IQ Option Review: Real User Experiences

Abstract:IQ Option broker review: See what users say about trading experience, withdrawals, and platform support.

IQ Option Broker sits in a grey zone: the core trading platform is polished and popular, but user feedback raises persistent questions about withdrawals, offshore entities, and the limited protection many traders actually receive. This review draws heavily on real user experiences and public records to examine whether IQ Option Broker is a suitable home for your capital.

IQ Option Broker Overview

IQ Option Broker launched in 2013 as a binary options specialist and has since expanded into CFDs on forex, stocks, indices, commodities, ETFs, and cryptocurrencies. The platform operates under at least two main entities: IQ Option Europe Ltd, which caters to EEA clients, and an international arm that onboards traders from the rest of the world via offshore registration.

Typical minimum deposit is around 10 USD, with trade sizes starting from 1 USD on many instruments, which keeps the barrier to entry low for casual traders. IQ Option Brokers trading platform is proprietary—delivered via web, desktop, and mobile—with visual trading, integrated charts, and community features aimed at high-frequency short‑term traders.

IQ Option Review: Regulation And Domain Details

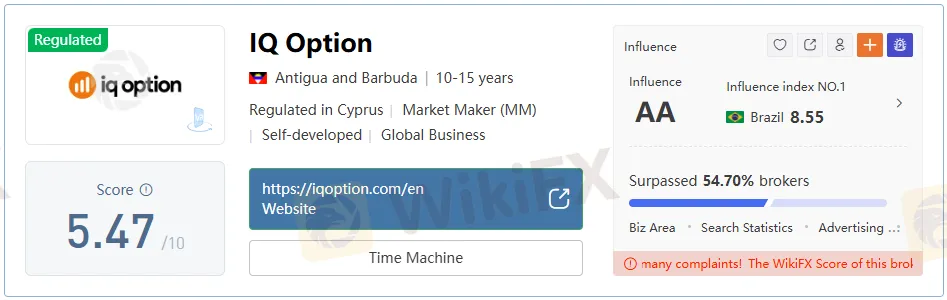

Regulation is the fault line that divides IQ Option Brokers user base. IQ Option Europe Ltd is authorized and supervised by the Cyprus Securities and Exchange Commission (CySEC) under license number 247/14, which appears as an active investment firm entry on the CySEC register. This license gives EEA traders access to investor protections such as capital requirements, segregation of funds, and access to a complaints mechanism, though binary options are no longer marketed to retail clients in the EU.

Outside the EEA, however, clients are typically onboarded through an entity registered in St. Vincent and the Grenadines or another offshore jurisdiction, which does not carry equivalent regulatory oversight. This dual‑entity structure means that many traders using IQ Option Broker trade under far weaker legal protections than the brand name might imply, a key point raised repeatedly in user forums.

Public databases show that the iqoption.com and iqbroker.com domains have been active for years and are tied to the brands European and international operations, but the offshore corporate layer makes it harder for non‑EU clients to rely on a single, clearly supervised legal entity. From a due diligence perspective, a prospective client must confirm which entity will actually hold their account before funding it.

Trading Instruments And Markets

IQ Option Broker has evolved into a multi‑asset venue built around short‑term speculation. Clients can trade CFDs on major and minor forex pairs, a selection of global stocks and indices, cryptocurrencies, ETFs, and commodities such as gold and oil. For some regions, binary and digital options on forex pairs, commodities, indices, and popular equities remain a core product line, though these instruments are restricted or banned in certain jurisdictions.

Coverage is broad enough for most retail traders, but not exhaustive. Independent tests note that the forex roster is narrower than what is available at some large multi‑asset brokers, while the crypto and stock CFD lists focus on high‑liquidity names rather than deep niche coverage. That said, for traders primarily interested in a mix of major forex pairs, headline equities, and crypto majors like Bitcoin and Ethereum, IQ Option Broker offers sufficient depth with reasonable execution quality.

Account Types, Deposits, And Withdrawals

Account structure at IQ Option Broker is intentionally simple. Most users open a standard live account with a minimum deposit of around 10 USD, alongside a free demo account funded with a virtual balance for practice. Some regions also advertise “VIP” or higher‑tier accounts based on deposit size or trading volume, often with perks such as higher potential payouts on options and priority support, although eligibility and benefits vary.

Deposits can usually be made via cards, e‑wallets, local payment processors, and sometimes PayPal, with near‑instant crediting on most methods. Withdrawal policy is less straightforward: one withdrawal per month is typically free, after which a fee of around 2% of the amount applies, capped at roughly 30 USD per transaction, and bank wires can carry a flat fee. Many users report withdrawals completed within one to three business days, but complaints about delayed or scrutinized payouts become more common as account balances grow, especially under the offshore entity.

Fees, Spreads, And Trading Costs

IQ Option Broker advertises zero deposit fees, though currency conversion charges may apply when funding in a non‑account currency. For CFDs, trading costs come from variable spreads and overnight financing (swap) charges, while some products also carry explicit commissions or “multiplier” funding rates. Independent fee reviews describe spreads as competitive but not always best‑in‑class, with EUR/USD and other majors generally in line with mid‑tier retail brokers rather than ultra‑tight ECN providers.

Binary and digital options use a payout model instead of spreads, with returns that can reach high percentages on certain short‑term contracts, but the risk of total stake loss on each trade is significant. Additional non‑trading costs include inactivity fees on dormant accounts and capped percentage fees on multiple withdrawals within a calendar month. Traders considering IQ Option Broker should model expected costs over realistic trading volumes rather than focusing only on headline payouts.

Platform Experience And Tools

IQ Option Brokers proprietary platform is widely regarded as one of its strongest assets. The interface combines multi‑chart layouts, several chart types, and an extensive library of technical indicators while maintaining a relatively low learning curve. Visual order entry, drag‑and‑drop charting, and configurable workspaces make it easy to execute short‑term strategies or monitor multiple assets simultaneously.

The broker does not offer third‑party platforms such as MetaTrader, cTrader, or TradingView integration for live trading, which may be a limitation for algorithmic or institutional‑style traders. On the other hand, features such as in‑platform tournaments, social sentiment, and a built‑in education section target a more gamified retail audience rather than seasoned systematic traders. Mobile apps mirror most of the desktop functionality, and user reviews frequently praise their stability and responsiveness.

Real User Experiences And Complaints

Public review platforms show a polarized picture of IQ Option Broker. On Trustpilot and other ratings sites, many users highlight the platforms ease of use, responsive live chat, and fast execution during normal market conditions. New traders in particular appreciate the combination of a low minimum deposit, small trade sizes, and a realistic demo environment.

The negative feedback clusters around three themes: withdrawal delays or rejections, aggressive bonus or promotion terms historically tied to trading volume requirements, and perceived conflicts of interest in how the broker manages risk on options. Several Reddit threads and consumer complaints allege stalled withdrawals after large profits, sudden requests for additional documents, and, in some cases, account closures under the offshore entity with limited recourse. While such reports cannot be treated as courtroom evidence, the volume and consistency of complaints warrant caution, especially for high‑deposit clients.

IQ Option Broker Vs Key Competitors

Traders often compare IQ Option Broker with other retail multi‑asset firms such as Olymp Trade, Pocket Option, and larger CFD brokers like XM or Exness. Olymp Trade and Pocket Option, for example, also focus on short‑term options and gamified interfaces but typically operate under looser regulatory regimes without an equivalent CySEC‑licensed EU arm. In contrast, larger forex‑CFD brokers may offer MetaTrader support, deeper forex rosters, and tighter spreads, but they rarely provide binary or digital options and may have higher minimum deposits.

The table below summarizes how IQ Option Broker stacks up along key dimensions versus a generic tier‑one CFD broker and a typical unregulated binary options platform.

IQ Option Broker occupies a middle ground between sleek, retail‑friendly trading and a regulatory framework that changes sharply depending on where a client lives. Understanding that a split is essential before funding an account or trusting user testimonials about profits, withdrawals, and support.

IQ Option Broker vs Competitors

Compared with large CFD brokers such as XM or Exness, IQ Option Broker typically offers a simpler single‑account setup, an ultra‑low minimum deposit, and a strong emphasis on its proprietary platform. These competitors, however, tend to provide tighter spreads, multiple professional platforms like MetaTrader, and broader global regulation, which may appeal to high‑volume or algorithmic traders.

Against other retail options, brands such as Pocket Option, Quotex, or IQCent, IQ Option Broker usually stands out for having at least one CySEC‑regulated entity, more robust infrastructure, and clearer disclosures for EU clients. Yet many pure options rivals attract traders with higher headline payouts or larger bonuses, accepting the trade‑off of weaker or no top‑tier regulation and higher structural risk.

Key Differences Across Broker Types

| Feature / Aspect | IQ Option Broker (EU entity) | IQ Option Broker (offshore entity) | Typical tier‑one CFD broker | Typical unregulated options site |

| Licensing & oversight | CySEC‑regulated investment firm (license 247/14) for EEA traders. | Registered offshore (e.g., St. Vincent, Seychelles) with no major regulatory authority. | Multiple top‑tier licenses (FCA, ASIC, CySEC, etc.), strong global oversight. | Often no recognized financial regulator or only self‑regulation. |

| Platforms | Proprietary web, desktop, mobile only. | Same proprietary stack, identical look and feel. | MetaTrader or equivalent plus proprietary platforms and APIs. | Proprietary web/mobile with limited tools. |

| Products | CFDs on forex, stocks, indices, crypto, commodities; options in limited regions. | Broader access to binary and digital options where allowed. | Wide CFD range; usually no binary options. | Narrow focus on digital or binary options. |

| Typical spreads | Around 0.6–0.8 pips on EUR/USD, commission‑free, moderate swaps. | Similar headline spreads; conditions may be less transparent. | Often tighter spreads; some offer 0.0‑pip accounts with commission. | Payout‑based pricing with no transparent spread benchmarking. |

| Minimum deposit | Around 10 USD with very low minimum trade sizes. | Same low entry threshold to attract global retail traders. | Usually 50–250 USD or higher, though some go lower. | Often 50–250 USD or more, especially at aggressive bonus brands. |

| Client protections | Segregated funds, complaints procedures, and EU investor safeguards. | No equivalent compensation scheme or formal dispute resolution. | Compensation schemes and robust dispute systems in most regions. | Little to no enforceable protection or recourse. |

Pros Of IQ Option Broker

Several advantages explain why IQ Option Broker maintains a large and active user base despite vocal criticism. The combination of a low minimum deposit, 1‑dollar‑style minimum trade sizes, and a free, refillable demo account makes it accessible for beginners who want to experience real‑time markets with limited capital. Real users frequently praise the modern platform design, fast order execution under normal conditions, and integrated charting tools that reduce reliance on external software.

The CySEC‑regulated European entity adds another positive layer, particularly for EEA clients who value clear licensing, segregated accounts, and a definable regulator to contact in disputes. Platform extras such as trading tournaments, in‑app education, and multi‑asset coverage (forex, stocks, crypto, ETFs, and options) allow traders to experiment with different markets from a single login, which is rarely the case at niche binary‑only brands.

Cons And Risk Factors

The same ecosystem carries real drawbacks, especially for traders routed to the offshore entity. Complaints across forums and review platforms highlight slow or contested withdrawals, repeated requests for additional documents once accounts become profitable, and occasional account closures with limited explanation under non‑EU registration. Some users also criticize opaque fee disclosures around swaps, multiplier financing, and non‑trading charges, such as inactivity and multiple‑withdrawal fees.

Regulatory coverage beyond CySEC remains thin relative to major global brokers, leaving many clients effectively outside top‑tier legal protection. The core focus on options and high‑leverage CFDs means that most products on IQ Option Broker carry an elevated risk of rapid capital loss, a reality underscored both by independent risk warnings and regulator statements about the dangers of binary options for retail traders.

How To Approach IQ Option Broker Safely

For traders still considering IQ Option Broker, careful preparation is essential. First, verify in writing which legal entity will hold the account, then cross‑check the license number and status against the official CySEC register or other regulator databases. Second, start with a small deposit, complete full KYC/AML verification early, and test at least one withdrawal before scaling up position sizes, particularly if your account is under an offshore jurisdiction.

Risk management must be conservative. Limiting leverage, avoiding oversized binary positions, and tracking cumulative fees and swaps can help prevent the platform‘s high‑frequency design from pushing trading behavior into gambling territory. Finally, compare conditions against at least one heavily regulated multi‑asset broker—looking at spreads, available platforms, and compensation schemes—to decide whether IQ Option Broker’s convenience and interface truly outweigh the extra risks.

Bottom Line On IQ Option Broker

Taken as a whole, IQ Option Broker offers an attractive, retail‑friendly trading environment backed by a polished proprietary platform, low entry costs, and a CySEC‑licensed EU entity that provides a recognizable regulatory anchor for some clients. At the same time, the offshore structure used for many international users, recurring withdrawal‑related complaints, and relatively narrow global licensing footprint mean that this broker cannot be treated as uniformly “safe” in the way that top‑tier multi‑licensed competitors are.

Read more

9X Markets Review: Is It Reliable?

9X Markets Broker explained: explore account types, trading tools, and reliability. Our review helps you decide.

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

WisunoFX is a trading company that lets you trade different types of investments. It has been running for 5 to 10 years and is registered in Seychelles. The broker lets you trade currencies (Forex), stock indexes, commodities like gold and oil, individual stocks, and cryptocurrencies. It offers itself as a good choice for traders around the world by providing the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. This review gives you an honest look at what WisunoFX offers. We will examine how it is regulated by two different authorities, compare the different account types you can choose from, and look at trading costs, including spreads and its very high leverage options. We will also check how well its platforms work and what real users say about it. This will help you decide if this broker is right for your trading goals.

Classic Global Ltd Review: Can You Trust This Broker or Are There Warning Signs?

When choosing an online broker, the most important thing for any investor is safety. The internet presents numerous opportunities, but it also poses significant risks. This brings us to Classic Global Ltd, a forex and CFD broker that has gotten attention recently. Potential investors are asking a crucial question: Is Classic Global Ltd. trustworthy? To answer this, you can't just rely on what the broker says about itself. You need to carefully look at whether it's properly regulated, its company history, and what real users say about it. This article gives you a complete, fact-based analysis designed to cut through the confusion. Our goal isn't to make a quick judgment but to show you the proven facts, so you can make a smart decision about the safety of your money. Doing your homework is the foundation of successful investing, and this review is an important part of that process for anyone thinking about Classic Global Ltd.

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

Deriv stands as a colossal figure in the retail trading landscape, recognized for its extensive global footprint and a multi-jurisdictional regulatory framework that spans from Europe to Southeast Asia. With a WikiFX score of 7.04, the broker commands significant influence, particularly in regions like the UAE, Australia, and parts of South America. Established in its current form in 2019, Deriv markets itself as a flexible, tech-forward broker offering access to diverse markets via the MetaTrader 5 (MT5) ecosystem. However, recent data suggests a growing dichotomy between its high-level regulatory status and the ground-level friction reported by traders, particularly regarding capital accessibility and sudden policy shifts.

WikiFX Broker

Latest News

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Inside Darwinex Broker Review: Regulation Explained & Authentic User Complaints

B2CORE Update Enhances Forex Broker Operations and CRM Systems

MIFX Regulation, Is This Indonesian Broker Safe?

CommSec Regulation, Login Information & User Review : A Comprehensive Review

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

FCA Waning list of Unauthorised firms

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

Rate Calc