AMarkets Reputation Analysis 2025: Looking Into Complaints and Withdrawal Problems

Abstract:When looking at AMarkets, traders often get mixed signals. The broker has been around for a long time (since 2007) and has a very high rating on Trustpilot. These things suggest it's reliable and customers are happy. But when you search for AMarkets complaints or AMarkets withdrawal issues, you'll find some worrying information, mostly about the broker's offshore licenses and problems some users have getting their capital out. This article will take a fair, fact-based look at these issues to help you understand the real risks and benefits of trading with AMarkets.

Getting to the Main Issue

Picking a broker is one of the biggest choices a trader will make, and keeping your money safe should be your top concern. When looking at AMarkets, traders often get mixed signals. The broker has been around for a long time (since 2007) and has a very high rating on Trustpilot. These things suggest it's reliable and customers are happy. But when you search for AMarkets complaints or AMarkets withdrawal issues, you'll find some worrying information, mostly about the broker's offshore licenses and problems some users have getting their capital out. This article will take a fair, fact-based look at these issues to help you understand the real risks and benefits of trading with AMarkets.

Understanding AMarkets' Safety Profile

To figure out if any broker is safe, you need to look beyond its marketing by checking its regulatory background. Doing this due diligence helps protect traders. For AMarkets, this picture has both good points and serious problems that need careful thought.

The Regulatory Framework

AMarkets has licenses in multiple places and uses third-party companies to build trust. Here's what its setup includes:

· Offshore Licenses:

· AMarkets LTD is authorized by the Mwali International Services Authority (MISA) in Comoros under license number T2023284.

· AMarkets LLC is registered with the Cook Islands Financial Supervisory Commission (FSC) under registration number LLC14486/2023.

· AMarkets LTD holds a registration with the Saint Vincent and the Grenadines Financial Services Authority (FSA), number 22567 BC 2015.

· Third-Party Verifications:

· The Financial Commission (FinaCom): AMarkets is a member of this independent organization that helps solve disputes. It is important to know that FinaCom is not a government regulator. Its main job is to help solve problems between traders and member brokers. It provides helpful protection through its Compensation Fund, which can cover up to €20,000 per case, giving you some financial backup if a dispute is solved in your favor.

· Verify My Trade (VMT): The broker gets checked monthly by VMT, a third-party service that confirms the quality of order execution. This adds some transparency to how it operates, showing its care for fair execution standards.

The Reality of Offshore Regulation

Most concerns come from the type of licenses AMarkets has. MISA, FSC, and the FSA are all considered offshore regulators. While they provide a legal framework for operation, the level of protection and oversight they offer is much different from that of top-tier regulatory bodies.

To understand what this means in practice, look at this comparison:

| Feature | Tier-1 Regulation (e.g., FCA, ASIC) | Offshore Regulation (e.g., MISA, FSA) |

| Government Oversight | High, with strict enforcement and legal power. | Low to minimal, with limited enforcement capacity. |

| Fund Segregation | Mandatory and strictly audited. Client funds must be kept separate from company funds. | Often stated as a policy but with less stringent auditing and enforcement. |

| Compensation Schemes | Government-backed schemes (e.g., FSCS up to £85,000). | Relies on third-party EDRs like FinaCom (up to €20,000). |

| Negative Balance Protection | Legally mandated and enforced. | Offered as a broker policy, not a legal requirement. |

This regulatory weakness is made worse by official warnings. Financial authorities in both Malaysia (SC Malaysia) and Italy (CONSOB) have issued alerts against AMarkets for operating in their areas without the required local authorization. These official warnings show the importance of staying updated. Before working with any broker, we strongly recommend traders use independent verification platforms, such as WikiFX, to check for the latest regulatory updates and any new alerts issued by global financial authorities.

Looking Into Withdrawal Issues

The most common and serious complaints against any broker involve withdrawals. A smooth and reliable withdrawal process shows if a broker is healthy and honest. Here, we investigate the keyword ‘AMarkets withdrawal issues’ by comparing the company's official policies against the common problems that lead to user complaints.

The Official Withdrawal Process

AMarkets offers various withdrawal methods, each with its own fee structure and processing timeline. Understanding these details is the first step in successfully navigating the process.

| Method | Fee | Internal Processing Time | Minimum Withdrawal |

| Credit/Debit Cards | 1.8% | Up to 24 hours | $5 |

| Crypto (USDT) | USD 1, EUR 1 | Up to 24 hours | 5 USDT |

| Crypto (BTC) | 0% | Up to 24 hours | 0.002 BTC |

| Volet (E-wallet) | 0.5% | Up to 24 hours | USD 10, EUR 10 |

| Ethereum | Standard Network Fee | Up to 24 hours | 0.02 ETH |

It's important to note that the “Internal Processing Time” of up to 24 hours is only for AMarkets' side. After it releases the funds, additional time is required by the payment processor (e.g., 3-5 business days for a bank transfer to show up).

Potential Withdrawal Problems

While the official process seems simple, several hidden rules and conditions contribute to several user complaints. Understanding these issues ahead of time can help prevent unpleasant surprises.

1. The Proportional Withdrawal Rule

This is probably the most confusing and complaint-causing policy. AMarkets requires that withdrawals be made in the same proportion as the deposits from various sources. For example, if you deposited $600 via credit card (60% of your total deposit) and $400 via Bitcoin (40%), your total withdrawal request, including profits, must be split 60/40 between the same credit card and a Bitcoin wallet. Users attempting to withdraw the full amount and having it credited to their bank or crypto wallet will have their request rejected. This is often seen by frustrated traders as the broker intentionally blocks their withdrawals, when actually it is enforcing a strict, though difficult, anti-money laundering (AML) policy.

2. Account Verification (KYC)

Like all legitimate brokers, AMarkets requires full Know Your Customer (KYC) verification before processing withdrawals. This includes providing proof of identity and address. The problem happens when traders deposit and trade without completing this step. When they request a withdrawal, the system flags the unverified account, and the support team requests documents. From the user's perspective, this last-minute demand can feel like a deliberate delay tactic, especially if they urgently need funds. The expert advice is simple: complete and confirm your full account verification before depositing.

3. Bonus and Promotion Terms

AMarkets offers generous promotions, such as a 100% deposit bonus. However, these bonuses are credited as non-withdrawable trading funds. Profits generated from trading with the bonus can be withdrawn, but the bonus credit itself cannot. Problems arise when users misunderstand these terms. A more subtle issue reported by some users is the “Cashback trap.” In this scenario, traders earn cashback rewards, but if their account equity drops to zero (a margin call), the accumulated cashback bonus is automatically removed. As traders deposit new funds, they are surprised to find the cashback gone, leading to feelings of being cheated, even if this condition is stated in the terms and conditions.

These complex rules can be a root cause of user frustration and complaints. To see how often these issues happen in real time, it is wise to check real user experiences on platforms, such as WikiFX, which often feature detailed accounts of withdrawal processes.

What Traders Are Saying

Public reviews provide an invaluable real-world view of a broker's performance. For AMarkets, the feeling is mostly positive but marked by serious, repeating red flags.

The Positive Feedback

The most striking data point is AMarkets' Trustpilot score: a 4.8 out of 5 from over 3,300 verified reviews. This shows a large and satisfied customer base. The most common praise includes:

· Excellent Customer Support: A common theme is the quality of the support team. Users frequently describe them as fast, professional, polite, and available 24/7 to solve issues.

· Fast Withdrawals (for many): Despite the complaints, a significant majority of reviewers report smooth and quick withdrawal experiences, with funds often received within a few hours to one business day.

· Platform Performance: Traders praise the stability of MT4 and MT5 platforms and the fast order execution, which averages around 30ms according to VMT audits.

· Good Trading Conditions: The high leverage (up to 1:3000), competitive spreads on ECN accounts, and valuable promotions like the cashback program are frequently mentioned as key benefits.

The Repeating Red Flags

While less common, the negative complaints are consistent and focus on critical areas. These red flags should not be ignored:

· Withdrawal Delays and Fees: This is the most critical complaint, directly linking to the problems discussed earlier. Users report unexpected delays, rejections due to the proportional rule, and frustration with the process.

· Complex Bonus Rules: The “Cashback trap” is a specific example of users feeling misled by promotional terms that are not immediately obvious.

· Platform Problems: Some traders have reported occasional freezing or slowdowns on the MT5 platform, which can be harmful during volatile market conditions.

· Crypto Trading Restrictions: This is a major operational drawback for crypto traders. On weekends, it is not possible to open, close, or modify cryptocurrency positions. Furthermore, stop-loss and take-profit orders are not executed during this period, exposing traders to significant gap risk over the weekend.

· Controversial Personnel: Community forums, such as Forex Peace Army, have noted that a senior employee at AMarkets was previously a marketing executive at MFX Broker, a firm that collapsed amid accusations of being a Ponzi scheme. While this is an association and not a direct reflection on AMarkets' current operations, it raises concerns for some in the trading community.

Conclusion: A Final Decision

Combining data on regulation, withdrawal policies, and user feedback provides a detailed picture of AMarkets' reputation and safety profile. The decision to trade with it requires carefully weighing its strengths against its built-in risks.

Summarizing the Risk-Reward

| Key Strengths (Risk-Reducing Factors) | Key Weaknesses (Risk Factors) |

| 18+ years of operational history. | Offshore regulation only (no Tier-1 license). |

| FinaCom membership with €20,000 compensation. | Official warnings from Malaysian & Italian regulators. |

| Overwhelmingly positive user reviews (4.8 on Trustpilot). | Complex proportional withdrawal rule causing friction. |

| VMT third-party audit of execution quality. | Repeating user complaints about withdrawal delays. |

| Negative balance protection policy. | Critical crypto trading limitations on weekends. |

Final Recommendations for Traders

We do not provide a simple “use” or “avoid” recommendation. Instead, we offer a framework for your own risk assessment based on our investigation.

1. Understand the Risk: You must be comfortable with the fact that AMarkets operates under an offshore regulatory framework. This carries naturally higher risks than a broker regulated in a Tier-1 jurisdiction such as the UK or Australia. The protections in place, while valuable, are not as strong.

2. Start Small: If you are interested in its offerings, the most careful approach is to start with a small capital. Test the entire process: deposit, trade for a period, and, most importantly, make a test withdrawal to experience the process firsthand. Use an amount you are fully prepared to lose.

3. Read the Fine Print: Before depositing, take the time to read and understand the terms of service, client agreement, and the specific conditions for any bonus or promotion you intend to use. Pay special attention to the withdrawal policy section.

4. Do Final Research: Ultimately, the decision is yours. Before depositing, we strongly advise doing one last check. Visit an independent broker verification site, such as WikiFX, to review the most current user feedback and regulatory status for AMarkets. This final step is a crucial part of any trader's research process.

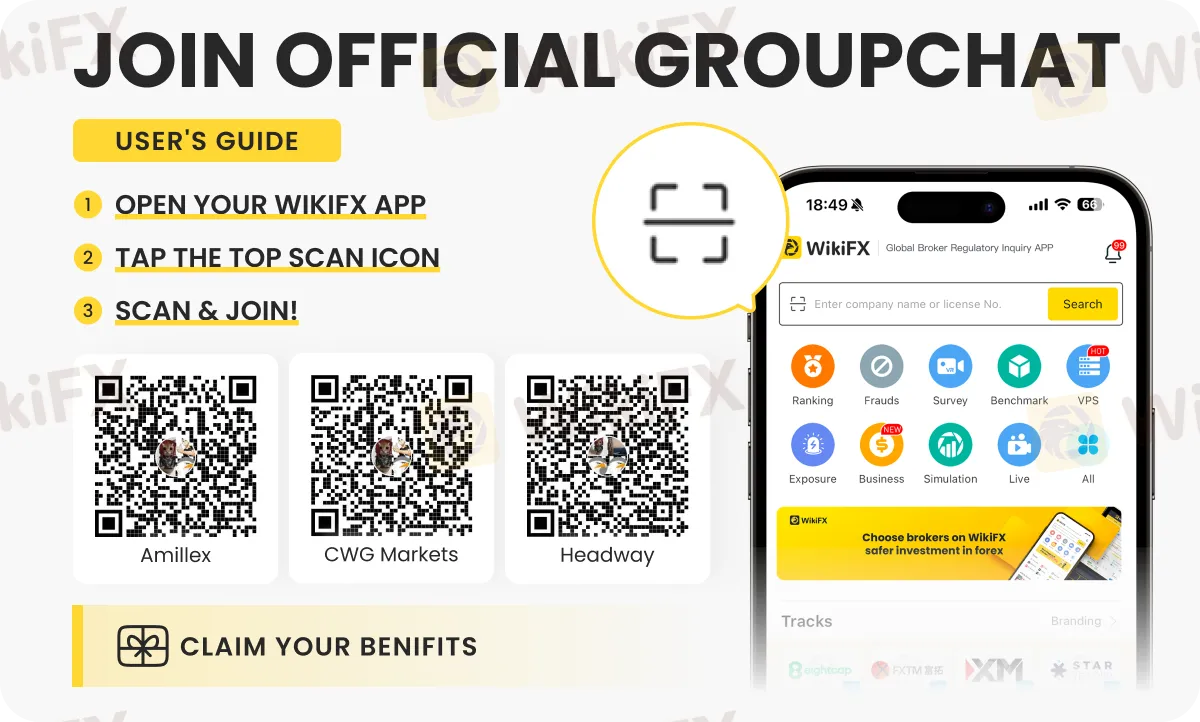

Stay updated about forex news, updates, insights and strategies on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s by following the instructions shown below.

Read more

Is SGFX Legit? A 2026 Deep Dive Investigation

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

SGFX Review 2026: A Trader's Warning on Spectra Global

If you are looking for an "SGFX Review" or want to know the "SGFX Pros and Cons," you have found an important resource. You probably want to know, "Is SGFX a safe and trustworthy broker?" Based on our detailed research, the answer is clearly no. While SGFX (also called Spectra Global) looks modern and professional, we have found serious warning signs that every potential investor needs to know about before investing. This review will get straight to the point. We will immediately discuss the main problems that make this broker extremely risky. These include weak and misleading regulation from offshore locations, questionable trading rules designed to get large deposits, and a worrying pattern of serious complaints from users, especially about not being able to withdraw. This article will give you a complete, fact-based analysis of how SGFX operates to help you make a smart and safe decision.

ZFX Review 2026: A Complete Guide to Trading Conditions, Costs & Safety

When traders look for trustworthy brokers in today's busy market, ZFX stands out as a major global company backed by the Zeal Group. The main question for anyone thinking about using them is simple: What is ZFX, and can you trust it? This broker has an interesting but important split personality. It works under a parent company that follows strict UK financial rules, but most regular customers actually sign up through a different offshore company. This creates a gap between how safe people think it is and how much protection traders actually get. The goal of this 2026 review is to give you a complete, fair look at ZFX's safety, costs, and features. We'll give you an honest view of what's good and bad about it, so you can make a smart choice based on facts, not advertising. Our analysis will look at its regulations, trading conditions, fees, and the important risks you need to know about.

TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

WikiFX Broker

Latest News

Fed’s Paulson Douses Rate Cut Hopes, Strengthening 'Higher for Longer' Case

Precious Metals Surge: Central Banks and Fed Outlook Fuel 'Bare-Knuckle' Bull Market

RIFAN FINANCINDO BERJANGKA Review (2025): Is it Safe or a Scam?

Is BotBro Legit or a Scam? 5 Key Questions Answered (2025)

WAYONE CAPITAL Review 2025: Institutional Audit & Risk Assessment

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Rate Calc