HTFX Under Fire: Malaysian Traders Should Think Twice

Abstract:HTFX markets itself as a global broker with international licences and modern trading technology. On the surface, it appears to provide a legitimate gateway into the forex and CFD markets. Yet beneath that polished image lies a troubling story. In recent months, mounting complaints from traders, withdrawal failures, and warnings from regulators have placed HTFX under intense scrutiny. For Malaysian investors, the risks cannot be ignored.

HTFX markets itself as a global broker with international licences and modern trading technology. On the surface, it appears to provide a legitimate gateway into the forex and CFD markets. Yet beneath that polished image lies a troubling story. In recent months, mounting complaints from traders, withdrawal failures, and warnings from regulators have placed HTFX under intense scrutiny. For Malaysian investors, the risks cannot be ignored.

Questionable Licensing Status

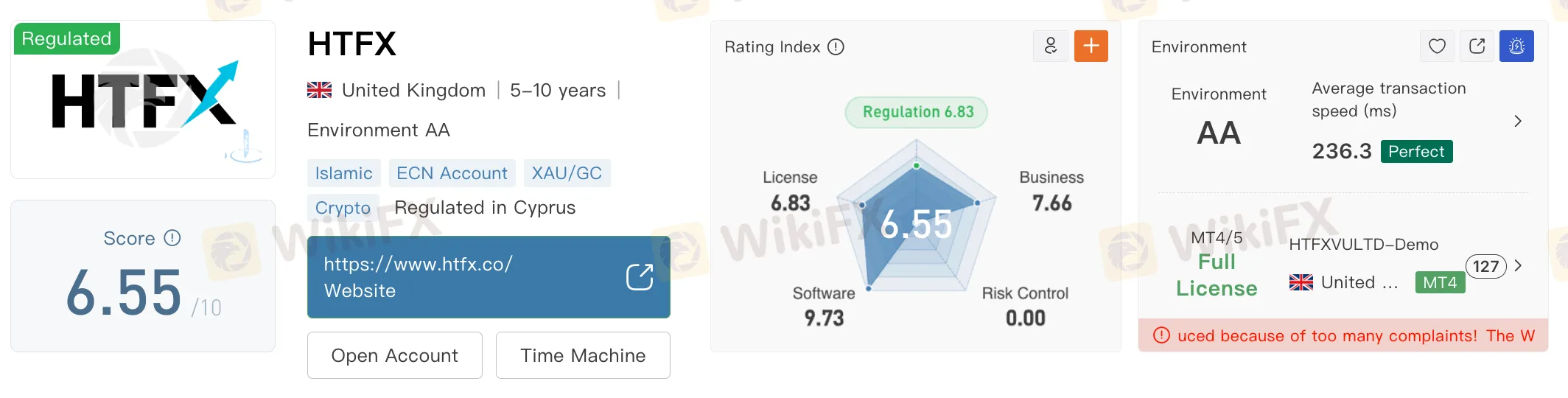

HTFX claims oversight from several international regulators, but a closer inspection raises concerns.

- The broker is licensed by the Cyprus Securities and Exchange Commission (CySEC). While this may appear reassuring, CySECs jurisdiction does not extend to Malaysia, meaning local investors are not protected under its framework.

- HTFX also holds a licence from the Vanuatu Financial Services Commission (VFSC) (Licence No. 700650). However, this is considered an offshore licence, which typically offers weaker investor safeguards. Traders should treat such authorisations with caution, as the level of oversight is limited compared to major financial centres.

- In the United Kingdom, HTFX is listed under the Financial Conduct Authority (FCA) (Reg. No. 822279). Yet this licence applies strictly to institutional forex business and does not cover retail trading services. In practice, it cannot legally open accounts for individual investors under this authorisation.

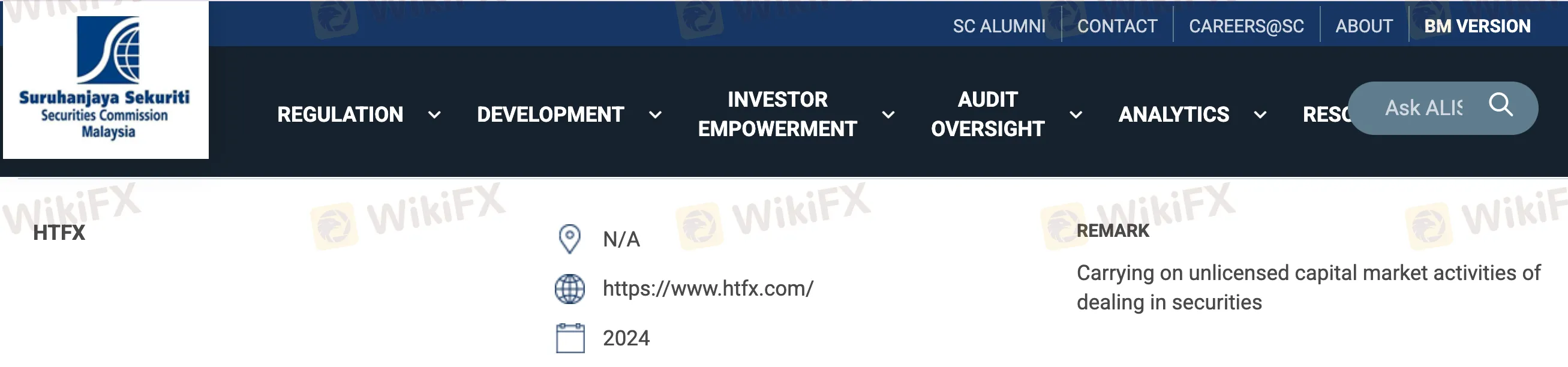

Most significantly, HTFX has been placed on the Investor Alert List of Malaysias Securities Commission (SC). This listing confirms that the broker is carrying out unlicensed activities in Malaysia and should be considered high risk by local traders.

View WikiFXs full review on HTFX here: https://www.wikifx.com/en/dealer/9814677820.html

A Surge of Complaints

The problems with HTFX are not confined to regulatory technicalities. Reports from traders themselves paint an equally troubling picture.

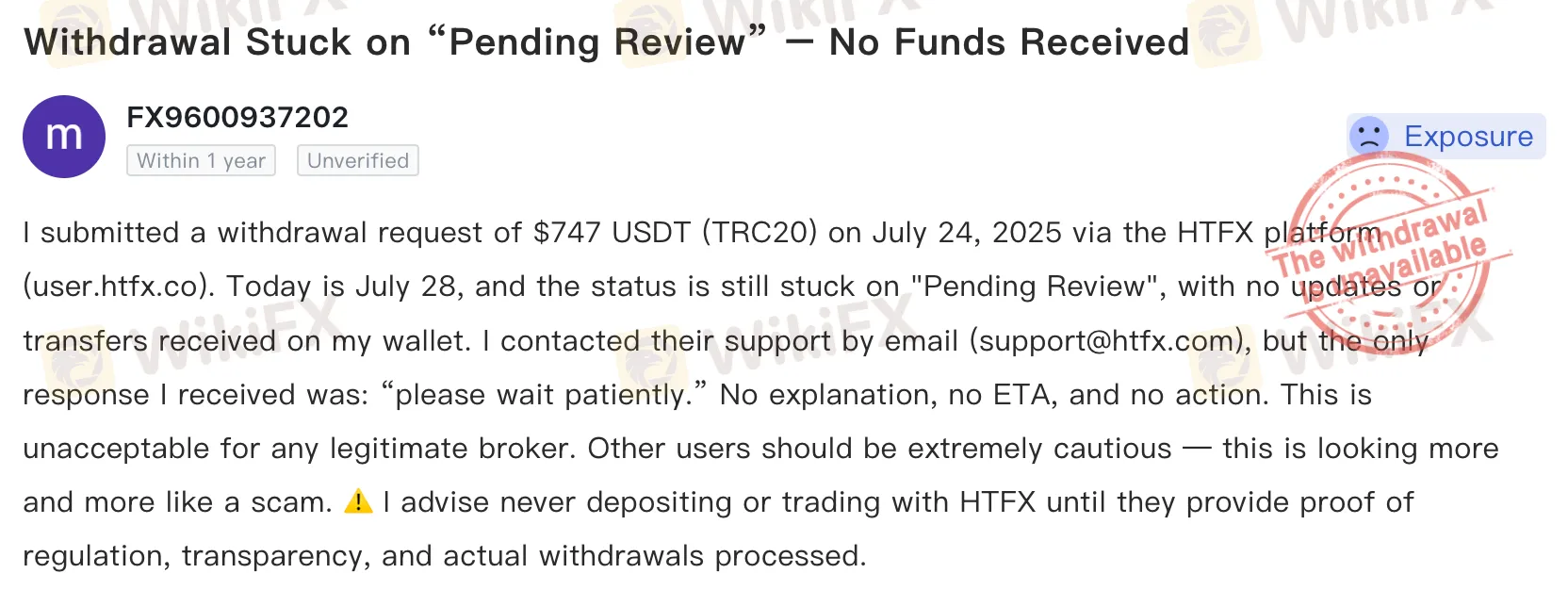

According to data collected by WikiFX, HTFX has accumulated over 30 formal complaints as of September 2025. The overwhelming majority of these centre on one issue: withdrawals.

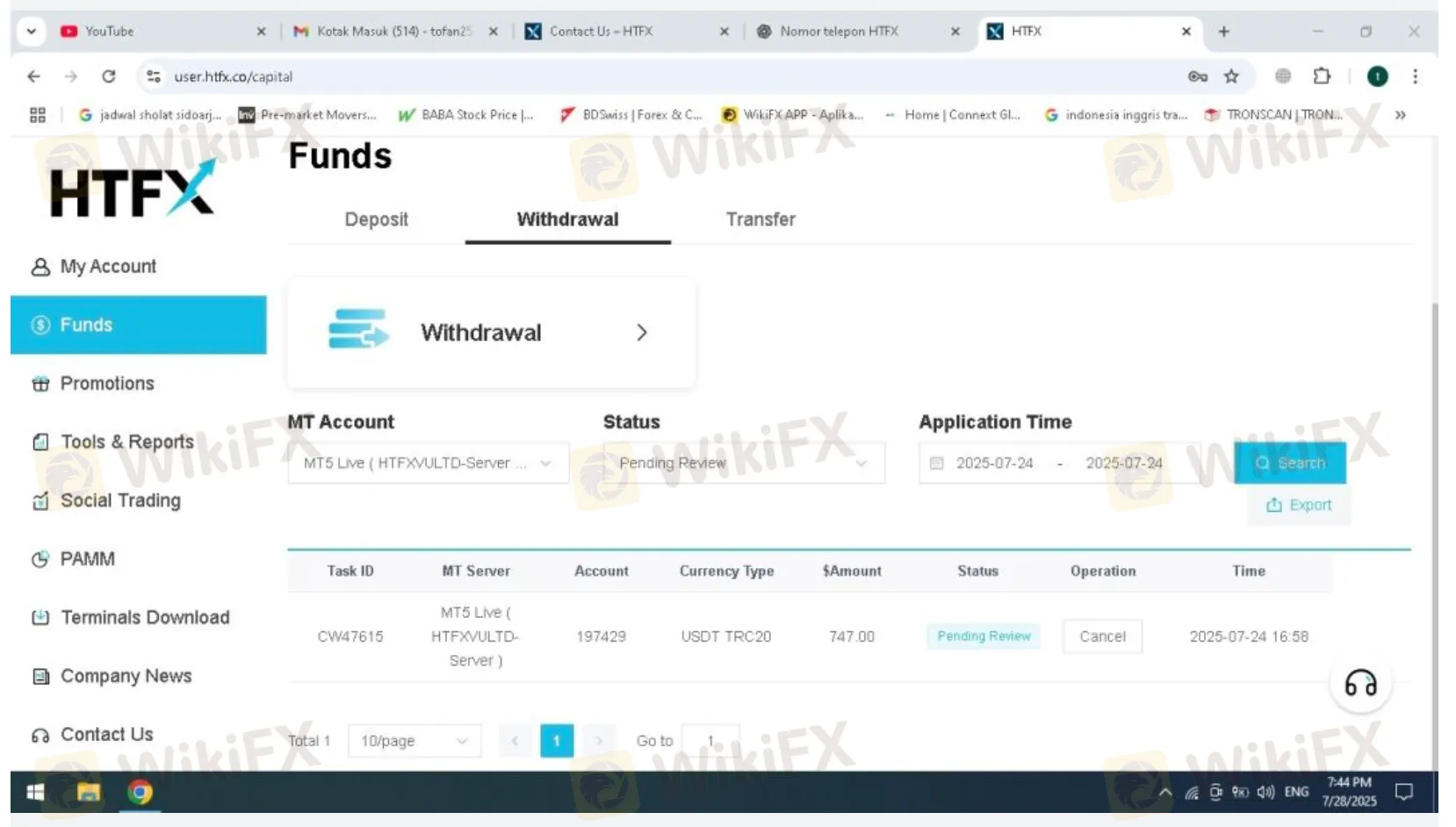

- In one case, a client submitted a withdrawal request of USD 747 in July 2025 via cryptocurrency. Days later, the funds were still marked “Pending Review,” and customer support could only offer the hollow reassurance to “please wait patiently.”

- Another trader, who had been with HTFX for years, suddenly encountered unexplained delays of more than two weeks when attempting to withdraw money. Despite multiple follow-ups, the only response was vague promises that the matter was being “processed.”

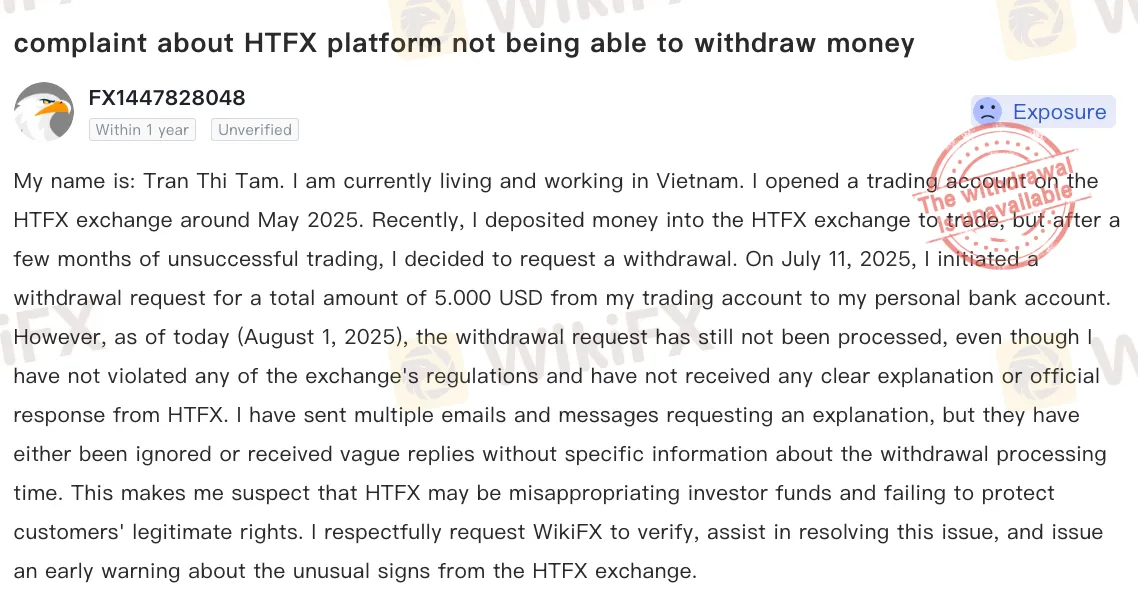

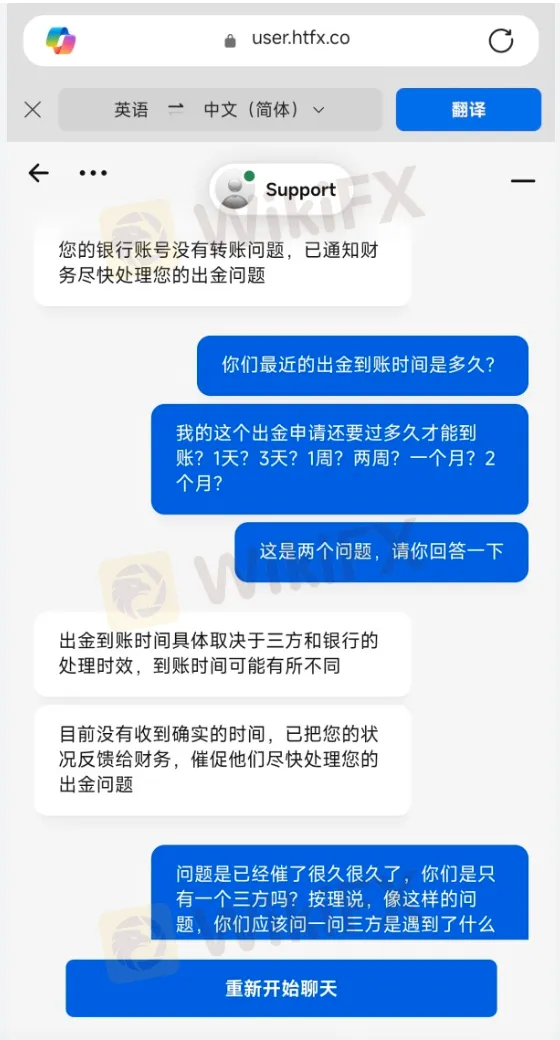

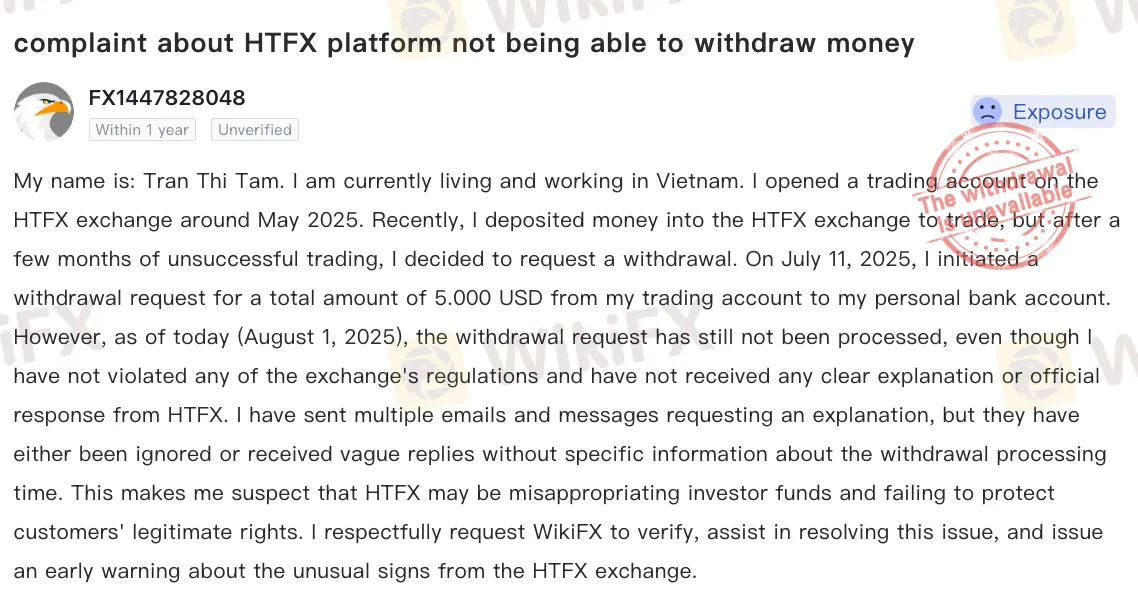

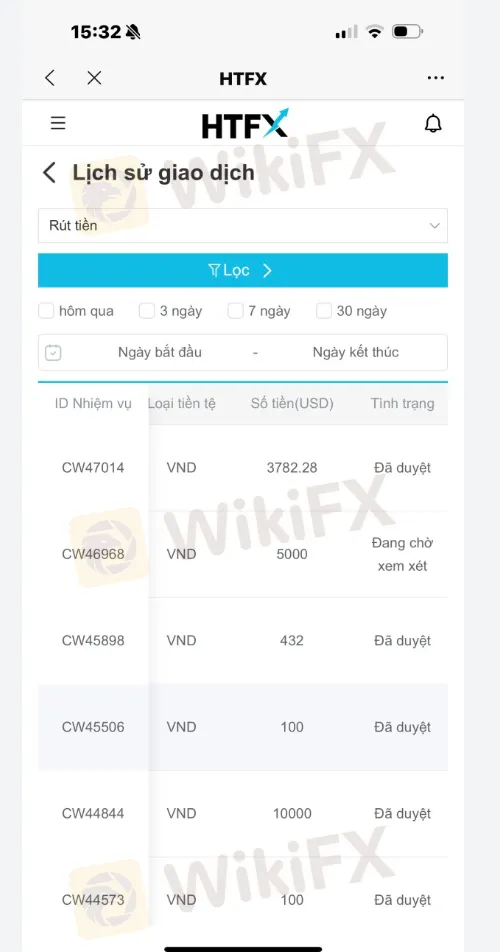

- A Vietnamese trader reported that she deposited funds on HTFX in May 2025 and later attempted to withdraw USD 5,000 on July 11, 2025. By August 1, the funds had still not been released. Despite repeated emails and messages, she received either no reply or vague responses without timelines. She noted that she had not breached any rules, yet HTFX failed to provide a clear explanation.

These examples show a disturbing pattern of clients being denied timely access to their own money, which is a major issue that undermines the very foundation of trust between a broker and its traders.

Weaknesses in Trust and Service

Independent evaluations of HTFXs performance add further weight to these concerns. Reviews place the broker at the lower end of credibility ratings, with a particular emphasis on:

- Trust and Safety: HTFXs low score reflects repeated warnings from regulators and limited transparency in its operations. There is little clarity about how client funds are handled or whether they are kept in segregated accounts.

- Account Transparency: Essential details about account types, deposit requirements, and withdrawal policies are either unclear or inconsistently communicated. This lack of transparency increases the risk of unexpected costs or delays.

- Customer Support: Traders consistently describe poor service. Requests for help, particularly around stalled withdrawals, often go unanswered or receive only generic responses. For many, this compounds the stress of losing access to their funds.

Taken together, these factors suggest more than occasional operational hiccups. They indicate systemic weaknesses that make HTFX a high-risk option for anyone considering depositing money.

For Malaysian traders, the dangers are heightened by two realities.

First, the SC's Investor Alert List is not issued lightly. When a broker appears on this list, it is an explicit warning that the company is not authorised to operate in the country. Trading with such a firm means accepting that if something goes wrong, the local regulator cannot intervene on your behalf.

Second, the repeated accounts of withdrawal failures show that these are not isolated incidents. When multiple traders in different countries report the same issue, including unprocessed transactions, indefinite delays, and unhelpful support, it points to structural flaws rather than unlucky exceptions.

In such a situation, choosing to invest with HTFX is effectively a gamble not just on market movements, but also on whether the broker will release your funds when you need them.

Lessons for Traders

The case of HTFX highlights some key lessons for investors:

- Local regulation matters. Even if a broker claims international licences, if it is not authorised in Malaysia, your legal protections are limited.

- Trader complaints are valuable signals. Platforms such as WikiFX collect and verify reports from real users. When complaints mount, they provide an early warning system that should not be ignored.

- Withdrawals are the ultimate test. A brokers true reliability is measured not by its promises but by whether it allows you to access your funds promptly and without unnecessary obstacles.

Conclusion

HTFX may present itself as a global player with regulatory backing, but the facts tell a different story. With its inclusion on Malaysias Investor Alert List, persistent complaints of unprocessed withdrawals, and poor customer support, HTFX represents a clear risk to investors.

For Malaysian traders, the message is simple: avoid entrusting your capital to brokers that lack local authorisation and a proven track record of reliability. In an industry already fraught with financial risk, the choice of broker should provide security, not add another layer of uncertainty.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

Forex 101: Welcome to the $7.5 Trillion Beast

Oil Surge: WTI Reclaims $60 as Middle East Tensions Override Venezuela Deadlock

ThinkMarkets Regulation: Safe Trading or Risky Broker?

ehamarkets Review 2026: Regulation, Score and Reliability

8xTrade Review 2025: Safety, Features, and Reliability

VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Rate Calc