Doto Review: Pros, Cons and Trading Instruments

Abstract:Doto review examines regulation, account types, spreads, leverage, and trading instruments including forex, crypto, and indic

Doto is a multi‑asset CFD and forex broker regulated in several jurisdictions, offering high leverage, tight advertised spreads, and a streamlined account structure built around a single live account and a feature‑rich proprietary app alongside MT4 and MT5. This Doto review examines whether that proposition holds up once regulation, trading conditions, platform depth, and operational transparency are put under closer scrutiny.

Doto Overview

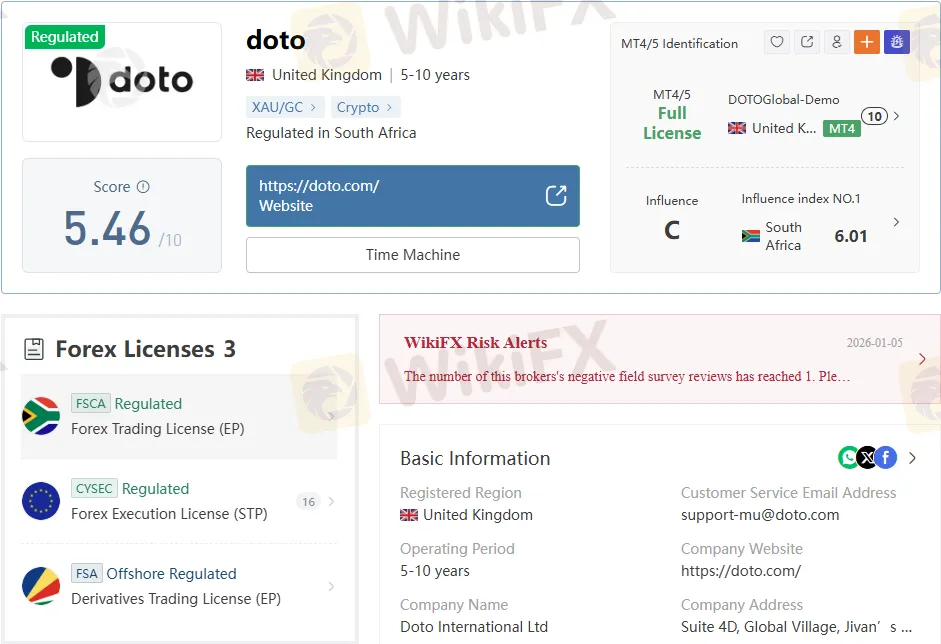

Doto positions itself as a cross‑market broker giving retail clients access to forex, indices, commodities, stocks and selected crypto CFDs from a single account, with a minimum deposit starting at 15 USD and leverage advertised up to 1:500. The brand presents a regulated profile across Europe, Seychelles and South Africa, but independent rating data shows a middling trust score of 5.46/10 and flags around its Seychelles presence.

Key facts:

- Founded: 2000, with an operating period listed as 5–10 years, suggesting either corporate restructuring or rebranding over time.

- Registered region: United Kingdom, through Doto International Ltd, with corporate address at Suite 4D, Global Village, Jivans Complex.

- Website: doto.com and EU sub‑domains for the European entity.

- WikiFX overall score: 5.46/10, labelled as “Regulated” but not in the top‑tier band.

Regulation and Domain Transparency

From a regulatory perspective, Doto operates a multi‑entity structure that spans European onshore regulation and offshore oversight, a model common to many mid‑sized CFD brokers. The key licenses are with CySEC in Cyprus, FSA in Seychelles and FSCA in South Africa, each covering different operating territories and permissions.

The main regulatory pillars cited are:

- Cyprus Securities and Exchange Commission (CySEC)

- Entity: DOTO EUROPE LTD.

- License type: Straight Through Processing (STP) / Forex Execution (STP).

- License number: 399/21, effective from 12 April 2021.

- Permissions: Forex trading, FX agency and investment consulting, financial derivatives trading and agency, plus securities trading and investment consulting across 15 EU member states via cross‑border passports.

- Seychelles Financial Services Authority (FSA)

- Entity: Doto International Ltd.

- License type: Retail Forex License.

- License number: SD0063.

- Status: “Offshore Regulated,” with no‑sharing license designation.

- Financial Sector Conduct Authority (FSCA), South Africa

- Entity: DOTO SOUTH AFRICA (PTY) LTD.

- License type: Forex Trading License (EP).

- License number: 50451, effective from 6 October 2021.

Contact and corporate details provided include:

- Email addresses: support-mu@doto.com, infoeu@doto.com, general@doto.com.

- Phone contact: +230 468 7113 and +27 081 354 9774, depending on entity.

- European office address reference: Agias Fylaxeos 1, KPMG Center, Cyprus.

One point that stands out in this Doto review is the Seychelles office inspection: a WikiFX field survey labelled “A Visit to Doto in Seychelles – No Office Found,” accompanied by a “Danger” tag for the physical address check in Victoria, Seychelles. While this does not in itself prove misconduct, it raises questions around the completeness of the offshore entitys physical presence compared with its licensed status.

Is Doto Legit?

The legitimacy of Doto rests heavily on its CySEC and FSCA registrations, which place parts of the group under onshore regulatory scrutiny, capital requirements and conduct rules. The STP license in Cyprus and the EP license in South Africa provide a framework for client fund segregation, dispute channels and minimum operational standards, elements often absent in unregulated brokers.

The key license records are as follows:

- Regulatory status: “Regulated” for the CySEC entity, with Doto Europe Ltd listed as an STP‑licensed institution under number 399/21.

- Regulatory status: “Offshore Regulated” for the Seychelles entity, Doto International Ltd, under Retail Forex License SD0063.

- Additional annotation: The Seychelles license is clearly tagged as “Current Status: Offshore Regulated,” with contact address at Suite 4D, Global Village, Jivans Complex and email general@doto.com.

Balancing those entries, the same Doto review source also displays a moderate WikiFX score and highlights the Seychelles office survey where no physical office could be located at the published address. For traders, this combination points to a broker that is indeed regulated but not uniformly robust across all jurisdictions, making entity selection and jurisdictional protection an important practical consideration.

Pros and Cons of Doto

The brokers profile combines some attractive trading conditions with structural limitations and a few red flags that an investigative Doto review cannot ignore.

Pros

- Regulated by CySEC, FSA (Seychelles) and FSCA (South Africa), giving a mix of onshore and offshore oversight.

- High leverage up to 1:500, significantly above the 1:30–1:50 caps imposed by many EU and UK brokers.

- Zero‑commission model on trading, with costs concentrated in spreads rather than ticket fees.

- Single account structure simplifies onboarding, with both demo and live access rather than multiple, confusing account tiers.

- Proprietary Doto platform plus MetaTrader 4 and MetaTrader 5, covering both beginner‑friendly and advanced trading environments.

- Low minimum deposit starting at 15 USD, notably below the 100–250 USD thresholds often seen at established competitors.

Cons

- Limited account choice, with no clear separation between beginner, professional, or swap‑free Islamic profiles.

- The offshore component in Seychelles is flagged as “Offshore Regulated,” which generally offers weaker client protections and may affect dispute resolution options.

- WikiFX score of 5.46/10, signalling a middle‑of‑the‑road trust profile rather than a high‑reliability broker.

- Field survey in Seychelles reporting “No Office Found,” which raises questions around the actual presence at the declared address.

When compared with large EU‑only competitors that maintain a single onshore regulatory umbrella, Doto appears more flexible in leverage and minimum deposit, yet less conservative in jurisdictional footprint. Many tier‑one brokers avoid offshore registration altogether, whereas Doto employs both EU and offshore entities to balance regulatory pressure with commercial latitude.

Trading Instruments on Doto

One of the central questions in any Doto review is instrument coverage, because product range directly affects risk management and diversification. The broker markets itself as a multi‑asset provider with access to forex, indices, commodities, stocks, and crypto CFDs.

The key advertised markets are:

- Forex market – Doto encourages traders to “hit the forex market” and “make the most of currency rollercoasters,” underlining a broad FX focus.

- Indices market – Major indices such as the S&P 500 and DAX are offered, allowing clients to trade equity baskets via a single position.

- Commodities market – Classic commodities, including gold and oil, are presented as “timeless classics,” integrated into the CFD lineup.

- Crypto market – Marketing copy references “riding the crypto market wave” with Bitcoin and “the hottest digital currencies,” pointing to a crypto CFD selection.

- Stock market – The platform showcases CFDs on major global companies, including Apple and NVIDIA, with leverage and spreads disclosed in an instrument table.

Illustrative instrument data includes:

- Apple (AAPL): price 246.9, daily move 1.6%, leverage 20x, minimum spread 21.

- Bitcoin (BTCUSD): price 98,181.3, daily move 2.16%, leverage 100x, minimum spread 20.1.

- EUR/USD: price 1.05832, daily move 0.2%, leverage 500x, minimum spread 1 pip.

- NVIDIA (NVDA): price 137.65, daily move 3.73%, leverage 20x, minimum spread 3.3.

- Gold (XAUUSD FX): price 2,668.366, daily move –1.35%, leverage 100x, minimum spread 11.3.

In contrast, a separate “Tradable Instruments” table lists Forex, Commodities, Stocks, and Indices as supported, while Cryptocurrency, Shares, and Metals are marked as not supported, an inconsistency that deserves clarification from the brokers current product schedule. For traders, it underscores the importance of checking live contract specifications before committing a strategy to the platform.

Account Types and Doto Review of Access

Rather than segmenting clients into multiple account tiers, Doto appears to run a single real account type complemented by a demo environment. The broker only provides one single account, with spreads starting from 1 pip, leverage up to 1:500, and zero commissions.

Core account features highlighted are:

- Real accounts for live trading across the available instruments.

- Demo accounts preloaded with 10,000 “demo dollars,” designed for practice and strategy testing without capital risk.

- High leverage up to 1:500, with example leverage settings of 500x on EUR/USD, 100x on Bitcoin and gold, and 20x on major equity CFDs.

While simplicity is a benefit, this account structure contrasts with many competitors that offer separate ECN, standard, and pro accounts with differentiated spreads and commission profiles. For advanced traders, the lack of explicit raw‑spread ECN tiers or professional classification may limit the ability to fine‑tune cost structures, even though headline spreads are advertised from 1 pip.

Fees, Spreads, and Leverage

The fee model highlighted in the document is straightforward: spreads from 1 pip, leverage up to 1:500 and zero commissions. Marketing panels emphasize “0% commissions,” “instant withdrawals,” and “fast trade execution,” with spreads and leverage presented as the main cost and risk levers.

- Spreads: starting from 1 pip, with example minimum spreads such as 1 pip for EUR/USD, 3.3 for NVDA, 11.3 for gold, and around 20 points for Bitcoin.

- Leverage: up to 500x on selected forex pairs, 100x on certain commodities and crypto, and 20x on major stock CFDs.

- Commissions: 0% ticket commissions, implying all trading costs are spread‑only.

This structure is more aggressive than the fee profiles of many EU‑only brokers, which often cap leverage at 1:30 for retail clients and may charge commissions on ECN accounts in exchange for tighter raw spreads. In a Doto review context, high leverage and no commission can be attractive for speculation but increase risk, particularly for inexperienced traders prone to over‑sizing positions.

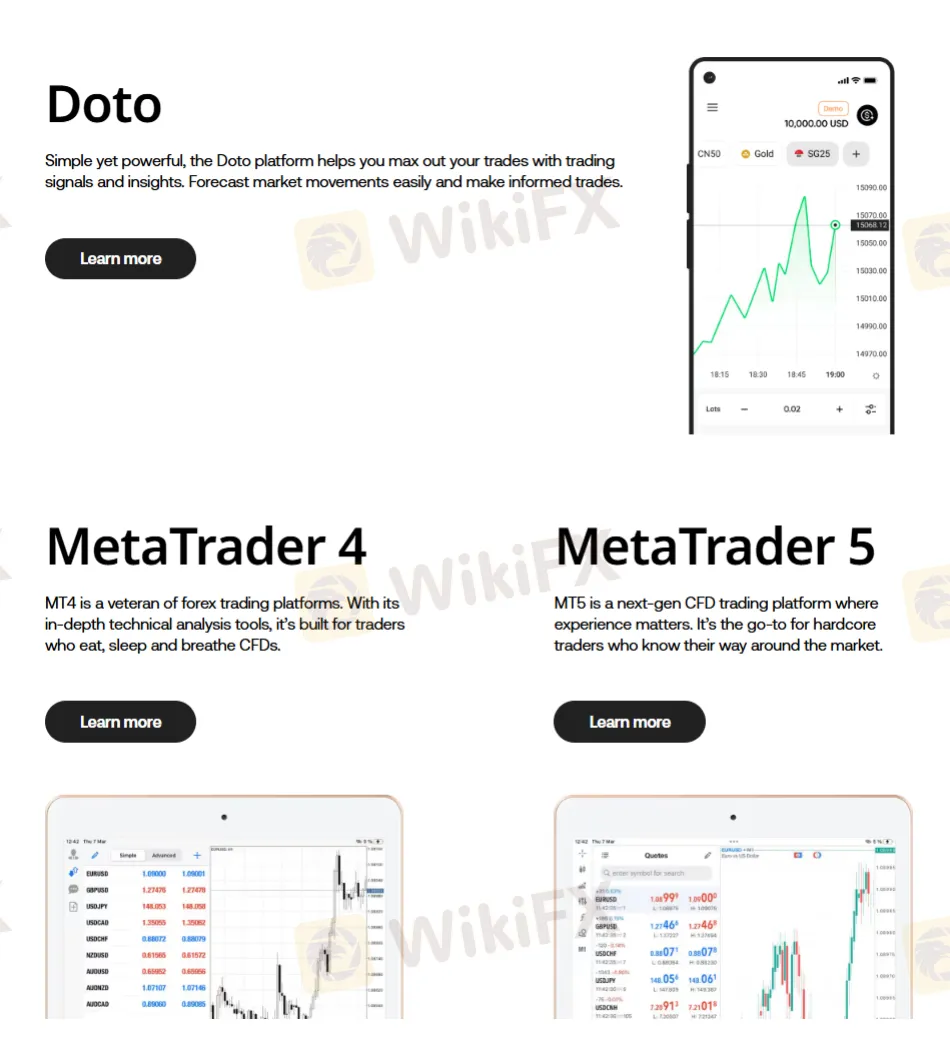

Platforms: Doto App, MT4, and MT5

Platform choice is a central pillar of any broker evaluation, and Dotos line‑up is competitive on paper. The broker promotes its own proprietary Doto platform for mobile traders while also offering MetaTrader 4 and MetaTrader 5 for those who prefer the industry standard.

The platform breakdown in the source is:

- Doto App

- Described as “simple yet powerful,” built to help traders “max out” their trades with trading signals, insights, and advanced analytical tools.

- Available for iOS and Android, marketed as suitable for “investors of all experience levels.”

- It shows market forecasts, intraday charts, and integrated signal prompts.

- MetaTrader 4 (MT4)

- Characterised as a “veteran of forex trading platforms” with “in‑depth technical analysis tools,” aimed at traders who “eat, sleep and breathe CFDs.”

- Supported on PC and mobile, giving access to EAs, custom indicators, and industry‑standard charting.

- MetaTrader 5 (MT5)

- Presented as a “next‑gen CFD trading platform where experience matters,” targeting “hardcore traders who know their way around the market.”[1]

- Also supported on PC and mobile, with multi‑asset support and extended order types.[1]

The combination of a proprietary app and the MetaTrader suite places Doto in line with many established competitors, and may appeal to traders who want to switch between a modern, signal‑driven interface and the more granular MT4/MT5 environment. However, it does not detail server performance metrics, slippage statistics, or order‑book depth, all of which are critical for a more advanced platform‑level Doto review.

Deposits, Withdrawals, and Payments

Funding mechanics are clearly described, with Doto promoting a low barrier to entry and fee‑free processing on most methods. The broker requires a minimum deposit of 15 USD and states that it does not charge deposit or withdrawal fees, except for network fees on crypto payments such as USDT.

According to the tables provided:

- Minimum deposit: 15 USD across most funding methods, including Visa, MasterCard, Maestro, QR payments, and bank transfer.

- Processing times:

- Cards and QR payments: up to 15 minutes.

- Bank transfer: up to one business day.

- USDT: up to 15 minutes, subject to network fee.

- Withdrawal terms: mirrored in a separate payment‑method table, which repeats the 15 USD minimum, “Free” commissions for fiat methods, and “Network fee” for USDT.

The structure makes Doto more accessible than brokers imposing higher minimums or charging deposit fees, particularly for new traders testing the waters. At the same time, the absence of broker‑side fees does not eliminate third‑party costs such as bank charges or blockchain network fees, which remain relevant in any practical Doto review.

Doto Review vs Typical Competitors

Placing Doto against the benchmark of mainstream regulated CFD brokers highlights a trade‑off between flexibility and conservatism. On one side, Doto offers high leverage, low minimum deposits, and zero commissions, along with the familiar MT4/MT5 stack; on the other, its offshore leg and moderate trust score contrast with the more tightly controlled frameworks of pure EU or UK brokers.

In context:

- Many EU‑only competitors cap leverage at 1:30 for retail clients and do not maintain offshore subsidiaries, which can reduce systemic risk but limit trading power for speculative strategies.[1]

- Dotos Seychelles entity, flagged as “Offshore Regulated” and linked to a “No Office Found” field survey, introduces an additional risk layer that cautious traders may want to avoid by opting for the CySEC or FSCA entities where possible.

For traders attracted to higher leverage and low capital entry, this Doto review indicates a broker that resembles other hybrid‑jurisdiction players more than it does strictly tier‑one institutions. Sophisticated clients will likely weigh the benefits of 1:500 leverage and spread‑only pricing against the implications of offshore regulation and mixed third‑party ratings.

Reported Cases and Field Findings

No report does contain specific client complaints or enforcement actions, but it does contain an investigative‑style field survey from WikiFX in Seychelles. The survey maps the teams route across Victoria, Seychelles, noting landmarks such as Botanical Gardens, Jetty Beachcomber, and local guest houses, ultimately concluding that no Doto office could be located at the published address.

Key elements from that survey segment include:

- A “Danger” label is associated with the visit to Doto in Seychelles and the “No Office Found” outcome.

- A “Public address check” and “Business status check” are referenced visually as part of WikiFXs on‑site verification process.

For a Doto review focused on risk, this absence of a verifiable physical office at the offshore jurisdiction should be treated as a cautionary signal, particularly for clients considering registration under the Seychelles entity. At a minimum, it justifies direct confirmation with the broker regarding current office locations and entity assignment before opening or funding an account.[1]

Bottom Line on Doto

This Doto review finds a broker that blends onshore CySEC and FSCA regulation with an offshore Seychelles license, a single account structure, high leverage up to 1:500, and a spread‑only fee model across forex, indices, commodities, stocks, and selected crypto CFDs. The presence of a proprietary app plus MT4 and MT5, a low 15 USD minimum deposit, and zero commissions creates a compelling value proposition for cost‑sensitive traders comfortable with leveraged CFDs.

At the same time, the moderate WikiFX trust score, “Offshore Regulated” Seychelles entity, and a field survey indicating “No Office Found” at the declared Seychelles address a risk factors that more conservative traders cannot ignore. For traders who choose to proceed, the prudent course is to prioritize onshore entities where possible, use leverage sparingly despite the 1:500 ceiling, and verify current contract specifications and regulatory details directly with Doto before committing significant capital.

Read more

Is SGFX Legit? A 2026 Deep Dive Investigation

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

SGFX Review 2026: A Trader's Warning on Spectra Global

If you are looking for an "SGFX Review" or want to know the "SGFX Pros and Cons," you have found an important resource. You probably want to know, "Is SGFX a safe and trustworthy broker?" Based on our detailed research, the answer is clearly no. While SGFX (also called Spectra Global) looks modern and professional, we have found serious warning signs that every potential investor needs to know about before investing. This review will get straight to the point. We will immediately discuss the main problems that make this broker extremely risky. These include weak and misleading regulation from offshore locations, questionable trading rules designed to get large deposits, and a worrying pattern of serious complaints from users, especially about not being able to withdraw. This article will give you a complete, fact-based analysis of how SGFX operates to help you make a smart and safe decision.

ZFX Review 2026: A Complete Guide to Trading Conditions, Costs & Safety

When traders look for trustworthy brokers in today's busy market, ZFX stands out as a major global company backed by the Zeal Group. The main question for anyone thinking about using them is simple: What is ZFX, and can you trust it? This broker has an interesting but important split personality. It works under a parent company that follows strict UK financial rules, but most regular customers actually sign up through a different offshore company. This creates a gap between how safe people think it is and how much protection traders actually get. The goal of this 2026 review is to give you a complete, fair look at ZFX's safety, costs, and features. We'll give you an honest view of what's good and bad about it, so you can make a smart choice based on facts, not advertising. Our analysis will look at its regulations, trading conditions, fees, and the important risks you need to know about.

TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

WikiFX Broker

Latest News

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Global Crypto Launch Tax Network to 48 Nations

OneRoyal Review: A Complete Look at How This Broker Performs

CFI Review 2025: Institutional Audit & Risk Assessment

OneRoyal Regulation: A Simple Guide

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

Rate Calc