Exposing: Risks of MTrading & Real Reviews From Actual Users!! Must Read

Abstract:If you are a current user, trader or investor considering MTrading, this article is for you. It will show you the real side of MTrading. The broker only highlights the good side to get you to invest, but the truth is very different. Read this article to know the Truth.

If you are a current user, trader or investor considering MTrading, this article is for you. It will show you the real side of MTrading. The broker only highlights the good side to get you to invest, but the truth is very different. Read this article to know the Truth.

Risks Linked to MTrading

Lack of Reputable Regulation

One of the most alarming issues with MTrading is its lack of regulation from any top-tier financial authority. Upon review, it's clear that the broker is not licensed by major regulatory bodies such as the FCA (UK), ASIC (Australia), or SEBI (India) known for enforcing strict rules to protect traders.

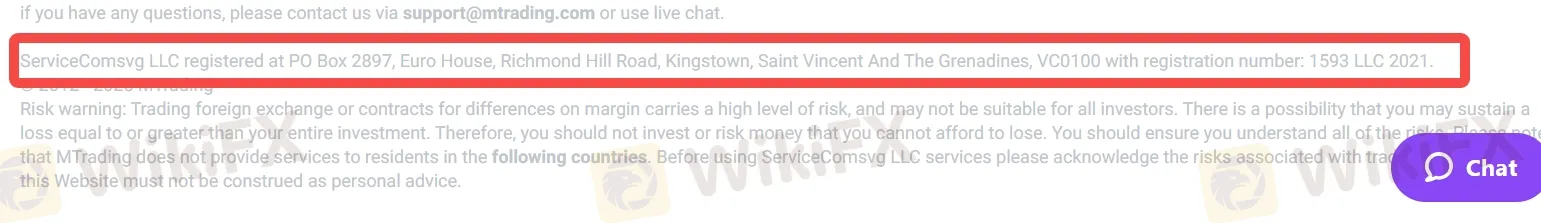

Instead, MTrading claims to registered at Saint Vincent And The Grenadines, VC0100 with registration number: 1593 LLC 2021. Its important to understand that Saint Vincent And The Grenadines (SVG) is offshore jurisdictions with very loose or no regulatory oversight, meaning they do not enforce strong rules regarding client fund protection, transparency, or fair trading practices.

Limited Customer Support Options

Customer support is very important for any trading platform, especially when problems like login issues, withdrawal delays, or technical errors happen. Sadly, MTrading offers limited support options. There is only a basic live chat and a short FAQ section. The email address is hidden at the bottom of the page, which is unusual. Trusted brokers usually show their contact details like email, phone number, or support portal clearly on their websites.

This lack of accessibility is concerning. Reputable brokers typically provide multiple channels of support, including 24/7 helplines, email assistance, and dedicated account managers. MTradings bare-minimum support system leaves traders on their own during urgent situations—a clear red flag for anyone considering this broker.

Lack of Transparency on Withdrawals and Fees

Another major concern is the lack of clear, detailed information about withdrawal methods, fees, and processing times. While most reputable brokers clearly outline their funding and withdrawal policies, including costs and timelines, MTrading keeps this information vague.

This kind of lack of transparency is often used by untrustworthy platforms to introduce hidden charges or create unnecessary delays when clients attempt to withdraw their funds.

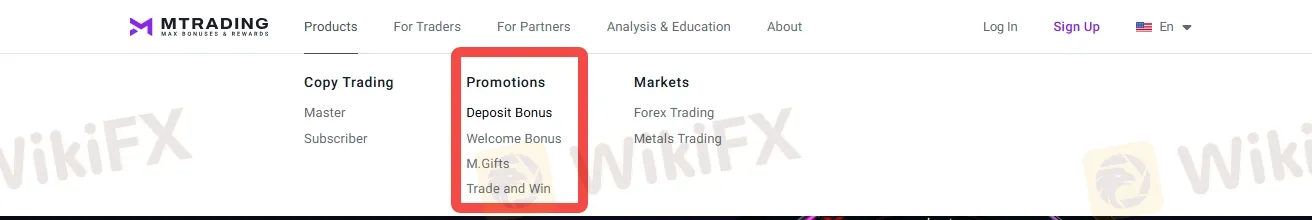

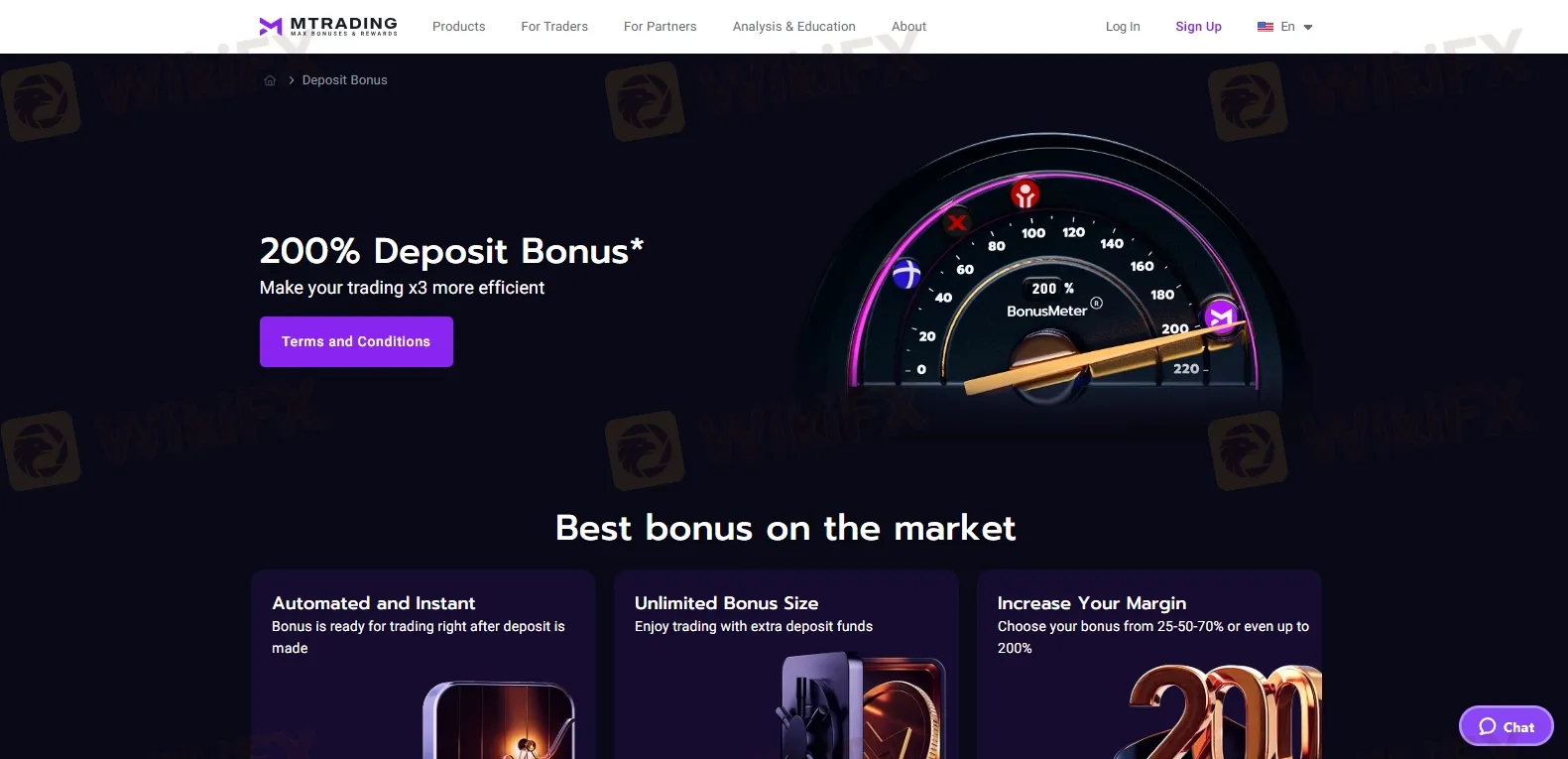

Overwhelming Promotions – Trap

MTrading appears to offer a wide range of bonuses, promotions, and trading incentives. While this may sound appealing at first, such offers often come with complicated terms and hidden conditions. In many cases, these promotions are designed more as marketing traps than genuine trader benefits.

For example, some bonuses may lock your funds until certain volume conditions are met, or restrict withdrawals altogether. Excessive promotions are often used by unregulated or offshore brokers to lure in inexperienced traders, only to leave them stuck with unfair trading conditions. Always approach such offers with skepticism if it sounds too good to be true, it probably is.

Reviews from Real Users

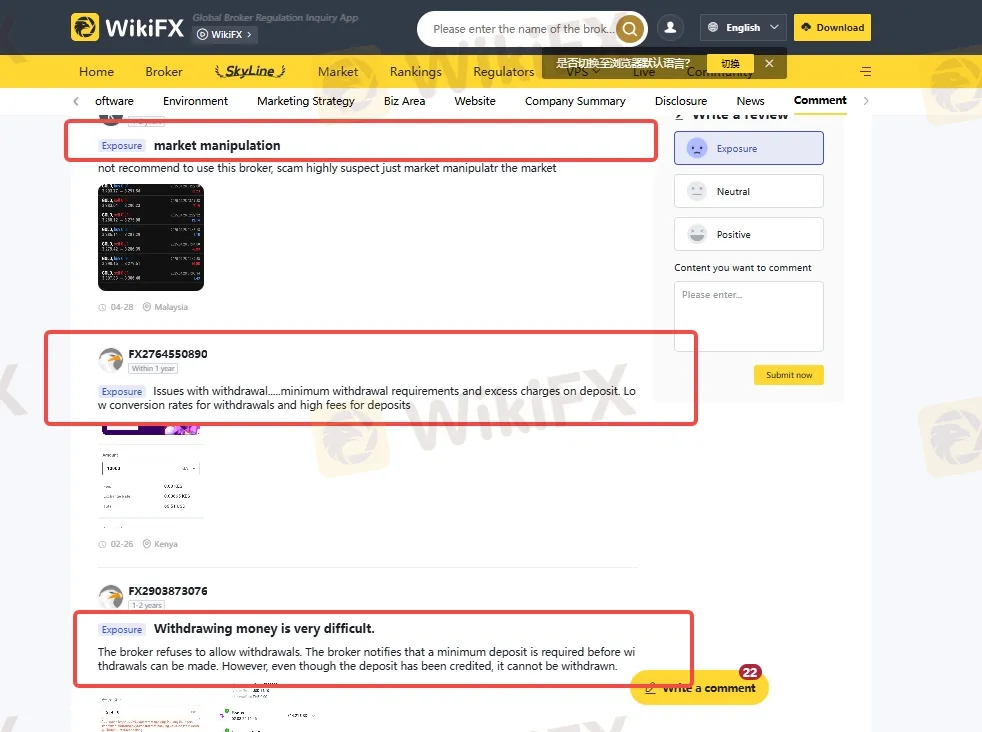

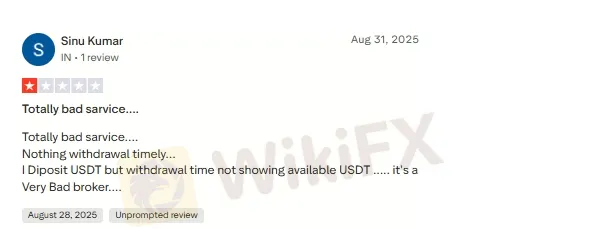

· Withdrawal Complaints

Withdrawal-related issues are one of the most frequently reported problems by MTrading users. Many have shared that they faced delays or were unable to access their funds altogether. In some cases, users say they were given unclear reasons for the delays, which led to frustration and loss of trust. Reliable brokers usually have clear, fast, and hassle-free withdrawal processes.

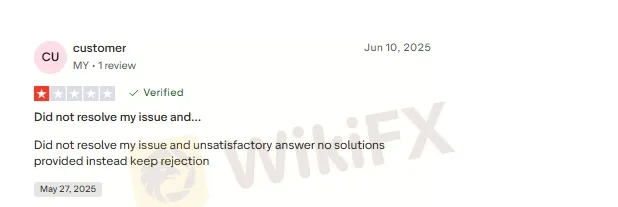

· Unhelpful Customer Support

Poor customer service is another common complaint. Users report that getting help from MTrading is difficult, with slow response times and unhelpful replies. Many mentioned that the live chat is the only support option, and even that doesnt always resolve the issue.

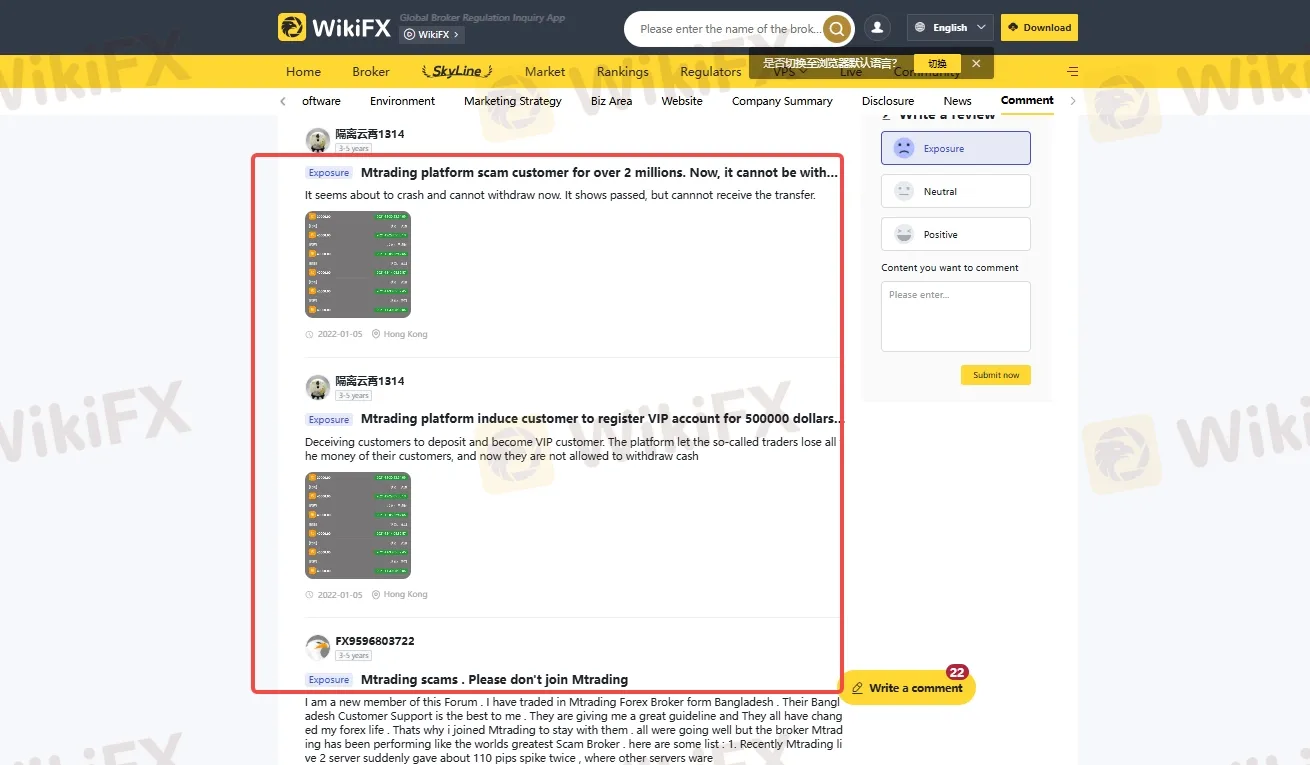

· Do Not Join MTrading

Two users have warned others not to join MTrading after facing problems with the platform. They were unhappy with how the broker handled their funds and overall service. While experiences may vary, such warnings suggest MTrading may not be a reliable choice for traders.

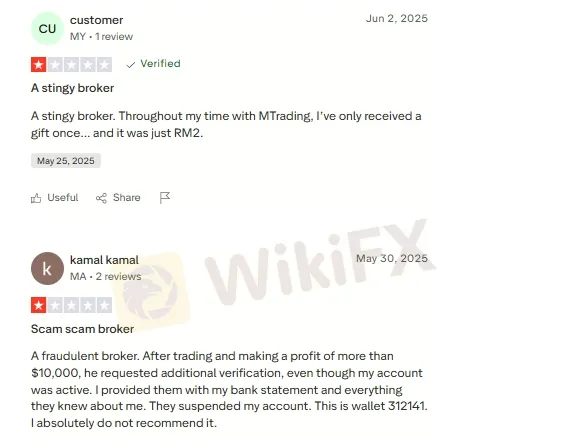

· Calling It Fraudulent

Some traders have accused MTrading of dishonest behavior, alleging that the platform manipulates trades or creates unfair conditions that lead to losses. A real user directly labeled MTrading as a fraudulent platform. This typically stems from negative experiences related to account handling, transparency, and unresponsive customer service. While calling a platform fraudulent is a serious claim clients should approach with caution.

Conclusion: Should You Trust MTrading?

Based on the findings above, MTrading displays multiple warning signs that should give traders serious pause. The broker lacks proper regulation, provides minimal customer support, fails to disclose important information about withdrawals and fees, and aggressively promotes questionable offers. Additionally, the reviews tell the real story of MTrading.

While MTrading may look legitimate on the surface, its operational structure and practices suggest otherwise. If you're serious about trading safely, its better to choose a broker regulated by a top-tier authority, with transparent policies, strong customer service, and a proven track record. Your money and peace of mind are too valuable to risk on an unreliable platform.

Read more

Biggest Scams In Malaysia In 2025

Malaysia is facing a sharp escalation in online scam activities, with reported losses reaching RM2.7 billion between January and November, driven by increasingly sophisticated and well-organised fraud schemes. Official data shows a significant rise in cases compared to the previous year, while experts warn that the true economic impact may be far greater due to widespread underreporting.

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

WikiFX Broker

Latest News

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

Is CMC Markets Legit or a Scam? Key Questions Answered (2025)

Biggest Scams In Malaysia In 2025

Rate Calc