Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Abstract:Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the brokers regulation status, and some other events it is linked to. Keep reading!

Wingo Markets - Products, Account Types & Trading Platforms

Wingo Markets is a full-fledged trading company by allowing traders to access different products through its platforms - Forex, Stocks, Metals, Indices, Crypto and commodities. With the MT5 trading platform accessible on mobile, web and desktop and offering traders a comprehensive market analysis, it promises to offer a data-backed trading environment. The company claims to offer four types of trading accounts - Starter, ECN, Pro and Social Trade - with minimum deposit requirements of $50, $500, $5,000 and $5, respectively. From the information available on its official website, Wingo Markets claims to offer tight and normal spreads with zero to low commission.

Examining the Top Complaints Against Wingo Markets

The Profit Deletion Complaint

A German trader accused Wingo Markets of deleting the entire profit exceeding $1,200 on the trading platform. The trader shared a long email from the broker justifying the act. As we read the complaint, we found that the broker claimed that the trader violated the terms and conditions stipulated in the trading agreement. However, there were no specific violations discussed in the Wingo Markets review shared by the trader. This somewhat makes the case even more puzzling. Here is the full review to look at.

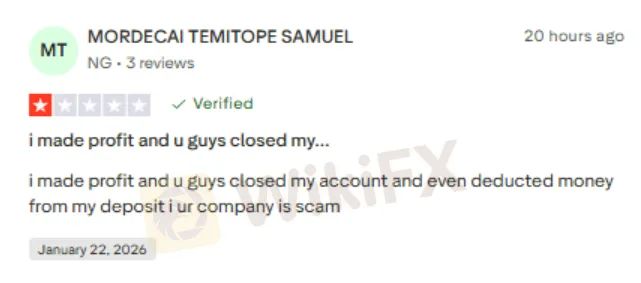

The Account Closure Complaint

A trader from Nigeria alleged that Wingo Markets closed his trading account once he made profits. The trader further accused the broker of deducting from the deposit balance. This made the trader term Wingo Markets as a scam. Lets find out this short but critical Wingo Markets review.

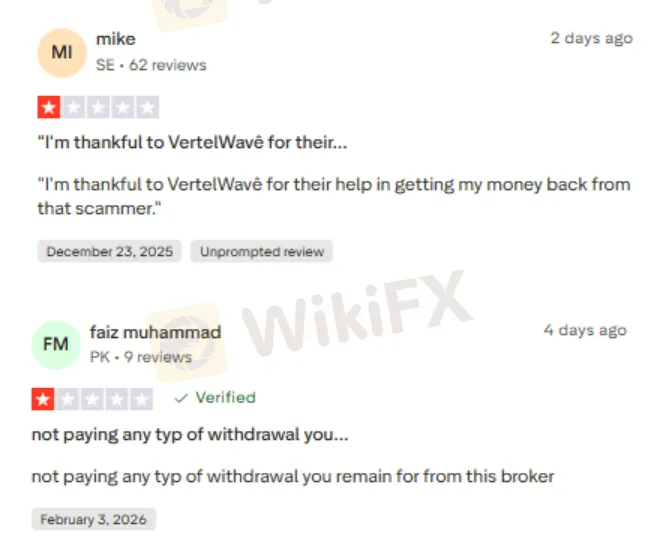

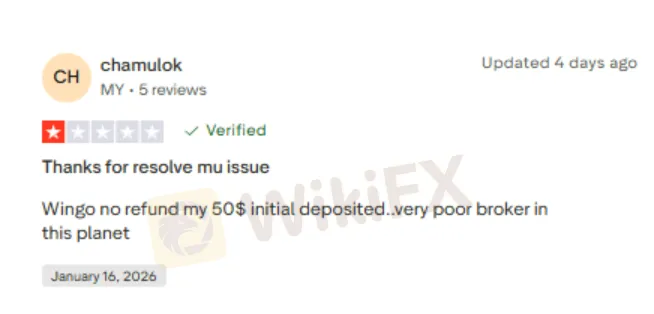

Multiple Fund Scam Allegations Against Wingo Markets

Multiple traders have expressed their helplessness over the lack of withdrawals, leading to complete fund scams later. While some managed to get their funds back, courtesy of legal firms, some are still searching for the same. We found some reviews supporting this complaint against Wingo Markets.

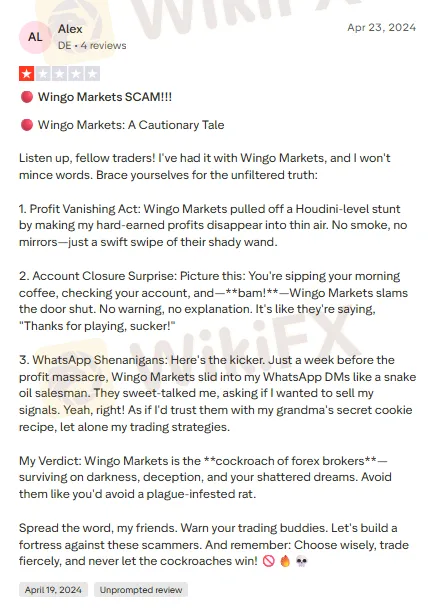

Multiple Complaints in One Wingo Markets Review

Almost summing up Wingo Markets, a trader accused the broker of multiple trading misconducts. The first complaint was regarding the profit vanishing act. It was followed by the account closure shock without any prior warning or explanation. The trader further revealed that a week before profit deletion, the broker officials were trying to sell forex signals through persuasive communication. However, the trader did not fall for these alleged wrong sales tactics. As the overall trading experience worsened, the trader chose to share this negative Wingo Markets review online. Take a look!

What Does Wingo Markets Say on Its Regulatory Status?

Wingo Markets claims to have been regulated by two entities - FinCEN USA MSB and Mwali International Services. While the first regulator is a renowned one in the United States (US), the Comoros-based Mwali International Services is an offshore regulator. Association with the second regulator heavily compromises traders safety as it does not offer the highest level of investment protection.

Wingo Markets Exact Regulatory Status in This WikiFX Review

The Comoros-based Wingo Markets does not carry any valid regulatory license, as found in our in-depth investigation, contrary to the claims made by the broker. As trading risks elevated with this revelation, the WikiFX team could give Wingo Markets a score of just 1.99 out of 10.

Read more

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

Is GLOBAL GOLD & CURRENCY CORPORATION Safe or Scam: Looking at Real User Reviews and Common Problems

When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers. This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

FlipTrade Group: Forex Scam Exposed in Nigeria

Scam alert: FlipTrade Group stole $611 from a Nigerian trader on Feb 2nd via rigged trading contests, no withdrawals. Unregulated broker exposed on WikiFX—learn the case, report, and trade safely now!

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc