BP PRIME Review: Safe Broker or Risky Broker

Abstract:BP PRIME is FCA‑regulated and offers MT5 trading with forex accounts. Explore broker profile, regulation, services, and account details in WikiFX App review.

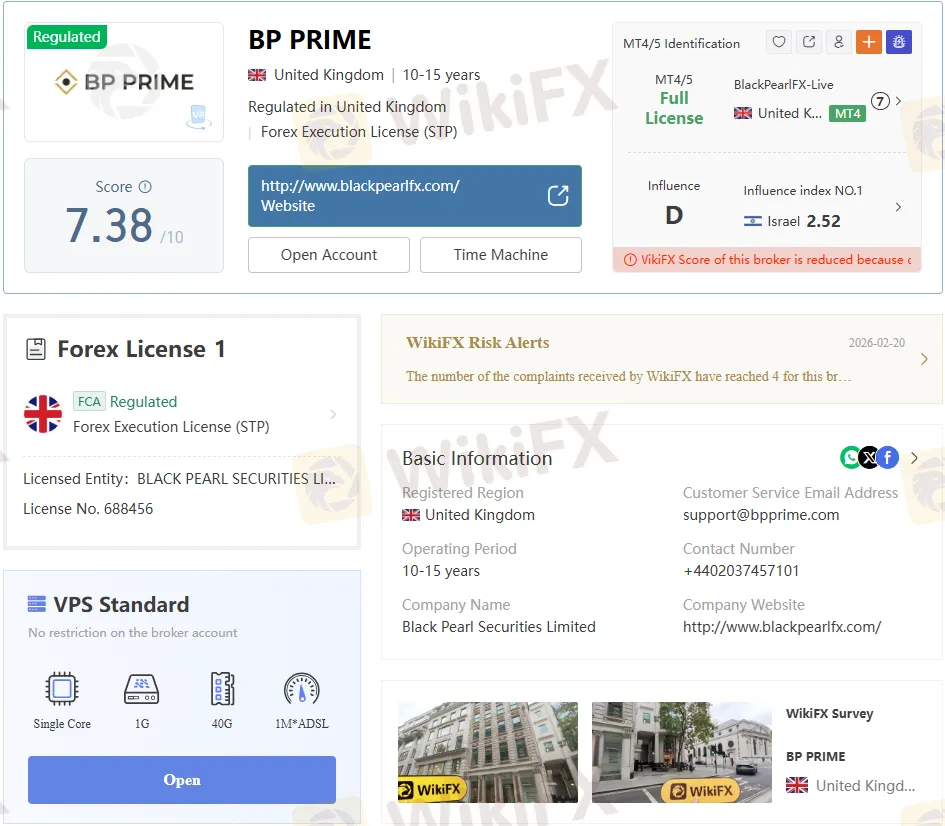

BP PRIME operates as a UK-based forex broker under Black Pearl Securities Limited. Traders often question its safety due to mixed user feedback and specific trading limitations. The WikiFX App provides detailed profiles to help evaluate such brokers objectively.

Broker Overview

BP PRIME started in 2013 and gained FCA regulation in 2015. It focuses on CFD trading in forex, commodities, indices, and precious metals via the MetaTrader platform. Revenue grew significantly to £1.64 million in FY22, showing business expansion amid market competition.

The broker serves retail and professional clients with STP execution and a no-dealing desk model. Minimum deposits start at $5,000, targeting experienced traders rather than beginners. WikiFX App users rate it around 7.35 out of 10 for overall safety.

Regulatory Status

BP PRIME holds an FCA license (number 688456) for forex execution as an STP broker. This UK regulation demands segregated client funds and adherence to strict financial standards. The license remains active without reported revocations.

FCA oversight includes membership of the Financial Services Compensation Scheme, which covers up to £85,000 per client in the event of insolvency. No major regulatory violations appear in recent records. Still, traders should verify license details directly via FCA registers.

Regulation BP PRIME aligns with top-tier standards, but limited asset classes raise questions on diversification. WikiFX App highlights this in its broker profiles for quick checks.

Trading Platforms

BP PRIME primarily uses MetaTrader 4 (MT4), with some reviews mentioning MT5 support. MT4 offers advanced tools, automated trading via Expert Advisors, and mobile access. Execution remains fast and low-latency under normal conditions.

Users report occasional slippage on the platform during volatile markets. The non-dealing desk setup aims for fair pricing without broker intervention. Demo accounts allow testing before a live BP PRIME login.

Platform stability scores medium in user assessments via the WikiFX App. Traders value customizable charts but note occasional order rejections.

Account Types and Fees

BP PRIME provides standard and pro accounts for retail clients, both requiring a $5,000 minimum deposit. Leverage caps at 1:30 for major forex pairs per ESMA rules. No inactivity fees apply, but overnight swaps vary.

Spreads start at 0.3 pips on majors like EUR/USD, below industry averages, with commissions on certain accounts. Micro lots support flexible position sizing. Funding is provided by UK banks for quick processing.

| Account Feature | Standard Account | Pro Account | Industry Avg |

| Min Deposit | $5,000 | $5,000 | $500 |

| Spread (EUR/USD) | 0.3 pips | 0.0 pips | 0.5 pips |

| Commission | Varies | Yes | Varies |

| Leverage (Majors) | 1:30 AM | 1:30 AM | 1:30 |

High entry barriers suit seasoned BP PRIME Forex traders. The WikiFX App effectively compares these fees with peers.

Tradable Instruments

Forex accounts for the core, with over 40 pairs, including majors and exotics. Indices cover global equity benchmarks from London, Europe, and New York. Commodities include oil, gold, silver, energy, and agricultural products.

No stocks, cryptocurrencies, ETFs, or options available, limiting portfolio options. CFDs dominate for leveraged exposure. This setup fits forex-focused strategies in BP PRIME broker services.

| Asset Class | Supported | Examples |

| Forex | Yes | EUR/USD, GBP/JPY |

| Indices | Yes | FTSE, DAX |

| Commodities | Yes | Gold, Oil |

| Crypto | No | |

| Stocks | No |

WikiFX App lists these clearly for Forex BP PRIME evaluations.

Safety Features

Client funds are segregated with top-tier banks and protected against negative balances. No history of major security breaches reported. FSCS backup adds reassurance for UK clients.

Non-dealing desk reduces conflict risks, though execution quality varies. WikiFX App verifies these claims through exposure checks. Overall, safety leans positive but not flawless.

Customer Support and Withdrawals

Support operates via email (compliance@bpprime.com), phone (+44 020 3745 7101), and dedicated channels. Responses prove prompt for most, per reviews. Global offices in London, Italy, and China aid reach.

Withdrawal complaints surface occasionally, citing delays or verification hurdles. Processes run through UK banks are typically fee-free. Login BP PRIME users should prepare the documents in advance.

Mixed feedback appears in WikiFX App discussions on broker BP PRIME support.

User Experiences

Traders praise competitive spreads and regulation in BP PRIME review forums. Platform tools and execution meet the needs of active forex users. High deposits and limited assets draw criticism from novices.

Some report verification slowdowns are affecting Review BP PRIME login access. Positive revenue growth signals stability. WikiFX App aggregates these for balanced views.

| Pros | Cons |

| FCA regulated | High min deposit |

| Low spreads | Limited assets |

| Negative balance prot | Withdrawal delays |

Risks and Considerations

Medium risks include platform glitches in volatility and withdrawal hiccups. High minimums exclude beginners from Broker BP PRIME. No crypto or stocks narrows appeal.

Test via demo first to gauge fit. Monitor for regulatory updates. The WikiFX App helps spot Regulation BP PRIME changes early.

Final Awareness

BP PRIME suits experienced forex traders who value FCA oversight and tight spreads. Risks like delays warrant caution over hype. Download the WikiFX App for ongoing broker monitoring and comparisons.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc