BOQ Review

Abstract:BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

| BOQ Review Summary | |

| Founded | 1874 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Financial Services | Bank accounts, home loans, credit cards, personal loans, insurance, business loans, business accounts, foreign exchange and trade services, merchant and payment products |

| Minimum Deposit | 0 |

| Customer Support | Tel: 1300 55 72 72 |

BOQ Information

BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | Age restrictions on high-yield savings |

| Diverse account types | Limited channels for customer support |

| Zero minimum deposit | |

| Long operation time |

Is BOQ Legit?

BOQ has a Market Maker (MM) license regulated by the Australian Securities and Investments Commission (ASIC) in Australia with a license number of 000244616.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Bank of Queensland Limited | Australia | Market Maker (MM) | 000244616 |

Financial Services

- For individuals, BOQ offers bank accounts (transaction, savings, term deposits), home loans (including refinancing and calculators), credit cards (with rewards), personal loans, and insurance (home/contents and car).

- For businesses, BOQ offers loans and finance (including business loans and overdraft), business accounts (transaction, savings, Visa debit card), foreign exchange and trade services, merchant and payment products, industry expertise (e.g., agribusiness, healthcare), and business banking support (tools, calculators, knowledge hub).

Account Type

Business bank account: BOQ offers various business bank accounts, including Business Transaction Accounts for daily operations and Savings and Investment Accounts to earn interest on business funds. They also provide Industry Specialist Accounts tailored for sectors like Solicitors, Real Estate Agents, and Not-for-Profits.

Personal account: BOQ offers two types of personal accounts, which are the Transaction Account and Savings Accounts.

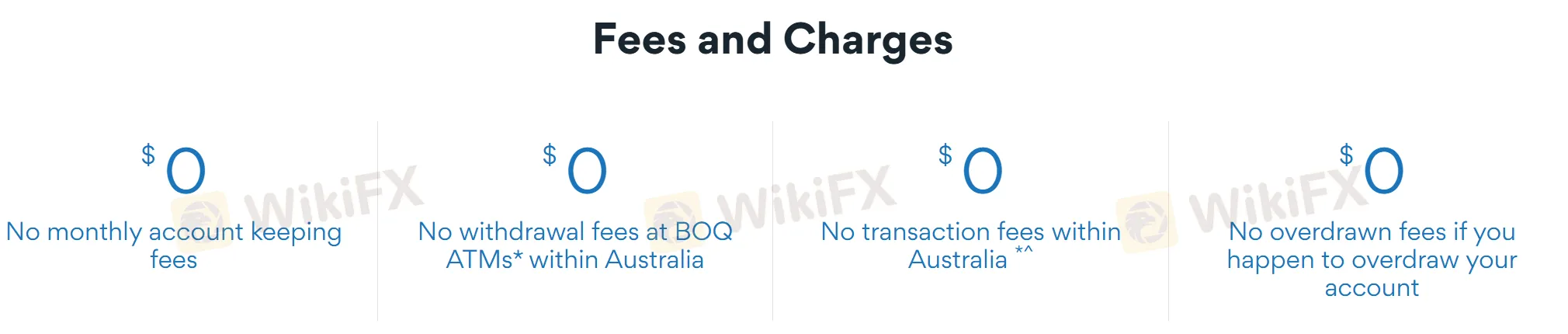

Transaction account: BOQ's transaction accounts generally feature no monthly account-keeping fees, no withdrawal fees at BOQ ATMs within Australia, and no transaction fees within Australia. They also state no overdrawn fees if you happen to overdraw your account.

Savings accounts:

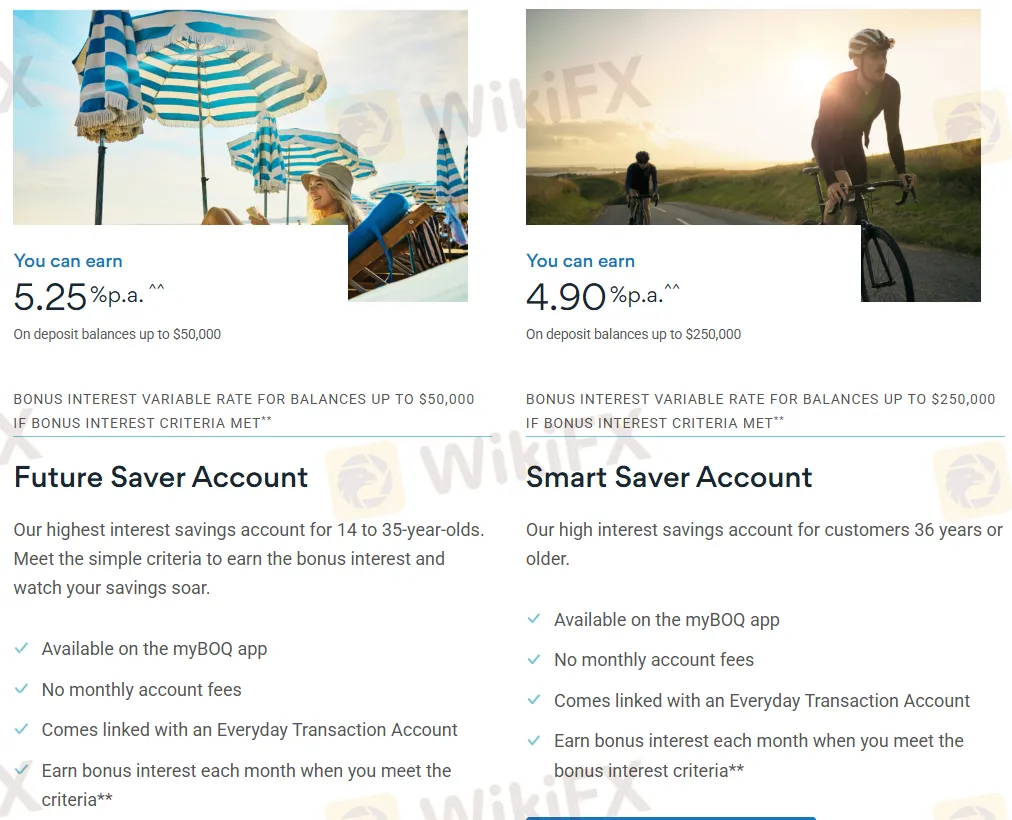

| Feature | Future Saver Account (14-35 years old) | Smart Saver Account (36 years or older) | Simple Saver Account | Term Deposits (Balances $5,000 - $249,999, Term 12-24 months) |

| Interest Rate | 5.25% p.a. on balances up to $50,000 | 4.90% p.a. on balances up to $250,000 | 4.55% p.a. on balances up to $5M | 4.00% P.A. |

| Bonus Interest | Variable rate up to $50,000 if criteria met | Variable rate up to $250,000 if criteria met | Get a great, ongoing interest rate | Fixed term interest rates and no account fees |

| Availability | Available on the myBOQ app | - | ||

| Monthly Account Fees | ❌ | ❌ | ❌ | ❌ |

| Minimum Deposit | - | - | 0 | $1,000 |

| Other Features | Earn bonus interest each month when criteria met | Simply sit back and watch your savings grow | Flexible terms from just 1 month, choose interest payment frequency | |

Read more

ForexDana Exposure: Do Traders Witness Fund Scams & Deposit Credit Failures?

Did your deposited amount fail to reflect in the ForexDana forex trading account? Failed to receive an adequate response from the broker’s customer support officials? Do you think that it is a clone firm that cheats traders? Were you fascinated by the profit shown on the trading platform, but could not withdraw funds? Have you been lured into trading by a deposit bonus that does not work in real-time? In this ForexDana review article, we have investigated some complaints against the broker.

SOLIDARY P R I M E Review: Reported Fund Scams & Poor Customer Support

Have you witnessed a complete fund scam experience when trading with SOLIDARY PRIME? Did you have a PAMM account that disappeared suddenly on the broker’s trading platform? Is the SOLIDARY PRIME customer support team inept in handling your trading queries? Did the broker deceive you on binary options? These complaints are showing up on broker review platforms. In this SOLIDARY PRIME review article, we have investigated some of the complaints against the broker. Take a look!

DBInvesting Forex Scams: User Exposure and Reviews

DBInvesting Forex scams exposed: offshore regulation, fake offices, and withdrawal issues. Read the full scam report now.

Quotex Forex Scam Reports: Fraudulent Practices Revealed

Traders expose Quotex's forex scam tactics: fake tasks, tax demands, and withheld funds. Broker remains unregulated and unsafe.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc