthy deposit process that took over 24 hours, their subsequent withdrawal request was stalled. After more than 48 hours, the request remained in a “Pending” state with no communication from the company, raising serious doubts about the accessibility of their funds.

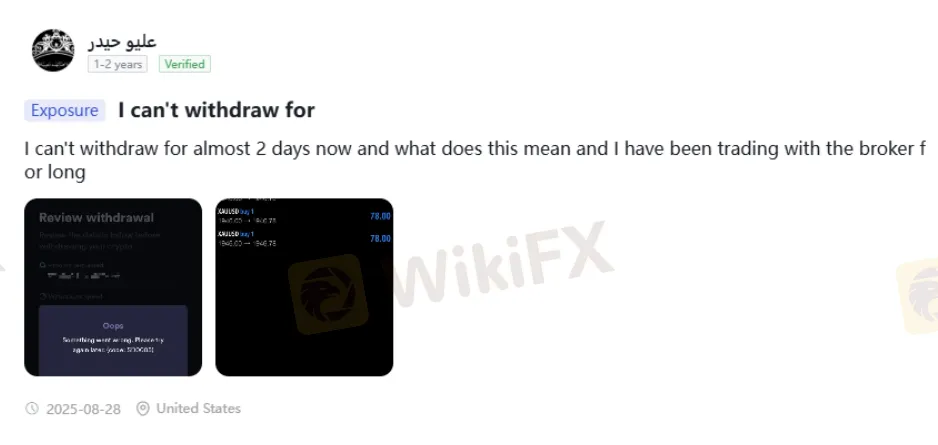

> Another user reported a similar experience, stating simply, “I can't withdraw for almost 2 days now.”

This directly contradicts the broker's claim of processing most withdrawals within 24 hours and highlights a severe gap between promises and performance.

These are not isolated incidents but part of a pattern that points to serious problems within the broker's payment processing system. The delays and lack of communication are classic warning signs of a high-risk operation.

Hook #1: Verify the Evidence

These reports are critical pieces of evidence that every potential client must see. To see a complete record of user reviews, regulatory status and official warnings, we strongly advise you to check the detailed NEWTON GLOBAL profile on WikiFX.

Analyzing the Risks

Understanding the warning signs is the first step. The next is to connect them to the real risk to your capital. A broker's trust score, as put together by independent verification services, is not a random number. It is a data-driven assessment of a broker's safety, calculated from factors such as regulatory status, business practices, software quality, and risk management. NEWTON GLOBAL's score is extremely low, showing serious problems.

The clear warning issued by platforms, such as WikiFX—“Low score, please stay away!”—is a direct result of these critical failures. It serves as a clear alert to the trading community. A broker with such a low rating has failed to meet the most basic standards of financial security and operational transparency. Putting funds into such an entity is not trading; it is a high-stakes gamble with bad odds.

Breaking Down the WikiFX Score

A deep look into the broker's profile shows why the score is so low. The WikiFX platform gives NEWTON GLOBAL a score of just 1.41 out of 10. This is a terrible rating that reflects multiple serious problems.

The main reason for this score is the complete lack of valid regulation. Beyond this, the platform also flags a “Suspicious Scope of Business.” This warning suggests that the broker's activities may not be fully legitimate or transparent, adding another layer of risk. These data points are not opinions; they are factual indicators put together to protect investors from potentially fraudulent or incompetent operations.

The Ultimate Risk Question

Based on the evidence—no regulation, credible user complaints of withdrawal failures and a critically low trust score—we can directly answer the most important question: Are your NEWTON GLOBAL deposits and withdrawals safe?

The answer is absolutely NO. The safety of your funds cannot be guaranteed. The chain of risk is clear and unavoidable. When you deposit funds into an unregulated entity, they are not protected by financial law. If the broker then refuses or indefinitely delays your withdrawal request, you have little to no effective legal way to recover your capital. You are left dependent on the goodwill of a company that has already shown a lack of transparency and reliability.

Hook #2: A Pre-Transaction Check

Before considering a deposit with any broker, especially one with many warning signs, such as NEWTON GLOBAL, doing your own research is extremely important. This is a necessary step to protect your financial health. You can access all the verified regulatory details and user exposure reports for NEWTON GLOBAL on its WikiFX page here: [Link to NEWTON GLOBAL's WikiFX Page]

A Guide to Checking Brokers

While the analysis of NEWTON GLOBAL is a warning story, it also provides a valuable learning opportunity. Understanding why this broker is high-risk gives you the knowledge to identify safe and trustworthy brokers in the future. Instead of focusing only on advertised features, such as spreads or payment methods, a security-first approach is essential.

A reliable broker's payment system is characterized by transparency, reliability and regulatory backing. The process of depositing and, more importantly, withdrawing your funds should be smooth and predictable. The following checklist provides a simple but powerful framework for checking any broker's payment system and overall trustworthiness before committing investments.

Your 3-Step Safety Checklist

1. Verify Regulation First. This is the most important step. Before you even look at account types or payment methods, confirm that the broker holds a valid license from a top-tier regulator. These include authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). A lack of regulation from a reputable body is an immediate disqualification.

2. Check Payment Transparency. A trustworthy broker is open about its processes. Look for a dedicated “Funding” or “Payments” section on their website that clearly lists all available methods, associated fees (if any), processing times for both deposits and withdrawals, and any minimum or maximum transaction limits. Unclear or hidden information is a major warning sign.

3. Cross-Reference with Reviews. Do not rely only on the broker's marketing. Actively search for what real users are saying about the broker's deposit and withdrawal process on independent, third-party review platforms. Pay close attention to how often and what kind of complaints there are related to payment delays or denials.

Hook #3: Making WikiFX Your First Step

To make this process simple and reliable, you can use a global broker regulatory inquiry tool such as WikiFX. It brings together regulatory information, license details and user reviews in one place, allowing you to perform steps 1 and 3 of the checklist in a matter of seconds. For example, a quick search for NEWTON GLOBAL immediately reveals its lack of regulation, saving you time and preventing potential risk.

Final Verdict on Payments

In summary, while NEWTON GLOBAL advertises several modern and seemingly convenient payment methods, these claims are completely overshadowed by overwhelming evidence of extreme risk. The broker's operations are defined by a complete lack of valid regulation, a dangerously low trust score of 1.41/10, and credible user reports of severe withdrawal problems that contradict its marketing promises.

The convenience of a payment method is irrelevant if the underlying system is unsafe. Based on our comprehensive analysis, we cannot endorse the safety of the NEWTON GLOBAL deposit and withdrawal process. We strongly advise all traders to prioritize financial security above all else. Always use independent verification tools to check a broker's regulatory status and user feedback before depositing. Your capital is too valuable to entrust to an unregulated entity with a proven track record of risk.

Read more

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

BP PRIME Review: Safe Broker or Risky Broker

BP PRIME is FCA‑regulated and offers MT5 trading with forex accounts. Explore broker profile, regulation, services, and account details in WikiFX App review.

EMAR MARKETS Scam Alert: Withdrawal Frozen!

EMAR MARKETS (FSCA 53070, exceeded) lures with $1 deposits & MT5 but traps funds in "data verification" scams & fake fees—avoid! Report & recover losses.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Rate Calc