User Reviews

More

User comment

16

CommentsWrite a review

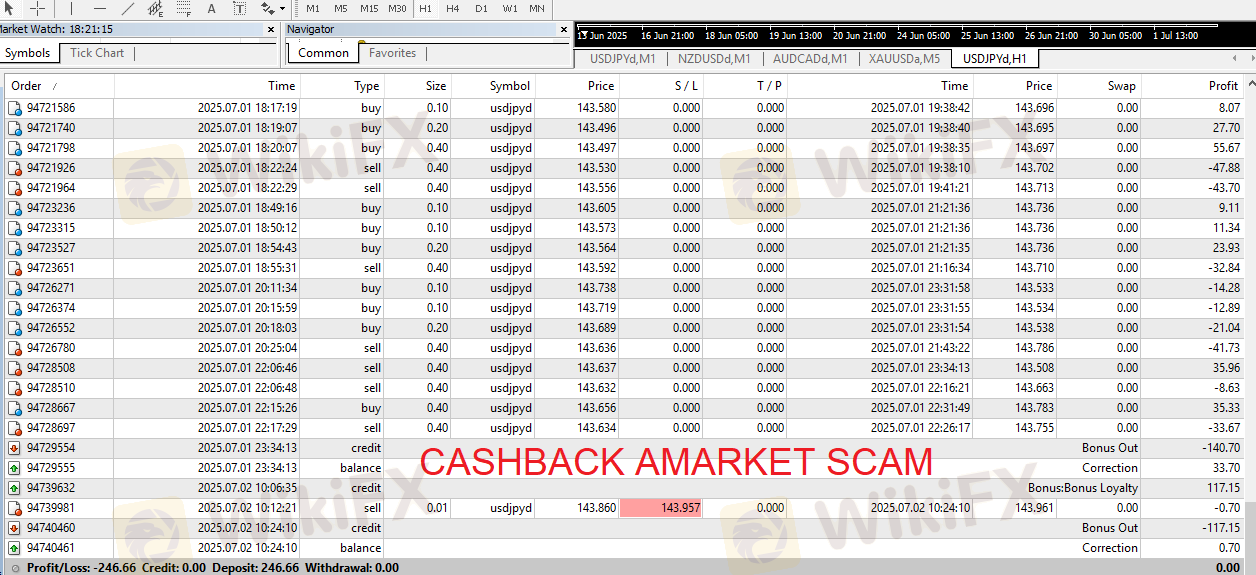

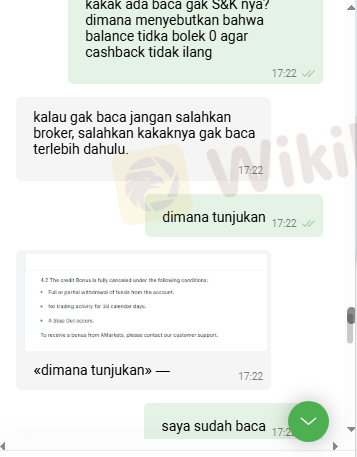

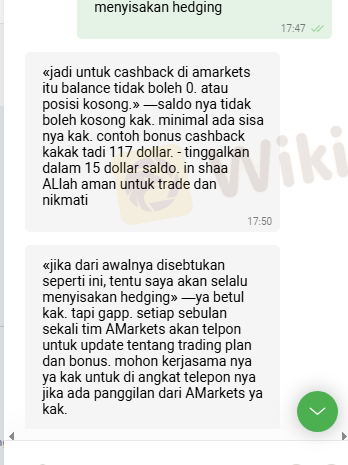

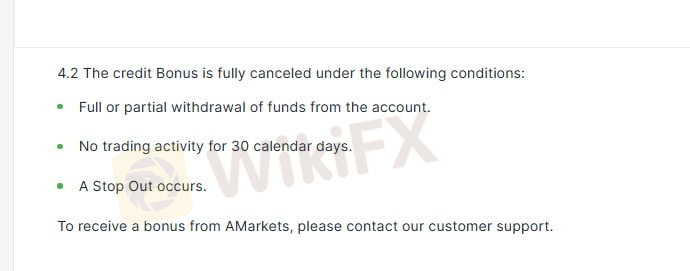

2025-07-02 23:30

2025-07-02 23:30

2024-07-23 17:34

2024-07-23 17:34

Score

10-15 years

10-15 yearsRegulated in Comoros

Forex Trading License (EP)

MT4 Full License

Regional Brokers

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index1.25

Business Index8.00

Risk Management Index8.90

Software Index9.18

License Index1.25

Single Core

1G

40G

More

Danger

Danger

Danger

More

Company Name

AMarkets LTD

Company Abbreviation

AMARKETS

Platform registered country and region

Saint Vincent and the Grenadines

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| Quick AMarkets Review Summary | |

| Founded in | 2007 |

| Registered in | St. Vincent and the Grenadines |

| Regulated by | Comoros regulated |

| Trading Instruments | 500+, forex, metals, cryptocurrencies, bonds, commodities, indices, stocks |

| Demo Account | ✅($10,000 virtual balance) |

| Min Deposit | $10 |

| Leverage | Up to 1:3000 |

| EUR/USD Spread | From 0.2 pips |

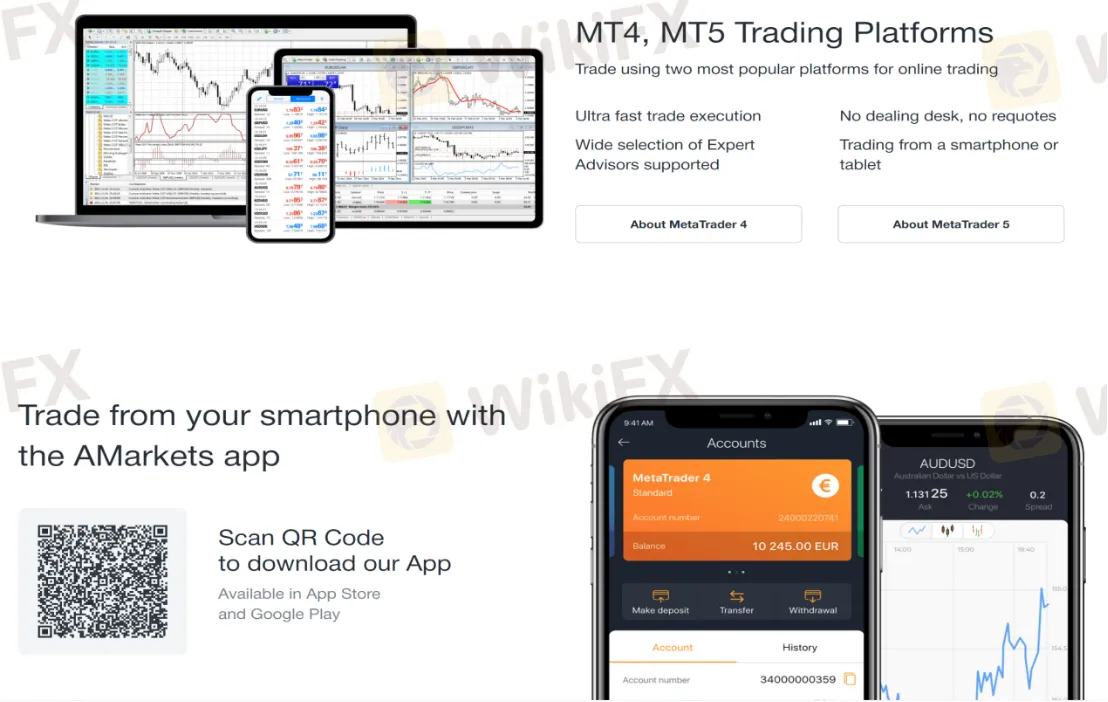

| Trading Platform | MT4/5, AMarkets App |

| Copy Trading | ✅ |

| Deposit Fee | ❌ |

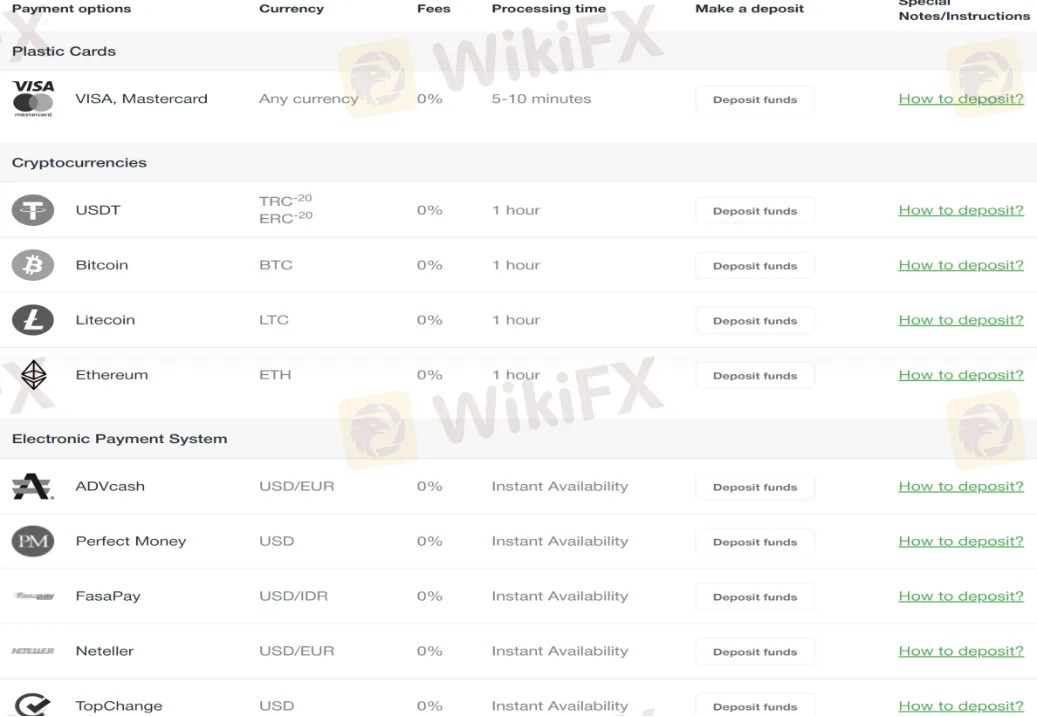

| Deposit and withdrawal Method | MasterCard, uzcard, bitcoin, tether, litecoin, ethereum, advcash, etcetera |

| Customer Service | 24/7 live chat, Telegram |

| Tel: +44 330 777 22 22 | |

| Email: support@amarkets.com | |

| Bonus | 15% first deposit bonus |

AMarkets is a Comoros regulated forex broker based in St. Vincent and the Grenadines, offering various appealing trading conditions such as high leverage, and access to popular trading platforms like MetaTrader4 and MetaTrader5. It provides a wide range of trading instruments across seven asset classes, including forex, metals, cryptocurrencies, bonds, commodities, indices, and stocks. AMarkets also offers a mobile trading app for both Android and iOS users, allowing traders to access their accounts on the go.

| Pros | Cons |

| Wide range of trading instruments available | Regional restrictions |

| Multiple account types to suit different needs | Commission fees for the ECN Account |

| Demo accounts | |

| MT4/MT5 trading platforms | |

| No deposit fees | |

| 24/7 live chat support |

Note: AMarkets does not offer services to clients from American Samoa, Angola, Armenia, Afghanistan, Benin, Botswana, Burkina Faso, Burundi, Cape Verde, Central African Republic, Chad, Comoros, Cuba, Ethiopia, Federated States of Micronesia, Gabon, Gambia, Grenada, Guam, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Jamaica, Japan, Kiribati, Kosovo, Laos, Lebanon, Lesotho, Liberia, Madagascar, Malawi, Maldives, Mali, Marshall Islands, Mauritania, Mongolia, Montenegro, Mozambique, Namibia, Nauru, Nepal, New Zealand, Nicaragua, Niger, Northern Mariana Islands, North Korea, Palau, Palestine, Paraguay, Puerto Rico, Republic of the Congo, Senegal, Sierra Leone, Somalia, South Sudan, Sudan, Suriname, Syria, Tanzania, The United Kingdom, The United States of America, The US Virgin Islands, Venezuela, Yemen, Zambia and Zimbabwe.

EU/EEA/EFTA countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland.

AMARKETS, operated by AMarkets LTD, holds a Forex Trading License (EP) issued by the Mwali International Services Authority (MISA) in Comoros. It authorizes the company to conduct forex, futures, financial derivatives, and options trading activities.

AMarkets offers 500+ trading instruments, including forex, metals, cryptocurrencies, bonds, commodities, indices, and stocks.

| Trading Assets | Available |

| Forex | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Options | ❌ |

| ETFs | ❌ |

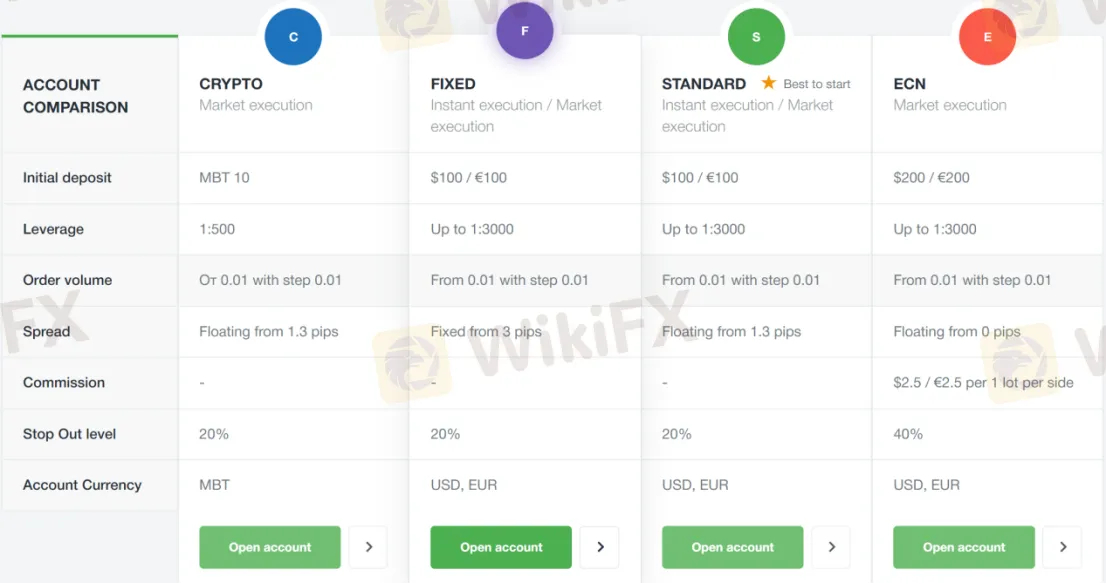

AMarkets offers a total of 4 account types: crypto, fixed, standard, and ECN. The minimum deposit to open an account is MBT10, $100, $100, and $200 respectively. It also offers an Islamic account option for traders who adhere to Islamic rules on trading. It also provides traders with a demo account, which can develop trading skills and reduce trading risk for traders.

Standard: The standard account is for beginning and experienced traders. It offers a floating spread (starting from 1.3 pips), zero transaction fees for FX and metals, and supports Instant and Market execution. The minimum initial deposit requirement is $100/€100, and traders can access up to 1:3000 leverage. The trading hours start Monday at 00:00 and end Friday at 23:00 Eastern European Time (EET). The account is denominated in USD and EUR. Clients also get negative balance protection.

Fixed: The fixed account has a fixed spread, so it's ideal for clients who prefer to pay a fixed amount for each trade. It is suitable for position trading. It shares many similarities with the standard account. The differences are that it has a fixed spread and offers only 28 Forex trading instruments instead of the 44 currency pairs offered by the standard account.

ECN: The ECN features direct order execution at the Prime broker. It is suitable for scalping due to its swift order execution speed. The minimum deposit is $200 €200, and the spread starts from as low as 0 pips. Users of this account will pay a commission charge of $2.5 / €2.5 per 1 lot per side. It offers all trading instruments and offers negative balance protection. Stop out the requirement is 40%, while the margin for a hedged position is 50%.

Crypto: The crypto account is denominated in MBT (1 MBT = 0,001 BTC) and shares similarities with the Standard account. It offers the lowest leverage (1:100) and spreads floating from 1.3 pips. Users of the Crypto account have access to all trading instruments and negative balance protection.

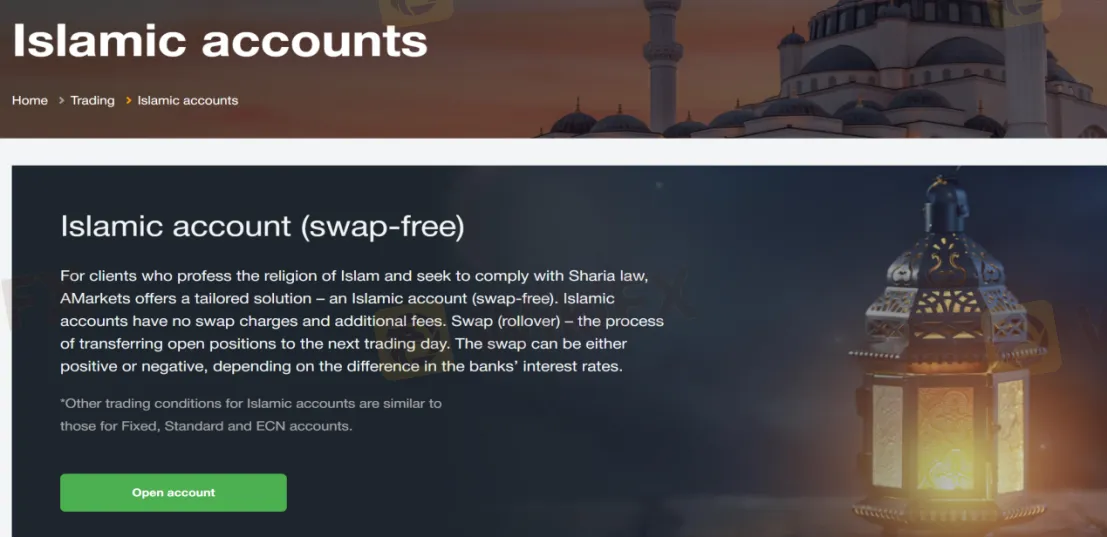

Islamic account (swap-free): Clients who want to comply with Sharia law can ask for an Islamic account. The Islamic account is a variation of the Fixed, Standard, and ECN accounts with no swap charges or additional fees. It is not available for Crypto accounts. To use the Islamic account, open any of the supported accounts and send a request to activate the Islamic option in the Personal Area. The swap-free service does not apply to stocks, indices, cryptocurrencies, commodities, and bonds.

Demo Account: AMarkets provides a demo account with $10,000 virtual balance that allows you to try out the financial markets without the risk of losing money.

AMarkets provides traders with a maximum leverage of up to 1:3000, which is considered to be one of the highest leverage options available in the forex trading industry. This generous leverage can be advantageous for experienced and professional traders who are looking to maximize their potential profits. However, it is crucial to acknowledge that high leverage also carries a higher level of risk.

It is important to note that the maximum leverage of 1:3000 is applicable to standard trading accounts, whereas the Crypto account offers a maximum leverage of 1:100. Traders should consider their trading strategy and risk management practices when deciding on the appropriate leverage size for their specific needs.

If you want to trade with AMarkets, we recommend that you take the time to calculate these transaction costs. As for the spread, we have given a brief explanation when describing account types. When it comes to the ECN Account, users of this account will pay a commission charge of $/€2.5 per lot per side. For the other three account types, AMarkets website shows that there are no commission fees.

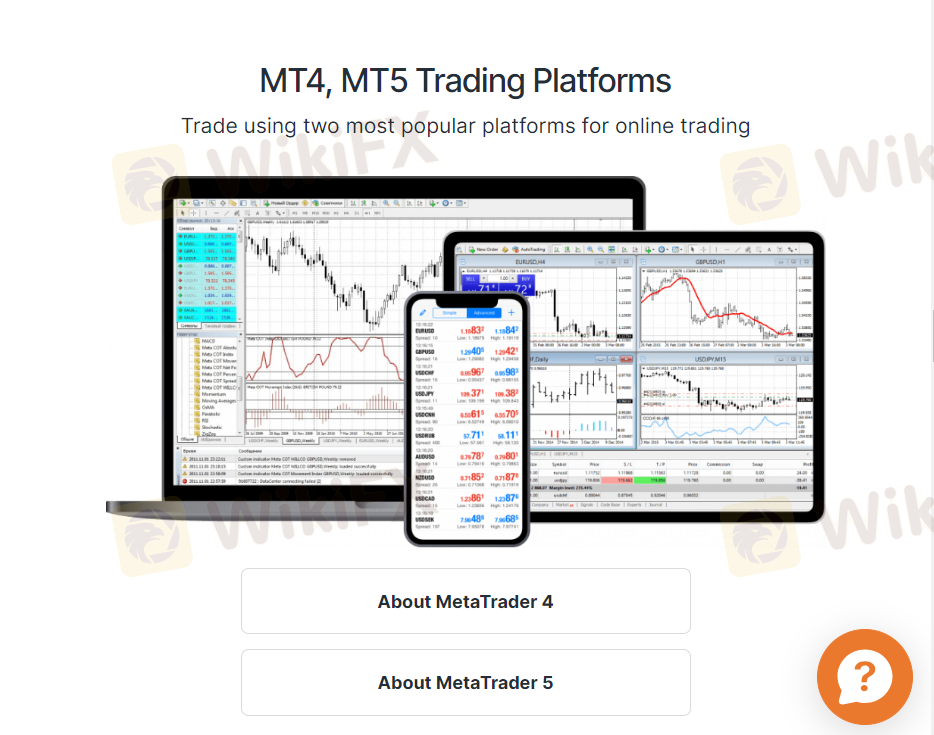

AMarkets supports MetaTrader4 and MetaTrader5 in addition to the AMarkets App it offers for iPhone and Android smartphone users.

AMarkets App: The AMarkets App is an ideal solution for people who want to trade with AMarkets on the go. It is available for iPhone, iPad, and Android devices. It offers trading instruments in 7 asset classes and is available in English, Indonesian, Malay, Persian, Russian, Turkish, and Uzbek languages. Users of the app have 24/7 customer support, real-time quotes, live and demo trading, and the ability to deposit and withdraw funds.

MetaTrader4: MT4 is regarded as the best trading platform for beginners and experienced traders. The app offers 30 indicators and supports 9 time frames, a locking option, and a single-thread strategy tester. It is accessible via mobile apps (iOS and Android), web terminals, and PC/MAC downloads.

MetaTrader5: MT5 is an advanced version of the MT4 trading platform. It offers more indicators, time frames, and updated strategy testers compared to the MetaTrader4. It also offers partial order filling, a built-in economic calendar, embedded MQL5 community chat, 6 types of pending orders, market depth, and a hedging option. It's ideal for copy traders (social trading) and algorithmic trading. It is accessible via mobile apps (iOS and Android), web terminals, and PC/MAC downloads.

In terms of deposit and withdrawal, like many other brokers, AMarkets provides a detailed form with important information about currency, payment method, minimum amount, arrival date, fees, etc. The feasible payment methods are Visa, MasterCard, USDT, Bitcoin,Litecoin, Ethereum, Advcash, Perfect Money, FasaPay, Neteller, and Topchange. Deposits are free of charge while the broker may charge withdrawal fees.

Does this broker offer MT4/MT5?

Yes, AMarkets offers both MT4 and MT5, as well as the proprietary AMarkets App for you to choose from.

How much leverage does this broker offer?

The maximum leverage of AMarkets is 1:3000.

What is copy trading?

Copy trading is an investment service that allows investors to earn income in the financial markets by following the strategies of experienced traders and copying their trades. Professional traders, in their turn, profit by earning commissions from using Strategies.

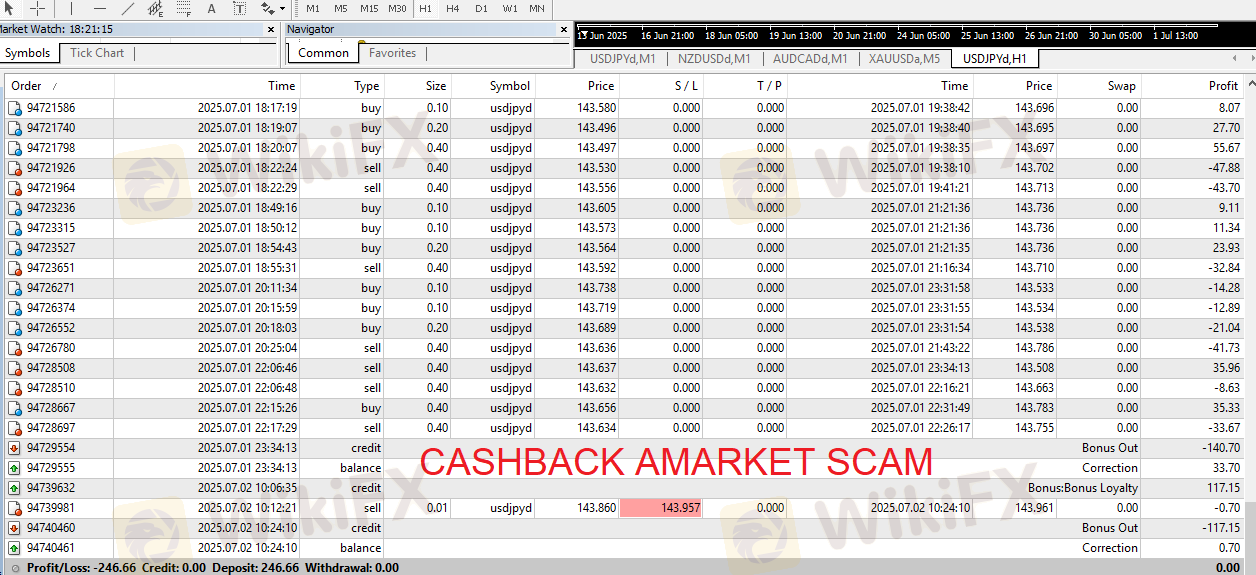

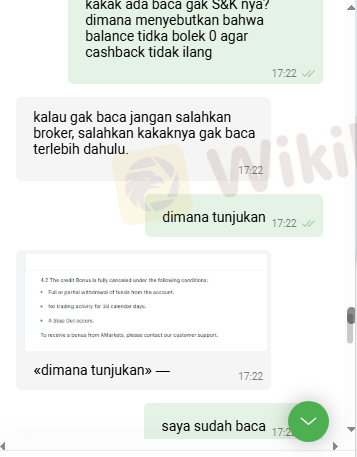

When looking at AMarkets, traders often get mixed signals. The broker has been around for a long time (since 2007) and has a very high rating on Trustpilot. These things suggest it's reliable and customers are happy. But when you search for AMarkets complaints or AMarkets withdrawal issues, you'll find some worrying information, mostly about the broker's offshore licenses and problems some users have getting their capital out. This article will take a fair, fact-based look at these issues to help you understand the real risks and benefits of trading with AMarkets.

WikiFX

WikiFX

In a competitive online trading space, few companies can claim a history as long as AMarkets. Started in 2007, this broker has helped over three million clients and built a strong presence, especially in CIS, Asian, and Latin American markets. What makes it appealing is clear right away: very high leverage, many different account types, and an excellent 4.8-star rating on Trustpilot based on reviews from over 3,000 users so far. These features show a popular and seemingly trustworthy trading partner. However, a closer look shows a basic problem that traders may face. Behind the attractive features and positive user opinions lies a major concern: AMarkets works only under offshore regulation. It doesn't have licenses from any top-level regulatory bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). This AMarkets Review 2025 aims to break down this contradiction. We will provide a complete analysis based on verified facts, looking at the broker's safety measures, trading condi

WikiFX

WikiFX

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

WikiFX

WikiFX

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

WikiFX

WikiFX

More

User comment

16

CommentsWrite a review

2025-07-02 23:30

2025-07-02 23:30

2024-07-23 17:34

2024-07-23 17:34