ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

Abstract:Is ACY Securities a safe and regulated broker? The answer isn't simply yes or no. This broker presents two distinct sides that any potential trader needs to look at carefully. On one hand, ACY Securities Pty Ltd holds real financial licenses, especially from the Australian Securities and Investments Commission (ASIC), which is a highly respected top-level regulator worldwide. This gives the company some credibility and legal standing. But this official status comes with major warning signs. Independent review websites, such as WikiFX, have marked the broker as "High potential risk" because of an extremely high number of user complaints. The large number of negative reports raises serious concerns about how the broker does business, treats clients, and whether its licenses actually protect traders. While the licenses look good on paper, the pattern of trader complaints and international warnings shows a more complicated situation. To see the current data and complete user feedback your

Understanding Both Sides of Regulation

Is ACY Securities a safe and regulated broker? The answer isn't simply yes or no. This broker presents two distinct sides that any potential trader needs to look at carefully. On one hand, ACY Securities Pty Ltd holds real financial licenses, especially from the Australian Securities and Investments Commission (ASIC), which is a highly respected top-level regulator worldwide. This gives the company some credibility and legal standing.

But this official status comes with major warning signs. Independent review websites, such as WikiFX, have marked the broker as “High potential risk” because of an extremely high number of user complaints. The large number of negative reports raises serious concerns about how the broker does business, treats clients, and whether its licenses actually protect traders. While the licenses look good on paper, the pattern of trader complaints and international warnings shows a more complicated situation. To see the current data and complete user feedback yourself, we recommend reviewing the complete ACY SECURITIES profile on WikiFX.

Understanding Official Licenses

What the Official Documents Show

To properly research this broker, we need to look at the official regulatory credentials ACY Securities claims to have. A license from a good authority is the basic foundation of whether a broker can be trusted. It means following strict financial rules designed to protect clients. Based on publicly available information, ACY Securities operates under two main regulatory bodies. Understanding what each license covers is important for judging the theoretical level of safety offered to traders.

ASIC Primary Regulation

The main part of ACY Securities' regulatory framework is its authorization in Australia.

The registered company, ACY Securities Pty Ltd, is regulated by the Australian Securities and Investments Commission (ASIC). With more than ten years of operating history, the firm holds two key license types under this regulator:

· Market Making (MM) License: This authorization lets ACY Securities act as the other party in its clients' trades. In this model, the broker can take the opposite side of a transaction, creating the market for its traders. This can result in faster trade completion but also creates a potential conflict of interest, since the broker may profit when a client loses capital.

· Straight Through Processing (STP) License: This license type shows that the broker can also operate by sending client orders directly to its liquidity providers (such as banks or other financial institutions). This model typically removes the direct conflict of interest seen in market making.

Having both licenses suggests a mixed operational model.

FSCA Secondary Regulation

Besides its Australian license, ACY Securities holds a Derivatives Trading License (EP) from South Africa's Financial Sector Conduct Authority (FSCA). The FSCA is a respected regulator in Africa, responsible for ensuring market integrity and protecting customers.

However, it is important to note that some sources have reported this license as being in an “exceeded” regulatory status. This means the broker might be operating beyond what its FSCA license allows, which is concerning for potential clients considering trading with this company.

What This Regulation Means

In theory, being regulated by a top-level authority like ASIC should provide traders with significant security. The benefits required by such a regulatory framework typically include:

· Client Fund Segregation: Brokers must keep client funds in separate bank accounts, different from the company's operational capital. This is designed to protect client capital if the broker goes bankrupt.

· Dispute Resolution Schemes: Regulated brokers must be members of an external dispute resolution organization, giving clients an impartial way to resolve conflicts.

· Capital Adequacy Requirements: Firms must maintain a minimum level of capital to show financial stability and the ability to handle market changes and operational losses.

· Fair Dealing and Transparency: Regulators impose strict rules on pricing, execution, and communication to ensure brokers treat their clients fairly and operate transparently.

These are the protections on paper. However, the real test of a broker's integrity lies in how these principles are applied in practice, which we will explore next.

The Other Side of the Story

International Warnings and Alerts

A broker's complete regulatory picture goes beyond the licenses it holds. It must also include any warnings or blacklists issued against it by regulatory bodies worldwide. This research step is important, as it can reveal a pattern of unauthorized operations or questionable business practices that aren't obvious from its primary licenses alone.

For ACY Securities, this is where the story of a safely regulated broker begins to fall apart. Despite its ASIC license, several international financial authorities have issued public warnings against the company. Up-to-date alerts are critical, and traders can track them on the comprehensive WikiFX profile for ACY Securities.

The “High Potential Risk” Flag

One of the most immediate alerts for traders is the “High potential risk” flag assigned to ACY Securities. According to WikiFX, this is a direct result of an overwhelming number of client complaints. The platform clearly states: “The WikiFX Score of this broker is reduced because of too many complaints!”

This is not a minor issue. It is a decision based on a large volume of negative user feedback, serving as a powerful, data-driven warning. It suggests that, regardless of its regulatory status, a significant number of traders have experienced serious problems with the broker, affecting their funds and trading results.

A Pattern of Scrutiny

The concerns aren't limited to user complaints. Multiple national regulators have placed ACY Securities on their warning or blacklist registers, showing that the firm has been targeting citizens in countries where it isn't authorized to operate.

| Issuing Authority | Country | Warning Type/Date |

| ES CNMV | Spain | Blacklist of unauthorized companies (Feb 2024) |

| FR AMF | France | Blacklist of unauthorized companies (July 2023) |

| MY SCM | Malaysia | Investor Alert List (Jan 2022) |

This pattern is highly concerning. It suggests that while ACY Securities may be compliant within Australia, its global business practices may not meet the regulatory standards of other developed markets. For a trader in Europe or Asia, these warnings are direct evidence that the broker is operating outside the legal framework of their country, potentially leaving them with no local regulatory protection or help.

Beyond the Paperwork

A Deep Look into Complaints

Regulation on paper is one thing; real-world trader experience is another. To truly understand the risks associated with ACY Securities, we must analyze the details of the over 156 complaints filed against the broker on platforms such as WikiFX. These firsthand accounts move beyond theoretical protections and reveal the practical problems traders face. The sheer volume of negative exposure, with 182 “Exposure” reviews overwhelming the 5 positive ones, points toward systematic issues rather than isolated incidents.

Theme 1: Profit Withholding

A recurring and deeply troubling theme is the broker's alleged practice of withholding client profits, often under the excuse of “arbitrage” or rule violations.

A detailed complaint from user “CEHN” from Taiwan in April 2025 provides a clear example. The trader, who chose ACY for its long history and Australian regulation, was suddenly informed of violating rules by “taking advantage of the price disparity” and engaging in “scalping arbitrage.” The broker allegedly determined the trader was working with accounts in Japan and offered to return only the initial deposit, freezing all profits.

The situation got worse when the broker allegedly demanded a new, substantial deposit before it would even process the withdrawal of the original funds. The user expressed deep frustration, asking, “How can such a malevolent platform...randomly label you as scalping arbitrage, wiping out your profits?” This case also highlights another claim: that withdrawals over $5,000 require “boss approval,” which can be arbitrarily denied.

Theme 2: Withdrawal Obstruction

Beyond profit withholding, numerous complaints detail significant delays and outright blocking of withdrawal requests. These aren't minor administrative problems but patterns of behavior that prevent clients from accessing their own funds.

One case involving Mr. Peter Tian describes a withdrawal being taken from his trading account, but he never received it. After he asked about it, the funds were returned to his trading account without his permission. He then traded and lost this money, a situation he had never experienced before.

Other users report many excuses for failed withdrawals, including the platform citing “wrong withdrawal method,” “wrong withdrawal information,” or channels being “under forex controls.” One extensive complaint from early 2024 describes this as a classic “Ponzi scheme” tactic, where a platform creates endless roadblocks to prevent fund outflows until it can no longer be contacted. These reports collectively paint a picture of a system where withdrawing funds, especially profits, can be a difficult and often unsuccessful battle.

Theme 3: Pricing and Execution Issues

The integrity of a broker's pricing and trade execution is extremely important. Several complaints against ACY Securities raise serious doubts in this area.

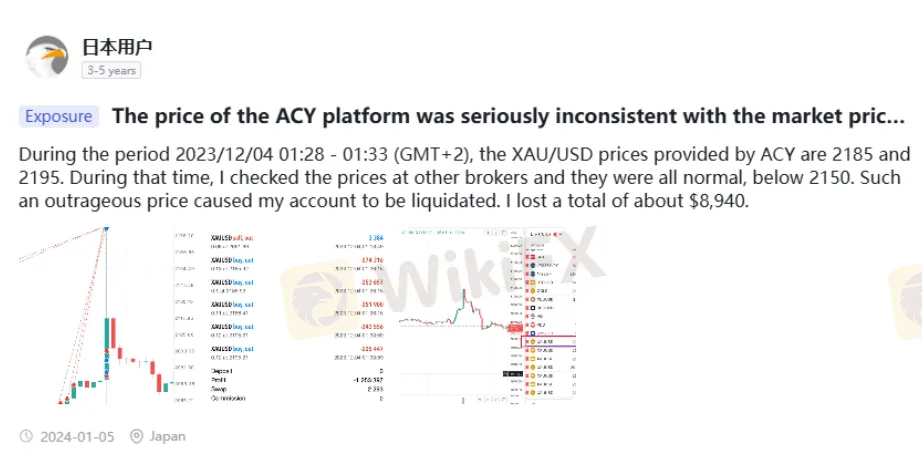

· Unusual Pricing: A Japanese user reported a catastrophic event in December 2023, where the price of XAU/USD (Gold) on ACY's platform spiked to an outrageous 2195. The user checked prices at other brokers, which were all below 2150 at the time. This unusual price spike caused a forced liquidation of the account, resulting in a loss of approximately $8,940.

Forced Liquidation: In January 2024, a trader complained of a forced liquidation when their margin level was still above 50%, a clear violation of standard margin call procedures. The user accused the platform of stealing their funds.

· Malicious Account Intervention: Multiple reports from late 2023 and early 2024 describe locked orders—hedged positions that should carry no market risk—being closed by the platform's backend. This action, which cannot be performed by the trader, resulted in malicious liquidations and significant losses.

A Note on Positive Reviews

To maintain a balanced perspective, it's important to acknowledge that a small number of positive reviews for ACY Securities exist. Users have praised its “fast execution,” “responsive support,” and “low and competitive spreads.” One user specifically complimented an account manager for clear communication and delivering on promises.

However, these few positive testimonials are overwhelmed by the weight of negative evidence. With over 180 detailed “Exposure” complaints cataloging severe issues, the positive reviews appear to be exceptions rather than the rule. The systematic nature of the complaints regarding profit withholding, withdrawal blockades, and questionable execution practices suggests a significant operational risk for all traders on the platform.

Conclusion: A Dual Reality

Balancing License with Risk

In conclusion, the ACY SECURITIES regulation status presents a stark duality. The broker holds a legitimate top-level license from ASIC in Australia, a fact that provides a baseline of credibility and regulatory oversight. For many, this is the primary benchmark for a broker's trustworthiness.

However, this official status is severely undermined by a large and growing body of evidence from trader experiences and other international regulators. The sheer volume and consistency of complaints filed against ACY Securities cannot be ignored. These aren't minor grievances but serious allegations that hamper the broker's function: the security of client funds and the integrity of its trading environment. The warnings from financial authorities in Spain, France, and Malaysia further lower confidence, suggesting a disregard for global compliance standards.

Potential clients must weigh this dual reality carefully. The primary risks documented by users are substantial:

· Risk of Profit Withholding: A clear pattern of profits being frozen or taken, particularly for traders deemed to be using scalping or “arbitrage” strategies.

· Risk of Withdrawal Obstruction: Widespread reports of unexplained delays, arbitrary requirements, and outright refusal to process withdrawals.

· Risk of Execution Issues: Credible accounts of unusual price spikes causing liquidations and questionable backend interventions in client accounts.

While ACY Securities isn't an outright unregulated scam, the documented operational risks are significant. Traders must ask themselves if the potential benefits of the platform are worth gambling against the credible, user-reported evidence of severe and systematic problems. The regulatory and user-feedback landscape can change rapidly. Before depositing, it's essential to check the very latest alerts, reviews, and regulatory status. You can find the complete and continuously updated ACY SECURITIES profile on WikiFX.

Read more

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.

ACY SECURITIES User Reputation: Looking at Real User Reviews and Common Problems to Check Trust

When choosing a broker like ACY Securities, the most important question is whether you can trust them. The internet has many different opinions, making it hard to know if a company is reliable or risky. This review directly answers the main question: Is ACY SECURITIES Safe or Scam? Our goal is to provide a fact-based look into the broker's reputation. We will not just give you our opinion. Instead, we will check its legal status, look at many ACY SECURITIES complaints, and compare them with positive user reviews. This complete review will break down the evidence to help you understand the real risks and possible benefits of trading with ACY Securities.

LONGSHARK Flagged as Unauthorised Broker, Faces Access Restrictions in Italy

The LONGSHARK platform is facing access restrictions after being classified as an unauthorised website, amid the absence of financial regulation and a WikiFX rating of 1.11/10.

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc