BMO Capital Markets-Some Detailed Information about This Broker

Abstract:BMO Capital Markets was established in 1992 and is registered in the United Kingdom. It operates across multiple sectors including energy transition, global metals and mining, real estate, and technology, and offers diversified services such as capital raising, carbon consulting, and sustainable finance.

| BMO Capital Markets Review Summary | |

| Founded | 1992 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeded) |

| Services | Capital Raising, Carbon Advisory, Carbon Markets, Credit Development, Global Banks & Global Trade, Institutional Investing, Investment Products, Market Risk Management, Research & Strategy, Sustainable Finance, Treasury Services |

| Customer Support | Social Media: YouTube, Twitter, LinkedIn, Facebook, Instagram |

BMO Capital Markets Information

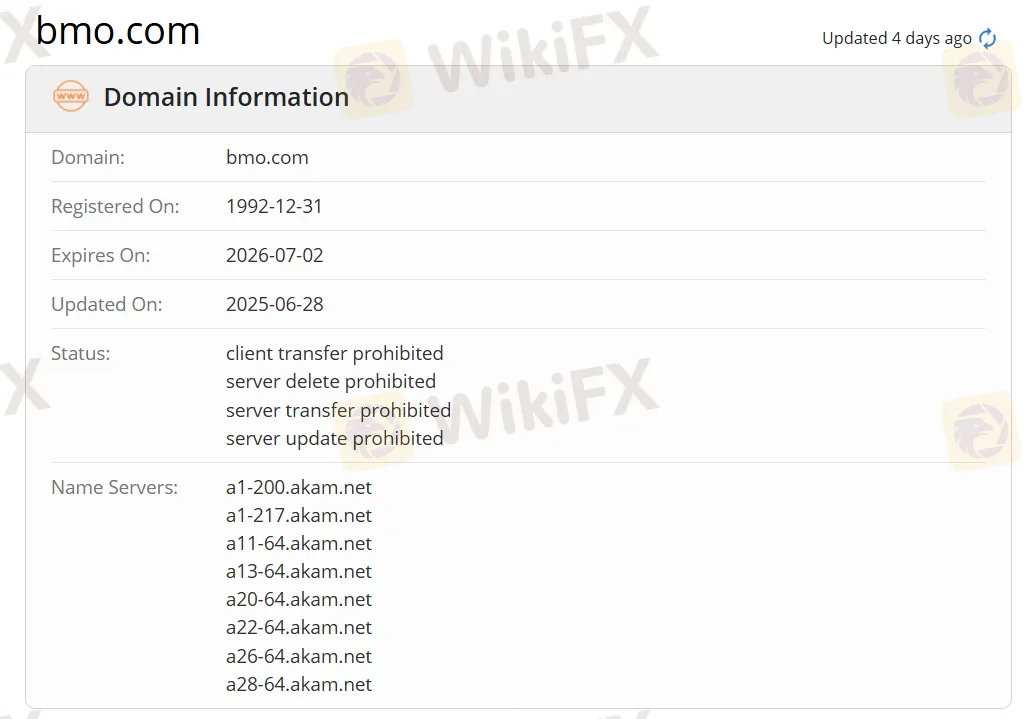

BMO Capital Markets was established in 1992 and is registered in the United Kingdom. It operates across multiple sectors including energy transition, global metals and mining, real estate, and technology, and offers diversified services such as capital raising, carbon consulting, and sustainable finance.

Although the company claims to be regulated and holds an FCA license (number 170937), its regulatory status is marked as “exceeded”.

Pros and Cons

| Pros | Cons |

| Long history | Exceeded FCA license |

| Multiple services support | Unclear fee structure |

Is BMO Capital Markets Legit?

BMO Capital Markets holds an FCA license with license number 170937, but it is marked as “exceeded.” Although BMO Capital Markets claims on its official website that it is regulated, it is unregulated. Traders should exercise caution and use funds prudently when trading.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | Exceeded | BMO Capital Markets Limited | Investment Advisory License | 170937 |

BMO Capital Markets Services

BMO Capital Markets' business spans multiple industries, including diversified industries, financial institutions, financial sponsors, food and retail, energy (particularly energy transition), global metals and mining, power, utilities and infrastructure, healthcare, industrial, real estate, regional investment banking, and technology.

BMO Capital Markets offers a wide range of services, including Capital Raising, Carbon Advisory, Carbon Markets, Credit Development, Global Banks & Global Trade, Institutional Investing, Investment Products, Market Risk Management, Research & Strategy, Sustainable Finance, Treasury Services.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc