Is SGFX Legit? A 2026 Deep Dive Investigation

Abstract:Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit?

This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

SGFX Corporate Identity

SGFX, which stands for Spectra Global, is a fairly new company in the brokerage industry. Our research shows its operations started around 2023, based on its website registration and market presence. A short operating history is the first warning sign for any trader, as it means the broker doesn't have a long-term record of reliability and trust.

The company operates through at least two separate legal companies registered in offshore locations:

1. Spectra Global LTD (MU): Registered in Mauritius at The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, Ebene.

2. Spectra Global Ltd: Registered in Saint Lucia at Ground Floor, La Place Creole Building, Rodney Village, Rodney Bay, Gros-Islet.

The choice of Mauritius and Saint Lucia as registration locations is common for offshore brokers, as these places often have less strict regulatory requirements compared to major financial centers. The official website for the brand is www.sgfx.com.

Checking SGFX Regulation

A broker's regulatory status is the most important factor determining its legitimacy and the safety of your funds. SGFX's regulatory situation is complex and raises serious concerns.

The main license SGFX holds is from the Financial Services Commission (FSC) of Mauritius for its company, Spectra Global LTD. The license number is GB22201302, under the category of “Investment Dealer (Full Service)”. While this is a real license, it's important to understand that the FSC is considered a Tier 2, or offshore, regulator. The protections, capital requirements, and oversight provided by the FSC are much weaker than those from top-tier regulators like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). For traders outside Mauritius, this license offers very little practical protection or legal help.

Furthermore, SGFX claims to hold a license from the Securities and Commodities Authority (SCA) of the UAE with number 20200000307. However, third-party verification platforms have flagged this claim as doubtful, suggesting it may not be valid or may not cover retail forex trading activities. The company in Saint Lucia is merely a company registration (2024-00735) and holds no regulatory power whatsoever.

Independent verification is essential. When checking reviews on authoritative third-party platforms, such as WikiFX, the assessment is very negative. SGFX currently holds an extremely low score of 1.14 out of 10. The platform clearly marks the broker with warnings like “current暂无有效监管” (no valid regulation at present) and flags its licenses as “suspected clone” or doubtful. This is a huge red flag and a clear signal to be extremely careful.

SGFX Trading Conditions Analysis

A broker's trading conditions reveal much about its target audience and business model. SGFX offers a tiered account structure, which we have organized below for clarity.

| Feature | Standard Account | Elite Account | ECN Account |

| Minimum Deposit | $100 | $5,000 | $25,000 |

| Spread Type | Floating | Floating | Raw (from 0.0 pips) |

| Spread Value | From 1.5 pips | From 0.8 pips | From 0.0 pips |

| Commission | None | None | $8 per lot (round turn) |

| Maximum Leverage | 1:500 | 1:300 | 1:300 |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 |

At first glance, the offerings may seem normal. However, a closer look reveals a harmful structure. The most alarming detail is the $25,000 minimum deposit required to access the ECN account. In the competitive brokerage industry, leading firms offer raw spread accounts for as little as $200. Demanding such a huge sum is highly unusual and is often a tactic used by questionable brokers to lock in significant client funds, making future withdrawals more difficult.

The broker provides access to the popular MetaTrader 5 (MT5) platform for PC and mobile, along with its own SGFX Web Trader. While offering MT5 is positive, it is simply licensed software and does not, by itself, validate the integrity of the broker using it. The range of tradable assets includes forex, stock CFDs, indices, commodities, futures, and cryptocurrencies.

Understanding the Fee Structure

Costs can significantly impact trading profitability. SGFX's fees are a mix of visible trading costs and potential hidden charges.

For the Standard account, the primary cost is the spread, which starts at 1.5 pips for major pairs like EUR/USD. This is relatively high compared to the industry average. The Elite account offers a slightly better spread from 0.8 pips but requires a hefty $5,000 deposit.

The ECN account, despite its prohibitive entry barrier, carries an $8 per lot round-turn commission. This is also on the higher end of the spectrum, as many top-tier ECN brokers charge between $6 and $7 per lot.

Regarding non-trading fees, SGFX claims to offer zero fees on bank wire deposits and withdrawals. While the platform may not charge a fee itself, this claim is misleading. Traders using wire transfers will almost certainly face intermediary and receiving bank fees, typically ranging from $20 to $50 per transaction, which are deducted from the transferred amount. Additionally, the broker's terms and conditions mention the possibility of charging maintenance or inactivity fees on dormant accounts, another potential cost to be aware of.

User Feedback

The most telling evidence of a broker's legitimacy often comes from the experiences of its users. While SGFX has a limited online presence due to its recent establishment, the feedback that has emerged is deeply concerning.

On platforms like Trustpilot, the broker holds a 3.7/5 rating from a very small number of reviews, which are highly polarized. The few positive comments praise fast execution on MT5 or helpful account managers, but these can often be attributed to affiliates or internal efforts to boost ratings.

The negative feedback, however, is specific and severe. The most common and critical complaints revolve around:

1. Withdrawal Difficulties: Multiple users have reported in 2025 that their withdrawal requests remain in a “pending” status for weeks or even months without resolution. When they contact customer support, they are reportedly given vague excuses about “compliance reviews” or “audits” with no definitive timeline for the release of their funds. This is a classic tactic used by fraudulent operations.

2. “Pig-Butchering” SGFX Scam Allegations: More disturbingly, SGFX has been directly implicated in “pig-butchering” scams. A YouTube exposé video published in July 2025 details how scammers use social media platforms, such as WhatsApp and Telegram, to build trust with victims. Posing as investment mentors or successful traders, they lure individuals into depositing large sums onto the sgfx.com platform. Once the funds are deposited, the scammers either disappear or the broker prevents any withdrawals, effectively stealing the client's capital.

These credible and recent allegations of financial misconduct are the most serious red flags and strongly suggest that SGFX is not a safe venue for your capital.

A Balanced Risk Assessment

To provide a clear picture, we must weigh any potential positives against the significant risks.

The Few Potential Positives

· MT5 Platform: SGFX provides access to the industry-standard MT5 trading platform.

· Stock CFDs: The broker advertises 0-commission trading on stock CFDs, which can be attractive to equity traders.

· Holds a License: It holds a real license from the FSC in Mauritius. While weak, this is marginally better than being completely unregulated.

The Overwhelming Red Flags

· Extreme Risk Score: An independent risk score of 1.36/10 from a platform like WikiFX is a clear warning to stay away.

· Harmful ECN Barrier: The $25,000 minimum for an ECN account is not a feature of a legitimate, competitive broker. It is a strategy designed to extract large sums from unsuspecting clients.

· Short Operating History: A broker founded around 2023 has no established reputation and has not proven its reliability over time.

· Severe Negative Feedback: Credible reports from 2025 detailing withdrawal failures and direct involvement in social media investment scams are impossible to ignore.

· Weak Regulatory Protection: The offshore FSC license offers no meaningful security for international clients. In the event of a dispute or the broker's failure, recovering funds is nearly impossible.

SGFX vs Reputable Brokers

To put SGFX's offering into perspective, let's compare it directly with established, well-regulated brokers like XM and IC Markets.

| Metric | SGFX (Spectra) | XM | IC Markets |

| Regulation Tier | Offshore (Mauritius) | Tier-1 (FCA/ASIC) | Tier-1 (ASIC/CySEC) |

| Minimum Deposit | $100 | $5 | $200 |

| ECN Account Threshold | $25,000 (Extremely High) | N/A (Offers Low Spread Ultra Low Account) | $200 (Raw Account) |

| Typical Spreads | From 1.5 / 0.8 pips | From 1.6 / 0.6 pips | From 0.0 pips |

| Reputation | ⚠️ Poor / Questionable | Good | Excellent |

This comparison clearly shows that traders have access to far safer, more reputable, and more affordable options in the market. There is no logical reason to choose a high-risk offshore broker like SGFX when top-tier regulated brokers offer better trading conditions and robust fund security.

Final Verdict and Advice

Based on our comprehensive investigation, the answer to the question “Is SGFX Legit?” is a firm and resounding no. We assess SGFX (Spectra Global) as a high-risk broker and strongly advise all traders to avoid this platform.

The combination of weak offshore regulation, a nonexistent track record, an absurdly high ECN account requirement, and, most importantly, credible user reports of withdrawal failures and “pig-butchering” scam involvement constitutes an unacceptable level of risk.

We leave you with this critical advice:

· Do Not Deposit Funds: Under no circumstances should you deposit money with SGFX. The likelihood of being able to withdraw your capital successfully is extremely low.

· Identify Scam Tactics: If you were introduced to SGFX through an unsolicited message on WhatsApp, Telegram, or another social media app by a supposed “mentor” or “friend” promising high returns, you are the target of a scam. Stop all communication immediately and block the person.

· Always Verify Before Trading: To protect yourself, make it a habit to verify any broker on an independent regulatory checker and review platform, such as WikiFX, before opening an account. A low score, a lack of Tier-1 regulation, or warnings of scam activity are definitive deal-breakers.

Your capital is hard-earned. Entrusting it to a platform with as many red flags as SGFX is not trading; it is gambling with a very high probability of total loss.

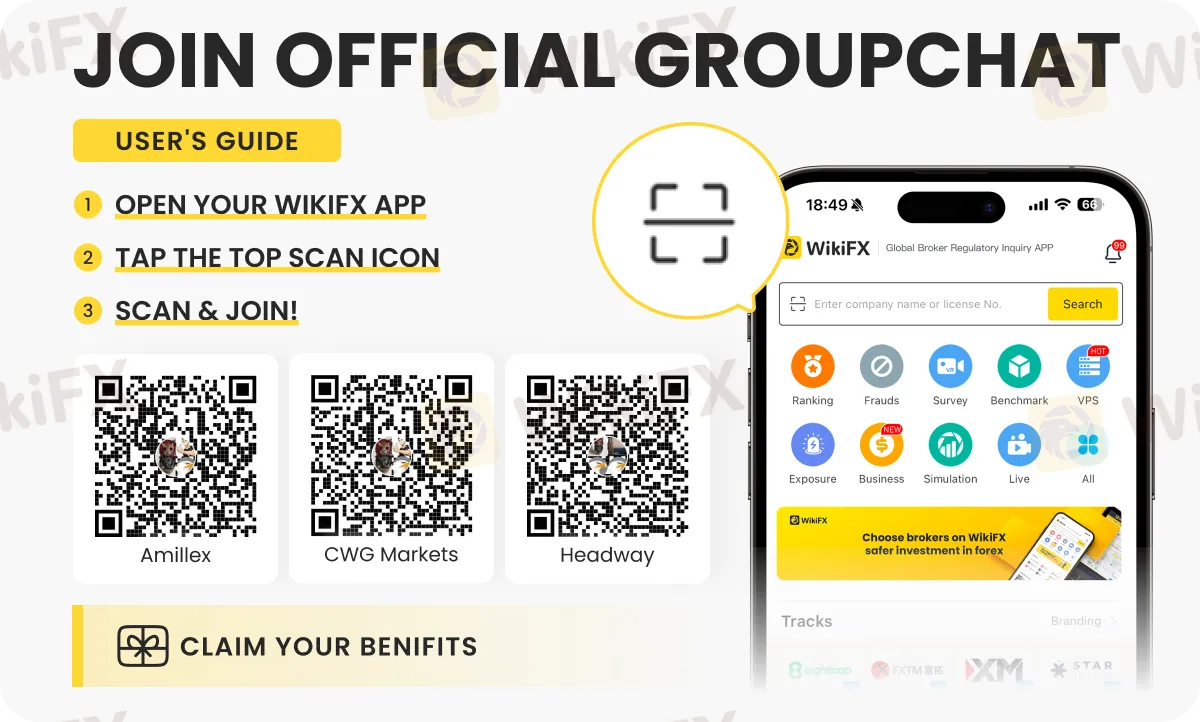

Check the latest forex updates easily on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Instructions for joining the group/s are shown below. Take a look.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc