AURO MARKETS Review 2025: Institutional Audit & Risk Assessment

Abstract:AURO MARKETS currently holds a WikiFX Score of 1.79 and is classified as an Unregulated entity operating out of Saint Lucia. Despite utilizing the reputable MT5 trading infrastructure, the broker has been flagged by the Central Bank of Russia for signs of illegal market activity. Compounded by severe allegations of account deletion and fund misappropriation, our analyst assessment categorizes AURO MARKETS as a high-risk platform. Investors are advised to exercise extreme caution, as the entity lacks the capitalization oversight and dispute resolution mechanisms standard in Tier-1 jurisdictions.

Executive Summary

AURO MARKETS currently holds a WikiFX Score of 1.79 and is classified as an Unregulated entity operating out of Saint Lucia. Despite utilizing the reputable MT5 trading infrastructure, the broker has been flagged by the Central Bank of Russia for signs of illegal market activity. Compounded by severe allegations of account deletion and fund misappropriation, our analyst assessment categorizes AURO MARKETS as a high-risk platform. Investors are advised to exercise extreme caution, as the entity lacks the capitalization oversight and dispute resolution mechanisms standard in Tier-1 jurisdictions.

Quick Take: Pros and Cons

The following checklist synthesizes the operational capabilities against the safety protocols observed during this audit.

Operational Highlights

- ✅ Platform Standard: Full support for MetaTrader 5 (MT5), the industry standard for algorithmic and multi-asset trading.

- ✅ Accessibility: Low barrier to entry with a minimum deposit of $50 on “Classic” accounts.

- ✅ Liquidity Access: offers high leverage options up to 1:1000, suitable for aggressive speculative strategies (though high risk).

Critical Risk Factors

- ❌ Regulatory Void: No valid license from any recognized financial regulator (FCA, ASIC, CySEC, etc.).

- ❌ Blacklisted: Officially flagged by the Central Bank of Russia (CBR) for illegal operations.

- ❌ Safety Score: A critically low WikiFX Score (1.79/10), indicating failed due diligence parameters.

- ❌ Client Feedback: Multiple reports of account deletion and refusal to process withdrawals.

- ❌ Offshore Jurisdiction: Registered in Saint Lucia, a jurisdiction often used for registration without rigorous financial oversight.

Regulatory Compliance & Safety Profile

This section constitutes a formal audit of the brokers legal standing. The primary function of regulation is to ensure the segregation of client funds and to provide a legal framework for recourse in the event of broker insolvency.

License Verification: Unregulated

AURO MARKETS purports to be headquartered in Saint Lucia, established in 2024. It is crucial to distinguish between registration and regulation. While a company may be registered as a business entity in Saint Lucia, this does not equate to holding a financial services license that authorizes forex brokerage activities or mandates capital reserves.

Risk Warning: Sovereign Blacklisting

A formal check of regulatory databases reveals a critical warning. The Central Bank of Russia (CBR) has issued a disclosure regarding AURO MARKETS (dated May 21, 2025). The regulator explicitly identified the entity as having:

“Signs of illegal professional securities market participant.”

Implications for Traders:

- No Deposit Insurance: Unlike brokers regulated by the FCA (UK) or CySEC (EU), there is no compensation fund (e.g., FSCS or ICF) to reimburse clients if AURO MARKETS goes bankrupt or absconds with funds.

- Operational Illegitimacy: The listing by the CBR suggests the broker is soliciting clients in jurisdictions where it holds no legal authority, highlighting a disregard for compliance norms.

- Counterparty Risk: Without regulatory oversight, there is no external audit of the broker's “Order Book.” This increases the risk of market manipulation, where the broker may trade against its own clients (B-Book execution) without transparency.

Trading Infrastructure & Costs

While the safety profile is concerning, the operational structure dictates the day-to-day trading environment. We analyzed the cost structure and technical offerings.

Leverage Policy: High Risk Exposure

AURO MARKETS offers leverage up to 1:500 on most accounts, and an aggressive 1:1000 on the Classic account.

- Analyst Note: While high leverage is attractive to retail traders with small capital, a ratio of 1:1000 is generally prohibited in Tier-1 jurisdictions (which typically cap FX leverage at 1:30) due to the statistical probability of rapid capital erosion. This leverage level confirms the broker's offshore nature and lack of negative balance protection mandates.

Cost Structure and Spreads

The broker utilizes a tiered account structure:

- Raw Account: Spreads from 0.3 pips. (Likely involves a commission, though not transparently detailed).

- Classic Account: Spreads from 1.7 pips.

- Pro Account: Spreads from 1.3 pips.

- Competitiveness: A starting spread of 1.7 pips on a standard account is significantly higher than the industry average of 1.0–1.2 pips for EUR/USD. This suggests a high cost of trading that creates a substantial drag on profitability for retail clients.

Software and Funding

The brokerage provides MetaTrader 5 (MT5), which is a positive “Perfect” rated software inclusion. However, the funding methods lean heavily on Cryptocurrency (USDT, BTC, ETH) along with Master/Visa and Skrill.

- Analyst Note: Reliance on crypto funding is a common red flag in offshore entities, as blockchain transactions are irreversible. Once funds are sent via USDT, they cannot be “charged back” like a credit card transaction if the broker refuses to withdraw.

Market Sentiment: User Complaints

A review of recent client activity (Risk Window: Recent 3 Months) reveals a disturbing pattern of complaints that goes beyond simple service delays. The nature of these disputes suggests potential malicious intent.

Complaint Taxonomy:

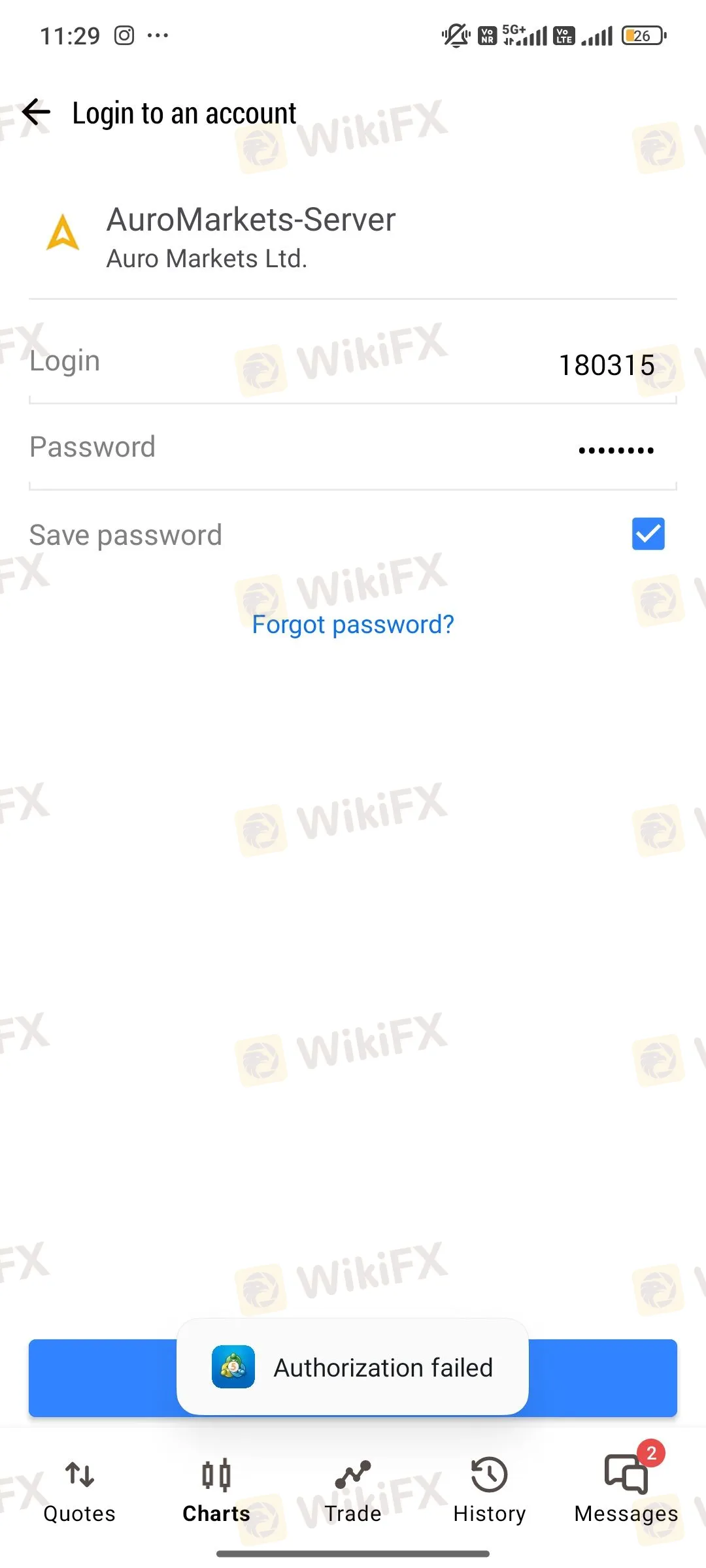

- Arbitrary Account Deletion: Multiple users reported that after requesting withdrawals, their trading accounts were deleted entirely.

- “Washout” Allegations: Claims exist that the broker utilized “auto-trading” or unauthorized trades to deliberately drain account balances to zero.

- Rebranding Scams: One detailed report alleges that AURO MARKETS is a rebrand of a previous entity (“Profit FX Markets”) aimed at distancing itself from past fraud allegations.

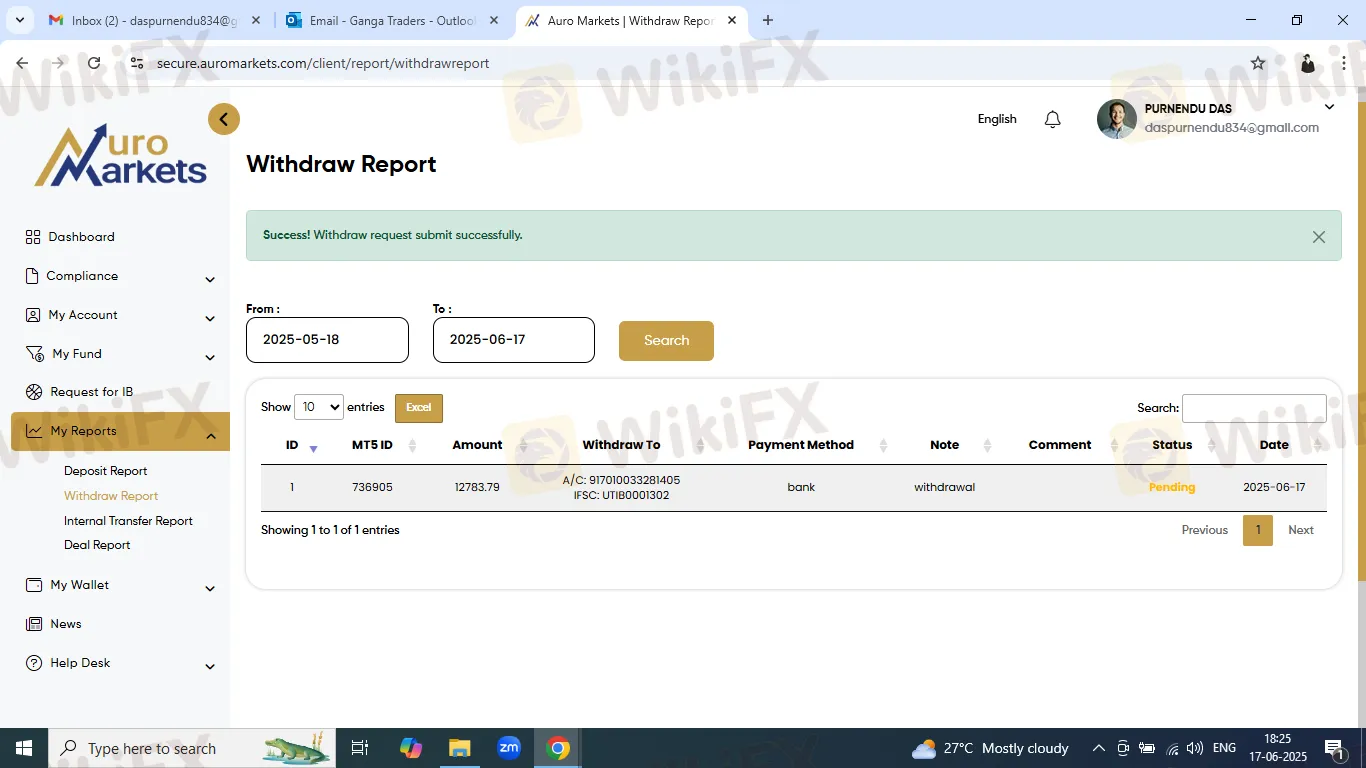

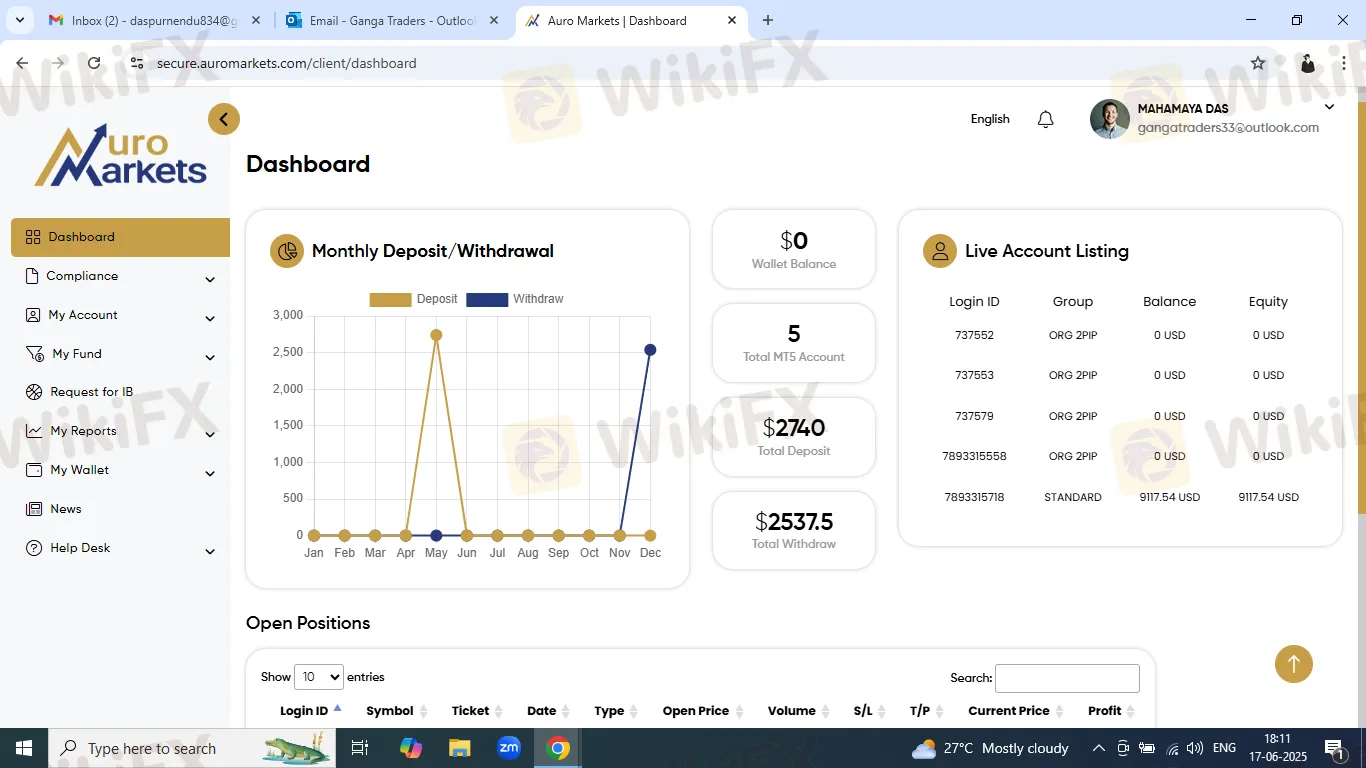

Evidence of Disputes:

- 🚩 Case ID 1: A user reported a loss of 5,000 USDT. Upon withdrawal request, the account was wiped and deleted.

🚩 Case ID 2 & 3: Users reported losses of $12,768 and $9,117 respectively, citing that their MT5 accounts were “washed by auto trade” without consent.

Analyst Limit: The recurrence of “account deletion” accusations is a critical severity indicator. Typical friction involves delayed withdrawals; deletion of accounts implies an attempt to destroy evidence of the client's funds existence.

Final Verdict

The audit of AURO MARKETS reveals a platform with foundational safety failures. While it offers the robust MT5 platform, the operational environment is marred by an absence of regulatory oversight, uncompetitive spreads (1.7 pips), and severe confirmed warnings from the Central Bank of Russia.

The combination of unlimited liability (due to lack of regulation), irreversible funding methods (Crypto), and specific allegations of account theft and deletion renders this broker unsuitable for institutional or retail capital.

Final WikiFX Score: 1.79 (High Risk)

Recommendation: Traders are strongly advised to avoid depositing funds with this entity.

For the most current regulatory certificates and real-time blocklisting status, verify AURO MARKETS on the WikiFX App.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc