The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

Abstract:While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

Abstract: While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

The 33,000 USD Question

For many African traders, the ultimate fear is not market volatility, but broker intervention. Recent complaints lodged with WikiFX suggest a disturbing trend where successful trades are retroactively nullified.

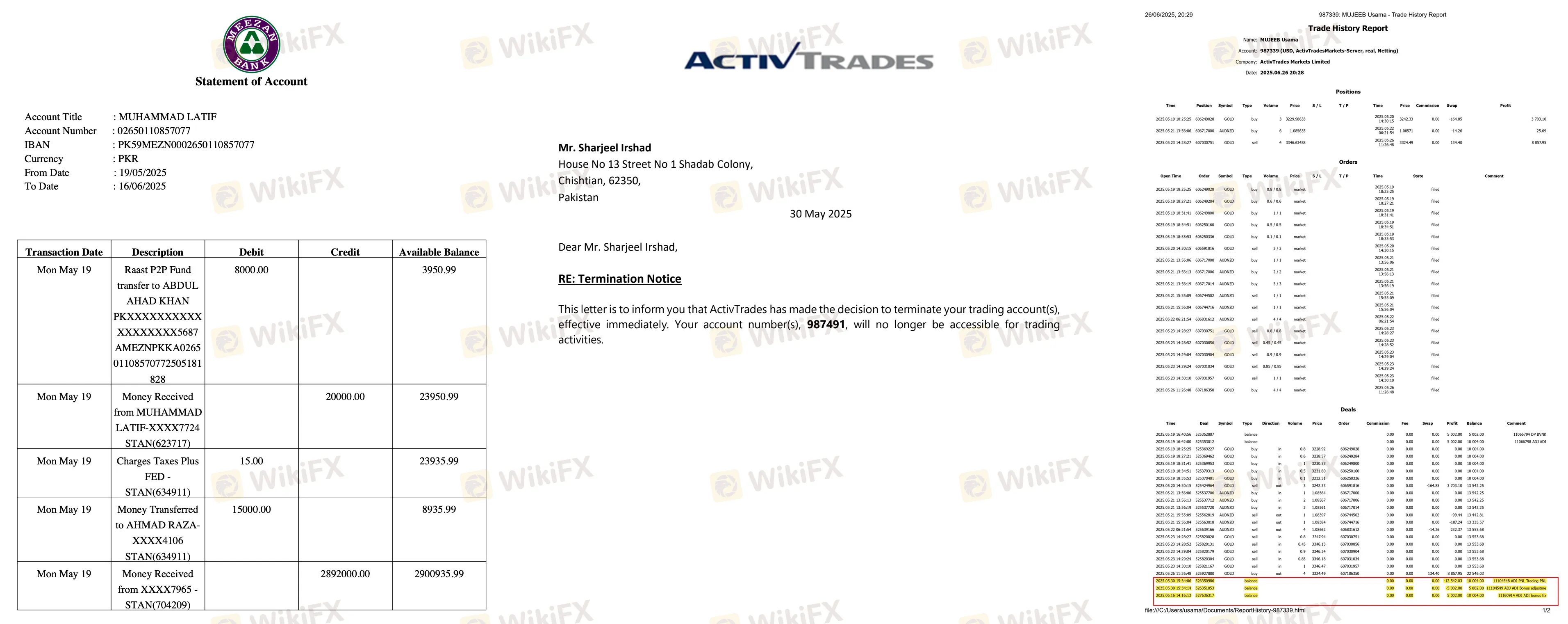

The most striking piece of evidence comes from a trader who reported a harrowing experience in June 2025. After successfully trading on the platform, the user attempted to realize their gains, only to find that $33,253.79 USD in profits were removed from the account. According to the trader's record, this deduction occurred “without any clear explanation.” More concerning is the allegation that the broker also refused to return the user's initial capital (real money), creating a scenario of total loss despite successful market prediction.

This is not an isolated incident. Another report dated August 2025 mirrors this specific mechanism. A trader described depositing funds and generating a profit, but upon initiating a withdrawal request, the broker allegedly “removed the profit” and simultaneously “removed the deposit amount.”

License vs. Reality: A Regulatory Audit

Traders often assume that a broker with a United Kingdom license is automatically safe. However, a deeper audit of the ActivTrades regulatory framework reveals a complex picture. While they maintain high-tier status in London, other jurisdictions show “revoked” statuses and offshore dependencies.

Acting as a neutral database auditor, WikiFX presents the complete regulatory footprint found in our records below. Traders should note the difference between “Valid” and “Revoked” statuses.

| Regulator Name | Country / Jurisdiction | License Type | Current Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | MM (Market Making) | Valid |

| Securities Commission of The Bahamas (SCB) | Bahamas | Offshore Regulatory | Valid |

| Dubai Financial Services Authority (DFSA) | UAE | General License | Revoked |

Additional Regulatory Warnings

Beyond the standard licenses, our records indicate significant regulatory friction in Southeast Asia. The Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI) has previously disclosed information regarding the blocking of illegal commodity futures trading websites. ActivTrades appeared in this disclosure effectively blacklisting the domain in that region for operating without local licensure.

The Exit Trap: Accounts Closing Upon Withdrawal

The narrative emerging from the complaints suggests that the “trigger” for these issues is almost always a withdrawal request.

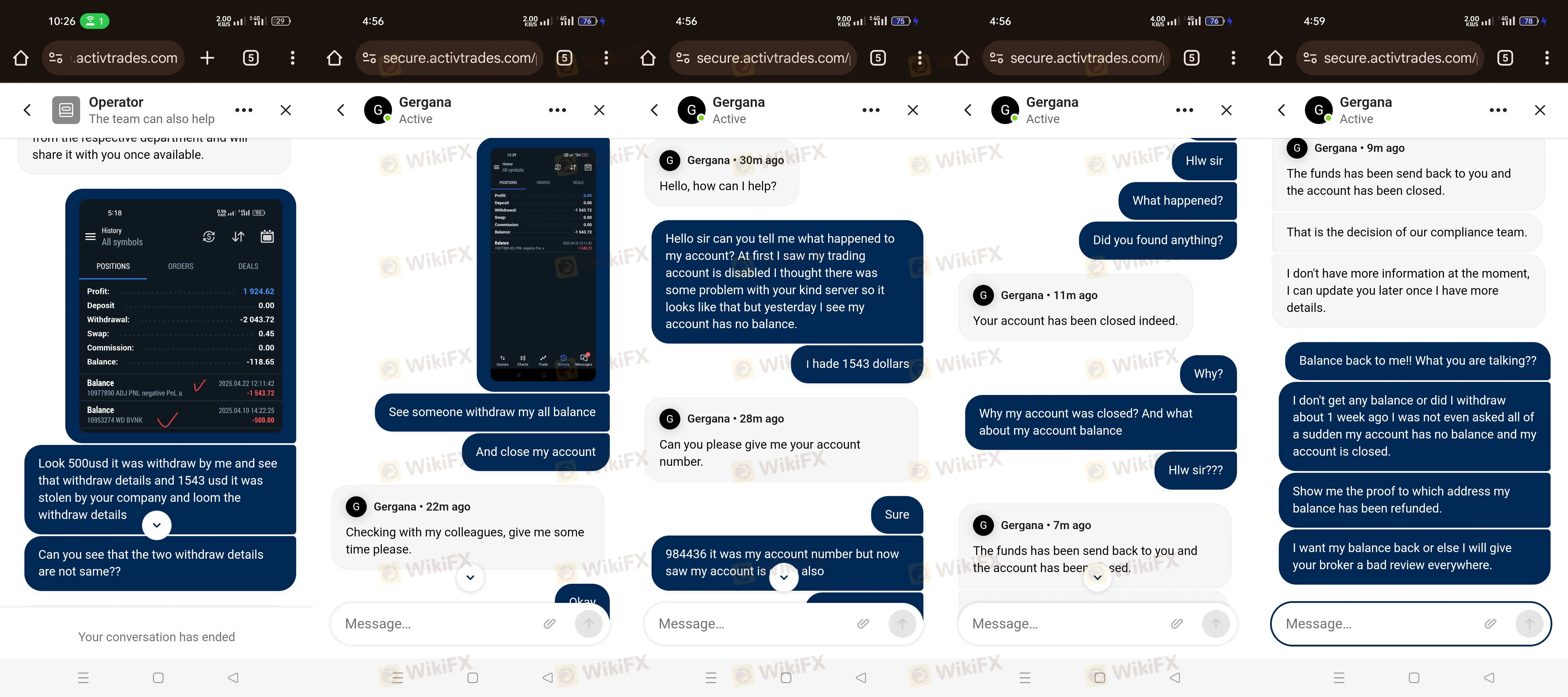

In April 2025, another trader reported having $1,543 in their account. After waiting two weeks for a partial withdrawal of $500, the request was not granted. Instead, the trading account was closed. The trader alleges that despite customer service claims that funds were returned, nothing was received. The user described the experience as dealing with a “thief broker,” citing a complete lack of email response regarding the missing funds.

This pattern was corroborated by a UK-based trader earlier in 2024. This user had been trading for six months without issue. However, the moment they attempted to withdraw profits, the account was closed. The broker reportedly claimed the termination was due to “trading activities.” The trader challenged this logic, asking, “Why didn't they claim it before if they saw any wrong activities?” implies that the trading style was only a problem once money was leaving the broker, not while it was being deposited.

Mixed Signals: The Divide Between Entry and Exit

To maintain objectivity, it is crucial to note that not all feedback is negative. Records from early 2024 include positive sentiments from traders in Germany and the UK.

- German Trader (March 2024): Praised the reliability, platform variety (TradingView interface), and the quick verification and deposit process.

- UK Trader (February 2024): Expressed general satisfaction with the services, noting that while leverage was low due to regulations, the overall environment was “appropriate.”

This creates a “Jekyll and Hyde” profile for the broker. The entry process (deposits, verification, platform setup) appears smooth and professional, earning praise from newcomers. However, the exit process (withdrawals, profit realization) is where the severe friction—and alleged fund removal—occurs.

Verdict: Caution Advised on “Profit Corrections”

While ActivTrades holds a valid FCA license, the repeated allegations of “profit stripping” and account closures upon withdrawal requests are significant red flags that cannot be ignored. The revocation of their UAE license further suggests volatility in their compliance history.

- Positive: Strong platform options (MT4/MT5/TradingView) and valid UK regulation.

- Negative: Recurring reports of profits being deducted without adequate explanation, revoked UAE license, and “offshore” handling of clients.

Anonymity Disclaimer: All cases cited in this article are based on real records lodged with the WikiFX Support Center. User identities have been hidden for their protection.

Risk Warning: Forex and CFD trading involves significant risk to your invested capital. The information provided here is based on available data and trader feedback. Please conduct your own due diligence before depositing funds.

Read more

DTT VAN LTD Exposure: Examining Complaints Concerning Fund Scams & Account Suspension

Did DTT VAN LTD scam your deposits as well as profits earned on the platform? Did you fail to receive any positive response on the fund withholding by the Vanuatu-based forex broker? Was your trading account illegitimately blocked by the broker? You are not alone! Many traders have vehemently opposed the broker for its suspicious trading activities. In this DTT VAN LTD review article, we have shared some of the complaints. Read on!

Binolla Review: Withdrawal Problems, Account Blocks & Other Complaints

Did Binolla block your forex trading account after you placed a few trades on the platform? Did the Saint Vincent and the Grenadines-based broker freeze your account after you started earning profits? Have you faced withdrawal cancellations by the broker? Were you prompted to deposit, seeing the fake profits on the Binolla trading app? Several traders have highlighted these inefficiencies while sharing the Binolla review online. To make it more comprehensive, we have prepared an exposure guide for this broker. Read on!

Former Web3 Fund Executive Accused of Fraudulently Selling Fake Crypto Investment Deals

Criticism has emerged within the cryptocurrency industry following reports alleging that Kampanat Wimonnot, a former Web3 fund executive, was involved in a fraudulent investment scheme involving fake pre-token deals linked to well-known blockchain projects. According to the allegations, the scheme used documents and information that were claimed to be fabricated in order to create the appearance of legitimacy and attract investors. At least 24 victims from multiple countries have reportedly been affected, with losses ranging from tens of thousands of dollars to more than US$1 million. The incident highlights the risks associated with private allocation crypto deals and underscores the importance for investors to verify information directly with the originating project before making any investment decisions.

OspreyFX Review: Do Traders Face High Slippage and Wide Spreads?

Are your funds stuck with OspreyFX, a Saint Vincent and the Grenadines-based forex broker? Does your trade execution price always remain far away from the requested price due to heavy slippage? Does the broker, contrary to its claims of low-cost trading experience, widen spreads to inflate your costs? Like others, do you always witness constant fund withdrawal denials by the broker? In this OspreyFX review article, we have investigated complaints against the forex broker. Read on!

WikiFX Broker

Latest News

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

China Signals Tolerance for Slower Growth with Revised 2026 Outlook

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

JRJR Review: Safety, Regulation & Forex Trading Details

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Forex Brief: Yen Weakens Past 157.75 as BoJ Policy Hopes Dim

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

US NFP Preview: Markets Brace for Volatility as Employment Data Tests Fed's Patience

Rate Calc