FBS Forex Scam Alert: High Complaint Ratio

Abstract:FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

FBS presents a glaring forex scam alert, with 188 negative cases out of 205 total on WikiFX, signaling significant risks despite its regulatory status. Traders face significant issues with withdrawals and profit cancellations, making it a prime example of a forex broker scam. Download the WikiFX App now to verify brokers and shield your funds from such online trading scams.

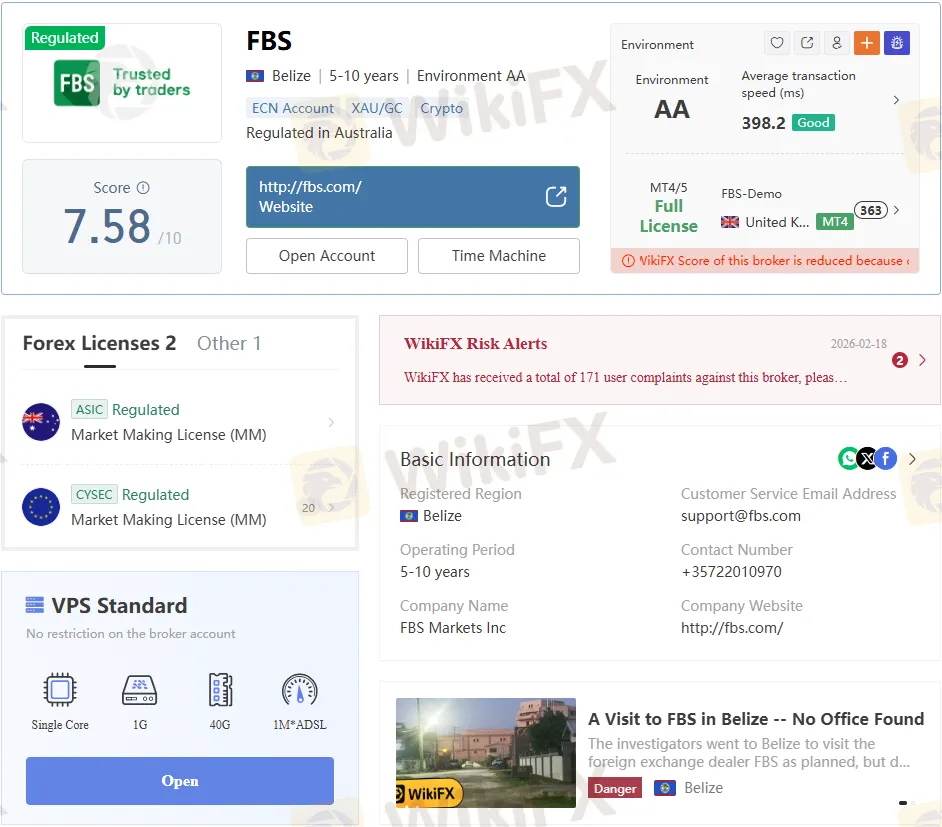

FBS Broker Overview

FBS operates as a regulated forex broker offering over 550 tradable instruments like currency pairs, metals, energies, indices, and shares. It supports platforms including the FBS app, MT4, and MT5, with leverage up to 1:3000, floating spreads from 0.0 pips, and a low $5 minimum deposit via Visa and MasterCard.

Customer support runs 24/7 through live chat and callbacks, but regional restrictions block users from the USA, EU, UK, Israel, Iran, and Myanmar. While it holds licenses from ASIC, CySEC, and an offshore FSC in Belize, these do not fully protect against the flood of user complaints.

Shocking Complaint Statistics

WikiFX records show FBS with 188 negative cases out of 205 total, a 91.7% complaint ratio that screams scam alert. This forex fraud pattern includes over 170 recent reports in just three months, far outpacing positive feedback and exposing deep operational flaws.

These numbers alone position FBS as a top contender in the forex scam space, where regulation fails to curb trader pain. The WikiFX App lays bare this exposure, urging caution before logging in to FBS or making any deposits.

Common Trader Nightmares

Traders repeatedly report “Balance Fixed” deductions wiping out profits after successful trades, a hallmark of forex investment scams. One user grew $248 to over $1,000 only for FBS to erase the gains, citing vague anti-money laundering checks, leaving balances gutted.

Withdrawal requests often show as “successful” but never arrive, with support demanding endless proofs like video selfies or mismatched deposit excuses. This endless loop traps funds, turning FBS into a textbook online scam that preys on profitable accounts.

Price manipulation adds fuel, as orders fill 40 points off market rates compared to other brokers, triggering stop-losses unfairly. Slippage like this on silver trades raises red flags of deliberate churning to harvest losses.

Regulation: Shield or Smoke Screen?

FBS boasts an ASIC license 000426359 via Intelligent Financial Markets Pty Ltd, a CySEC license 331/17 through Tradestone Ltd, and an offshore FSC 000102/460 in Belize. These Tier-1 regs promise segregated funds and investor protection, painting FBS regulation as solid on paper.

Yet the 188/205 negative ratio shatters this illusion, with complaints surging despite oversight. Offshore Belize ops sidestep strict rules, funneling global clients into weaker safeguards where unchecked profit grabs thrive.

The Malaysian Securities Commission even issued an investor alert about FBS, highlighting gaps between its licenses and its actual operations. Use the WikiFX App to scan real-time certs before risking an FBS review turns into personal regret.

Hidden Dangers in Platforms

FBS login via MT4, MT5, or their app seems standard, but chart discrepancies from global feeds like TradingView spark concerns about manipulation. Profits vanish post-login under “Balance Fixed,” unrelated to actual violations.

Proprietary FBS app controls data feeds, enabling subtle dips to hit stops only on their end. Stick to neutral MT platforms if you try, but the complaint volume warns against it entirely as a vector for forex trading scams.

Endless “tax fees” or deposits to unlock withdrawals seal the scam trap, never demanded by legit brokers. The WikiFX App exposes these tactics daily, helping users avoid pitfalls with FBS.

Real Victim Stories Emerge

A trader detailed depositing modestly, scaling profits steadily, then watching FBS cancel everything via “Balance Fixed” with no recourse. Support ghosted emails, mirroring dozens of identical forex alert cases on WikiFX.

Another faced blocked accounts post-profit, accused of policy breaches without proof, and lost thousands in this investment scam cycle. These exposures pile up, with 188 negatives proving a pattern over coincidence.

Video proof demands for routine payouts are delayed indefinitely, a classic delay tactic in online investment scams. FBS review survivors urge checking the WikiFX App first for such FBS horror stories.

Why Profits Vanish

“Balance Fixed” strikes winning trades arbitrarily, often after AML excuses that evaporate under scrutiny. This forex scam selectively erases gains, sparing deposits to lure more funds.

High leverage up to 1:3000 amplifies wins, drawing the deduction hammer faster on successes. Regulated or not, this chews retail traders dry, fueling the 91% complaint rate.

WikiFX App complaint logs confirm hundreds hit this wall recently, turning FBS Forex into a profit black hole. Avoid login FBS rushes; verify via app scans instead.

Withdrawal Hell Unleashed

Dozens report “processed” withdrawals vanishing into limbo, with support looping pointless verifications. Mismatched methods become excuses even when identical, stalling payouts indefinitely.

Some face “deposit more for tax” demands, a blatant scam red flag no ethical broker deploys. This traps escalating sums, bloating FBS scam tallies to 188 negatives.

Global payment options like Sticpay tease ease, but reality bites hard per WikiFX exposures. Prioritize the WikiFX App for broker checks over trusting FBS promises.

Offshore Risks Exposed

Belize FSC licenses offer loose reins, enabling high leverage absent in ASIC/CySEC jurisdictions. Most international sign-ups land here, dodging Tier-1 protections despite marketing gloss.

This setup breeds a surge of complaints, as offshore flexibility morphs into trader exploitation. FBS regulation looks robust on the surface, but practice screams forex fraud.

WikiFX App distinguishes these layers, flagging risks before you commit to reviewing FBS blindly. Heed the 188/205 ratio as your scam alert siren.

Protect Yourself Now

Skip FBS login temptations; the 188 negative cases scream forex broker scams loudly. Cross-check every broker on WikiFX App for live complaints and certs, dodging withdrawal nightmares.

Demand segregated funds proof and test tiny withdrawals first if ignoring warnings. But with this exposure, safer options abound minus the profit wipeout roulette.

WikiFX App empowers real-time vigilance, turning scam potentials into avoided disasters. Stay ahead of forex scams—download and scan today.

Final Scam Warning

FBS Forex blends a regulation facade with 188/205 complaints, a forex investment scam hallmark. Profits vanish, withdrawals stall, and support stonewalls amid offshore shadows.

This exposure via the WikiFX App reveals the disconnect: licenses exist, trust erodes. Shun FBS broker hype; protect funds from the rampant realities of online trading scams.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc