FlipTrade Group: Forex Scam Exposed in Nigeria

Abstract:Scam alert: FlipTrade Group stole $611 from a Nigerian trader on Feb 2nd via rigged trading contests, no withdrawals. Unregulated broker exposed on WikiFX—learn the case, report, and trade safely now!

Overview of FlipTrade Group

FlipTrade Group presents itself as a multi-asset trading platform offering forex, stocks, commodities, indices, metals, and cryptocurrencies to global clients. The broker promotes tight spreads, fast execution, MetaTrader 5 access, and low entry deposits, which can easily appeal to new traders searching online for “forex investment scam” warnings yet overlooking key risks.

On its website and in some user reviews, FlipTrade Group is described as transparent, client-focused, and suitable for scalpers and intraday traders, with claims of no hidden fees and 24/7 support. However, these marketing promises sharply contrast with at least one serious exposure from Nigeria that alleges outright scam practices and withdrawal abuse.

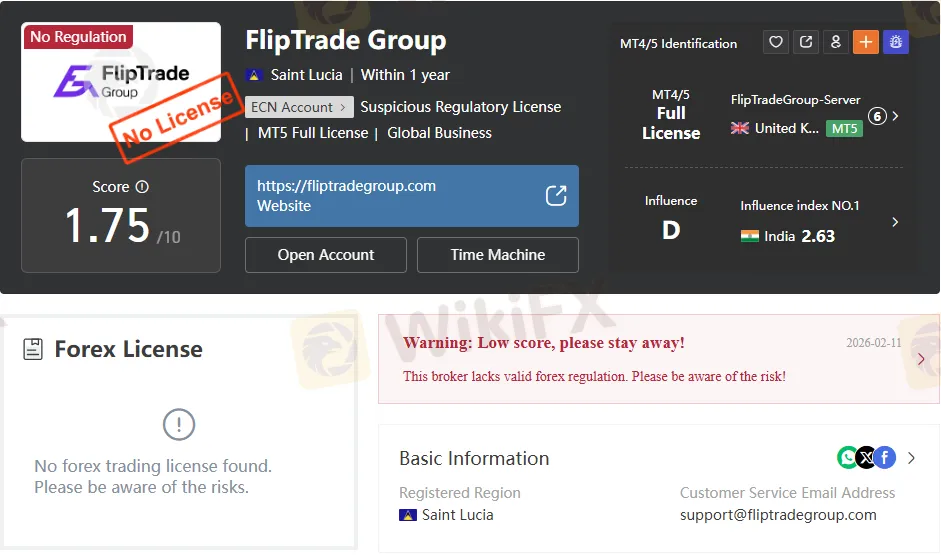

Regulatory Status: Unregulated Risk

According to the FlipTrade Group page on WikiFX, no valid forex trading license has been found for this broker. WikiFX flags this clearly, warning users to “be aware of the risks,” indicating that FlipTrade Group operates as an unregulated entity under forex oversight.

An unregulated status means FlipTrade Group is not supervised by major financial regulators such as the FCA, ASIC, or NFA, which are commonly used to check for forex scams. Without regulatory protection, traders in Nigeria and other regions have limited recourse if funds are withheld, trades are manipulated, or the platform engages in forex trading scams.

Case Exposure: $611 Lost in Nigeria

WikiFX Exposure records a detailed complaint from a trader in Nigeria who explicitly labels FlipTrade Group as a scam. The trader reports that FlipTrade Group is unregulated and stole 611 USD on February 2nd, tying the loss directly to fake trading competitions designed to lure participants.

In this case, the trader alleges that both demo and live trading contests were rigged, with winners pre-selected or “fixed” rather than determined by genuine trading performance. Once the trader deposited funds and generated earnings, FlipTrade Group allegedly blocked withdrawals, effectively turning the platform into a forex investment scam in which deposits and profits were confiscated.

How the Alleged Scam Works

The Nigeria case shows a pattern typical of many online forex scams. First, FlipTrade Group uses attractive marketing—such as low spreads, small minimum deposits, and “opportunities” in contests—to attract traders who may not verify their regulatory status.

Next, traders are encouraged to participate in demo and live contests, promising high rewards and fair competition. According to the exposure, these contests are allegedly manipulated, with outcomes predetermined and real performance ignored, turning what appears to be a fun trading challenge into a forex scam mechanism.

The final stage of the reported scam is the withdrawal block. When the Nigerian trader tried to withdraw the 611 USD deposit and trading gains, FlipTrade Group allegedly refused to release the funds, contradicting its public claims about smooth deposits and withdrawals.

Broker Review: Why Caution Is Necessary

On paper and in selected online reviews, FlipTrade Group appears to be a competitive broker, offering fast execution, MetaTrader 5 support, and multi-asset access. Some users publicly praise its service quality, spreads, and support, which can mislead new traders into assuming the platform is safe without checking licensing.

However, the absence of a recognized forex trading license, combined with detailed Nigeria exposure, resulted in a 611 USD loss, raising serious red flags for anyone seeking to avoid forex investment scam risks. A single well-documented case of blocked withdrawals and rigged contests is enough to undermine claims of transparency and puts FlipTrade Group firmly in the “scam alert” category for cautious traders.

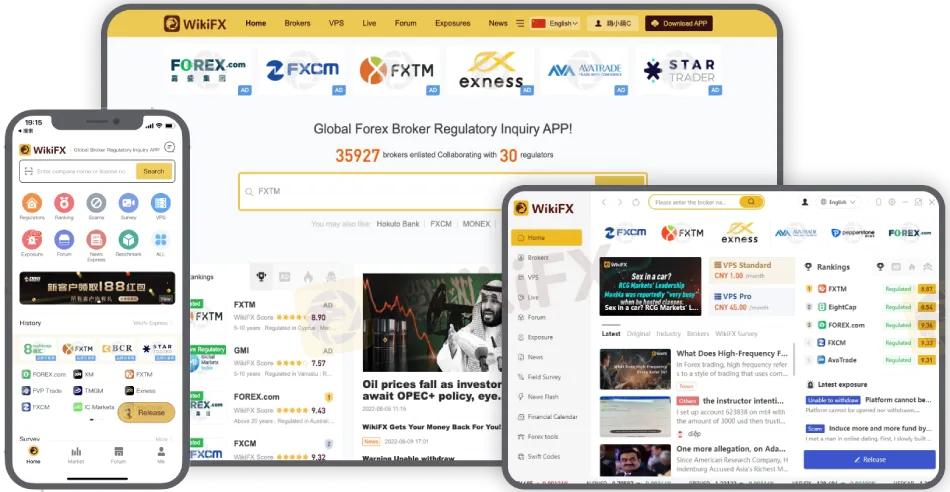

Role of WikiFX App in Verifying Brokers

The WikiFX App is a third-party regulatory inquiry tool that helps users verify whether a forex broker is legitimate, authorized, and operating legally before depositing any money. It aggregates data from dozens of global regulators, compiles broker profiles, and offers risk exposure reports so that traders can quickly identify unregulated platforms like FlipTrade Group.

Within the WikiFX App, traders can view regulation information, license status, user reviews, and exposure cases in one place. For FlipTrade Group, the app shows that no valid forex trading license is found and highlights the Nigerian complaint where 611 USD was allegedly stolen, providing a clear warning signal for anyone researching potential forex trading scam risks.

The WikiFX App also supports investor rights protection by allowing users to submit complaints and read other traders experiences. For Nigerian traders facing similar issues with FlipTrade Group or other suspicious platforms, this tool can document losses, support future investigations, and help others avoid dangerous brokers.

How Traders in Nigeria Can Protect Themselves

Traders in Nigeria should treat any unregulated broker promoting trading contests, deposit bonuses, or unusually high returns as a potential scam alert until proven otherwise. Before opening an account or joining a contest with FlipTrade Group or any similar platform, verify the brokers license number and regulator directly through tools such as the WikiFX App.

If you have already deposited funds and face withdrawal delays, sudden account restrictions, or suspicious contest rules, document everything—screenshots, emails, transaction records—and file an exposure report through WikiFX. Taking early action can help limit losses, support other victims, and strengthen the case that the behaviour fits a broader pattern of forex scams.

Final Warning on FlipTrade Group

The combination of unregulated status, the detailed 611 USD loss in Nigeria, and allegations of rigged demo and live contests positions FlipTrade Group as a high-risk broker for retail traders. Even though some online reviews appear positive, they do not offset the specific and serious complaints that match classic forex scam tactics, especially the refusal to honour withdrawals.

Anyone considering FlipTrade Group should pause and conduct a full risk check using tools like the WikiFX App before sending any money. If you suspect you have already encountered a forex trading scam with this broker, report the incident through WikiFX, consult local authorities where possible, and focus on regulated brokers that clearly publish verifiable licenses and transparent withdrawal histories.

Read more

Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

Is GLOBAL GOLD & CURRENCY CORPORATION Safe or Scam: Looking at Real User Reviews and Common Problems

When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers. This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc