Is GLOBAL GOLD & CURRENCY CORPORATION Safe or Scam: Looking at Real User Reviews and Common Problems

Abstract:When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers. This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

The Bottom Line

When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers.

This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

A Company Without Proper Rules

Before looking at what users say, we need to understand the basic facts about GGCC's legal status. Whether a broker follows proper rules is the main way to tell if it's safe and responsible. For GGCC, this picture is worrying.

Here are the important facts as of early 2026:

· Rule Status: No proper rules. The broker doesn't have a valid license to trade forex from any trusted financial authority. This is the biggest warning sign. Also, Russia's Central Bank has issued a warning against this company.

· WikiFX Score: 1.36 out of 10. This score comes with a clear warning: “Low score, please stay away!”

· Main Risk Factors: Very high risk, questionable license.

· Where It's Registered: Saint Lucia.

· How Long It's Been Running: 2-5 years (Started in 2023).

· Trading Software: MT5.

Being “without proper rules” means the broker works without anyone watching its operation. For a trader, this creates three big risks: no promise that your capital is protected, since client funds might not be kept separate from company money; no standard way to solve problems; and no legal authority making sure the broker plays fair. Basically, if something goes wrong, the trader has very little help available.

These facts show a worrying picture. Before thinking about any broker, especially one like this, it's important to check its current information on a verification website. You can see the full, up-to-date details and warnings for GGCC on its WikiFX page.

A Close Look at GLOBAL GOLD & CURRENCY CORPORATION Complaints

While not having proper rules is a major warning, the best way to understand how a broker really works day-to-day comes from its users. The low trust score given to GGCC comes mainly from a pattern of serious complaints. We have organized these verified user reports to give a clear look at the problems traders face again and again.

Major Problem #1: Huge Price Differences and Poor Trade Handling

The most common complaint against GGCC involves poor trade handling, specifically unusual and extreme price differences. This happens when there's a difference between the price you expect for a trade and the price you actually get. While small differences are normal in fast-moving markets, what GGCC users report goes way beyond what's normal in the industry.

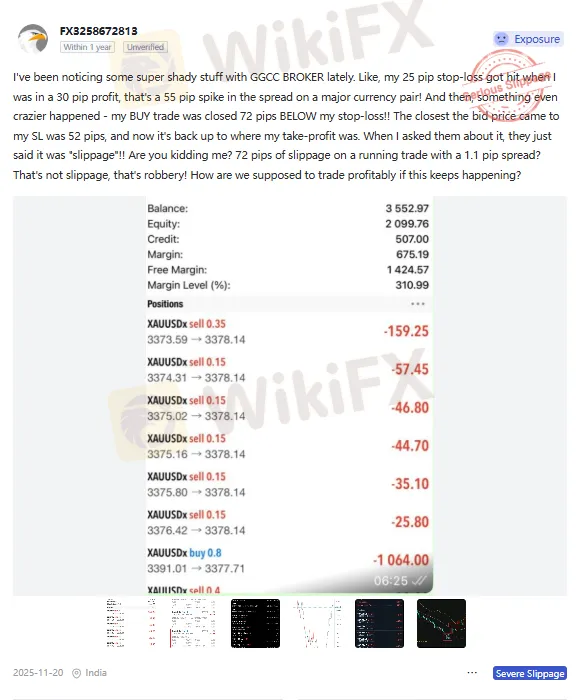

· One trader from India reported that their safety stop, set at 25 pips, was triggered while their trade was making a 30-pip profit. This means a sudden, unexplainable 55-pip jump in the price difference on a major currency pair.

· In an even worse case, another user from India saw their BUY trade closed 72 pips below their set safety stop. They called this not just a price difference but “robbery,” noting that a 72-pip change on a running trade with a 1.1-pip spread isn't normal.

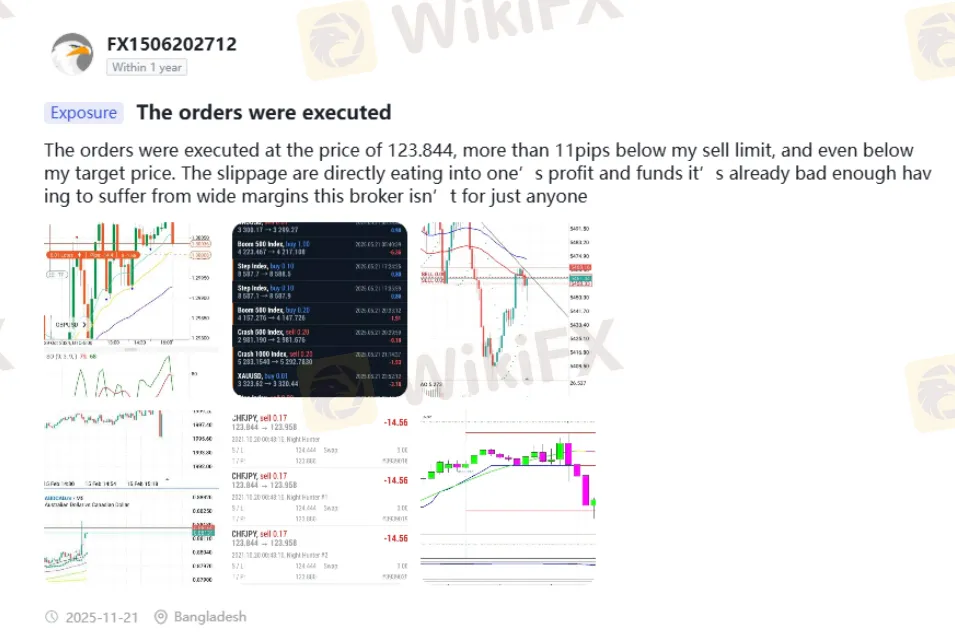

A user from Bangladesh complained that their sell orders were completed more than 11 pips below the set price, cutting into profits before the trade had a chance to work.

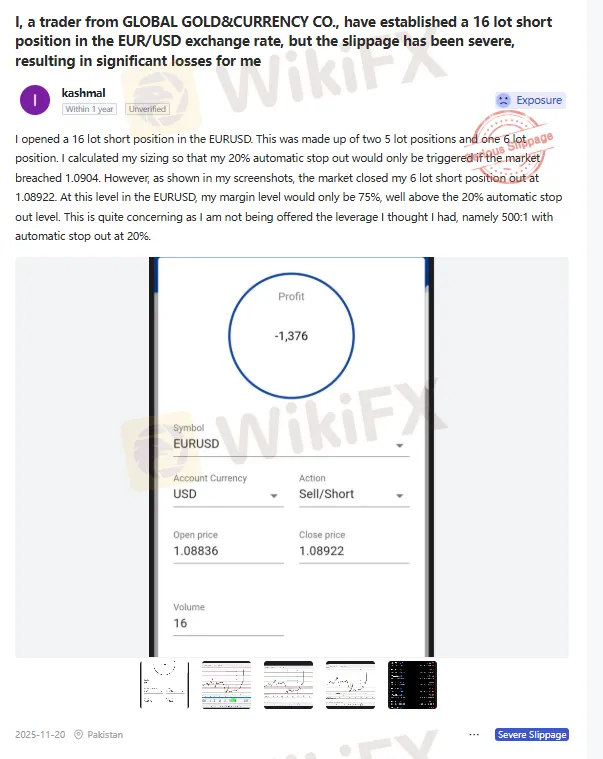

A trader from Pakistan had their position closed incorrectly. They had calculated their position size so that the broker's 20% automatic closure would only happen at a specific market level. However, their position was closed too early when their safety level was still at 75%, showing a serious problem with the platform's handling or calculation.

Major Problem #2: Withdrawal Delays and Blocks

The second big area of complaint is about the most important job of any broker: giving client capital back. Many users report serious problems when trying to withdraw their capital, a classic warning sign of a possibly fraudulent operation.

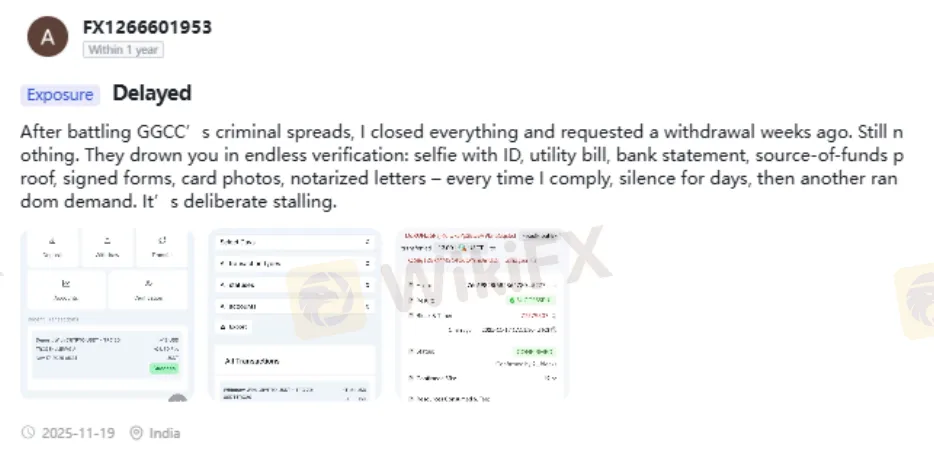

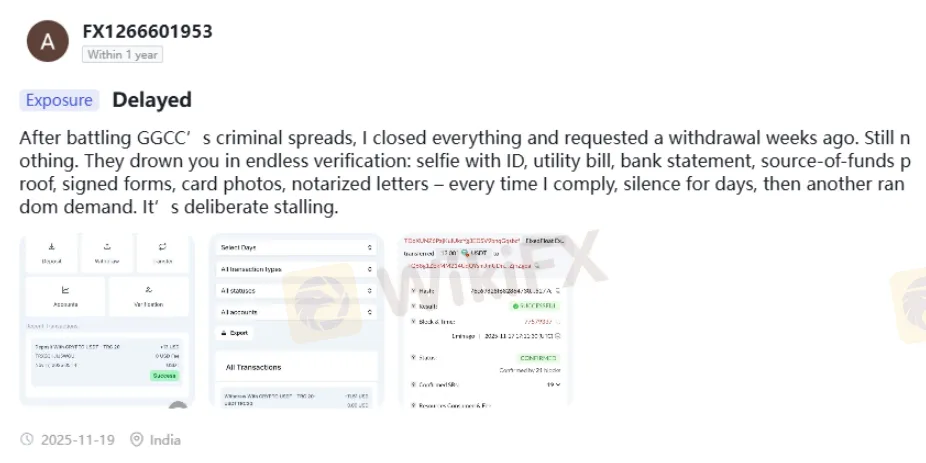

· A trader from India described a frustrating experience where they asked for a withdrawal weeks ago but got nothing. Instead, they were stuck in an “endless verification” loop, with the broker asking for new documents every few days after long periods of silence.

