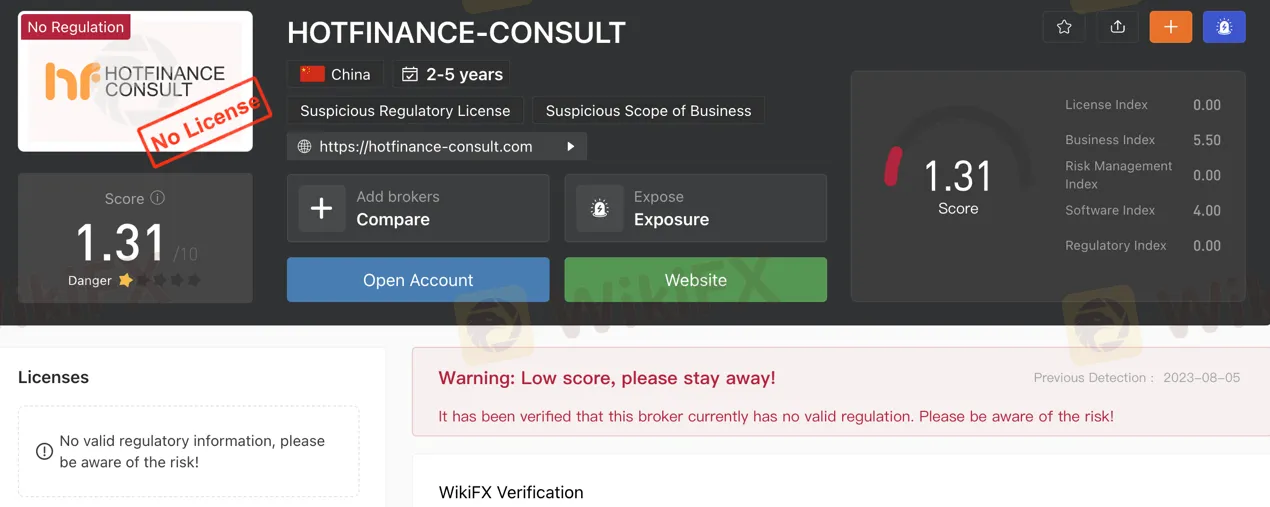

HOTFINANCE-CONSULT Information Revealed

Abstract:HOTFINANCE-CONSULT operates without valid regulation, posing potential risks for investors in the financial market. The broker provides a range of market instruments, including forex currency pairs, global indices, stocks from various companies, and commodities. It offers different account types with varying leverage options, such as Bronze, Silver, Gold, and Platinum accounts. Traders can access the Metatrader 4 trading platform for real-time market data and analysis. Customer support is primarily available via email. Caution is advised when considering any financial involvement with this broker due to the lack of regulatory details and potential risks.

| Aspect | Information |

| Registered Country/Area | Not provided |

| Founded Year | Not provided |

| Company Name | HOTFINANCE-CONSULT |

| Regulation | Not regulated; potential risks |

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:400 |

| Spreads | From 0.1 pips (Platinum) to 2.8 pips (Bronze) |

| Trading Platforms | MetaTrader 4 |

| Tradable Assets | Forex currency pairs, global indices, stocks, commodities |

| Account Types | Bronze, Silver, Gold, Platinum |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Email: support@hot-f1nance.com |

| Payment Methods | Fees for wire transfers, ACH transfers; bank checks free |

| Educational Tools | Not mentioned |

Overview of HOTFINANCE-CONSULT

HOTFINANCE-CONSULT operates without valid regulation, which raises potential concerns for investors considering engaging with this broker. Caution is advised when contemplating any financial involvement with this platform. It offers a range of trading instruments, including forex currency pairs like EUR/USD, GBP/JPY, and USD/JPY. Additionally, traders can access global indices such as the S&P 500, FTSE 100, and Nikkei 225, along with stocks from various sectors like Apple Inc., Microsoft Corporation, and Amazon.com. The platform also provides trading opportunities in commodities like gold, oil, and agricultural products.

HOTFINANCE-CONSULT offers different account types, each with varying leverages and minimum deposits. The Bronze account type has a maximum leverage of 1:100, requiring a minimum deposit of $250, while the Platinum account offers a maximum leverage of 1:400, with a mandatory minimum deposit of $50,000. Traders can potentially amplify their trading positions with leverage options of up to 1:400, but this comes with increased risk. The broker's spreads range from 0.1 pips (Platinum) to 2.8 pips (Bronze), and a minimum deposit of $250 is necessary to start trading.

HOTFINANCE-CONSULT utilizes the widely recognized Metatrader 4 trading platform, allowing traders to access real-time market data, execute trades, and utilize technical analysis tools. Customer support is primarily offered through email communication at support@hot-f1nance.com. It's important to note that the absence of valid regulation and limited details on the main website could potentially pose risks for investors considering this broker.

Pros and Cons

HOTFINANCE-CONSULT presents advantages such as leverage reaching 1:400, a $250 minimum deposit, spreads from 0.1 pips, and access to diverse trading options. However, notable drawbacks include the lack of valid regulation, absence of a comprehensive website, potential risks associated with higher leverage, unclear account benefits, limited commission details, fees for wire and ACH transfers, and inadequate customer support.

| Pros | Cons |

| Leverage up to 1:400 | Operates without valid regulation |

| Low minimum deposit of $250 | Main website unavailable |

| Spreads from 0.1 pips | Higher leverage entails increased risk |

| Access to forex, indices, stocks, commodities | Lack of clarity on account benefits |

| MetaTrader 4 platform | Limited information on commissions |

| Bank checks for free deposits/withdrawals | Fees for wire and ACH transfers |

| Real-time market data and technical tools | Lack of comprehensive customer support |

Is HOTFINANCE-CONSULT Legit?

HOTFINANCE-CONSULT operates without valid regulation, posing potential risks for investors. It is crucial to exercise caution when considering any financial involvement with this broker.

Market Instruments

FX CURRENCY: HOTFINANCE-CONSULT offers a range of forex currency pairs for trading, allowing investors to speculate on the exchange rate fluctuations between different currencies. Examples of currency pairs include EUR/USD, GBP/JPY, and USD/JPY.

GLOBAL INDICES: Traders on HOTFINANCE-CONSULT have access to a selection of global indices, enabling them to invest in the performance of multiple stocks grouped within a specific market. Popular indices available for trading include the S&P 500, FTSE 100, and Nikkei 225.

STOCKS: HOTFINANCE-CONSULT provides the opportunity to trade stocks from various companies across different sectors. Investors can engage in buying and selling shares of companies like Apple Inc., Microsoft Corporation, and Amazon.com.

COMMODITIES: The platform offers trading in commodities, allowing investors to speculate on the price movements of various raw materials. Commodity options include gold, oil, and agricultural products like corn and soybeans.

Pros and Cons

| Pros | Cons |

| Opportunity to trade stocks and commodities | Lack of detailed information on instrument specifics |

| Access to global indices | Limited types of accounts |

| Risk associated with lack of transparent regulation |

Account Types

Bronze:

HOTFINANCE-CONSULT offers a Bronze account type with a maximum leverage of 1:100. The minimum deposit required for this account is $250. Traders can expect a minimum spread starting from 2.8 pips.

Silver:

The Silver account type at HOTFINANCE-CONSULT provides a maximum leverage of 1:200. To open a Silver account, a minimum deposit of $2,000 is necessary. The minimum spread for this account starts from 2.5 pips.

Gold:

For those opting for the Gold account, HOTFINANCE-CONSULT presents a maximum leverage of 1:300. The minimum deposit requirement for this account type is $10,000. Traders can anticipate a minimum spread starting from 1.0 pips.

Platinum:

HOTFINANCE-CONSULT's Platinum account offers a maximum leverage of 1:400, providing traders with higher leverage options. To access this account, a minimum deposit of $50,000 is mandatory. The minimum spread for the Platinum account starts from 0.1 pips.

Pros and Cons

| Pros | Cons |

| Graduated leverage options from 1:100 to 1:400 | Higher leverage accounts require substantial minimum deposits |

| Varied minimum deposit requirements for different accounts | Limited information on additional account benefits |

| Low spreads, starting from 0.1 pips | No demo account mentioned |

Leverage

HOTFINANCE-CONSULT offers leverage options of up to 1:400, providing traders the potential to amplify their trading positions, although it's important to note that higher leverage also involves increased risk.

Spreads & Commissions

HOTFINANCE-CONSULT offers spreads from 0.1 pips (Platinum), 1.0 pips (Gold), 2.5 pips (Silver), and 2.8 pips (Bronze).

Minimum Deposit

HOTFINANCE-CONSULT maintains a minimum deposit requirement of $250, which is the initial amount needed to begin trading on their platform.

Deposit & Withdrawal

There are fees for wire transfers and ACH transfers, but bank checks can be deposited or withdrawn for free. Deposits typically take 1-2 business days to process, and withdrawals typically take 3-5 business days to process.

Pros and Cons

| Pros | Cons |

| Bank checks for free deposits/withdrawals | Fees for wire transfers and ACH transfers |

| Relatively fast deposit processing (1-2 days) | Withdrawals take 3-5 business days to process |

| Variety of deposit methods | Limited options for fee-free withdrawals |

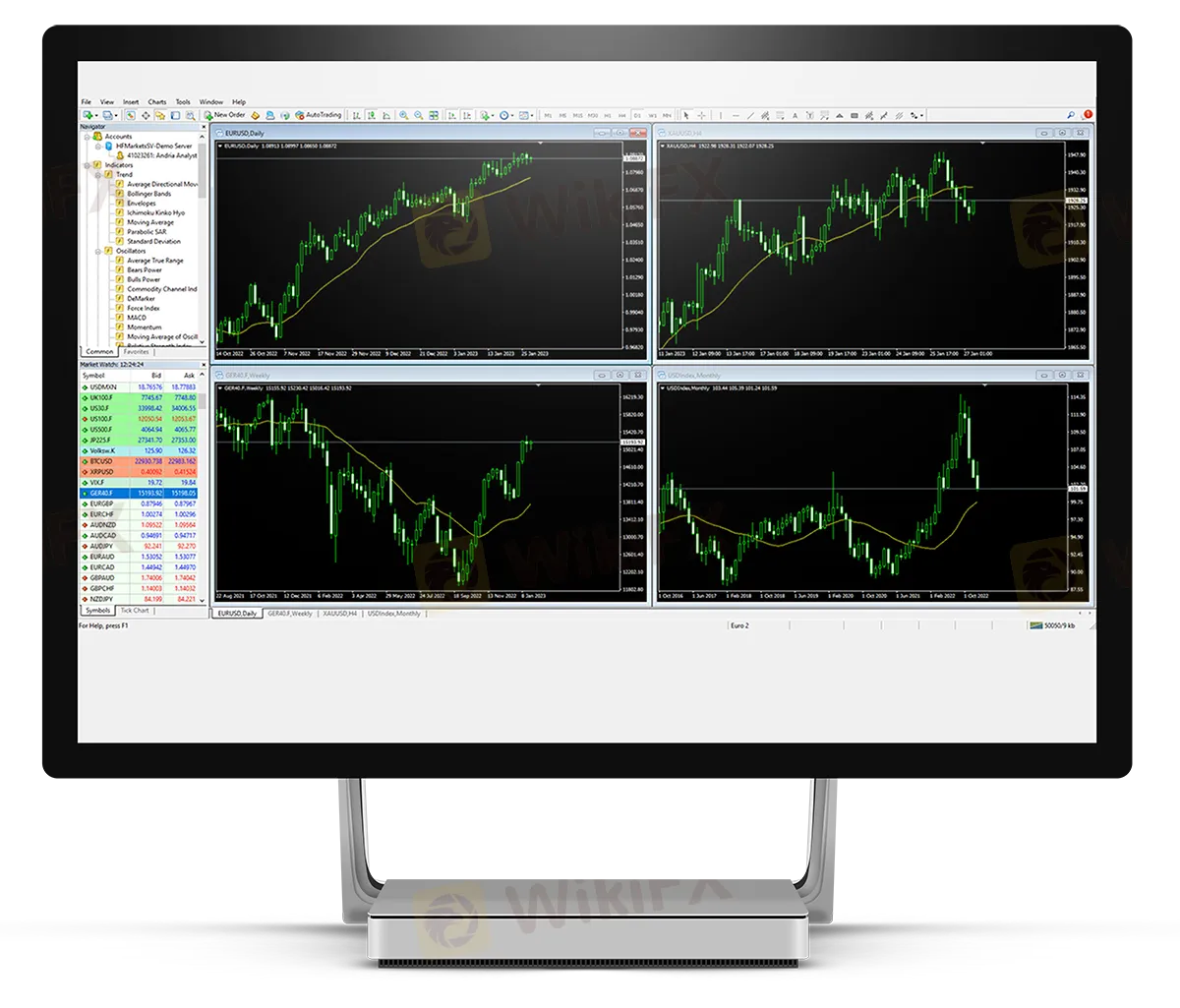

Trading Platforms

METATRADER 4: HOTFINANCE-CONSULT offers the Metatrader 4 trading platform, a widely recognized software in the industry. Traders can access real-time market data, execute trades, and utilize technical analysis tools through this platform. It supports various order types and offers a user-friendly interface for both novice and experienced traders.

Pros and Cons

| Pros | Cons |

| Offers popular METATRADER 4 platform | Lack of information on additional platform options |

| Real-time market data and technical tools | Limited customization features |

| User-friendly interface for traders | Potential system glitches or technical issues |

Customer Support

HOTFINANCE-CONSULT offers customer support primarily through email at support@hot-f1nance.com.

Conclusion

In conclusion, HOTFINANCE-CONSULT presents potential advantages through its offering of a variety of market instruments, including forex currency pairs, global indices, stocks, and commodities. However, notable disadvantages arise from the lack of valid regulation, absence of a main website, and insufficient details overall, raising concerns about transparency and credibility. The range of account types with varying leverages provides traders with options, yet the absence of clear information about the company's background and operations introduces an element of uncertainty. The availability of the Metatrader 4 platform for trading is a positive aspect, but the limited customer support channels, primarily through email, may hinder efficient issue resolution. It is recommended that investors exercise caution and thorough research before engaging with HOTFINANCE-CONSULT due to the aforementioned drawbacks and uncertainties surrounding the broker.

FAQs

Q: Is HOTFINANCE-CONSULT a legitimate broker?

A: HOTFINANCE-CONSULT lacks valid regulation, posing potential risks for investors. Exercise caution before engaging.

Q: What market instruments can I trade on HOTFINANCE-CONSULT?

A: HOTFINANCE-CONSULT offers forex currency pairs, global indices, stocks, and commodities like gold and oil.

Q: What are the account types and their features?

A: HOTFINANCE-CONSULT offers Bronze, Silver, Gold, and Platinum accounts with varying leverages and spreads.

Q: What leverage options does HOTFINANCE-CONSULT provide?

A: HOTFINANCE-CONSULT offers leverage up to 1:400, enhancing trading potential but also raising risk levels.

Q: What are the minimum deposit requirements?

A: The minimum deposit on HOTFINANCE-CONSULT is $250, varying for different account types.

Q: How long do deposits and withdrawals take?

A: Deposits take 1-2 business days, while withdrawals take 3-5 business days on HOTFINANCE-CONSULT.

Q: What trading platform does HOTFINANCE-CONSULT offer?

A: HOTFINANCE-CONSULT provides the Metatrader 4 platform for real-time trading and technical analysis.

Q: How can I contact HOTFINANCE-CONSULT's customer support?

A: You can reach HOTFINANCE-CONSULT's customer support through email at support@hot-f1nance.com.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc