BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Abstract:Is BLITZ finance a scam? Despite claims of a Swiss presence, regulators have issued warnings against this unregulated broker. Read our evaluation of its 1.09 WikiFX score and user complaints.

Global Reach or Global Trap?

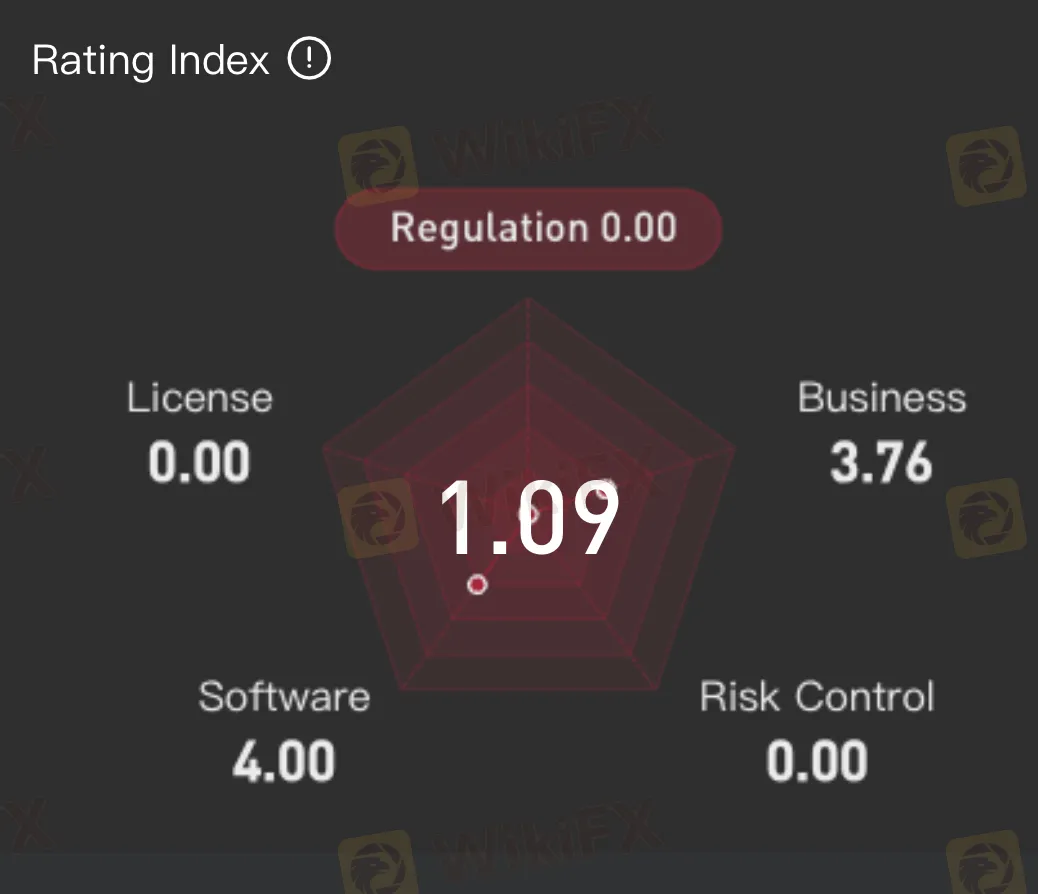

BLITZ finance presents itself as a heavyweight in the trading world, boasting operations that supposedly span over 83 countries. With a sleek digital presence and claims of high-level service, it attempts to court investors looking for a secure place to trade. However, a deeper evaluation reveals a stark disconnect between its marketing facade and its operational reality. According to the WikiFX database, the broker holds a threateningly low Score of 1.09/10, signaling that this platform is likely a dangerous trap for the uninformed.

Regulatory Analysis: The Fake Swiss Identity

The primary red flag in our review is the broker's claim to legitimacy via a Swiss address. In the financial world, a Swiss location implies stability, prestige, and strict oversight. BLITZ finance exploits this perception to build false trust.

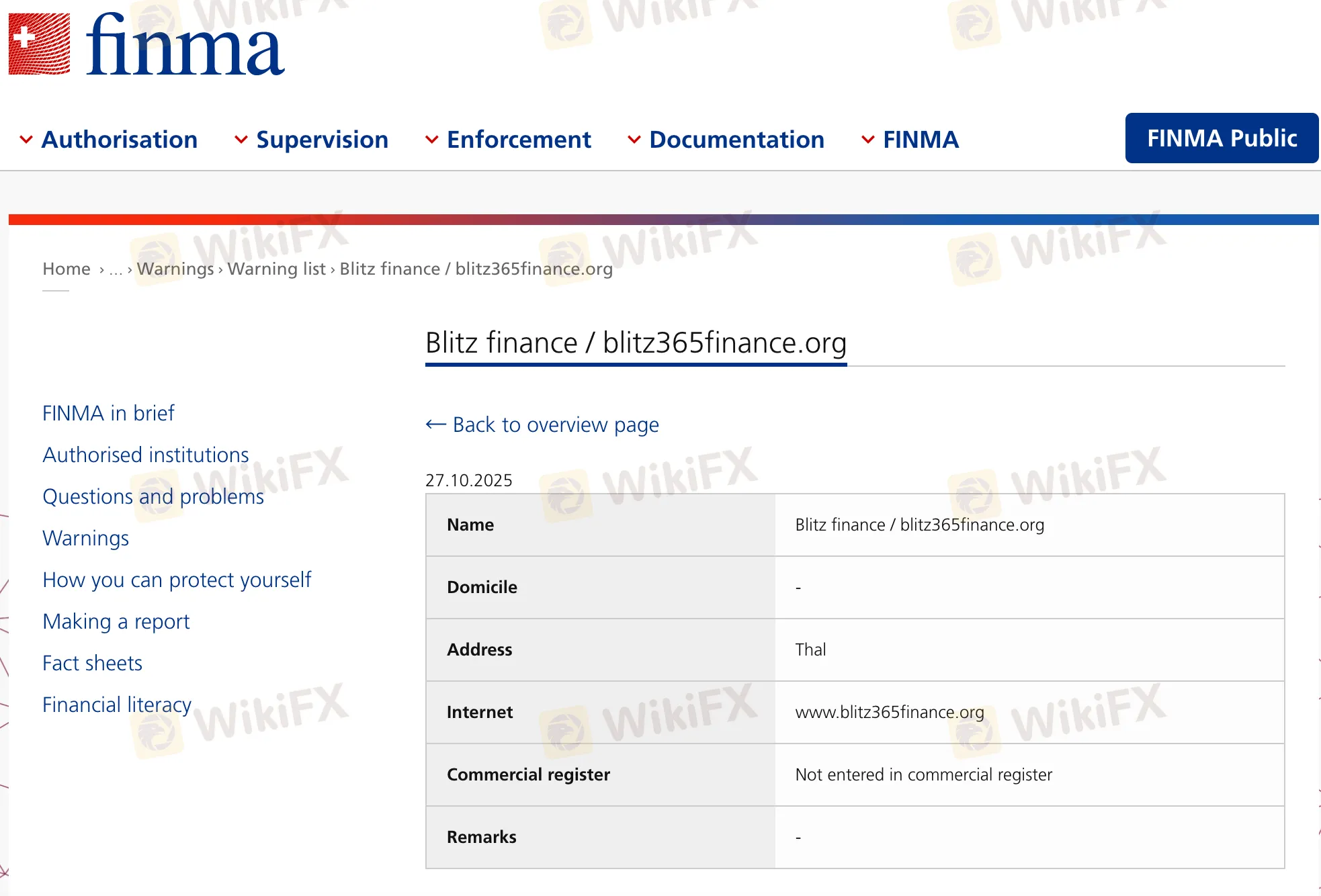

However, this facade has been dismantled by the regulators themselves. The Swiss Financial Market Supervisory Authority (FINMA) has issued a formal warning against “Blitz finance / blitz365finance.org.” FINMA explicitly states that the company is “Not entered in commercial register,” meaning it has no legal authority to operate in Switzerland.

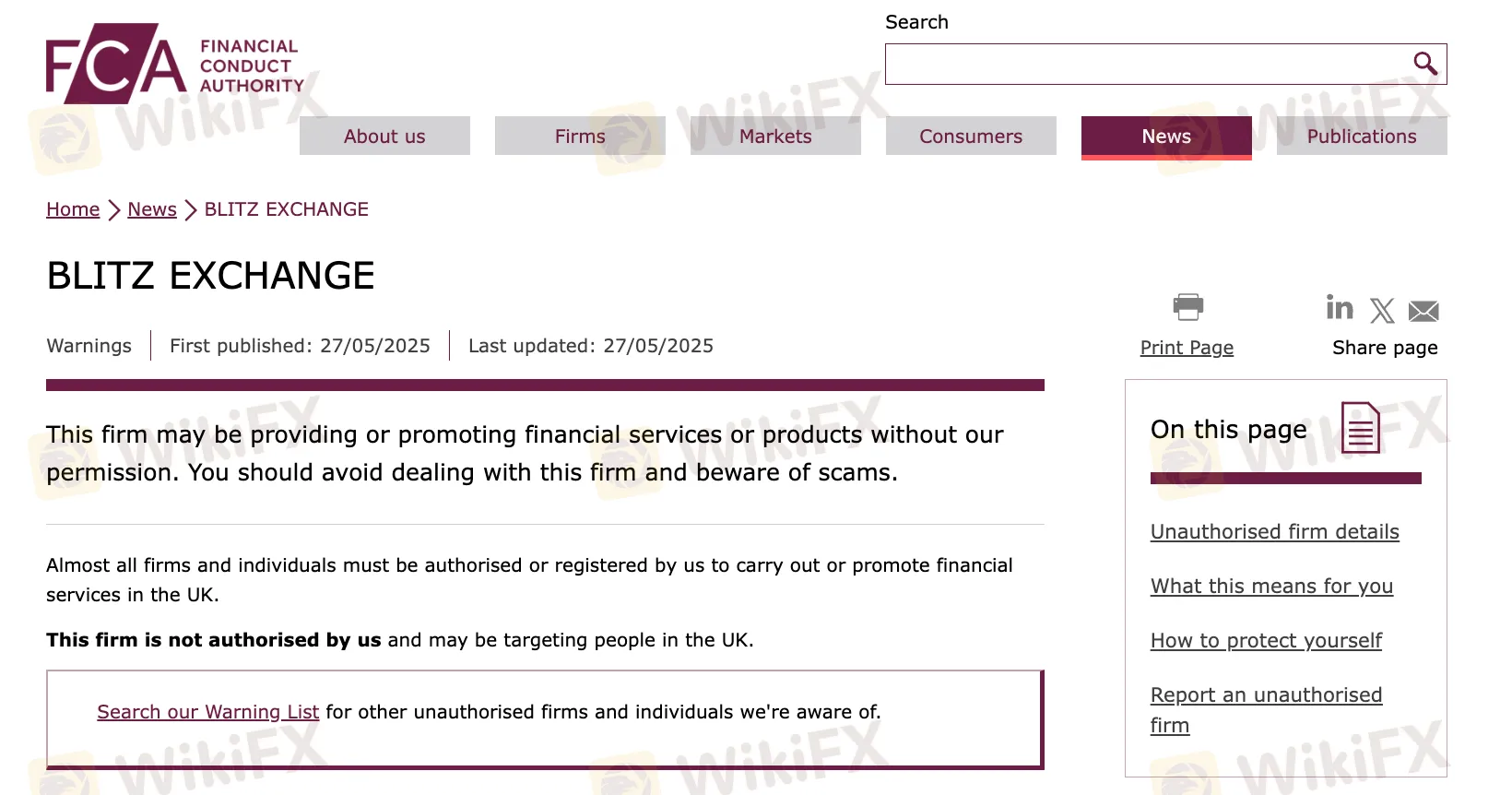

Adding to the list of regulatory troubles, the UK's Financial Conduct Authority (FCA) has also flagged a similar entity named “BLITZ EXCHANGE.” The FCA warned that the firm is providing financial services without permission, further cementing the pattern of unauthorized operations associated with the “Blitz” brand.

User Exposure: Aggressive Tactics and Withdrawal Failures

Beyond the lack of a valid license, user feedback paints a concerning picture of the broker's operational conduct. Reports allege that the firm employs aggressive telemarketing tactics, harassing potential clients with persistent, unwanted calls to solicit deposits. More critically, numerous traders have claimed that the platform effectively traps funds; once capital is deposited, withdrawal requests are reportedly ignored or rejected, and communication with support often ceases entirely.

WikiFX Final Verdict

BLITZ finance exhibits all the classic warning signs of a fraudulent operation.

- License: None (0.00/10). The broker is unregulated and has been warned by both the FCA and FINMA.

- Safety: The firm uses a fake address to feign credibility while allegedly blocking client withdrawals.

- Conclusion: This is a high-risk entity. The combination of a 1.09 score and official regulatory warnings makes it a clear “Avoid.”

Use WikiFX to Avoid Clone Brokers

Distinguishing between a sophisticated scam and a legitimate broker is becoming increasingly difficult for the average investor. To navigate this risk, experts recommend utilizing WikiFX as a primary verification tool.

By simply searching for a broker's name on the WikiFX App, users can instantly access its comprehensive regulatory profile and confirm the authentic, official website URL. Before engaging with any platform, a quick cross-reference on WikiFX provides the definitive proof needed to avoid falling victim to identity theft scams.

WikiFX Broker

Latest News

The "Arbitrage" Accusation: How Winning Trades Turn Into Account Reviews at ACY Securities

IC Markets Formula 1 Partnership Debuts at Abu Dhabi GP 2025

The TikTok Scam That Cost a Retiree Nearly RM470,000

QuickTrade Review: Multiple Reports of Account Freezes and Login Failures by Users

Is Tauro Markets Safe? A 2025 Deep Look into Its Risks and Openness

CommSec Regulation, Login Information & User Review : A Comprehensive Review

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

FCA Waning list of Unauthorised firms

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Rate Calc