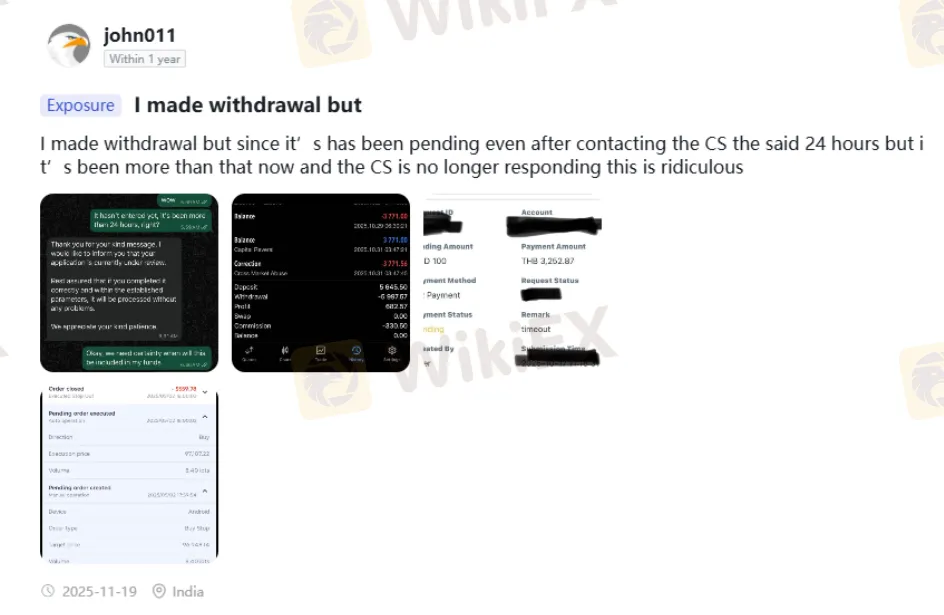

· Another user's withdrawal has been “waiting for a long time.” After contacting customer service and being promised a 24-hour fix, the service stopped responding, leaving the withdrawal stuck.

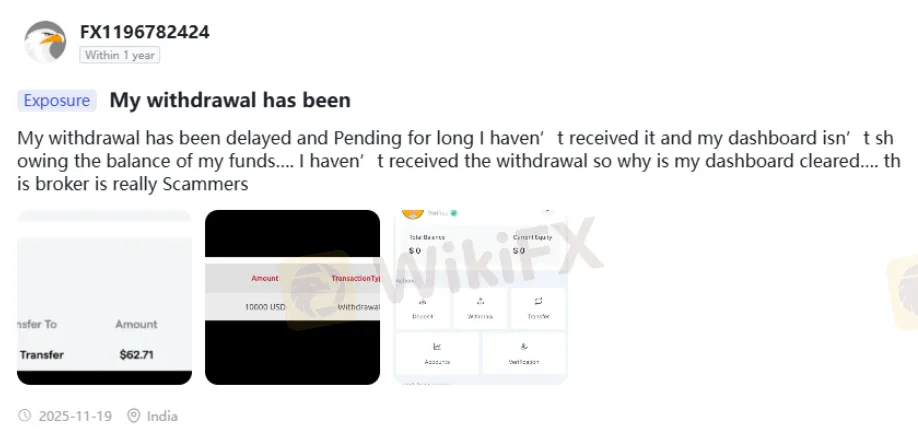

In a particularly scary report, a user from India noted that after starting a withdrawal, their balance completely disappeared from their account, even though the withdrawal was never processed. The trader directly called the broker “Scammers.”

Major Problem #3: Account Access and Trust Issues

Beyond trade handling and withdrawals, some users have reported problems with basic account access and platform reliability, suggesting a lack of stability and trustworthiness.

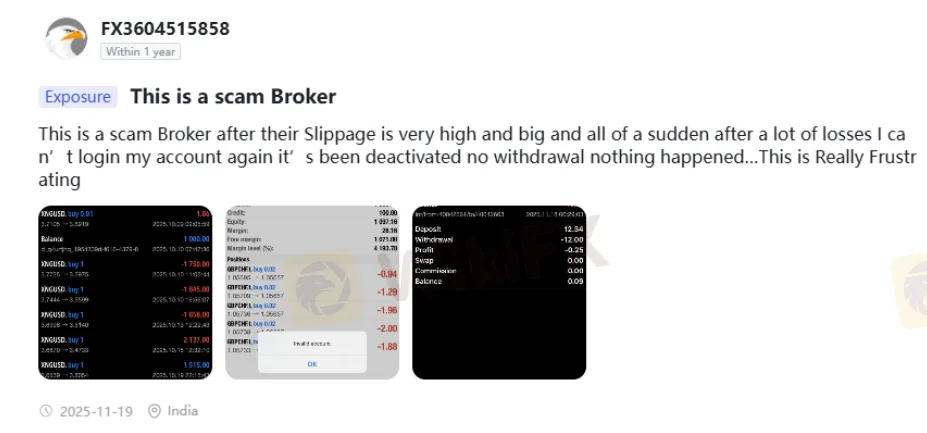

· One trader reported that after losing a lot of capital, which they blamed on high price differences, they suddenly couldn't log into their account. The account seemed to be shut down, making it impossible to try withdrawing any remaining capital.

· Many users have used terms like “criminal spreads” and expressed the feeling that the platform is actively “changing the market to destroy our positions.” This feeling, coming from repeated bad experiences, points to deep distrust in the broker's fair operation.

| Complaint Type | Common User Reports | How Serious |

| Trading Handling | Extreme price differences, stop hunting, incorrect closures. | Very Serious |

| Money Withdrawals | Endless delays, too much verification, funds disappearing. | Very Serious |

| Account Safety | Accounts shut down, can't log in. | Serious |

| Costs & Fees | Very wide and changing price spreads. | Serious |

Looking at Positive Reviews

To give a complete picture, it's important to note that some positive feedback for GGCC exists. The data includes two positive reviews, one from a user in Ukraine and another from the Netherlands. These reviews praise the broker for an “excellent experience,” withdrawals that “happen very fast,” easy deposits, and helpful support.

However, there's an important detail to consider: WikiFX clearly marks both of these positive reviews as “Unverified.” In this case, “unverified” means the platform couldn't confirm that the review came from a real client with documented trading history with the broker. Unverified reviews can be easily faked and should be viewed with high suspicion, especially when they're very different from a larger group of verified negative feedback. The evidence shows over 10 verified, detailed negative reports compared to just two unverified positive comments, clearly showing where most user experience lies.

Expert Analysis: Why Warning Signs Matter

The patterns seen in GGCC's user complaints aren't just separate incidents; they represent basic failures that make a broker untrustworthy and dangerous for traders. As industry experts, we see these issues as deal-breakers.

The Danger of No Rules

The main problem is the lack of proper rules. In a properly regulated environment, brokers must follow strict standards. Client capital must be kept in separate accounts, away from the company's operating funds, to protect it if the broker goes out of business. Regulators also enforce rules on fair trade handling and have established ways for clients to file complaints. Without regulation, GGCC has no legal requirement to follow these best practices. The broker operates in a gray area where it answers to no one, and traders' capital isn't protected.

How Price Differences Destroy Accounts

Price differences are real in markets, but what users describe with GGCC is different. Price differences of 50, 60, or even 70+ pips on major currency pairs isn't normal; it suggests either a deeply flawed and poorly funded trading platform or, more worryingly, deliberate manipulation. When a broker can trigger your safety stop whenever it wants or complete your trades at prices far from the actual market rate, risk management becomes impossible. You're no longer trading the market; you're trading against the broker, and the broker controls the platform. This completely breaks the model of fair trading.

These technical problems aren't just inconveniences; they're basic failures that make profitable trading nearly impossible. Checking a broker's user complaint history on a platform, such as WikiFX, is a necessary step to avoid such problems.

Conclusion: A Clear Answer

The evidence gathered from objective data and verified user experiences leads to a clear and unavoidable conclusion: working with GLOBAL GOLD & CURRENCY CORPORATION carries an extremely high level of risk. The complete lack of credible regulation, combined with many serious complaints about trade handling and fund withdrawals, shows a broker that traders should approach with extreme caution. The main risks - losing capital not through bad trades but through extreme price differences and spreads, and not being able to access your capital - are too significant to ignore.

The evidence strongly suggests that working with GLOBAL GOLD & CURRENCY CORPORATION is a significant gamble. Your capital is best protected by choosing brokers with strong regulatory oversight and a proven positive track record. Before you ever invest, make it a habit to do a thorough check about the broker on WikiFX. A few minutes of research on this platform can save you from the huge financial and emotional stress highlighted by the user complaints in this review. Stay informed, stay safe.

Read more

Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

FlipTrade Group: Forex Scam Exposed in Nigeria

Scam alert: FlipTrade Group stole $611 from a Nigerian trader on Feb 2nd via rigged trading contests, no withdrawals. Unregulated broker exposed on WikiFX—learn the case, report, and trade safely now!

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc