Is CMC Markets Legit or a Scam? Key Questions Answered (2025)

Abstract:If you are looking for a broker that has been around the block, CMC Markets is likely on your radar. But experienced doesn't always mean "perfect." You need to know if your funds are actually safe and if their trading environment works for you.

If you are looking for a broker that has been around the block, CMC Markets is likely on your radar. But experienced doesn't always mean “perfect.” You need to know if your funds are actually safe and if their trading environment works for you.

According to WikiFX data, CMC Markets holds a high score of 8.04, which is considered very safe in our rating system. They were established in 2001 and have their headquarters in Singapore, giving them over two decades of market history.

Here is what the data reveals about their safety, software, and what users are strictly complaining about right now.

Question 1: Is my money safe with CMC Markets?

The Evidence:

According to their regulatory filings, CMC Markets is regulated by several top-tier authorities:

- UK FCA (Financial Conduct Authority) - License No. 173730 & 170627

- Singapore MAS (Monetary Authority of Singapore)

- New Zealand FMA (Financial Markets Authority) - License No. 41187

- Canada CIRO (Canadian Investment Regulatory Organization)

The Verdict:

Yes. Based on these licenses, CMC Markets is considered a “Tier-1” regulated broker.

What this means for you:

When a broker has a license from the UK FCA, like CMC Markets does, it is the gold standard of safety. It means they must follow strict rules, such as Segregation of Funds.

- Segregation of Funds: This means the broker cannot use your money to pay their own business expenses (like electricity bills or staff salaries). Your money sits in a separate bank account.

- Strict Oversight: Unlike unregulated “offshore” brokers who answer to no one, CMC Markets is watched closely by government agencies in the UK, Singapore, and Canada. If they act shadily, they face massive fines or lose their license.

Question 2: What are real traders complaining about?

Official claims are one thing, but user feedback tells the real story. We analyzed the complaints in the WikiFX database, and while the broker is safe, the trading experience has some friction points.

1. Severe Slippage (Price Gaps)

A user from the Philippines reported that their account was “blown” due to severe slippage, particularly when trading volatile assets like Gold (XAU). Slippage happens when the price you click is not the price you get—usually costing you money. The user noted their stop losses were hit due to negative balances caused by these gaps.

2. Hidden “Inactivity” Fees

A trader from India highlighted a frustration with “hidden fees.” They stopped trading for a while and were hit with a 15 NZD inactivity fee per month. Unlike some brokers that pay you interest, this fee eats away at your balance if you take a break from trading.

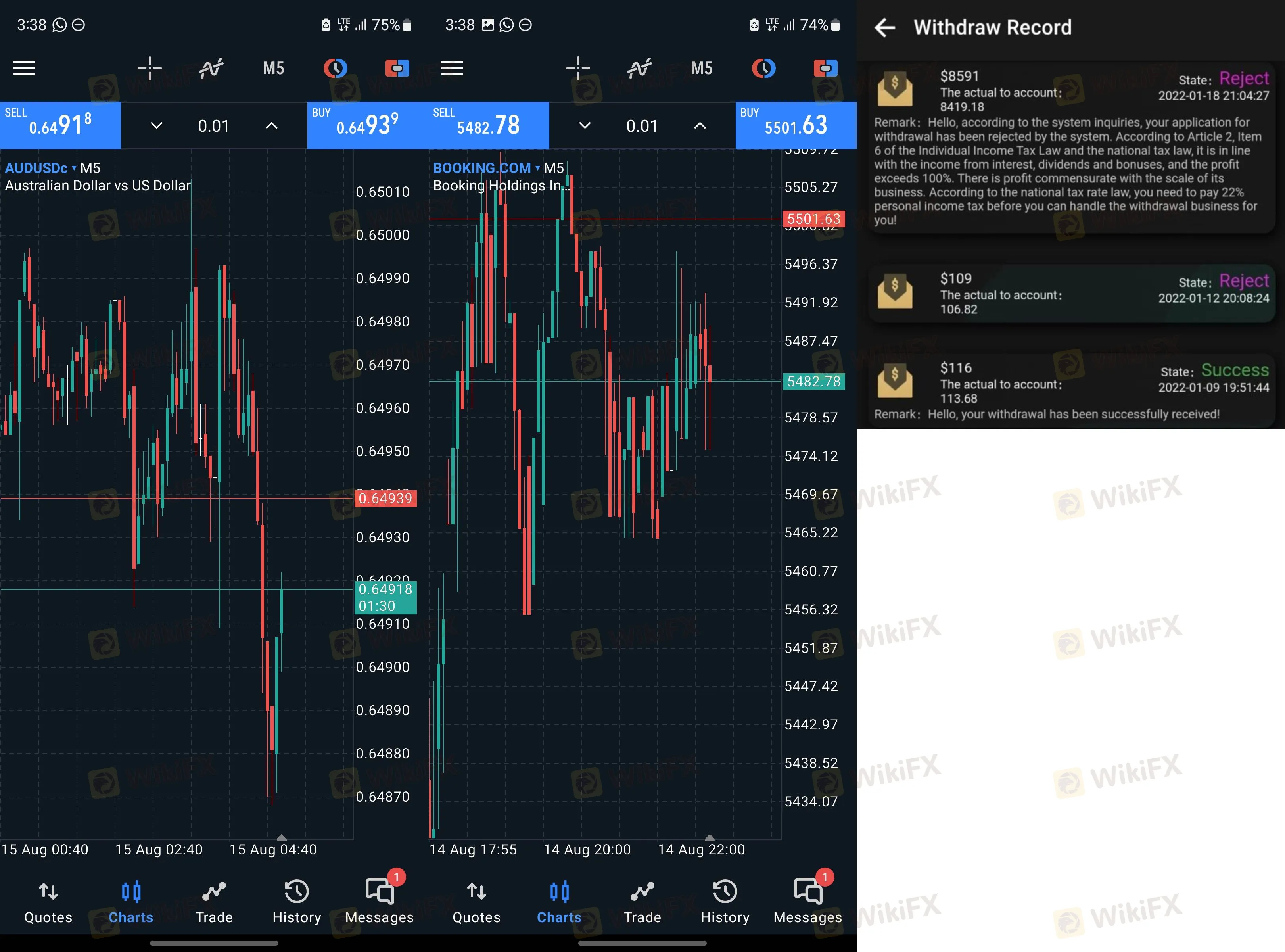

3. Difficulty Withdrawing Funds

Another recurring issue involves support and documentation. A user from Australia reported that their funds were “held hostage” because support kept rejecting their documents, even when uploaded in high resolution. This points to a strict, sometimes frustrating, compliance process.

Advice: If you choose CMC Markets, verify your documents before depositing large amounts, and be aware that if you stop trading, you should withdraw your funds to avoid monthly inactivity charges.

Question 3: What software will I use?

The Evidence:

CMC Markets offers three main ways to trade:

- MT4 (MetaTrader 4)

- MT5 (MetaTrader 5)

- Self-developed (Proprietary) Platform

Analysis:

This is a strong setup. MT4 and MT5 are likely what you are used to if you have traded before—they are reliable and support “Expert Advisors” (trading robots).

If you choose their Proprietary (Self-developed) platform, user reviews suggest it has good search functions and clear fee reports. However, WikiFX data notes a security flaw: it currently lacks two-step login or biometric authentication, which is a standard safety feature in 2025. If you use their own app, ensure you use a very strong password.

Final Verdict: Should I open an account?

CMC Markets is a legitimate heavyweight in the industry. With a WikiFX Score of 8.04 and active regulation from the FCA (UK) and MAS (Singapore), your funds are generally far safer here than with an unregulated broker.

However, knowing the risks is key:

- Good for: Traders who prioritize fund safety and want to use industry-standard software like MT4/MT5.

- Watch out for: Inactivity fees (don't leave a dormant account open) and potential slippage during high-volatility news events.

Brokers change their terms often. Before you click 'Deposit', take 5 seconds to verify their live status and latest certificate on the WikiFX App.

WikiFX Broker

Latest News

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc