SGSSL-Some important Details about This Broker

Abstract: SGSSL is an unregulated financial firm established in 2007, based in Surat, India. It offers diverse market instruments: equity, foreign currency, commodities, mutual fund, and real estate. However, there is limited information available on trading fees, account features, and trading platforms.

| SGSSL Review Summary | |

| Founded | 2007 |

| Registered Country/Region | India |

| Regulation | No Regulation |

| Market Instruments | Equity, Foreign Currency, Commodity, Mutual Fund, Real Estate |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Phone: 0261-2450773 , 0261-2450774 | |

| Email: igsgssl@sgssl.co.in | |

| Address: Third Floor, Belgium Chambers, OppositeLinear Bus Stop, Ring Road, Surat – 395003 | |

| Facebook, LinkedIn, X, Telegram, Instagram, YouTube | |

SGSSL is an unregulated financial firm established in 2007, based in Surat, India. It offers diverse market instruments: equity, foreign currency, commodities, mutual fund, and real estate. However, there is limited information available on trading fees, account features, and trading platforms.

Pros and Cons

| Pros | Cons |

| Multiple customer support channels | No regulation |

| A wide range of trading products | Limited info on accounts |

| Limited info on trading fees | |

| No demo accounts | |

| Lack of info on trading platforms |

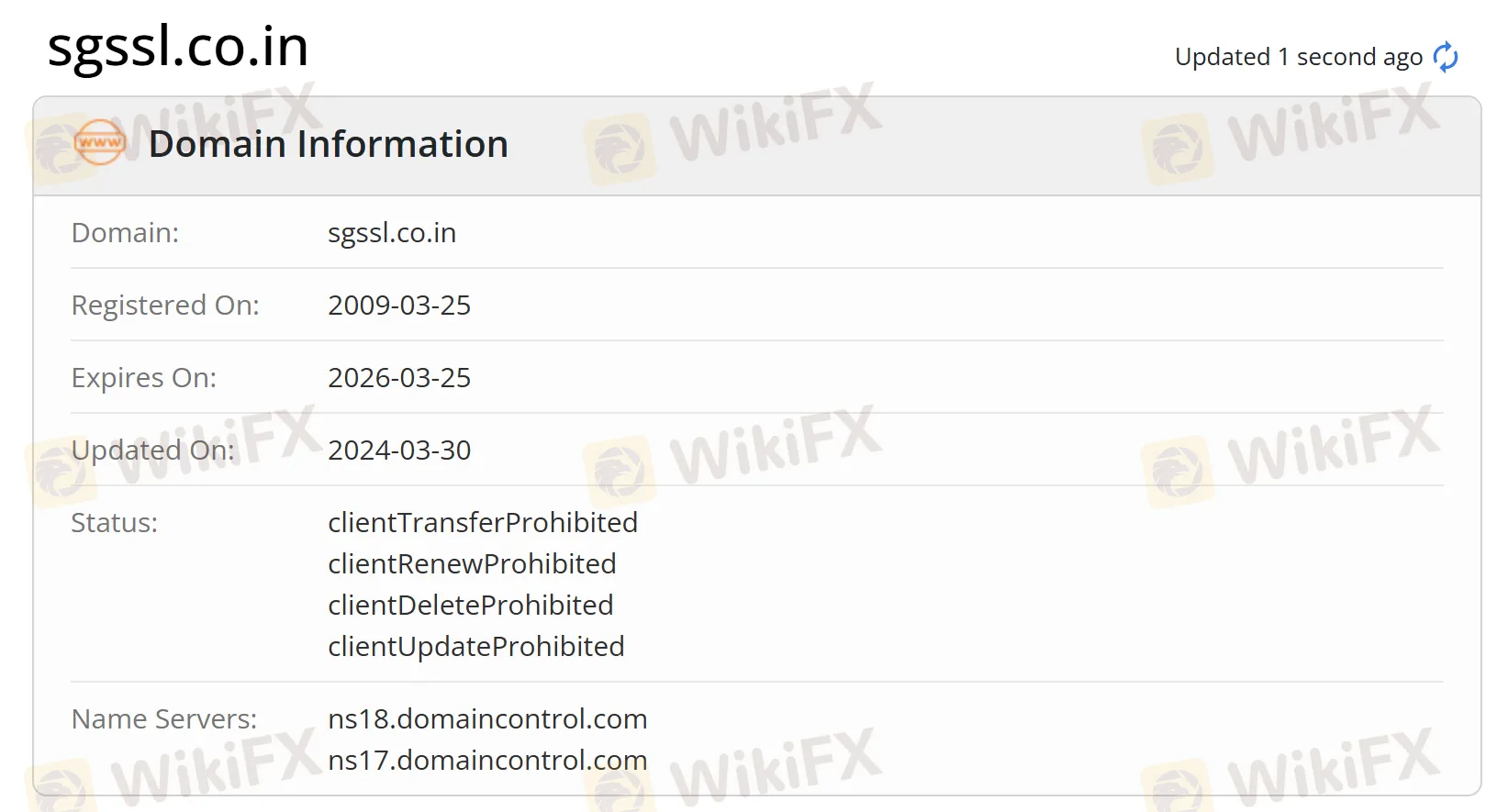

Is SGSSL Legit?

At present, SGSSL lacks valid regulation. Its domain was registered on March 25, 2009, and the current status is “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”. Please pay high attention to the safety of your funds if you choose this broker.

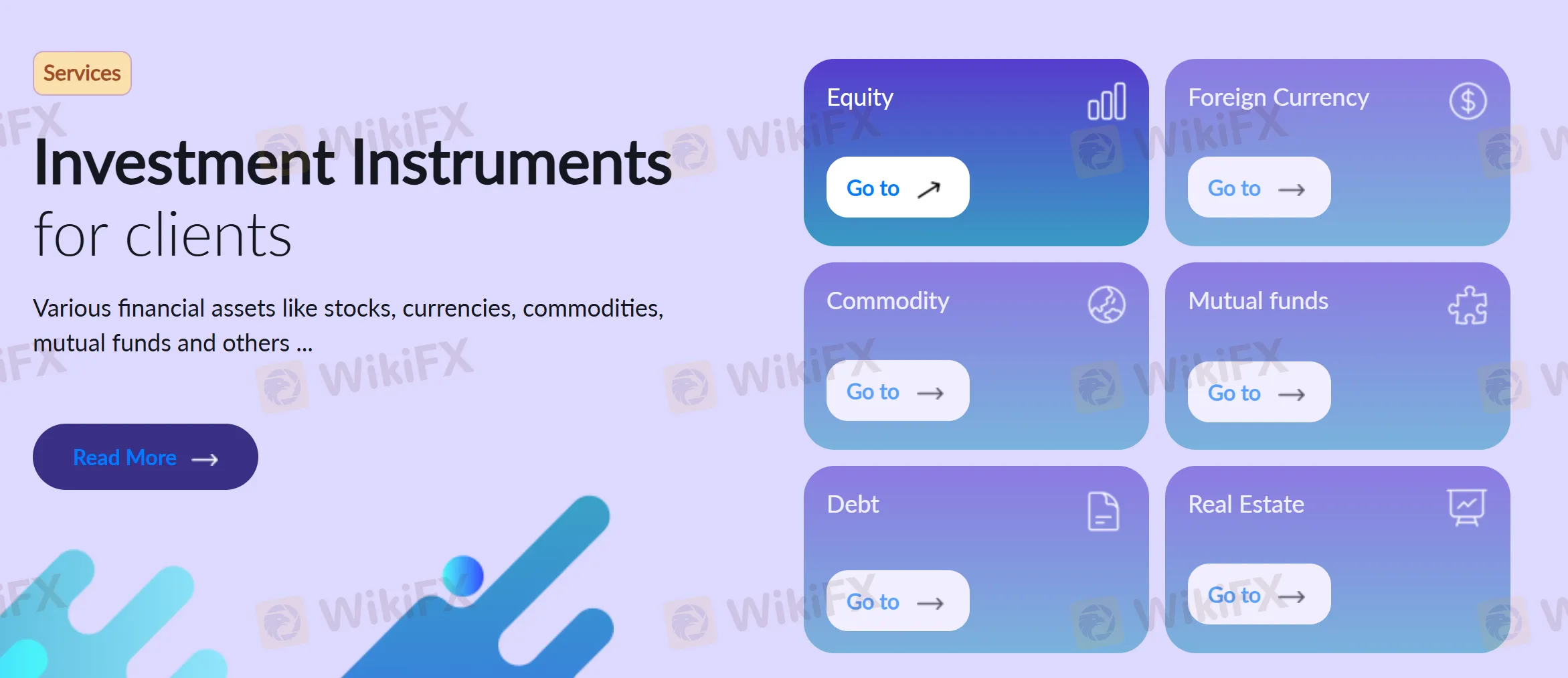

What Can I Trade on SGSSL?

On SGSSL, you can trade with Equity, Foreign Currency, Commodity, Mutual Fund, and Real Estate.

| Trading Instruments | Supported |

| Equity | ✔ |

| Forex | ✔ |

| Commodity | ✔ |

| Mutual Fund | ✔ |

| Real Estate | ✔ |

| Indice | ❌ |

| Stock | ❌ |

| Cryptocurrency | ❌ |

| Bond | ❌ |

| Option | ❌ |

| ETF | ❌ |

Read more

ACY SECURITIES User Reputation: Looking at Real User Reviews and Common Problems to Check Trust

When choosing a broker like ACY Securities, the most important question is whether you can trust them. The internet has many different opinions, making it hard to know if a company is reliable or risky. This review directly answers the main question: Is ACY SECURITIES Safe or Scam? Our goal is to provide a fact-based look into the broker's reputation. We will not just give you our opinion. Instead, we will check its legal status, look at many ACY SECURITIES complaints, and compare them with positive user reviews. This complete review will break down the evidence to help you understand the real risks and possible benefits of trading with ACY Securities.

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

Is ACY Securities a safe and regulated broker? The answer isn't simply yes or no. This broker presents two distinct sides that any potential trader needs to look at carefully. On one hand, ACY Securities Pty Ltd holds real financial licenses, especially from the Australian Securities and Investments Commission (ASIC), which is a highly respected top-level regulator worldwide. This gives the company some credibility and legal standing. But this official status comes with major warning signs. Independent review websites, such as WikiFX, have marked the broker as "High potential risk" because of an extremely high number of user complaints. The large number of negative reports raises serious concerns about how the broker does business, treats clients, and whether its licenses actually protect traders. While the licenses look good on paper, the pattern of trader complaints and international warnings shows a more complicated situation. To see the current data and complete user feedback your

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc