User Reviews

More

User comment

4

CommentsWrite a review

2024-06-04 14:24

2024-06-04 14:24

2024-03-22 18:22

2024-03-22 18:22

Score

Above 20 years

Above 20 yearsRegulated in United Kingdom

Market Making License (MM)

Self-developed

Global Business

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index8.06

Business Index8.00

Risk Management Index9.79

Software Index7.25

License Index8.06

Single Core

1G

40G

Danger

More

Company Name

Spreadex Ltd

Company Abbreviation

SPREADEX

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Spreadex Review Summary in 10 Points | |

| Founded | 1999 |

| Registered Country/Region | United Kingdom |

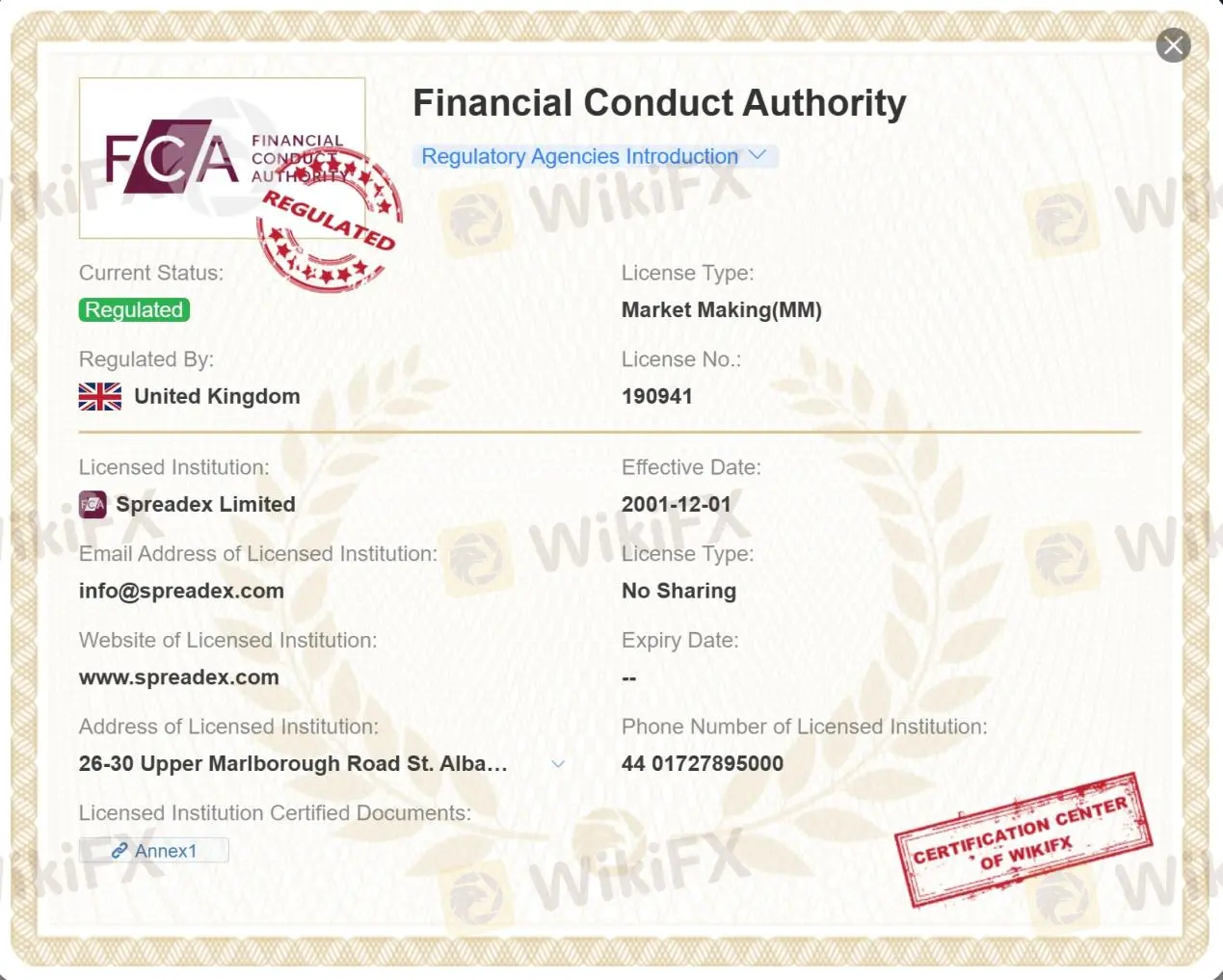

| Regulation | FCA |

| Market Instruments | indices, shares, forex, commodities, bonds, interest rates, exchange traded funds, options, cryptocurrencies, IPOs |

| Demo Account | N/A |

| Leverage | 1:30 |

| EUR/USD Spread | 0.6 pips |

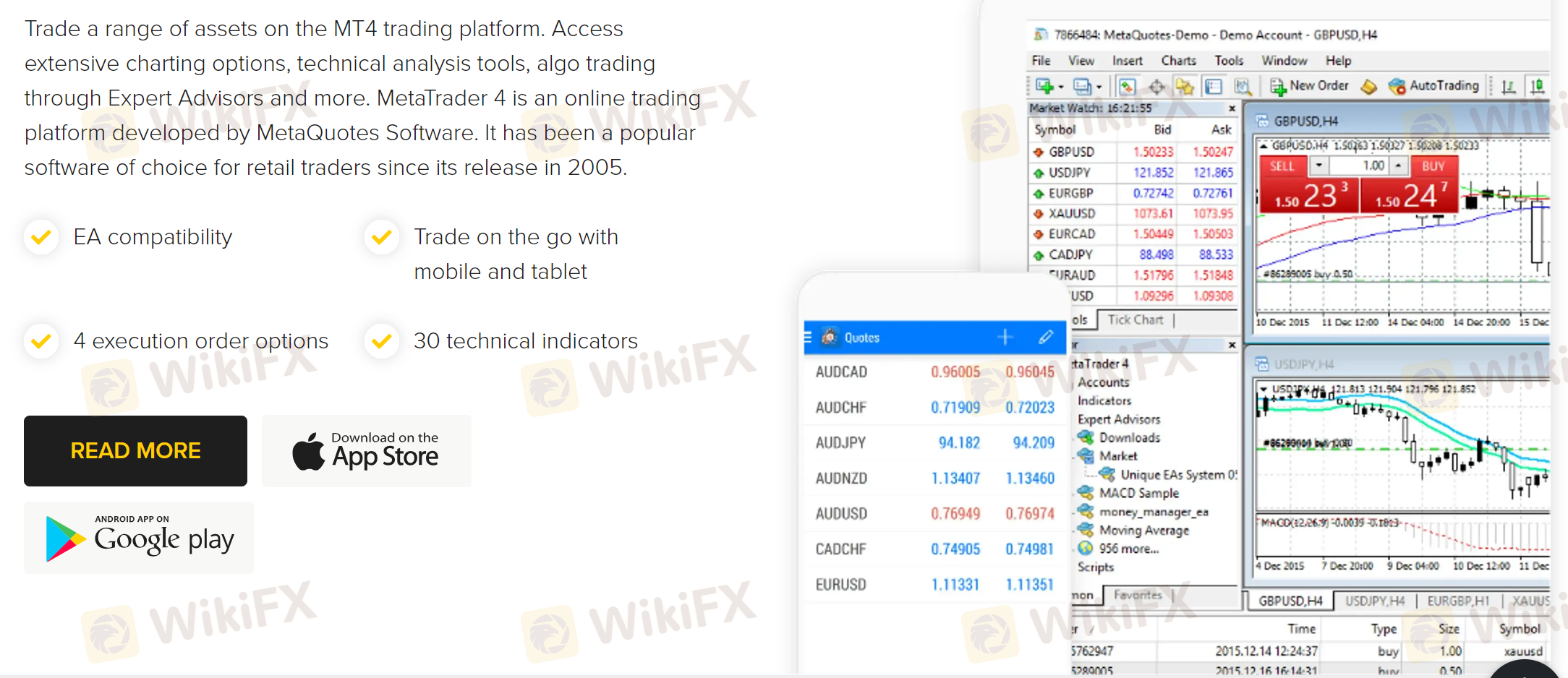

| Trading Platforms | Online platform, Mobile trading, and TradingView |

| Minimum Deposit | $1 |

| Customer Support | Live chat, phone, email |

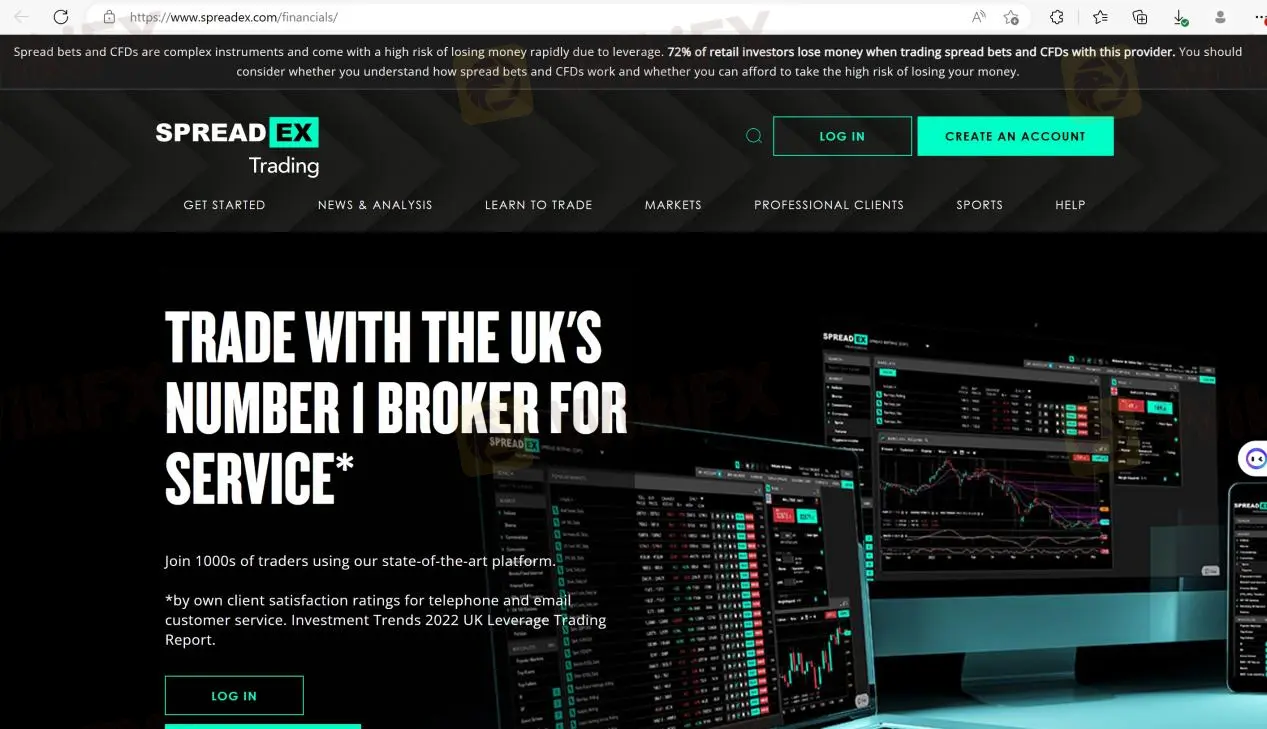

Spreadex is a UK-based brokerage firm, established back in 1999 and focused on a financial trading service providing, as well spread betting and sports betting, through its maintained office in London. Spreadex first moved into the online market in 2006 when it launched its website. Spreadex is regulated by the Financial Conduct Authority (FCA, registration number 190941) in relation to the spread betting services it offers.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • FCA-regulated | • No MT4/5 trading platform |

| • Offers various financial products, spread betting and trading services to retail and professional clients | • Limited deposit and withdrawal options compared to other brokers |

| • Operates within regulatory restrictions for leverage levels | |

| • Offers a range of educational resources | |

| • Multi-channel customer support | |

| • Many years experience in the indus | |

| • Quick account opening and easy to use platform |

There are many alternative brokers to Spreadex depending on the specific needs and preferences of the trader. Some popular options include:

FP Markets - for traders seeking access to a wide range of trading platforms, advanced charting tools, and competitive pricing across various financial markets.

LiteForex - for traders looking for user-friendly MetaTrader platforms, a variety of analysis tools, and a range of trading instruments to choose from.

Global Prime - for traders who prioritize institutional-grade execution, access to multiple trading platforms, and a focus on transparent and reliable trading conditions.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Spreadex appears to be a legitimate broker for individuals interested in trading. The company is regulated by the United Kingdom Financial Conduct Authority (FCA, No. 190941), which adds a layer of safety and transparency for investors. Additionally, the fact that Spreadex offers clients segregated bank accounts can further enhance safety and security for their funds.Having many years of experience in the industry can also be seen as a positive sign, as it suggests that the company has a solid track record and established reputation.

However, it is always recommended for traders to do their own due diligence and research any potential broker before investing funds. Reviews and feedback from other traders can be helpful in determining the safety and legitimacy of a broker, as well as checking for any past incidents of fraud or other issues. Additionally, testing out the available trading platforms and customer support options can help to determine if a broker is a good fit for your individual trading needs and preferences.

Spreadex offers access to over 15,000 tradable assets, covering a wide variety of markets and instruments. This includes popular markets such as indices, shares, forex, commodities, and bonds, as well as interest rates, exchange traded funds, options, cryptocurrencies and IPOs .

Indices - Trade futures or daily contracts on a global selection of indices with tight spreads from 0.6 points. Access major markets worldwide.

Equities - Buy or sell shares of thousands of companies across the globe. Specialized capabilities in trading small-cap stocks.

Forex - Spot and futures forex pairs spanning hundreds of currencies. 24/5 trading from Sunday open to Friday close.

Commodities - Speculative opportunities across metals (gold, copper), energy (Brent crude, natural gas), and soft commodities (cotton, corn).

Fixed Income - Treasury products including UK Gilts, US T-Bonds, and interest rates like Short Sterling, Eurodollar.

ETFs - Gain index exposure efficiently by trading bundled equity ETFs without buying all constituent stocks.

Options - Limited online options suite complemented by broader phone trading capabilities.

Cryptocurrencies - Speculate on major crypto prices like Bitcoin and Ether through spread bets.

IPOs - Stay informed on upcoming and past initial public offerings for new trading prospects.

There seems only one single account available for all traders, which is the Standard account. To open a real account just with the minimum deposit of $1, which sounds a good opportunity for most traders to get started.

As a UK brokerage firm, Spreadex operates within regulatory restrictions for leverage levels. The maximum leverage offered to retail traders is 1:30 for major currency pairs and lower for other instruments. This limitation is in place to protect investors from significant losses and ensure responsible trading practices.

Professional traders, however, may have access to higher leverage ratios once their status is confirmed and specified conditions towards spread betting and trading services are met. This can provide experienced traders with the opportunity to increase their potential profits, but it should be noted that higher leverage also carries higher risk.

Overall, Spreadex's leverage offering is in line with regulatory restrictions and aims to promote responsible trading practices. Traders can still access a range of markets and instruments, but should be aware of the potential risks involved with higher leverages.

Spreadex offers variable spreads that can fluctuate throughout the day depending on market volatility. Major currency pairs such as EURUSD and GBPUSD have very low spreads of 0.6 and 0.9 pips respectively, which is competitive with other brokers in the industry. Spreads for minor and exotic currency pairs are comparable to most other brokers as well.

For all markets apart from shares, the fee is simply the spread between the buy and sell price. However, for shares, there is an interest rate charge applied to the total value of the stock. This fee typically amounts to 1.25%, but it can increase to 1.5% for smaller stocks and those with less liquidity.

There is no information available on any commissions charged by Spreadex. However, the competitive spreads and lack of hidden fees make Spreadex a potentially attractive option for traders looking to minimize their costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Spreadex | 0.6 | No commissions |

| FP Markets | 0.1 | $3 |

| LiteForex | 1.5 | No commissions |

| Global Prime | 0.0 | $7 |

Please note that this information may have changed since my last knowledge update, and it's always recommended to verify the latest details with the respective brokers directly.

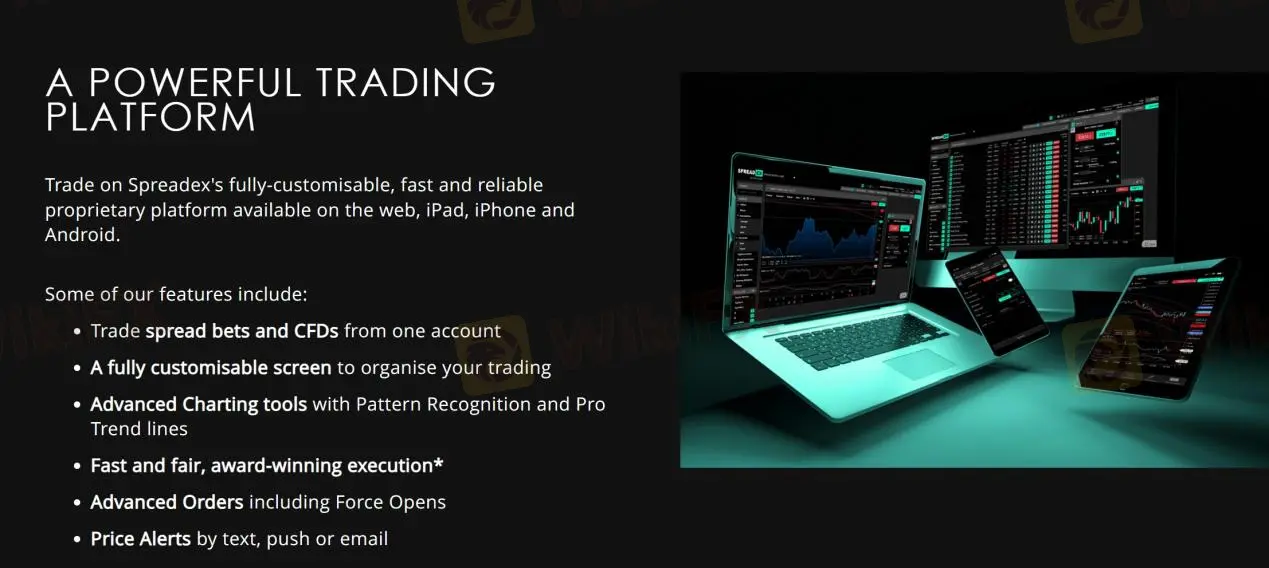

Spreadex offers a range of trading platforms to cater to traders' different preferences and needs. The online platform is Spreadex's flagship trading platform, featuring a user-friendly interface and a range of tools and features. The platform allows traders to access all of Spreadex's tradable assets and markets, as well as providing access to a range of analysis tools and educational resources.

Mobile trading is available through Spreadex's mobile app, which is available for both iOS and Android devices. The app provides traders with a convenient and flexible way to access their accounts and trade on-the-go, with many of the same features and tools as the online platform.

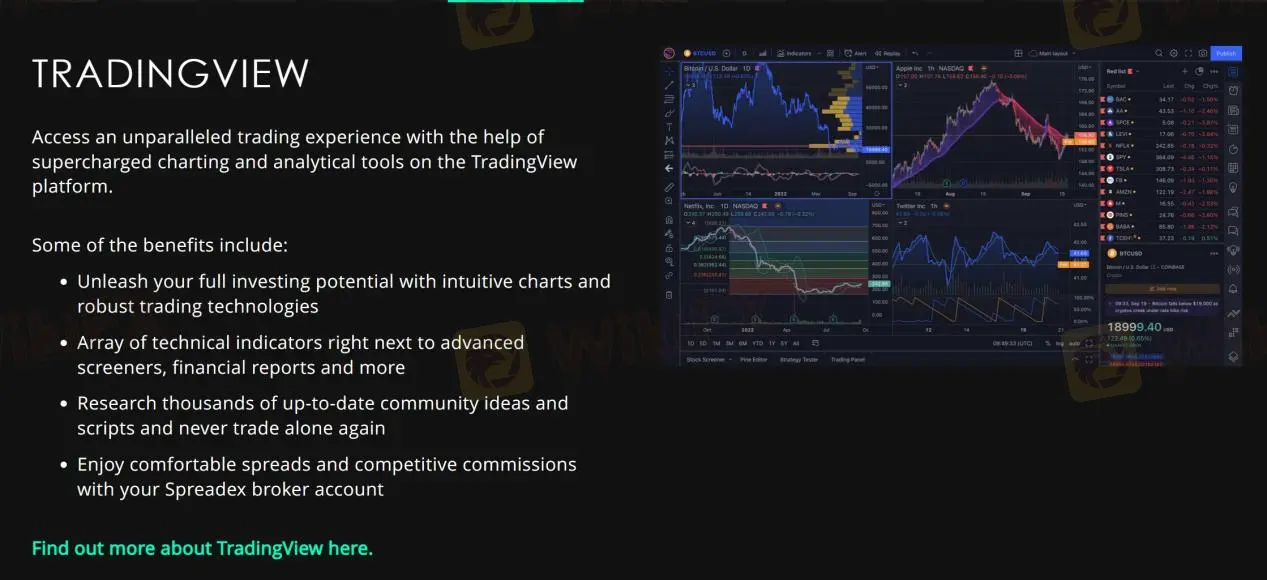

Finally, Spreadex also offers integration with TradingView, a popular third-party charting software. This can allow traders to access advanced charting features and tools, as well as collaborate with other traders in the TradingView community.

Overall, Spreadex's range of trading platforms provides traders with a range of options to suit their individual needs and preferences, whether they prefer a desktop platform, mobile app, or third-party software integration.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Spreadex | Custom online platform, Mobile app |

| FP Markets | MetaTrader 4, MetaTrader 5, IRESS |

| LiteForex | MetaTrader 4, MetaTrader 5, WebTrader |

| Global Prime | MetaTrader 4, WebTrader, FIX API |

Spreadex accepts deposits and withdrawals via Credit Card, Bank Transfer, Cheque, and Direct Debit. However, it does not currently accept deposits from E-Wallets such as Moneybookers, Paypal, Neteller, Ukash, etc. Deposits made by debit card under £50 are subject to a £1 fee. Spreadex does not accept any third-party payments.

| Spreadex | Most other | |

| Minimum Deposit | $500 | $100 |

International bank transfers and bank transfers in currencies other than sterling will be subject to additional charges. The minimum withdrawal amount is £50 cleared funds on your trading ledger that is not being used to support the margin/NTR on any open positions. If the available amount is less than £50, you will only be able to withdraw the full amount.

Spreadex offers card withdrawals which you'll receive within 2 hours of your withdrawal being approved. However, some card issuers may be unable to accept funds through this method, and in such circumstances, payments back to these cards will take 2-5 days to be received. Bank transfers should be in your account within 2 working days.

Overall, Spreadex's deposit and withdrawal options are limited compared to some other brokers, but the available options are low-fee and relatively quick processing times. It is recommended for traders to carefully review the available deposit and withdrawal options to ensure they meet their individual needs and preferences before investing funds.

Spreadex customer support channels available includes live chat, phone support, and email support. The financial desk can be reached at +44 (0)1727 895 151 while general inquiries can be directed to +44 (0)1727 895 000. The email address for customer service is info@spreadex.com.

Traders can also follow Spreadex on various social networks, including Twitter, Facebook, Instagram, YouTube, and LinkedIn. This can provide a convenient way to stay up-to-date on news and updates from the broker, as well as connecting with other traders and the Spreadex community.

| Pros | Cons |

| • Multi-channel support | • No 24/7 customer support available |

| • Live chat support | • No information on multilingual support for non-English speakers |

| • Social media presence on various platforms for easy communication and updates |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Spreadex's customer service.

Spreadex offers a range of educational resources to support traders, including a video training center, account FAQs, charting FAQs, trading FAQs, and a financial spread betting glossary. These resources can provide traders with a solid foundation of knowledge and help them develop their skills and understanding of the trading markets and instruments.

The video training center offers a library of educational videos covering topics such as market analysis, technical analysis, and risk management. Traders can watch these videos at their own pace and access them at any time.

The account FAQs, charting FAQs, and trading FAQs provide answers to common questions and concerns that traders may have about using Spreadex's platform and services. These resources can provide guidance and clarity for traders who are new to the platform or may be experiencing technical issues.

Finally, the financial spread betting glossary provides definitions and explanations of key terms and concepts related to spread betting and trading. This can be a valuable resource for traders who are new to the industry or may be unfamiliar with some of the terminology and jargon used in trading.

Overall, Spreadex's educational resources can provide traders with a solid foundation of knowledge and help them develop their skills and understanding of the trading markets and instruments.

In conclusion, Spreadex is a regulated financial spread betting and CFD provider offering various trading instruments. With competitive spreads, a user-friendly online platform, and mobile trading capabilities, Spreadex aims to cater to traders' needs. As with any trading platform, it's essential to review the latest information, terms, and conditions to make an informed decision that suits your specific requirements.

Is Spreadex legit?

Yes. It is regulated by United Kingdom Financial Conduct Authority (FCA, No. 190941).

At Spreadex, are there any regional restrictions for traders?

Yes. The information on their website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any law or regulatory requirement.

Does Spreadex offer industry leading MT4 & MT5?

No. Instead, it offers Online platform, Mobile trading, and TradingView.

What is the minimum deposit for Spreadex?

The minimum initial deposit to open an account is $1.

Is Spreadex a good broker for beginners?

Yes. It is a good choice for beginners because it is regulated well and has many years experience in the industry, as well as offers various trading instruments with competitive trading conditions on multiple trading platforms.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

SPREADEX, FCA-regulated since 1999, provides 15k+ assets, low spreads & secure trading. No scam flags; reliable broker. Read full review.

WikiFX

WikiFX

UK CMA rejects SpreadEx and Sporting Index merger, ruling it would harm sports spread betting competition by limiting choice and raising costs.

WikiFX

WikiFX

Spreadex, a UK-based provider of spread betting and CFD trading services, has introduced a promotional offer for new clients. Individuals who open a live trading account and deposit at least £500 will receive a six-month digital subscription to the Financial Times.

WikiFX

WikiFX

UK Gambling Commission fines Spreadex £2M for anti-money laundering and social responsibility breaches, marking its second major penalty in three years.

WikiFX

WikiFX

More

User comment

4

CommentsWrite a review

2024-06-04 14:24

2024-06-04 14:24

2024-03-22 18:22

2024-03-22 18:22