The gold paradigm vs crypto’s fresh ‘new wave’: OctaFX does both

Abstract:Many have wondered how the domains of gold and crypto might intersect with each other. People may ask questions like "Is there any common ground?", "Does it have to be one over the other?" International Forex broker OctaFX will answer all these questions.

There appears to be regular competition between gold maximalists and their blockchain counterparts. The one side has its impenetrable record of history to its name. The other has technological innovation, progress, and huge gains to offer.

But with great gains comes great responsibility. If you lack the latter, you are in for a grim surprise, even permanent loss.

The industry's experts always considered gold a safe-haven asset that withstood the test of time and rightly so. It is the usual pick for conservative investors who are patient and resilient towards the emotionality of the financial markets.

While glancing at the bitcoin-initiated blockchain industry, it shows a sheer endless potential for novel application and invention. The booming NFT market alone is a potential 'gold mine' (pun intended).

But with gold, there simply can't be quite as steep and hefty changes, extensions, and surprises, for better and for worse.

Trade both gold and crypto on Foreign Exchange

Users can actually trade both gold and crypto on Foreign Exchange.

Reliable platforms like the international Forex broker OctaFX allow users to participate in several markets, staying in touch with national fiat currencies and the famous yellow metal or the most established cryptocurrencies on the market.

The currency pair XAUUSD (gold and U.S. dollar) is a popular option for traders who want to apply their know-how of market dynamics and specifically have gold involved in the profit equation.

As already mentioned, gold as a store of value is quite resilient, but it can be like a sponge concerning the market's trust in fiat currencies. If it goes down, capital flows into gold, weakening fiat in turn. When fiat regains market trust, gold is usually squeezed again.

The synergy of both worlds: Gold existing on the blockchain

Some might be unaware that companies use the blockchain to make gold an accessible asset to crypto investors while simultaneously providing an entry point for traditional investors to access the blockchain.

One such company is Paxos Gold, which issues special stablecoins on the Ethereum network called PAXG. One PAXG equals one fine ounce of gold, which the token holder can physically redeem in many places worldwide. You can even earn interest on your 'blockchain gold', so to speak. Many platforms offer this as an incentive to keep your gold stablecoins as liquidity on their networks.

Vast options

Don't get caught up in this unnecessary stand-off between these two asset classes and their communities. Both have their strengths and can amplify a wisely diversified portfolio. If you settle on one monolithic asset, you restrict your mobility to act as an investor. Gold proved its use case and keeps storing value long-term as an inflation hedge. It's just the way it is. On the other hand, cryptocurrencies allow multiplying initial investments, draw significant profits, and move the new capital to more static and resilient assets. Another approach is buying back those cryptocurrencies once they hit a substantial low again.

In any case, stay educated and widen your horizon on these markets. Remain flexible and open-minded. As always, calculate your cost-benefit ratio to be as balanced as it gets without missing opportunities.

And another note: Cryptocurrencies and their futures—as opposed to more conservative futures trading—are available during weekends as well. More and more brokers tend to provide this option to their clients. The earlier mentioned fintech player OctaFX just recently introduced this, as well. It started on the first weekend of February.

Read more

WikiFX Deep Dive Review: Is dbinvesting Safe?

If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

BitPania Review 2025: Safety, Features, and Reliability

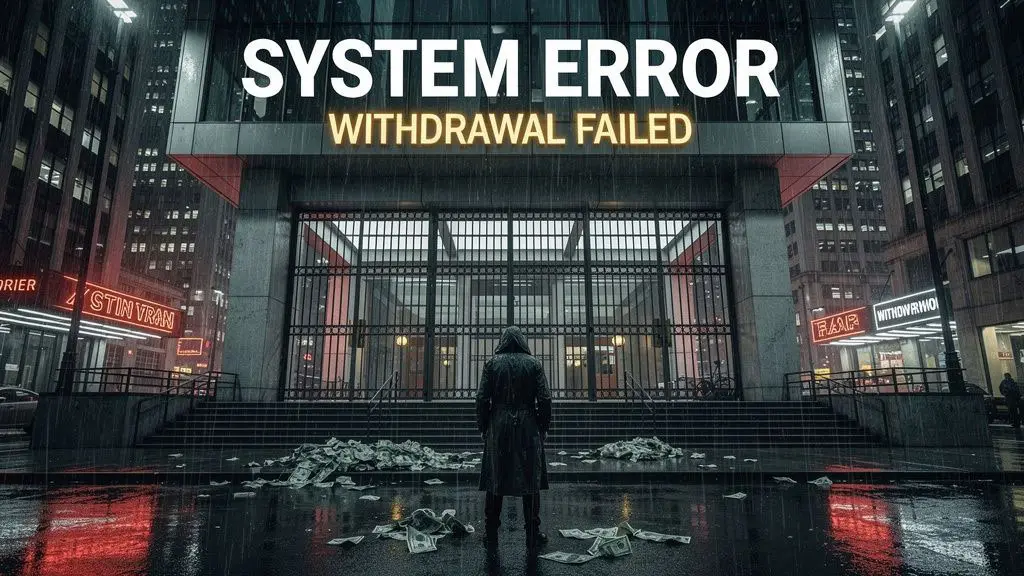

BitPania is a relatively new brokerage established in 2024 and registered in Saint Lucia. The platform markets itself as a digital trading solution offering multiple account types and support for automated trading (EAs). However, potential investors should approach with significant caution. Currently, BitPania holds a WikiFX Score of 1.20, a very low rating that reflects its lack of regulatory oversight and recent user complaints regarding withdrawals.

Common Questions About ExpertOption: Safety, Fees, and Risks (2025)

ExpertOption presents itself as a sleek, modern trading platform with a low barrier to entry, attracting significant attention across social media and search engines. With its proprietary app and promises of easy profits, it’s no surprise many beginners are tempted to sign up. However, flashy interface design often hides fundamental risks.

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Robert Hahm, the Founder and CEO of Algorada. Robert Hahm is a seasoned financial executive who has successfully transitioned from managing traditional assets to founding a cutting-edge fintech platform. As the Founder and CEO of Algorada, he leverages decades of experience in portfolio management to bridge the gap between financial domain knowledge and the power of AI.

WikiFX Broker

Latest News

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Fake Government Aid Scams Are Wiping Out Elderly Savings

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Rate Calc