RM1.15 Million Lost: Two Women Fall to Fake Profits and Fake Police

Abstract:Two women in Penang saw more than RM1.15 million vanish within weeks after being ensnared by sophisticated investment scams.

Financial scam syndicates are tightening their grip on unsuspecting victims, and two recent cases in Penang show just how quickly savings built over decades can disappear. In less than six weeks, two women lost a combined RM1.15 million after falling prey to separate online investment and phone scams, underscoring the urgent threat posed by increasingly polished fraud operations.

In the first case, a 71-year-old woman was drawn into an online investment scheme that appeared credible, professional and highly lucrative. The victim, a consultant at a private company, encountered a stock investment promotion on TikTok in mid-November. What began as a casual online interaction soon escalated into a carefully structured deception.

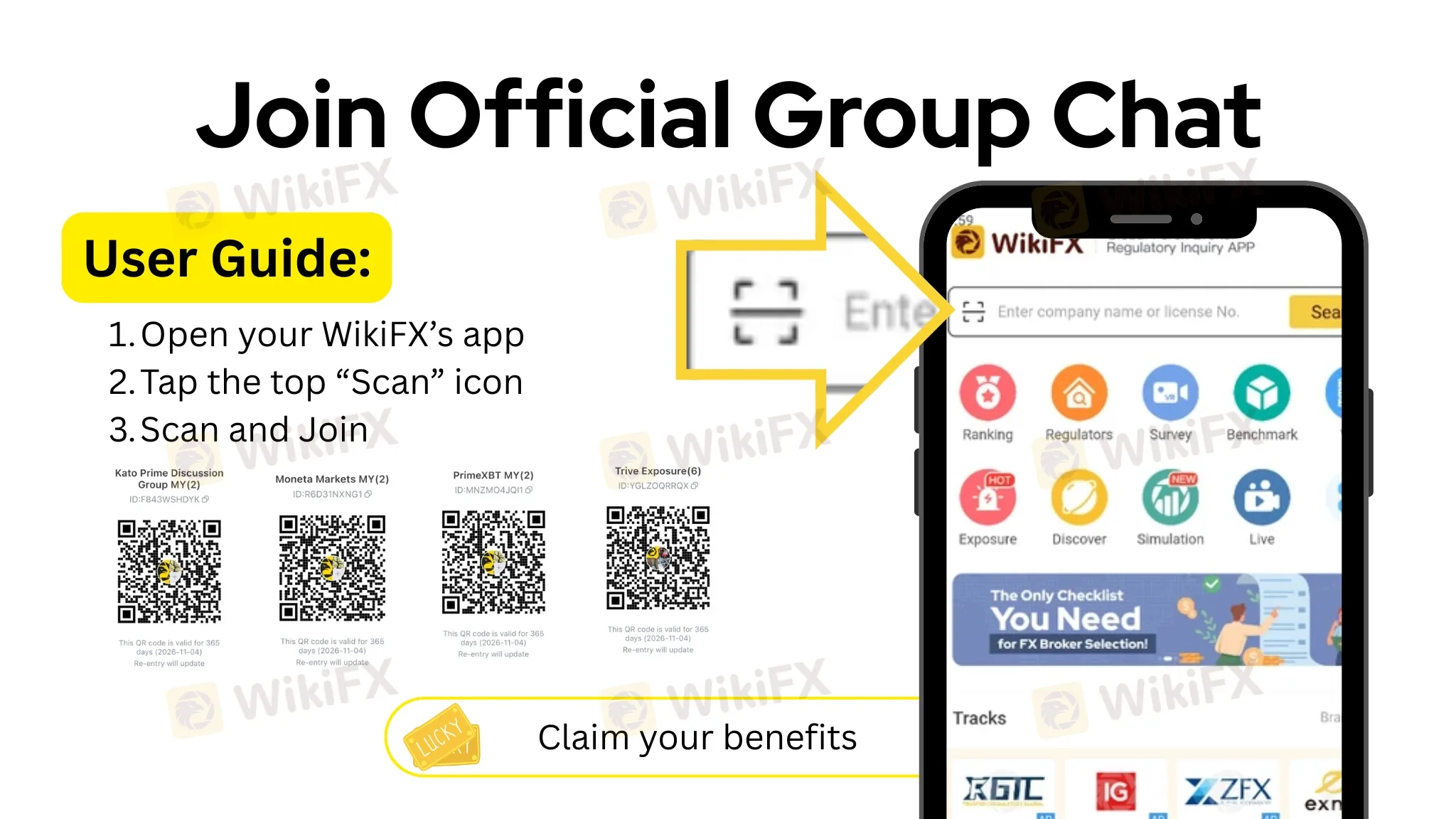

After responding to the advertisement, she was contacted via WhatsApp by a woman who later added her to a group chat that gave the impression of an active investment community. The group reinforced the illusion of legitimacy, sharing discussions that mimicked real market analysis. The victim was then instructed to download an application known as ONTCX, presented as a trading platform.

She was persuaded that rapid returns of up to 100 per cent were achievable. Over a period of just six weeks, from 10 November to 23 December, she made 20 transfers totalling RM690,500 into four different bank accounts linked to separate companies. The scale and frequency of the transactions point to a methodical effort by the syndicate to extract as much money as possible before suspicion set in.

The warning signs became clear only when the victim attempted to withdraw her profits. Instead of receiving funds, she was told further payments were required to unlock the returns. By then, the money was gone. She reported the case to police on 29 December.

The second case followed a different but equally effective tactic, relying on fear rather than greed. A 58-year-old private-sector retiree lost RM462,000 after being targeted by a phone scam designed to mimic official authorities. The case was reported on 22 December.

The scam began with a call from a man claiming to represent Touch ‘n Go, who alleged a suspicious transaction on the victim’s account. The call was then transferred to individuals impersonating police officers from Penang police headquarters and Bukit Aman. The victim was accused of links to money laundering and drug trafficking, creating immediate panic.

Believing she was cooperating with law enforcement, she was instructed to move her funds and provide banking details. On 10 December, she transferred RM460,000 from her Employees Provident Fund savings into her personal account. She was later told to withdraw RM230,000 in cash and hand it over, along with her ATM card, to someone posing as a Bank Negara Malaysia representative.

The exchange took place at a roadside location in Batu Ferringhi. Only after speaking with a family member did the victim realise she had been deceived. Checks later showed RM232,000 had been withdrawn from her account without authorisation.

Both cases are being investigated under Section 420 of the Penal Code for cheating. Together, they highlight an urgent reality: modern scam syndicates move fast, appear credible and exploit trust, fear and technology to devastating effect.

Read more

Biggest Scams In Malaysia In 2025

Malaysia is facing a sharp escalation in online scam activities, with reported losses reaching RM2.7 billion between January and November, driven by increasingly sophisticated and well-organised fraud schemes. Official data shows a significant rise in cases compared to the previous year, while experts warn that the true economic impact may be far greater due to widespread underreporting.

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

31 Malaysians rescued from Myawaddy scam center returned home after joint cross-border operation

Italy’s CONSOB Blocks Five Illegal Investment Sites

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

Police Smash Forex Scam Network Operating from Pahang

A police raid on an unassuming home in Pahang has exposed a covert app-based fraud operation targeting foreign investors.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

Scammed Twice: How a RM1,500 Loss Escalated to RM1.2 Million

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

Is 4SYTE TRADING LTD Legit or a Scam? 5 Key Questions Answered (2025)

Poland Fines Trading Firms $5.7M Over Pyramid Schemes

AURO MARKETS Review 2025: Institutional Audit & Risk Assessment

Euro Under Siege: French Fiscal Crisis Weighs heavily on the Common Currency

SogoTrade Fined $75K Amid Compliance Failures

Indonesian Nickel Supply Cut Sends LME Prices Soaring

Fed Focus: Markets Pause for Minutes as 2026 'Dovish Shift' Looms

Rate Calc