VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Abstract:VEBSON

VEBSON is a Forex and CFD broker established in 2023 with its headquarters located in Saint Lucia. The company promotes itself as a digital-first brokerage offering the MetaTrader 5 (MT5) platform and multiple account types. Despite its claims of easy access and low entry barriers, VEBSON holds a low trust score of 1.86 on WikiFX, indicating potential risks for investors.

While the broker serves clients in regions such as Kenya, Bangladesh, and Germany, serious concerns have been raised regarding its regulatory status and withdrawal processes.

Is VEBSON Legit? Regulatory Status and Safety

The most rigorous test of a broker's legitimacy is its regulatory compliance. Based on the available data, VEBSON does not hold any valid license from a reputable financial regulator.

Regulatory Overview

| Regulatory Body | License Status | License Type |

|---|---|---|

| None | No Regulation | N/A |

The broker operates out of Saint Lucia, an offshore jurisdiction that often attracts brokers seeking lower compliance standards. Unlike Tier-1 regulators (such as the FCA in the UK or ASIC in Australia), Saint Lucia does not enforce strict capital requirements or client fund segregation rules for forex brokers.

Furthermore, user reports suggest that VEBSON has claimed registration with the National Futures Association (NFA) in the US. However, verification checks indicate that the broker is not a member of the NFA, which creates a significant credibility issue. Trading with an unregulated entity means your funds are not protected by compensation schemes or legal oversight.

Exposure: User Complaints and Scam Allegations

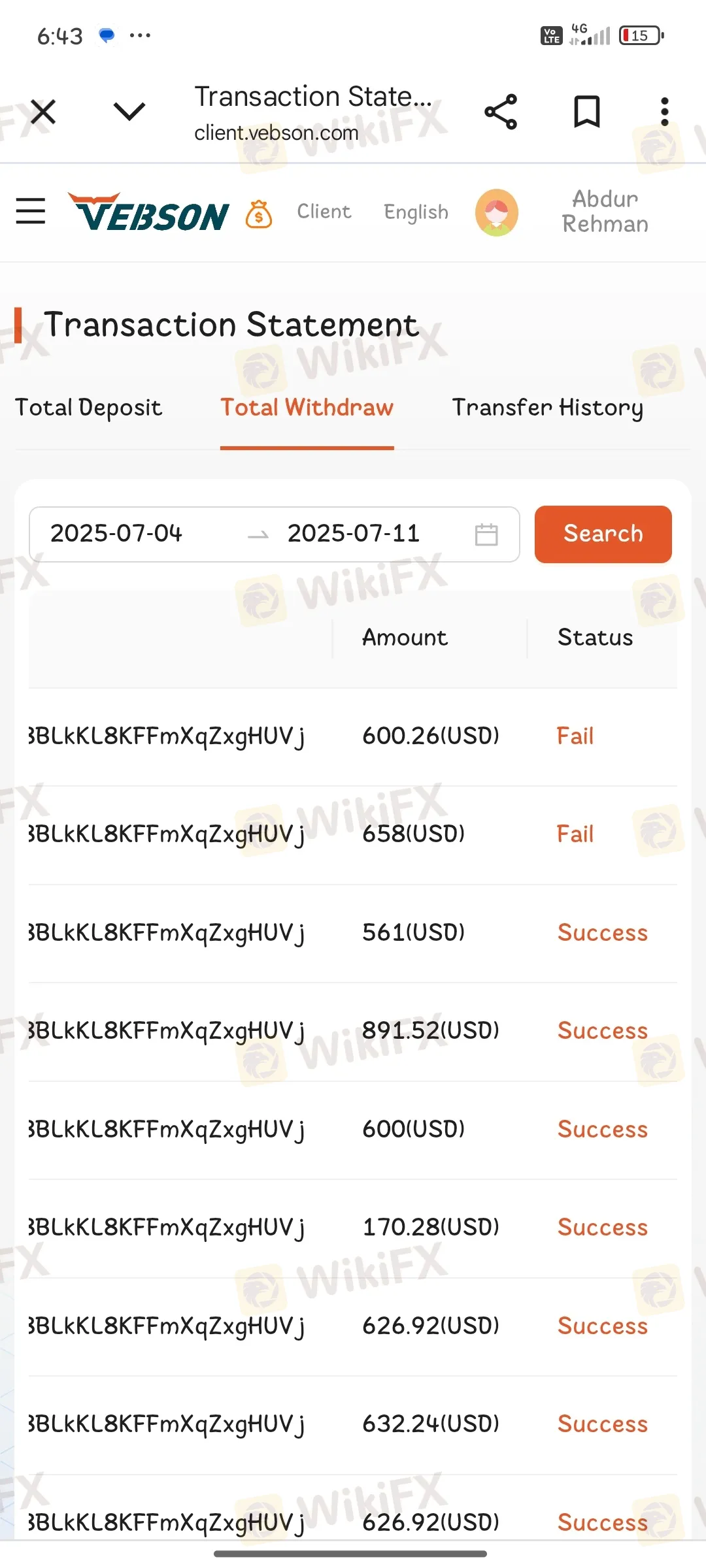

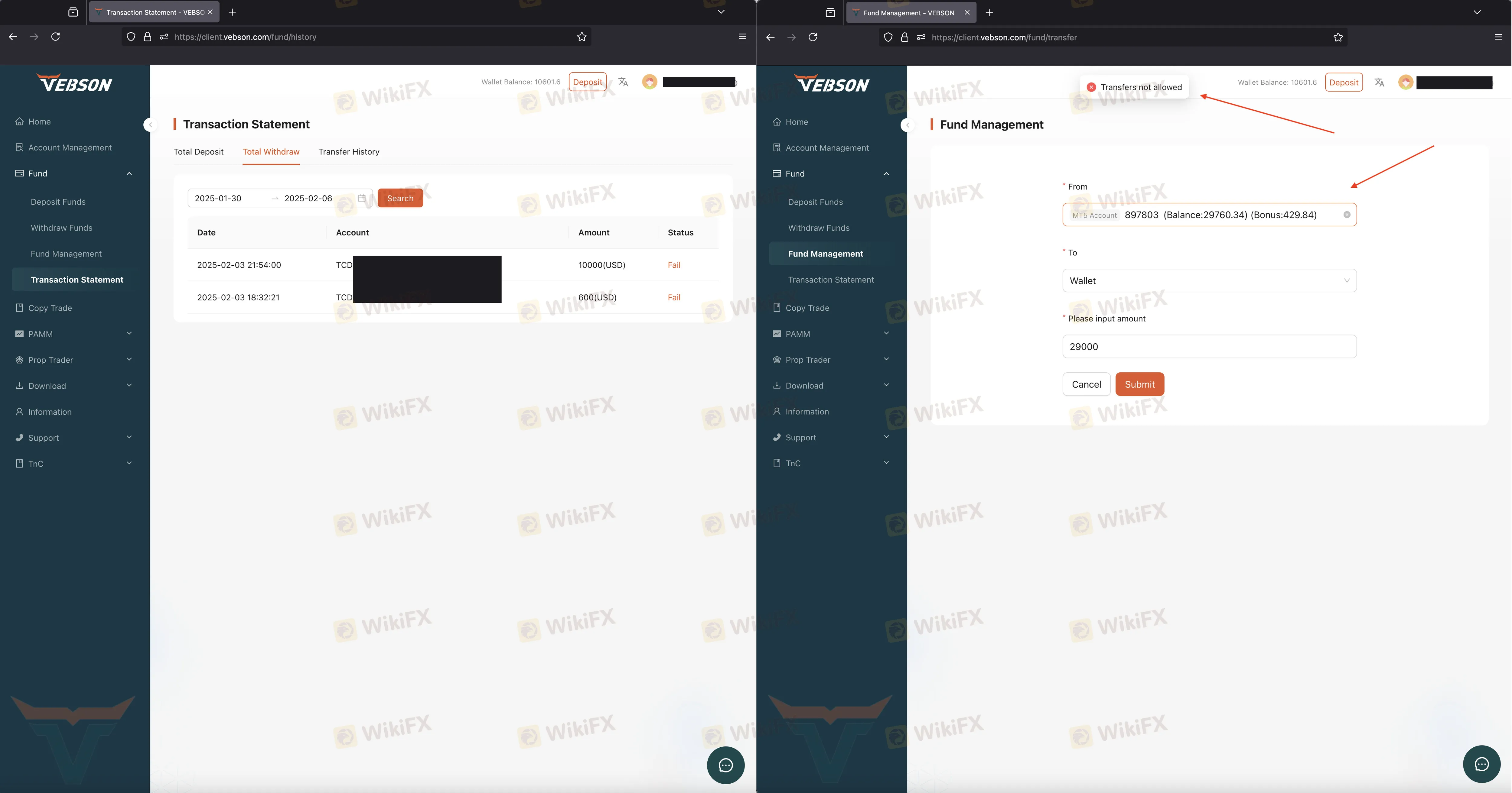

Recent user feedback paints a concerning picture of VEBSON's operational practices. In the last few months alone, multiple complaints have been lodged regarding withdrawal failures and account blocking.

Withdrawal Refusals and Account Blocking

Several traders have reported that the broker refuses to process withdrawals.

- Case 4 (China): Another trader stated that after making a profit, not only was the withdrawal denied, but their backend access was banned. The user described the broker's attitude as malicious.

False Regulatory Claims and Profit Confiscation

A particularly detailed report from a user in Portugal highlighted deceptive practices. The trader alleged that VEBSON claimed false NFA registration. After the trader made successful trades, the broker reportedly confiscated profits, citing “prohibited trading” (such as using Expert Advisors or scalping), despite the account terms typically allowing these strategies.

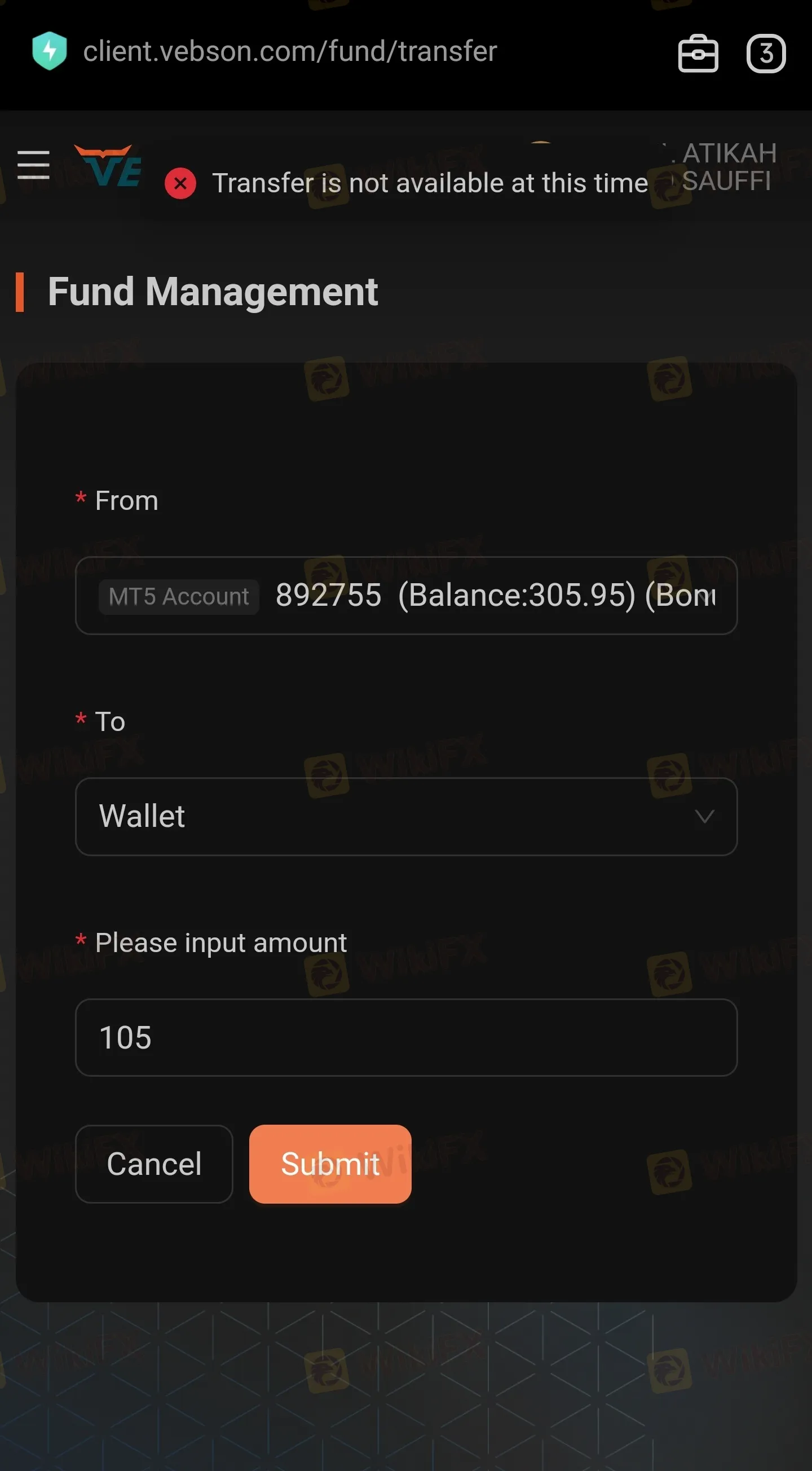

Internal Transfer Blocks

A case from Malaysia detailed a tactic where the broker allegedly disabled internal transfers—a necessary step to withdraw funds from the trading account to the wallet. When the user inquired, the broker demanded excessive KYC verification (selfies, video proof) in what the user described as a delay tactic used to avoid payment.

Trading Conditions: Platforms and Accounts

If we look strictly at the technical offering, VEBSON provides the industry-standard MetaTrader 5 (MT5) platform. This software is highly regarded for its customizability and search functions, though the review data notes it lacks two-step authentication for safer login.

Account Types and Costs

VEBSON offers three distinct account types, all requiring a low minimum deposit of $10.

| Account Type | Minimum Deposit | Spread From | Commission |

|---|---|---|---|

| SUPER ECN | $10 | 0.0 pips | Not Specified |

| STANDARD | $10 | 1.1 pips | Not Specified |

| CENT | $10 | 1.1 pips | Not Specified |

Key Features:

- Spreads: The Super ECN account advertises raw spreads from 0.0 pips, while Standard and Cent accounts start at 1.1 pips.

- Trading Restrictions: The data suggests that scalping and EAs (Expert Advisors) are technically allowed on these accounts, which contradicts the user complaints mentioned earlier regarding profit confiscation for using these exact strategies.

Pros and Cons of VEBSON

Pros:

- Uses the advanced MT5 Trading Platform.

- Very low minimum deposit ($10).

- Offers a “Cent” account suitable for testing small amounts.

- Customer support is available via phone and email.

Cons:

- No Regulatory License (Unregulated).

- Very Low Trust Score (1.86).

- Multiple complaints regarding withdrawal refusals.

- Reports of account blocking and false regulatory claims.

- Offshore registration (Saint Lucia) offers no client protection.

Final Review Verdict: Can You Trust VEBSON?

We do not recommend trading with VEBSON.

The combination of an unregulated status, a low safety score of 1.86, and documented complaints regarding unpaid withdrawals makes this broker a high-risk entity. While the $10 entry point and MT5 platform may look attractive, the safety of your principal capital is compromised by the lack of oversight. Reports of the broker blocking accounts after clients generate profits are a major red flag.

Protect Your Investments:

Before depositing money, always verify a broker's license to ensure they are regulated in your region. Use the WikiFX app to check real-time regulatory status, read the latest trader exposures, and find safer, regulated alternatives.

WikiFX Broker

Latest News

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

Rate Calc