ACY SECURITIES User Reputation: Looking at Real User Reviews and Common Problems to Check Trust

Abstract:When choosing a broker like ACY Securities, the most important question is whether you can trust them. The internet has many different opinions, making it hard to know if a company is reliable or risky. This review directly answers the main question: Is ACY SECURITIES Safe or Scam? Our goal is to provide a fact-based look into the broker's reputation. We will not just give you our opinion. Instead, we will check its legal status, look at many ACY SECURITIES complaints, and compare them with positive user reviews. This complete review will break down the evidence to help you understand the real risks and possible benefits of trading with ACY Securities.

When choosing a broker like ACY Securities, the most important question is whether you can trust them. The internet has many different opinions, making it hard to know if a company is reliable or risky. This review directly answers the main question: Is ACY SECURITIES Safe or Scam? Our goal is to provide a fact-based look into the broker's reputation. We will not just give you our opinion. Instead, we will check its legal status, look at many ACY SECURITIES complaints, and compare them with positive user reviews. This complete review will break down the evidence to help you understand the real risks and possible benefits of trading with ACY Securities.

Rules and Official Status

Before looking at user opinions, we need to check the broker's official background. A regulatory license is the first protection for a trader. Based on public information from regulatory agencies and sites such as WikiFX, here is the factual status of ACY Securities.

The broker works under two different regulations. Its main credentials include:

· Australian Securities & Investments Commission (ASIC): ACY has a Market Making (MM) license in Australia, a top-level area known for its strict financial oversight. This provides important security and accountability.

· Financial Sector Conduct Authority (FSCA): The broker also has a Derivatives Trading License in South Africa, expanding its regulatory coverage.

According to its profile, ACY Securities has been working for 10-15 years, showing it has lasted in a competitive industry. However, there is a problem because the company registration date is listed as February 5, 2019. This conflict should make us careful.

Despite these regulations, warning signs exist. WikiFX, which has recorded over 156 complaints against the broker, gives it a score of 7.44 out of 10, noting that the score has been lowered specifically because of the high number of complaints. Also, ACY Securities has appeared on warning lists from international regulators, including:

· ES CNMV (Spain): Warning issued February 5, 2024.

· FR AMF (France): Blacklisted on July 13, 2023.

· MY SCM (Malaysia): Placed on the Investor Alert List on January 1, 2022.

While regulatory oversight provides some security, it's important to see the complete picture. You can check these details and watch for updates directly on the ACY Securities official website.

Looking at User Complaints

With around 182 complaints recorded on WikiFX alone, a clear pattern of user-reported problems appears. These are not single incidents but repeated themes that point to possible ongoing problems within the broker's operations. Our analysis of this feedback shows four major areas of concern.

Keeping Profits and “Arbitrage” Claims

The most serious and often mentioned complaint involves taking away trading profits. Users report that after making money, their earnings are suddenly removed. The broker often justifies this action by accusing the trader of breaking rules, commonly citing “scalping arbitrage” or “collusion.”

A detailed story from user 'CEHN' in Taiwan shows this perfectly. After trading profitably, they were accused of “collusion” with unrelated accounts in Japan and engaging in “scalping arbitrage.” ACY Securities allegedly canceled their profits and was only willing to return the initial deposit. According to the user, any withdrawal over $5,000 required direct approval from the “boss,” who could randomly label a trader's strategy as a violation to block the withdrawal. The user also claimed they were told to deposit more as a condition for having their profits restored.

This theme is repeated in WikiFX news reports, such as “ACY Securities Review: $40k Profits Withheld in Singapore” and “The 'Arbitrage' Accusation: How Winning Trades Turn Into Account Reviews...,” suggesting this is a repeated issue for profitable traders.

Withdrawal Problems and Delays

Beyond profit disputes, many complaints focus on basic withdrawal problems. Traders report that getting their funds out of the platform is difficult, with delays, unexplained reversals, and blocking requirements.

For example, user 'Mr. Peter Tian', from Hong Kong, reported applying for a withdrawal, seeing the funds taken from his trading account, only to have them sent back to the account without his permission. This reversal prevented the withdrawal and later led to trading losses.

Another user, '12345553,' stated, “The withdrawal problem is not solved. I need to make another deposit transaction before I can withdraw the money.”

This practice of requiring a withdrawal to depend on a new deposit is a major warning sign in the industry.

User 'FX1422835145' described a friend's experience where the platform used many excuses to block a withdrawal, including “wrong withdrawal method,” “wrong withdrawal information,” and “forex controls.” These changing justifications create a frustrating and seemingly impossible situation for traders trying to access their capital.

Platform Problems and Price Spikes

Technical problems and platform reliability are another source of major complaints. Users have reported issues ranging from unfair order closures to abnormal price feeds that lead to huge losses.

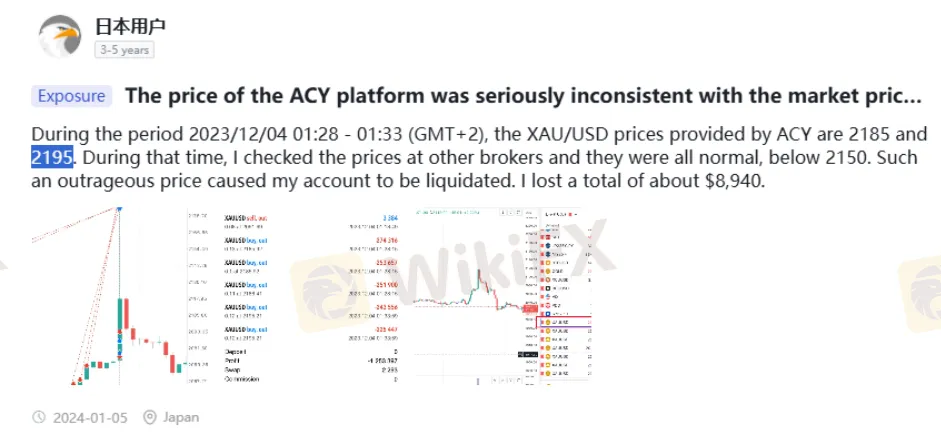

A user from Japan reported an “outrageous price” on the XAU/USD (Gold) pair. During a specific period on December 4, 2023, they claim ACY's platform showed a price of 2185/2195 while other brokers were quoting below 2150. This abnormal price spike resulted in the forced closure of their account, causing a loss of about $8,940.

User '12345553' made multiple reports, including claims that “The backend directly closed customers' orders” and “My lock order was maliciously closed.” Similarly, user '刘2059' reported that the “background forced liquidation of less than 50% of the positions,” an action that should not happen if margin levels are adequate.

Poor Customer Service

Supporting many of these issues is a pattern of unresponsive and unhelpful customer service. When traders have problems with profits, withdrawals or the platform, they report being met with silence, delays, and no resolution.

User '12345553' complained, “Australian ACY deletes the work order record scoundrelly and does not reply!” In another post, they added, “They say the policy is to report it and make you wait! They also don't say they won't deal with it, they just want the customer to give up.”

This suggests a strategy of waiting until the client abandons their claim.

These user-reported issues highlight a big gap between the service promised and the experience delivered. We encourage readers to review the broker's own terms and conditions on the ACY Securities official website to understand its policies on withdrawals and trading practices firsthand.

The Other Side of the Story

To keep a balanced view, it is important to recognize that not all user experiences with ACY Securities are negative. A smaller but notable group of traders reports positive interactions, highlighting specific strengths of the broker.

The most common themes in positive feedback include:

· Fast Execution and Stable Spreads: A user from Thailand, 'ธนวัฒน์', praised the platform for keeping a stable spread during a period of high volatility, which saved their trade from being stopped out. Another user, 'Mahve', noted the spreads are “low and competitive.”

· Transparency and Responsive Support: User 'FX2734530034' from Jordan described ACY as having “clean pricing” and “responsive support.” They specifically credited an employee named “Bahaa” for clear communication and for understanding what traders and affiliates need.

· Reliability and Quick Withdrawals: 'Mohamed Ashrf' from Egypt, a trader with five years of experience, called ACY a “reliable and transparent” broker. He stated that his withdrawal requests were always reviewed within a day, a stark contrast to the complaints.

· Good Customer Service: User 'John993', also from Egypt, mentioned fast execution and a customer service team that “doesn't delay in solving any issues.” He particularly praised the Arabic-speaking support team.

This pool of positive feedback suggests that for some traders, particularly in certain regions or with specific account managers, the experience can be satisfactory.

Weighing the Evidence

To combine these conflicting reports, we have created a scorecard summarizing the key strengths and weaknesses based on the available data. This provides a clear, quick overview of the factors to consider.

This scorecard provides a snapshot based on available data. For the most current information on its offerings and platform features, it's always best to check the source at the ACY Securities official website.

| Green Flags (Potential Strengths) ✅ | Red Flags (Significant Concerns) 🚩 |

| Regulated in a Top-Level Area: Holds an ASIC (Australia) license, providing some oversight. | Huge Number of Complaints: 180+ complaints recorded on WikiFX, causing a score reduction. |

| Long Operating History: Stated as 10-15 years, suggesting longevity in the market. | Serious Claims of Profit Withholding: Multiple, detailed reports of profits being canceled under “arbitrage” or “scalping” accusations. |

| Positive Feedback on Execution and Spreads: Some users praise fast execution, stable spreads, and reliable platform performance. | Widespread Withdrawal Issues: Many complaints of delayed, blocked, or conditioned withdrawals, a major warning sign for any financial service. |

| Good Customer Support Reported by Some: A subset of users reports excellent and responsive support. | Serious Platform and Pricing Issues: Reports of abnormal price spikes (e.g., on Gold) leading to forced liquidations. |

| Wide Range of Instruments and MT4/MT5: Offers over 2,200 instruments and the industry-standard MT4/MT5 platforms. | Unresponsive or Unhelpful Customer Service: A repeated theme in complaints is the inability to get issues resolved, with users feeling ignored or stalled. |

| Regulated in South Africa (FSCA): Holds a second license, adding to its regulatory profile. | Regulatory Warnings/Blacklists: Flagged by regulators in Spain, France, and Malaysia. |

Final Verdict

So, is ACY Securities safe or a scam? The evidence does not support calling the broker an outright “scam” in the traditional sense of an unregulated company designed only to steal funds. It is a registered company with licenses from reputable bodies like ASIC.

However, the answer to whether it is “safe” is much more complex. The central conflict is clear: ACY Securities is a regulated, long-standing broker that is also plagued by an extremely high number of serious complaints. The warning signs are not minor problems; they concern the most basic aspects of a broker's duty—allowing clients to withdraw their funds and keep their earned profits.

The repeated pattern of profit taking under vague “arbitrage” rules, widespread withdrawal problems, and reports of platform manipulation suggest significant operational and ethical risks. These risks appear to be most serious for profitable traders, scalpers, or anyone attempting to withdraw a large sum. While some users report a positive experience, the sheer number and seriousness of the negative reports cannot be ignored.

Ultimately, while ACY Securities operates under a regulatory framework, the patterns of user complaints present a level of risk that potential traders must seriously consider. We advise proceeding with extreme caution. If you choose to trade with this broker, consider starting with a minimal investment that you are fully prepared to lose to test its systems and withdrawal process firsthand.

Read more

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

Is ACY Securities a safe and regulated broker? The answer isn't simply yes or no. This broker presents two distinct sides that any potential trader needs to look at carefully. On one hand, ACY Securities Pty Ltd holds real financial licenses, especially from the Australian Securities and Investments Commission (ASIC), which is a highly respected top-level regulator worldwide. This gives the company some credibility and legal standing. But this official status comes with major warning signs. Independent review websites, such as WikiFX, have marked the broker as "High potential risk" because of an extremely high number of user complaints. The large number of negative reports raises serious concerns about how the broker does business, treats clients, and whether its licenses actually protect traders. While the licenses look good on paper, the pattern of trader complaints and international warnings shows a more complicated situation. To see the current data and complete user feedback your

LONGSHARK Flagged as Unauthorised Broker, Faces Access Restrictions in Italy

The LONGSHARK platform is facing access restrictions after being classified as an unauthorised website, amid the absence of financial regulation and a WikiFX rating of 1.11/10.

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc