Ranger Capital

Abstract:Ranger Capital is a broker registered in the United Kingdom, offering a variety of financial instruments to traders. With a range of account types, traders can access the forex, stocks, commodities, cryptocurrencies, indices, and more through the Mobile platforms and ХCritical Online platform. The company can be contacted at +44,2081576945 for any inquiries or assistance. However, its lack of regulation may pose risks to traders, requiring careful consideration before engaging in trading activities.

| Ranger Capital | Basic Information |

| Company Name | Ranger Capital |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

| Tradable Assets | Forex, stocks, commodities, cryptocurrencies, indices |

| Account Types | Starter, silver, gold, platinum, VIP |

| Minimum Deposit | Starter –$250Silver –$3 001Gold –$10 001Platinum –$50,001Vip –$100 001 |

| Time to open account | Instant |

| Trading Platforms | Mobile platforms and ХCritical Online platform |

| Customer Support | Phone: +44,2081576945Skype: rangercapital.onlineE-mail: support@rangercapital.onlineClaims department: dispute@rangercapital.online |

Overview of Ranger Capital

Ranger Capital is a broker registered in the United Kingdom, offering a variety of financial instruments to traders. With a range of account types, traders can access the forex, stocks, commodities, cryptocurrencies, indices, and more through the Mobile platforms and ХCritical Online platform. The company can be contacted at +44,2081576945 for any inquiries or assistance. However, its lack of regulation may pose risks to traders, requiring careful consideration before engaging in trading activities.

Is Ranger Capital Legit?

Ranger Capital is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

Ranger Capital offers traders five classes of trading instruments and multiple account types, providing flexibility and catering to varying trading needs. Additionally, the utilization of the popular Mobile platforms and ХCritical Online platform enhances accessibility and familiarity for traders. However, the lack of regulatory oversight raises concerns about transparency and investor protection. Moreover, the limited customer support options, primarily through email, may hinder efficient resolution of queries or issues. Overall, while Ranger Capital offers opportunities for trading, traders should approach with caution due to the lack of regulatory supervision and limited support resources.

| Pros | Cons |

|

|

|

|

|

|

|

Trading Instruments

Ranger Capital offers five trading instruments, including Forex, stocks, commodities, cryptocurrencies, indices.

Account Types

Starter: Requires a first deposit of $250. It offers a co-funding bonus and manager assistance for account activation. It features standard online chat, introductory financial analyst services, and standard spreads, providing a safe and efficient trading environment. The 'Save the Account' program is available upon request from the analyst, further securing your investments.

Sliver: It is designed for traders who are ready to take their trading to the next level, with a minimum first deposit requirement of $3,001. This account tier offers the advantage of co-funding up to 40%, providing substantial financial leverage to amplify trading positions. Upon activation, account holders receive personalized assistance from a manager, ensuring a smooth start. The online chat service is standard, offering reliable and timely support. Additionally, traders have access to financial analyst services, including strategy training to enhance their trading skills. The spreads are average, balancing cost-efficiency with access to a wide range of trading instruments.

Gold: It caters to discerning investors, setting the entry threshold at a minimum first deposit of $10,001. This account amplifies trading capabilities through a generous co-funding offer of up to 60%, effectively leveraging initial investments. Upon activation, clients are welcomed by personalized manager assistance, ensuring a seamless onboarding process. Priority online chat services are provided, guaranteeing swift and prioritized responses to inquiries. Additionally, the account unlocks exclusive access to joint trading opportunities with financial analysts, offering a collaborative approach to strategy and execution. With average spreads, the gold account strikes a balance between cost and access to a wide range of markets.

Platinum: It is designed for the ambitious investor, requiring a minimum first deposit of $50,001. It stands out with its generous co-funding option, offering up to 75%, thereby significantly leveraging the investor's capital. Upon signing up, clients receive dedicated assistance from a manager to ensure smooth account activation. The account also provides medium priority online chat support, ensuring timely and efficient communication. A standout feature is access to financial analyst services, including the creation of tailored investment portfolios, designed to meet individual financial goals. Moreover, the account benefits from low spreads, optimizing trading costs for investors.

VIP: It is an elite investment platform for serious investors, with a significant minimum first deposit of $100,001. This premium account offers an unparalleled co-funding feature, matching up to 100% of the investor's deposit, effectively doubling the trading power. Expert manager assistance is provided from the outset to facilitate a smooth account activation process. Account holders benefit from high-priority online chat support, ensuring prompt and attentive service. Exclusive financial analyst services are available, focusing on crafting sophisticated stock investment portfolios. Additionally, the account boasts low spreads, reducing transaction costs and maximizing the potential for profit.

How to open an account with Ranger Capital

Set up a profile, open a genuine account or utilize a test account to try it out.

Acquire a trading platform. The XCritical platform work with computers, mobile phones, and web-enabled devices.

Begin trading. Send a moderate sum of money to your account, and use it to experiment with the foreign exchange market.

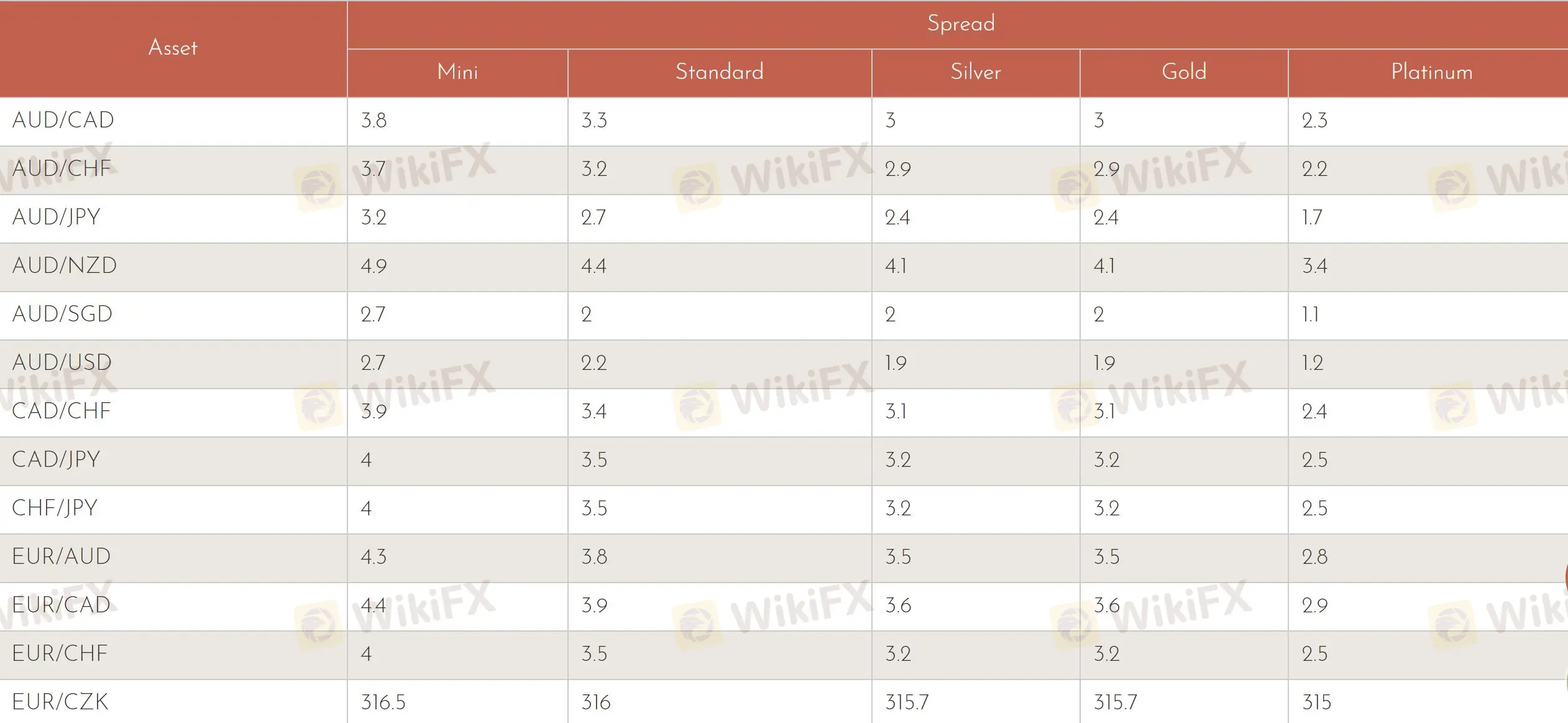

Spreads and Commissions

Spreads

At Ranger Capital, traders have the flexibility to choose from an array of account levels, each designed to provide the most competitive spreads in the market.

Mini Account: Perfect for those just starting out in the forex market, the Mini account offers spreads as follows: 3.8 pips on AUD/CAD, 3.7 pips on AUD/CHF, and 3.2 pips on AUD/JPY.

Standard Account: Stepping up, the Standard account tightens the spreads to provide better value with 3.3 pips on AUD/CAD, 3.2 pips on AUD/CHF, and a competitive 2.7 pips on AUD/JPY.

Silver Account: More seasoned traders often opt for the Silver account, enjoying even more narrow spreads at 3 pips for AUD/CAD, 2.9 pips for AUD/CHF, and 2.4 pips for AUD/JPY.

Golden Account: Aligned with serious traders in mind, the Golden account echoes the spreads of the Silver account, providing consistency with premium service.

Platinum Account: At the pinnacle, the Platinum account is tailored for high-volume traders, offering the tightest spreads starting at just 2.3 pips for AUD/CAD, 2.2 pips for AUD/CHF, and an impressive 1.7 pips for AUD/JPY.

Trading Platforms

Traders can trade forex, stocks, commodities, cryptocurrencies, indices, and more through the Mobile platforms and ХCritical Online platform.

Mobile platforms:The application is compatible with both iOS and Android smartphones. Harness the power of the mobile app to gather data, conduct detailed analyses, and execute FX transactions no matter where you are.

ХCritical Online platform: The ХCritical website is an expansive platform offering a total of 170 trading tools, designed to cater to every trader's requirement. It provides the unique opportunity to craft a personalized investment portfolio tailored to individual preferences and goals. The platform emphasizes efficient risk management through the use of limit orders, ensuring traders can safeguard their investments. For those looking to refine their strategies, it offers access to trading history for comprehensive past strategy analysis.

Customer Support

The Customer Support services of Ranger Capital can be accessed through various channels. Clients can reach out to the broker via phone at +44 2081576945, Skype at rangercapital.online, email at support@rangercapital.online, and the Claims department at dispute@rangercapital.online.

Conclusion

In conclusion, Ranger Capital presents traders with a variety of trading instruments and account types, along with the widely used the mobile platforms and ХCritical Online platform, facilitating flexible and accessible trading opportunities. However, the absence of regulatory oversight poses potential risk may hinder efficient resolution of inquiries. Additionally, the lack of educational resources and unclear company policies may present challenges for traders seeking comprehensive guidance. Traders should exercise caution and conduct thorough research before engaging with Ranger Capital to mitigate potential risks and ensure a safer trading experience.

FAQs

Q: Is Ranger Capital Legit?

A: Ranger Capital is not regulated, indicating it operates without oversight from recognized financial regulatory bodies. Traders are advised to thoroughly research a broker's regulatory status for a safer trading experience.

Q: What are the Pros and Cons of Ranger Capital?

A:

Pros:

1. Diverse range of trading instruments

2. Multiple account types

3. Utilizes popular trading platforms.

Cons:

Operates without regulatory oversight

Lack of transparency and investor protection

Limited customer support options

Q: How to Open an Account with Ranger Capital?

A:

Create a profile and open a genuine or trial account.

Access the XCritical trading platform.

Fund the account and start trading in the forex market.

Q: What are the Spreads and Commissions at Ranger Capital?

A: Commissions are charged for positions held overnight, varying by transaction size.

Q: What Trading Platforms does Ranger Capital Use?

A: Ranger Capital utilizes the mobile platforms and ХCritical Online platform across all account types.

Risk Warning

Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc