Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

Abstract:You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

You are likely looking at PRCBroker because youve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

According to WikiFX data, PRCBroker has a score of 6.16 out of 10. They were established in 2014 and are registered in Cyprus. While a score above 6 usually suggests a moderate level of reliability, there are critical red flags in the user complaints that you need to see before making a deposit.

Here is what the data reveals about their safety, high entry barriers, and withdrawal issues.

Question 1: Is my money safe with PRCBroker?

The Evidence:

According to official regulatory filings, PRCBroker holds two main licenses:

- Cyprus Securities and Exchange Commission (CySEC): They hold a “Straight Through Processing” (STP) license (No. 253/14).

- Vanuatu Financial Services Commission (VFSC): They hold an offshore license (No. 14788).

The Verdict:

Use Caution. While they are regulated by a top-tier authority (CySEC), they also use an offshore entity (Vanuatu). Additionally, there is a Regulatory Disclosure warning from 2025 regarding unregulated entities associated with similar domains.

What this means for you:

- The Good News: A CySEC license is generally a gold standard. It requires the broker to segregate client funds (keep your money separate from theirs) and participate in compensation funds if they go bankrupt.

- The specific risk: Many global clients are often onboarded through the Vanuatu (VFSC) entity rather than the Cyprus one. Vanuatu is an “offshore” regulator with much looser rules. If you are registered under the Vanuatu entity, you do not have the same protections as European traders.

Question 2: Are the trading fees and leverage fair?

The Evidence:

- Max Leverage: The data states the maximum leverage is 1:100.

- Minimum Deposit: The entry requirements are unusually high. The “Premium” account requires $10,000, and the “VIP” account requires $100,000.

What this means for you:

- Leverage Risk: A 1:100 leverage ratio means for every $1 you deposit, you can trade $100. While this allows for larger potential profits, it is a “double-edged sword.” If the market moves 1% against you, you could lose your entire investment instantly.

- High Entry Barrier: Most brokers allow you to start with $100 or less. PRCBroker asking for $10,000 minimum is extremely rare for a retail broker. This is a significant commitment for a platform with a moderate trust score.

Question 3: What are real traders complaining about?

The Evidence:

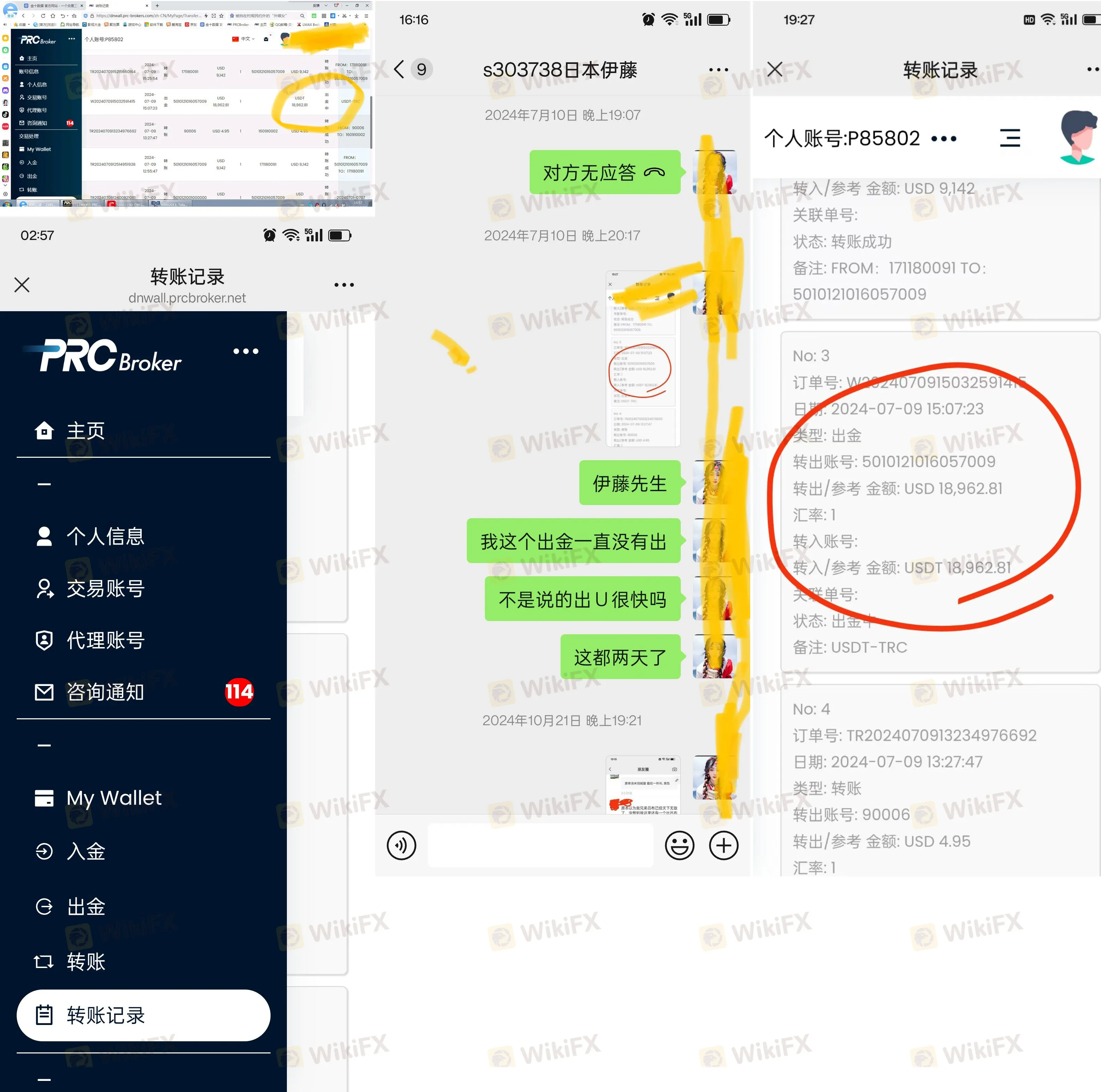

Official claims are one thing, but user feedback tells the real story. In the last 3 months alone, WikiFX has received 19 serious complaints.

The Recurring Issues:

- Severe Withdrawal Denials: The vast majority of complaints (dates ranging from 2024 to May 2025) report that the broker refuses to process withdrawals.

- Account Blocking after Profits: Multiple traders claim that once they made a profit (e.g., one user made $1.13 million, another $100k+), their accounts were frozen, and they were accused of “violations” to justify confiscating funds.

- Agent Commission Issues: Partners (IBs) have reported that PRCBroker is withholding their commission fees.

User Story:

One user reported in April 2025 that after 10+ years of trading, when a client made a large profit, the specific manager refused the withdrawal and blocked communication.

My Advice:

When a broker consistently blocks withdrawals for profitable accounts, it is the biggest warning sign in the industry. If you haven't deposited yet, do not do so until these complaints are resolved.

Question 4: What software will I use?

The Evidence:

PRCBroker provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

The Verdict:

These are the industry-standard platforms.

- Why it's good: MT4 and MT5 are reliable, support automated trading (EAs), and act as a neutral tool.

- The Trap: Just because the software is legitimate (MT4/5) does not mean the broker is honest. A broker can still manipulate spreads or block withdrawals even if they use legitimate software.

Final Verdict: Should I open an account?

Recommendation: AVOID due to high risk of withdrawal failure.

While PRCBroker holds a valid CySEC license, the volume of recent, specific complaints regarding unpaid withdrawals and frozen accounts is alarming. Combined with an unusually high minimum deposit requirement ($10,000), the risk-to-reward ratio is poor for the average trader.

The “So What?” Summary:

- If you are already trading: Attempt a small withdrawal immediately to test their solvency.

- If you are looking to join: There are many brokers with higher scores (8.0+) and lower deposit requirements ($100) that do not have a history of blocking profitable traders.

Brokers change their terms often. Before you click 'Deposit', take 5 seconds to verify their live status and latest certificate on the WikiFX App.

Read more

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking for a broker that can handle serious liquidity without compromising safety. You might be asking: is Finalto just another generic platform, or is it a secure place for your capital?

Is SOUQ CAPITAL Legit or a Scam? 5 Key Questions Answered (2025)

If you are considering depositing money with SOUQ CAPITAL, you are right to be doing your research first. Safety is the most important factor in trading, not just profit potential.

WikiFX Deep Dive Review: ExpertOption

Reference to WikiFX records shows that **ExpertOption is a high-risk broker.** While the company has been operating since 2017 and has a popular trading app, the safety foundations are weak.

Common Questions About ICM Capital: Safety, Fees, and Risks (2025)

If you are looking into ICM Capital (also known simply as ICM), you might be attracted by their established history since 2017 or their access to the MetaTrader platforms. However, glancing at the surface isn't enough when your capital is at risk. With a concerning WikiFX Score of 2.46 out of 10, this broker is currently flashing warning signals that every potential client needs to understand before hitting the "Deposit" button.

WikiFX Broker

Latest News

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Trading.com Launches Zero-Commission Investment Account

Quotex Review 2025: Safety, Features, and Reliability

Government Officer Lost RM12,000 to Non-Existent Forex Scheme

Rate Calc