User Reviews

More

User comment

1

CommentsWrite a review

2024-02-29 14:52

2024-02-29 14:52

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Inst Deriv Trading License (MM)

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index5.23

Business Index7.58

Risk Management Index0.00

Software Index4.70

License Index3.51

Single Core

1G

40G

More

Company Name

BMO Capital Markets Limited

Company Abbreviation

BMO Capital Markets

Platform registered country and region

United Kingdom

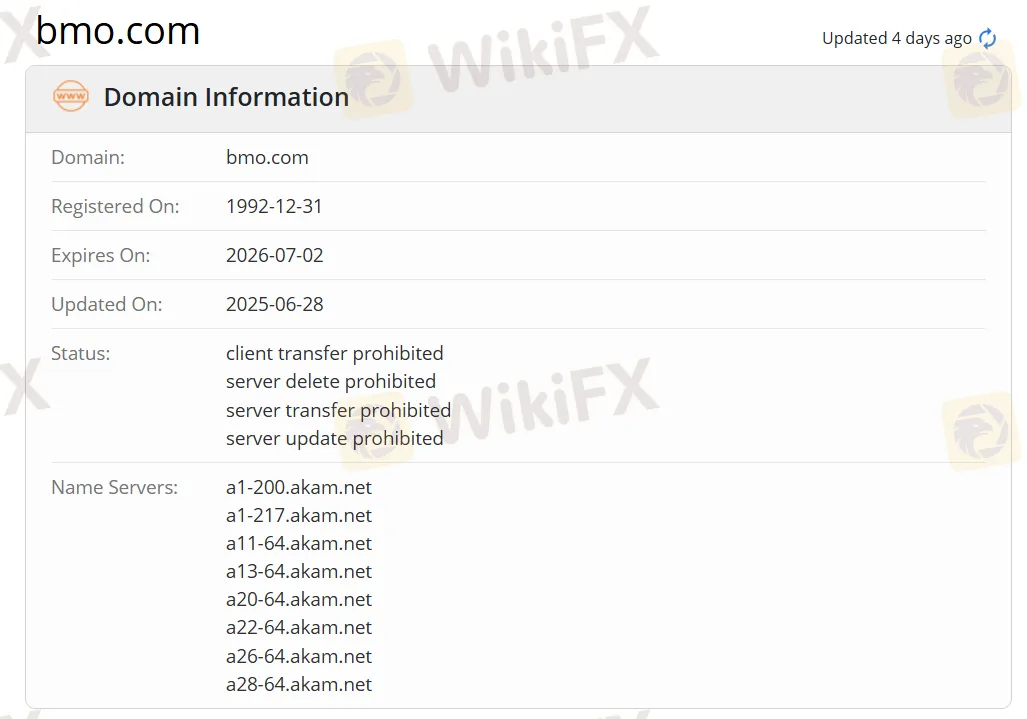

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| BMO Capital Markets Review Summary | |

| Founded | 1992 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeded) |

| Services | Capital Raising, Carbon Advisory, Carbon Markets, Credit Development, Global Banks & Global Trade, Institutional Investing, Investment Products, Market Risk Management, Research & Strategy, Sustainable Finance, Treasury Services |

| Customer Support | Social Media: YouTube, Twitter, LinkedIn, Facebook, Instagram |

BMO Capital Markets was established in 1992 and is registered in the United Kingdom. It operates across multiple sectors including energy transition, global metals and mining, real estate, and technology, and offers diversified services such as capital raising, carbon consulting, and sustainable finance.

Although the company claims to be regulated and holds an FCA license (number 170937), its regulatory status is marked as “exceeded”.

| Pros | Cons |

| Long history | Exceeded FCA license |

| Multiple services support | Unclear fee structure |

BMO Capital Markets holds an FCA license with license number 170937, but it is marked as “exceeded.” Although BMO Capital Markets claims on its official website that it is regulated, it is unregulated. Traders should exercise caution and use funds prudently when trading.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | Exceeded | BMO Capital Markets Limited | Investment Advisory License | 170937 |

BMO Capital Markets' business spans multiple industries, including diversified industries, financial institutions, financial sponsors, food and retail, energy (particularly energy transition), global metals and mining, power, utilities and infrastructure, healthcare, industrial, real estate, regional investment banking, and technology.

BMO Capital Markets offers a wide range of services, including Capital Raising, Carbon Advisory, Carbon Markets, Credit Development, Global Banks & Global Trade, Institutional Investing, Investment Products, Market Risk Management, Research & Strategy, Sustainable Finance, Treasury Services.

More

User comment

1

CommentsWrite a review

2024-02-29 14:52

2024-02-29 14:52