Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

Abstract:New brokers often enter the market with flashy websites and promises of high returns, but discerning the legitimate platforms from the dangerous ones can be difficult. GLOBAL GOLD & CURRENCY CORPORATION (often referred to as GGCC) is a relatively new player, established in 2023. While their entry barrier is low, allowing traders to start with very little capital, surface-level appeal isn't enough to guarantee the safety of your funds.

New brokers often enter the market with flashy websites and promises of high returns, but discerning the legitimate platforms from the dangerous ones can be difficult. GLOBAL GOLD & CURRENCY CORPORATION (often referred to as GGCC) is a relatively new player, established in 2023. While their entry barrier is low, allowing traders to start with very little capital, surface-level appeal isn't enough to guarantee the safety of your funds.

When evaluating a broker, we look at objective data. According to the WikiFX Score, which uses an algorithm to assess reliability based on license, business volume, and complaints, GGCC currently holds a score of 1.91 out of 10. This is considered a high-risk score, suggesting that traders should proceed with extreme caution.

Is GLOBAL GOLD & CURRENCY CORPORATION actually regulated?

No. GLOBAL GOLD & CURRENCY CORPORATION is not regulated by any valid financial authority.

While the data indicates the broker is registered in Saint Lucia, registration is not the same as regulation. Thousands of companies can register a business address in offshore jurisdictions without undergoing the strict financial scrutiny required to hold a Forex brokerage license.

Why does “Unregulated” matter?

When you trade with a regulated broker (like those overseen by the FCA in the UK or ASIC in Australia), there are safety nets in place. These regulators enforce segregation of funds, ensuring your deposits are kept in a separate bank account from the broker's operating funds. They also often mandate Negative Balance Protection, so you cannot lose more than you deposited.

Because GGCC has no regulatory oversight:

- There is no legal guarantee that your money is segregated.

- If the broker goes bankrupt, there is no compensation scheme to recover your funds.

- There is no government body audit to ensure their trading software is fair and not manipulated.

What problems are users reporting?

Unfortunately, the user feedback for GGCC paints a concerning picture. We have analyzed 10 recent complaints from regions like India, Pakistan, and Bangladesh, and a clear narrative of “slippage” and “withdrawal blocking” has emerged.

The “Slippage” Nightmare

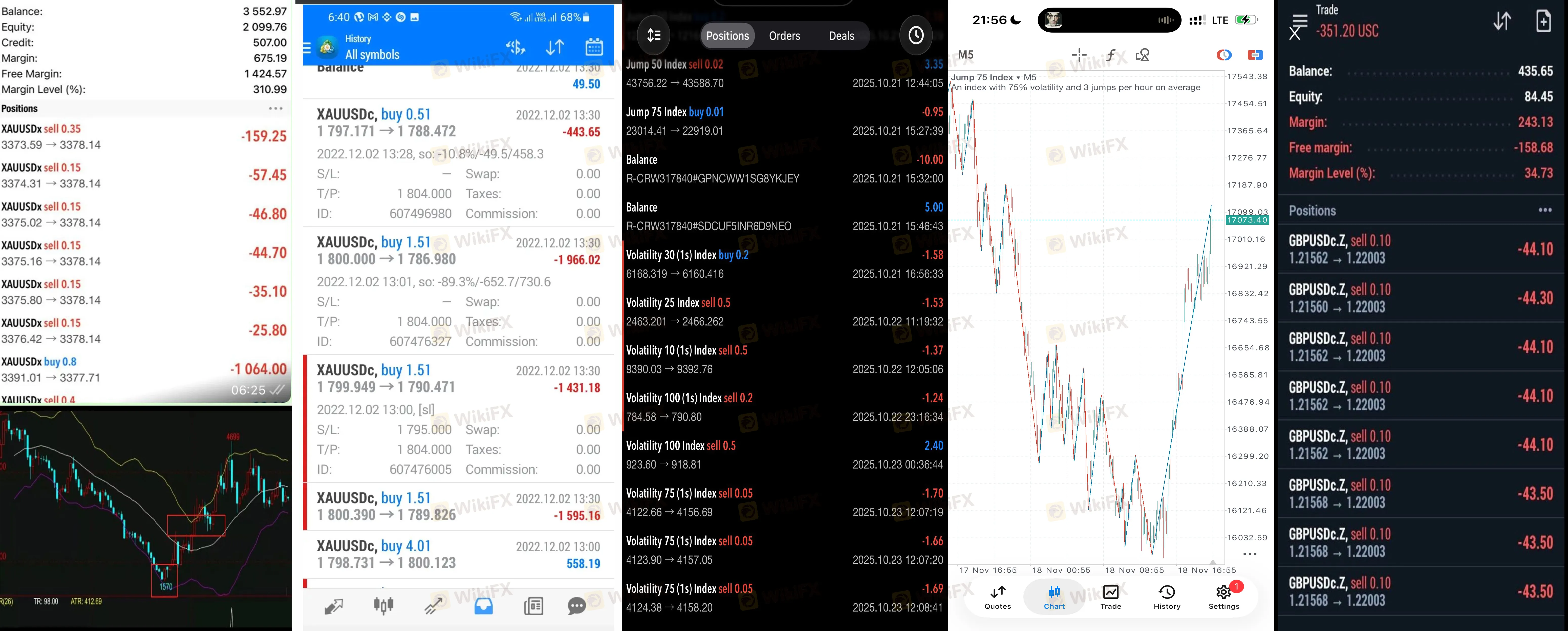

Slippage—when your trade executes at a different price than requested—is normal in volatile markets, usually accounting for a few points. However, users at GGCC are reporting slippage that defies standard market behavior.

One user reported a staggering 72 pips of slippage on a major currency pair. Their trade was closed far below their Stop Loss, wiping out funds that should have been protected. Another user noted that prices suddenly spiked to hit their Stop Loss, only for the market to immediately reverse—a tactic often associated with market manipulation.

Withdrawal Delays and “Verification loops”

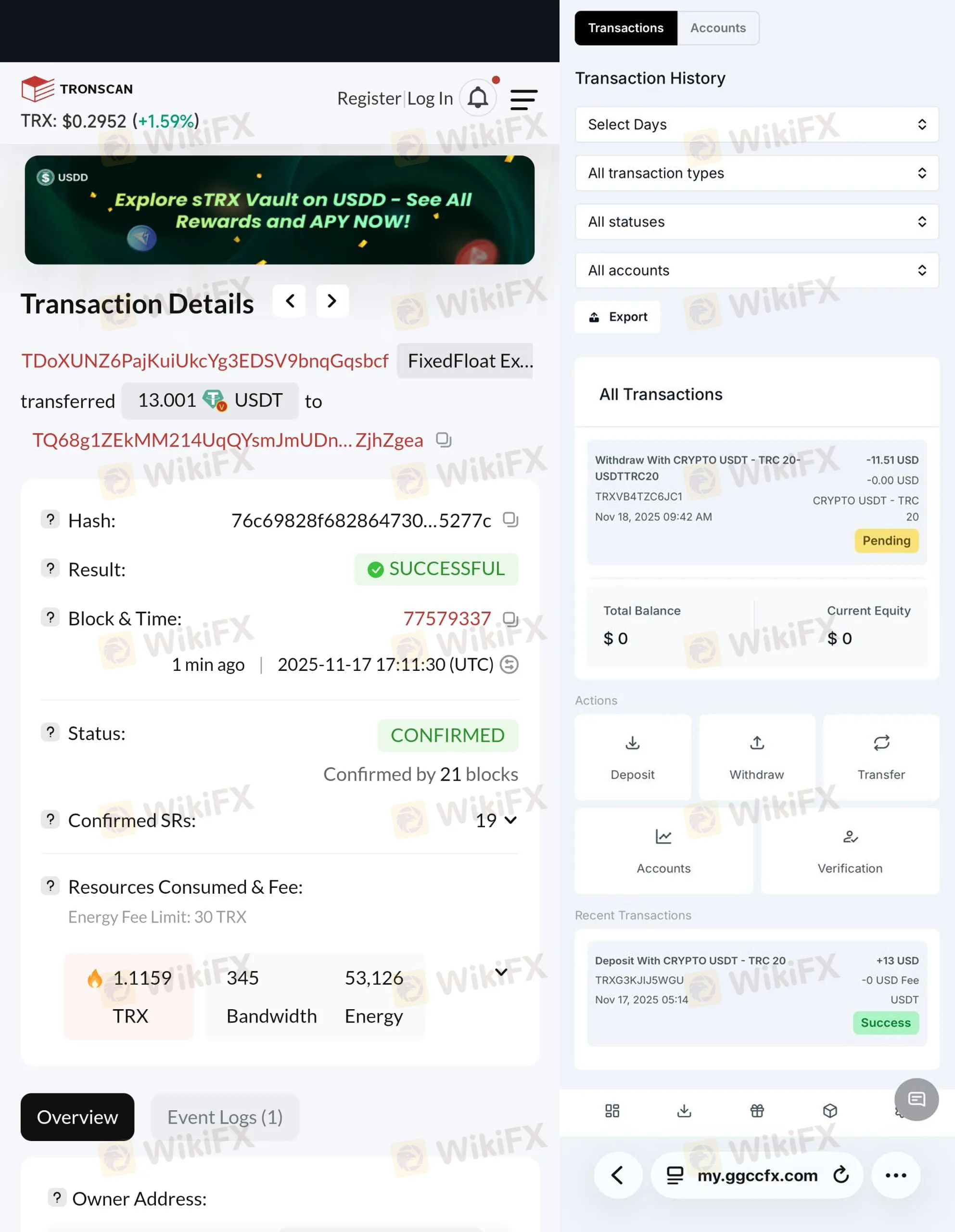

Another recurring theme involves traders trying to retrieve their money. Multiple users have reported that after deciding to quit the platform due to bad trading conditions, their withdrawals remain “pending” for weeks.

When users contact support, they are often trapped in a verification loop. A user detailed how they provided a selfie with ID, utility bills, bank statements, and source-of-funds proof, only to be met with silence or demands for even more obscure documents. This is a common delay tactic used by problematic brokers to discourage users from pursuing their funds.

What trading conditions does GLOBAL GOLD & CURRENCY CORPORATION offer?

If you look past the regulatory risks, the trading specifications offered by GGCC are designed to attract aggressive or high-volume traders, though the costs vary significantly by account type.

Leverage Rules

GGCC offers very high leverage, reaching up to 1:500 on their “Micro” account. While this allows you to control large positions with a deposit as low as $10, it is dangerous for inexperienced traders.

- Educational Note: High leverage is often called a “double-edged sword.” While it magnifies potential profits, it equally magnifies losses. With 1:500 leverage, a market move of just 0.2% against your position could liquidate your entire account instantly. Regulated brokers in top-tier jurisdictions are often capped at 1:30 to prevent this exact scenario.

Spreads & Costs

The broker offers five account types: Master, Premium, Foresight, Standard, and Micro.

- The Expensive Reality: Most retail traders will likely use the Micro or Standard accounts (entry $10 - $500). These accounts have spreads starting from 1.8 to 2.5 pips. This is significantly higher than the industry average (usually 1.0 - 1.2 pips for standard accounts), meaning you start every trade at a larger loss.

- The Bait: To get “From 0” spreads, you must deposit between $5,000 (Foresight) and $30,000 (Premium). Given the lack of regulation, depositing this amount of capital carries immense risk.

Software

On a positive note, the broker utilizes MetaTrader 5 (MT5). This is a legitimate, industry-standard platform known for its advanced charting and algorithmic trading capabilities. However, even the best software cannot protect a trader if the broker controlling the server executes trades unfairly (as suggested by the slippage complaints).

Bottom Line: Should you trust GLOBAL GOLD & CURRENCY CORPORATION?

Based on the available data, we cannot recommend trading with GLOBAL GOLD & CURRENCY CORPORATION.

The combination of being unregulated, holding a dangerously low WikiFX Score of 1.91, and facing serious user allegations regarding price manipulation and withdrawal refusals makes this broker a high-risk option. The potential for lost funds far outweighs the benefits of their low minimum deposit or high leverage.

Markets change fast. To verify their current license status or to check for new user complaints before you deposit, search for GLOBAL GOLD & CURRENCY CORPORATION on the WikiFX App.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

INVESTIZO Review: Profit Cancellation Claims, Withdrawal Denials & Poor Customer Support

AssetsFX Review : Read This Before You Put Money In it

DeltaFX Broker: No Regulation Exposed

Is Stonefort Legit Company? Understanding the Risks

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

Warsh Likes It Hot, And Will Move The Fed's Inflation Target To 2.5-3.5%

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Rate Calc