CFI Review 2025: Institutional Audit & Risk Assessment

Abstract:CFI (Credit Financier Invest) presents a complex profile characterized by a high-tier regulatory framework in Europe and the Middle East, juxtaposed with operational irregularities in other jurisdictions. With a WikiFX score of 7.35, the broker is positioned in the upper quadrilateral of trust, largely due to its longevity (established in 2012) and oversight by top-tier bodies like the UK FCA and Cyprus CySEC. However, distinct risk signals—specifically a revoked license in Dubai (DFSA), a "superceded" status in South Africa, and a substantial AML-related fine from CySEC—prevent this entity from receiving a flawless safety rating. This audit classifies CFI as a legitimate, high-capacity brokerage that requires traders to diligently verify which specific legal entity they are contracting with to avoid regulatory arbitrage.

Executive Summary

WikiFX Score: 7.35 / 10

Regulatory Status: Multi-Regulated (Significant Regulatory Discrepancies Detected)

CFI (Credit Financier Invest) presents a complex profile characterized by a high-tier regulatory framework in Europe and the Middle East, juxtaposed with operational irregularities in other jurisdictions. With a WikiFX score of 7.35, the broker is positioned in the upper quadrilateral of trust, largely due to its longevity (established in 2012) and oversight by top-tier bodies like the UK FCA and Cyprus CySEC. However, distinct risk signals—specifically a revoked license in Dubai (DFSA), a “superceded” status in South Africa, and a substantial AML-related fine from CySEC—prevent this entity from receiving a flawless safety rating. This audit classifies CFI as a legitimate, high-capacity brokerage that requires traders to diligently verify which specific legal entity they are contracting with to avoid regulatory arbitrage.

Quick Take: Pros and Cons

Operational Strengths

- ✅ Tier-1 & Tier-2 Regulation: Valid oversight from the UK Financial Conduct Authority (FCA) and CySEC reinforces capital safety.

- ✅ Competitive Cost Structure: Spreads on the “Dynamic Trader” account start from 0.0 pips, indicating institutional liquidity access.

- ✅ Infrastructure Quality: Utilization of “Main Label” MT4 and MT5 servers suggests robust proprietary infrastructure rather than cheap white-label rentals.

- ✅ High Leverage Flexibility: Offers up to 1:500 leverage for accounts under offshore jurisdictions (Vanuatu/Seychelles).

Risk Factors

- ❌ Regulatory Sanctions: Fined €150,000 by CySEC (2022) for deficiencies in Anti-Money Laundering (AML) and client due diligence procedures.

- ❌ License Revocation: The license with the Dubai Financial Services Authority (DFSA) is flagged as “Revoked.”

- ❌ Execution Complaints: User reports allege severe slippage and spreads widening significantly during execution compared to screen prices.

- ❌ Asset Limitations: Data indicates cryptocurrency trading is not supported (allowCryptocurrency: false).

Regulatory Compliance & Safety Profile

CFI operates under a “hub-and-spoke” regulatory model. The safety of client funds is entirely dependent on the specific jurisdiction where the trading account is domiciled.

Validated Oversight

The broker maintains valid active licenses with the following authorities:

- United Kingdom (FCA): Credit Financier Invest Limited (License No. 828955). FCA regulation implies strict adherence to the CASS (Client Assets Sourcebook) rules, segregation of funds, and participation in the Financial Services Compensation Scheme (FSCS).

- Cyprus (CySEC): Credit Financier Invest (CFI) Ltd (License No. 179/12). Provides passporting rights within the EU and mandates investor compensation fund participation.

- UAE (SCA): CFI FINANCIAL MARKETS L.L.C (License No. 20200000154). Offers specialized oversight for the MENA region.

- Offshore Entities: Regulated by VFSC (Vanuatu) and FSA (Seychelles). These licenses allow for higher leverage and relaxed onboarding but lack the stringent deposit insurance mechanisms of the FCA or CySEC.

Risk Warning: Compliance Failures & Sanctions

During this audit, significant negative disclosures were uncovered in the regulatory data that institutional and retail clients must consider:

- CySEC Enforcement Action (AML Failure):

On June 21, 2022, CySEC fined CFI €150,000. The settlement settled alleged violations incurred during 2020 regarding the Prevention and Suppression of Money Laundering and Terrorist Financing Law. Specifically, the regulator identified weaknesses in CFI's “Know Your Customer” (KYC) procedures and the detailed examination of high-risk transactions. While the fine was settled, it highlights historical gaps in the firm's internal risk controls.

- License Irregularities:

- DFSA (Dubai): The license (F003933) is marked as “Revoked”. Traders believing they are under the protection of the Dubai International Financial Centre must verify they are not onboarded through this defunct entity.

- FSCA (South Africa): The legal entity CFI FINANCIAL (PTY) LTD is flagged for “Exceeded” operation (Over-limit operating), suggesting the firm may be offering services beyond the scope of its authorized financial permissions in South Africa.

Trading Infrastructure & Costs

CFI utilizes industry-standard technology with a cost structure that caters to both high-frequency scalpers and standard retail traders.

Leverage Policy

The data confirms a maximum leverage ratio of 1:500. This high leverage cap is indicative of clients being onboarded through the offshore entities (Mauritius, Vanuatu, or Seychelles). While this provides capital efficiency for experienced traders, it significantly amplifies counterparty risk. In contrast, European clients (FCA/CySEC) would typically be capped at 1:30 by ESMA regulations, suggesting the 1:500 offer applies to professional or non-EU accounts.

Cost Structure

CFI divides its offering into two primary account tiers, ensuring versatility:

- Dynamic Trader Account: Features spreads from 0.0 pips. This is likely a commission-based ECN/STP model suitable for scalpers and algorithmic traders using Expert Advisors (EAs).

- Zero Commission Account: Offers spreads ranging from 0.4 to 1.1 pips. A spread of 0.4 on a commission-free account is highly competitive relative to the industry average (typically 1.0 - 1.2 pips for EUR/USD), enticing strictly cost-sensitive traders.

Software Architecture

CFI supports MT4 and MT5. Crucially, the license type is identified as “Main Label” (Score 11).

- Audit Note: A “Main Label” (or Full License) indicates CFI owns the server infrastructure directly. This contrasts with “White Label” brokers who rent server space from third parties. Main Label status generally correlates with faster execution speeds, better bridge connectivity to liquidity providers, and lower technical insolvency risk.

Market Sentiment: User Complaints

Analysis of recent user feedback reveals a dichotomy between platform features and execution quality.

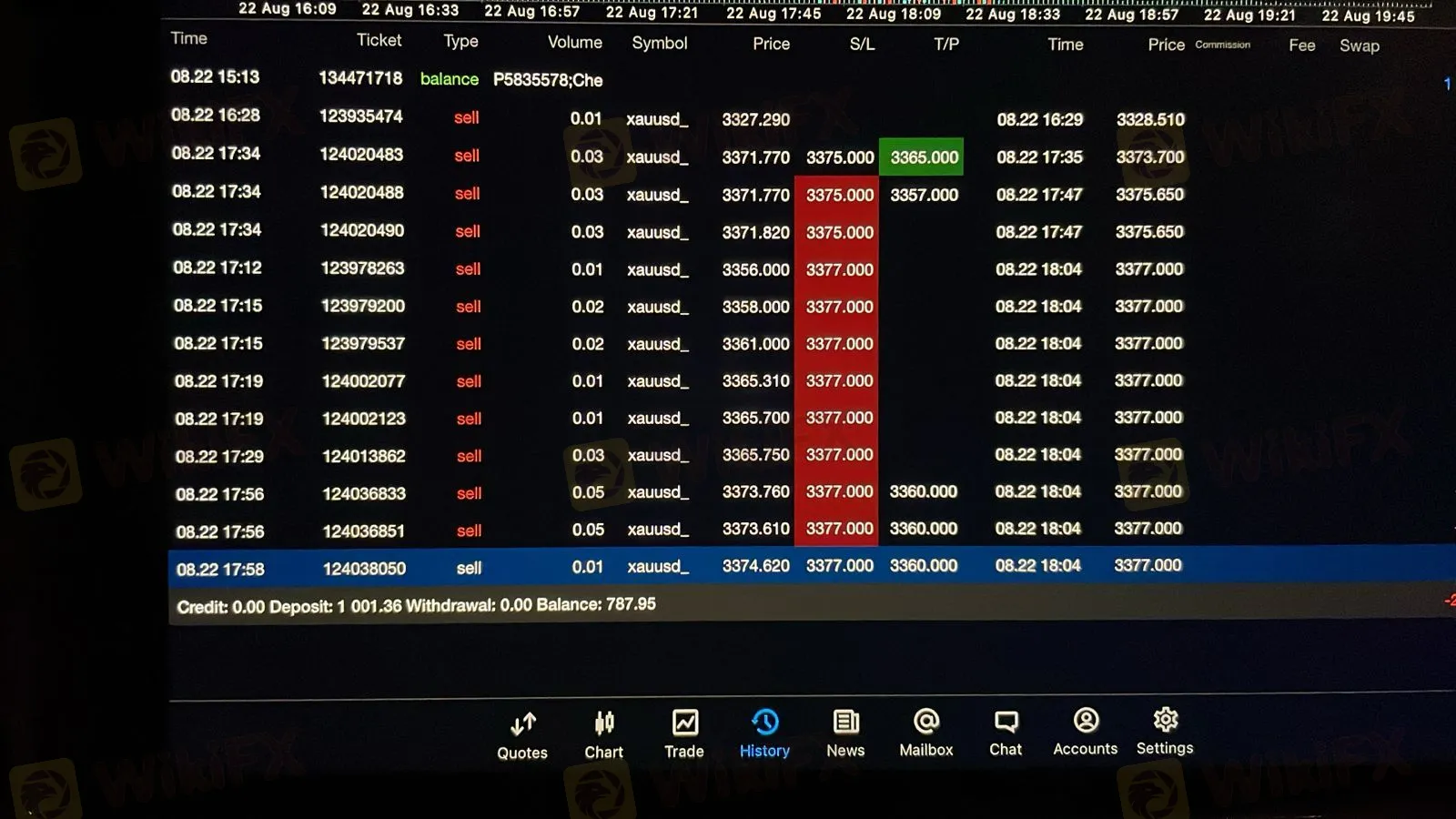

- Risk Factor: Execution Quality (Slippage)

A verified user from the UAE reported distinct anomalies in order execution. The complaint alleges that while the on-screen spread appears low, the actual execution price suffers from severe slippage (high cost at execution). Furthermore, the user reported that pending orders were frequently ignored and winning trades were closed at a loss due to these discrepancies.

- Analyst Assessment: This pattern is symptomatic of aggressive “B-Book” (Market Maker) execution or poor liquidity bridge calibration during high volatility.

- Positive Feedback: Product Diversity

Conversely, a user from New Zealand praised the platform's sheer volume of tradable assets (approx. 13,000 products) and regulatory oversight. This suggests that for standard investing (equities/longer timeframes), the platform performs adequately.

Final Verdict

CFI (Credit Financier Invest) is a well-established, multi-regulated broker that scores a respectable 7.35 on WikiFX. Its primary strengths lie in its Tier-1 licensing (FCA/CySEC) and “Main Label” trading infrastructure which offers highly competitive pricing (0.0 pips raw spread).

However, potential clients must exercise due diligence regarding entity selection. The presence of a €150,000 regulatory fine for AML breaches and revoked/over-limit licenses in the MEA region (Dubai/South Africa) indicates inconsistent compliance efficacy across different borders. The user reports of slippage further suggest that while the legal framework is solid, the technical execution may vary by region or account type.

Recommendation: Safe for traders onboarding under FCA or CySEC jurisdictions. High-leverage traders onboarding via offshore entities should act with caution regarding negative balance protection and execution risks.

For the most current regulatory certificates and real-time blocklisting status, verify [CFI] on the WikiFX App.

WikiFX Broker

Latest News

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

Fraudsters Impersonate Hong Kong Monetary Authority Using Fake Websites and Login Pages

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

US and China Ramp Up Trade Incentives for African Markets

Is QUOTEX Broker Safe? Unauthorized Status Exposed

Rate Calc