TotalFX Regulation Review: Compliance and Trading Safety

Abstract:TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

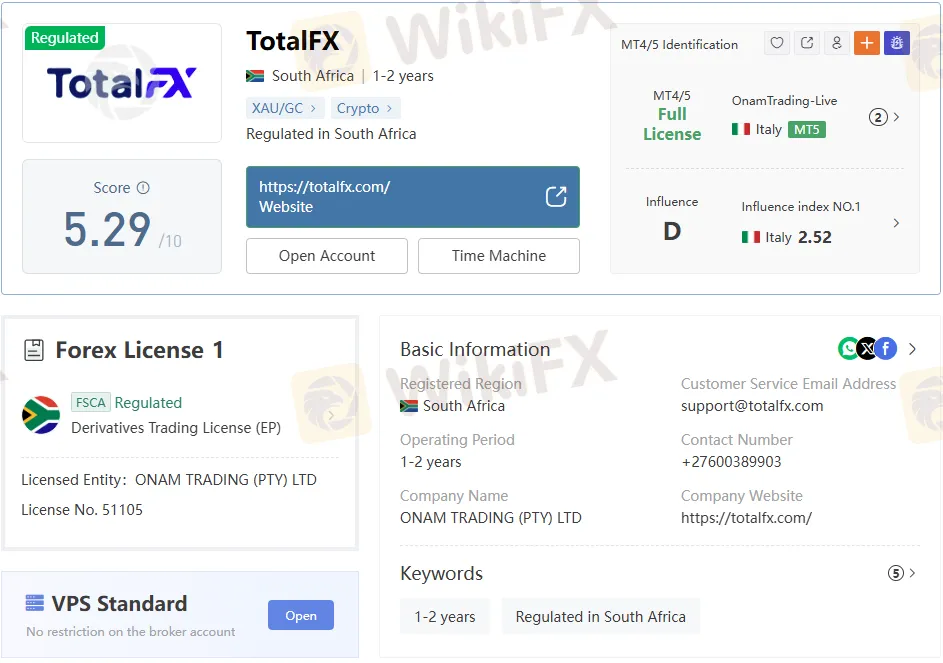

FSCA Oversight and Licensing Transparency

TotalFX operates under the regulatory supervision of the Financial Sector Conduct Authority (FSCA) in South Africa. The brokers license, No. 51105, is held by ONAM Trading (Pty) Ltd, with authorization granted on 10 February 2021. This license covers a wide range of financial activities, including derivatives trading, securities investment consulting, bond trading, and pension-related financial products.

The FSCA‘s involvement provides a layer of compliance assurance. Unlike offshore brokers with vague oversight, TotalFX’s South African registration offers traders a clear jurisdictional framework. This regulatory standing is a critical factor in evaluating trading safety, especially in a market where unregulated entities often pose risks.

Domain Registration and Corporate Background

The brokers official domain, totalfx.com, was registered on 30 March 2000 and is valid until 30 March 2032. The domain is hosted via Cloudflare name servers, with its status marked as “client transfer prohibited,” signaling protection against unauthorized transfers.

The company behind the broker, ONAM Trading (Pty) Ltd, has been operating for 1–2 years under the TotalFX brand. While the corporate entity is relatively new, the domains long-standing registration suggests continuity and brand stability.

Trading Instruments and Market Coverage

TotalFX provides access to a broad spectrum of instruments:

- Forex (over 60 currency pair CFDs)

- Shares

- Indices

- Cryptocurrencies

- Metals

- Energies

- ETFs

- Soft commodities

- Bonds

- Options

This multi-asset offering positions TotalFX competitively against brokers that limit clients to forex or equities. The inclusion of cryptocurrencies and ETFs reflects an effort to align with modern trading demands, while traditional instruments such as bonds and commodities cater to conservative investors.

Account Types and Fee Structures

TotalFX offers two account types:

| Account Type | Minimum Deposit | Spread | Commission | Platforms |

| Zero | $0 | From 0.6 pips | $0 | MT5 & cTrader |

| Raw | $0 | From 0.0 pips | $2.75 per side | MT5 & cTrader |

Both accounts feature no minimum deposit requirement and leverage up to 1:1000. The Zero account appeals to traders seeking commission-free trading, while the Raw account provides institutional-style spreads with a transparent commission structure.

Compared to competitors, the leverage offered is significantly higher. While this can amplify profits, it also increases risk exposure, making risk management essential.

Platforms: MT5, MT4, and cTrader

TotalFX supports three major platforms:

- MetaTrader 5 (MT5): Advanced charting, automated trading, and copy trading.

- MetaTrader 4 (MT4): Simplified interface, suitable for beginners.

- cTrader: Professional-grade execution with desktop, web, and mobile compatibility.

The availability of all three platforms is a notable advantage. Many brokers restrict clients to MT4 or MT5, but TotalFXs inclusion of cTrader broadens its appeal to experienced traders seeking alternative execution environments.

Pros and Cons of TotalFX

Pros:

- Regulated by FSCA (License No. 51105).

- Wide range of trading instruments, including crypto and ETFs.

- MT5, MT4, and cTrader platforms supported.

- No minimum deposit requirement.

- Copy trading functionality is available.

Cons:

- Payment methods remain unclear.

- Regulatory scope noted as “exceeded regulation,” raising questions about cross-border permissions.

- Limited operating history under ONAM Trading (Pty) Ltd despite long-standing domain registration.

Competitor Context

When compared to regional competitors, TotalFX‘s leverage of 1:1000 stands out. Many FSCA-regulated brokers cap leverage at lower levels to mitigate risk. Additionally, TotalFX’s dual account structure mirrors offerings from global brokers but with more aggressive spreads and commissions.

However, the brokers WikiFX score of 5.29/10 indicates mixed market perception. Competitors with longer operating histories and clearer payment transparency often score higher, suggesting TotalFX still has ground to cover in building trader confidence.

Bottom Line: Is TotalFX Safe?

This TotalFX Review highlights a broker that combines regulatory compliance under FSCA with a diverse product offering and competitive trading conditions. The presence of license No. 51105 provides legitimacy, while the inclusion of MT5, MT4, and cTrader ensures platform flexibility.

Yet, traders should weigh the brokers relatively short operational history and lack of clarity on funding methods against its regulatory standing. For those seeking high leverage and multi-asset exposure under FSCA oversight, TotalFX presents a viable option.

Verdict: TotalFX delivers compliance-backed trading safety with expansive market access, but transparency in payment systems and longer operational history will be key to strengthening its reputation.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Global Crypto Launch Tax Network to 48 Nations

OneRoyal Review: A Complete Look at How This Broker Performs

CFI Review 2025: Institutional Audit & Risk Assessment

OneRoyal Regulation: A Simple Guide

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

Rate Calc